Many of my friends and colleagues tell me that video and movies are nowadays better than books for documenting real life. I still feel there is in books a depth I do not find anywhere else. A question of generations, probably. HBO’s Silicon Valley may be a funny and close-to-reality account of what high-tech entrepreneurship is but Startup Land is a great example of why I still prefer books. I did not find everything I was looking for – and I will give one example below – but I could feel the authenticity and even the emotion from Mikkel Svane’s account of what building a start-up and a product means. So let me share with you a few lessons from Startup Land.

The motivation to start

“We felt that we needed to make a change before it was too late. We all know that people grow more risk-averse over time. As we start to have houses and mortgages, and kids and cars, and schools and institutions, we start to settle. We invest a lot of time in relationships with friends and neighbors, and making big moves becomes harder. We become less and less willing to just flush everything down the drain and start all over.” [Page 1]

No recipe

“Along the way, I’ll share the unconventional advice you learn only in the trenches. I am allergic to pat business advice that aims to give some formula for success. I’ve learned there is no formula for success; the world moves too fast for any formula to last, and people are far too creative—always iterating and finding a better way.” [Page 6]

About failure

In Silicon Valley there’s a lot of talk about failure—there’s almost a celebration of failure. People recite mantras about “failing fast,” and successful people are always ready to tell you what they learned from their failures, claiming they wouldn’t be where they are today without their previous spectacular mess-ups. To me, having experienced the disappointment that comes with failure, all this cheer is a little odd. The truth is, in my experience, failure is a terrible thing. Not being able to pay your bills is a terrible thing. Letting people go and disappointing them and their families is a terrible thing. Not delivering on your promises to customers who believed in you is a terrible thing. Sure, you learn from these ordeals, but there is nothing positive about the failure that led you there. I learned there is an important distinction between promoting a culture that doesn’t make people afraid of making and admitting mistakes, and having a culture that says failure is great. Failure is not something to be proud of. But failure is something you can recover from. [Pages 15-16]

There are other nice thoughts about “boring is beautiful” [page 23], “working from home” [page 34], “money isn’t only in your bank account, it’s also in your head” [page 35], and an “unconventional (possibly illegal) hiring checklist” [page 127]

I will quote Svane about investors [page 61]: “I learned an important lesson in this experience – one that influenced all of the investor decision we’ve made since then. There is a vast spectrum of investors. Professional investors are extremely aware of the fact that they will be successful only if everyone else is successful. Great investors have unique relationships with founders, and they are dedicated to growing the company the right way. Mediocre and bad investors work around founders, and the company end in disaster. The problem is, early on many startups have few options, and they have to deal with amateur investors who are shortsighted and concerned with optimizing their own position.” [and page 93]: “Good investors understand that the founding team often is what carries the spirit of a company and makes it what it is.”

And about growth [page 74]: “Even after the seed round with Christoph Janz, we were still looking for investors. If you’ve never been in a startup this may seem odd, but when you’re a startup founder you’re basically always fund-raising. Building a company costs money, and the faster you grow, the more cash it requires. Of course, that’s not the case for all startups – there are definitely examples of companies that have come a long way on their own positive cash flow – but the general rule is that if you optimize for profitability, you sacrifice growth. And for a startup, it’s all about growth.”

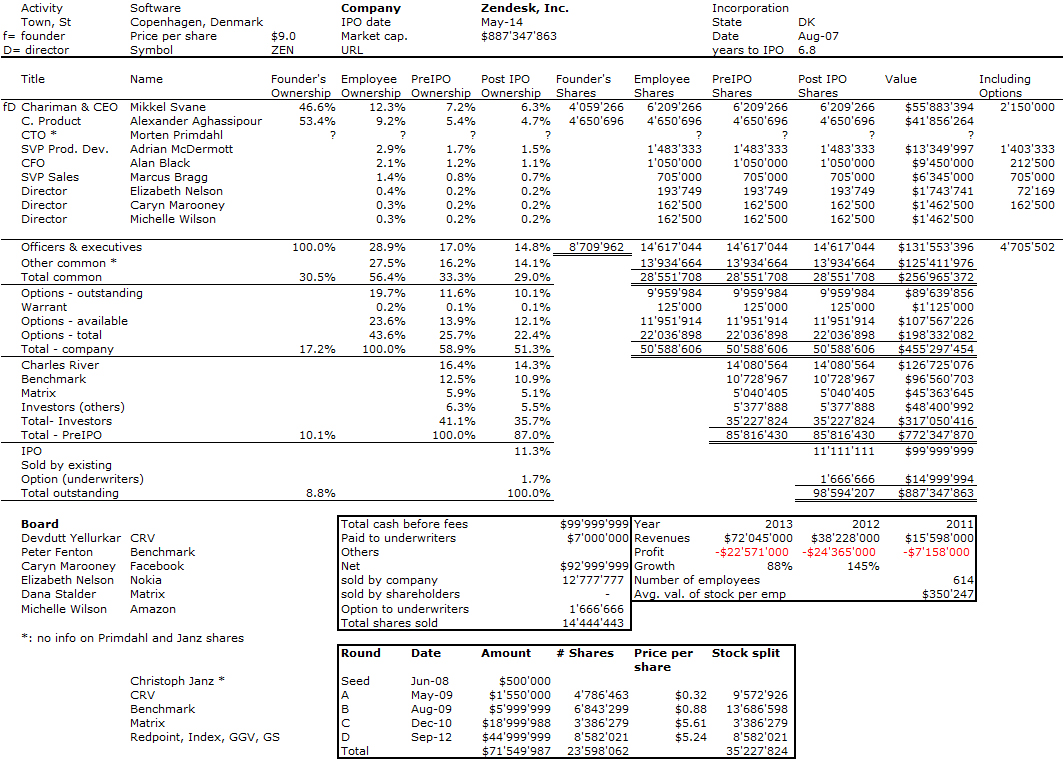

In May 2014, Zendesk went public and the team was so extatic, many pictures were tweeted! The company raised $100M at $8 per share. They had a secondary offering at $22.75 raising more than $160M for the company. In 2014, Zendesk revenue was $127M!… and its loss $67M.

There was one piece of information I never found neither in Startup Land nor in the IPO filings: Zendesk has three founders, Mikkel Svane, CEO and author of the book. Alexander Aghassipour, Chief Product Officer and Morten Primdahl, CTO. I am a fan of cap. tables (as you may know or can see here in Equity split in 305 high-tech start-ups with founders, employees and investors shares) and in particular studying how founders share equity at company foundation. But there is no information about Primdahl ‘s stock. I only have one explanation: On page 37, Svane writes: “the thing about money is, it’s happening in your head. Everyone processes it differently. Aghassipour adnSvane could live with no salary in the early days of Zendesk, but Primdahl could not. It’s possibly he had a salary against less stock. I would love to learn from Savne if I am right or wrong!