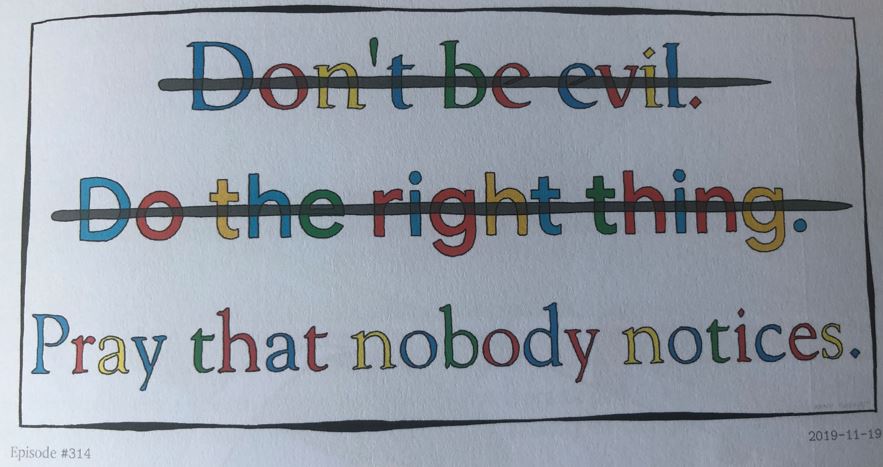

“Don’t be evil” Google (former) motto

“Make something people want” Y Combinator (current) motto

What a shock to discover the briefing of Y Combinator “against” Google in the U.S.’s monopoly case against the search giant. The link is here and the pdf there:

govuscourtsdcd22320513001I have been a fan of both entities for 20 years. But time flies and the world apparently changes. At the end of this post I will come back to the reasons why I have been impressed by Y Combinator over time and in particular the duo Jessica Livingston / Paul Graham.

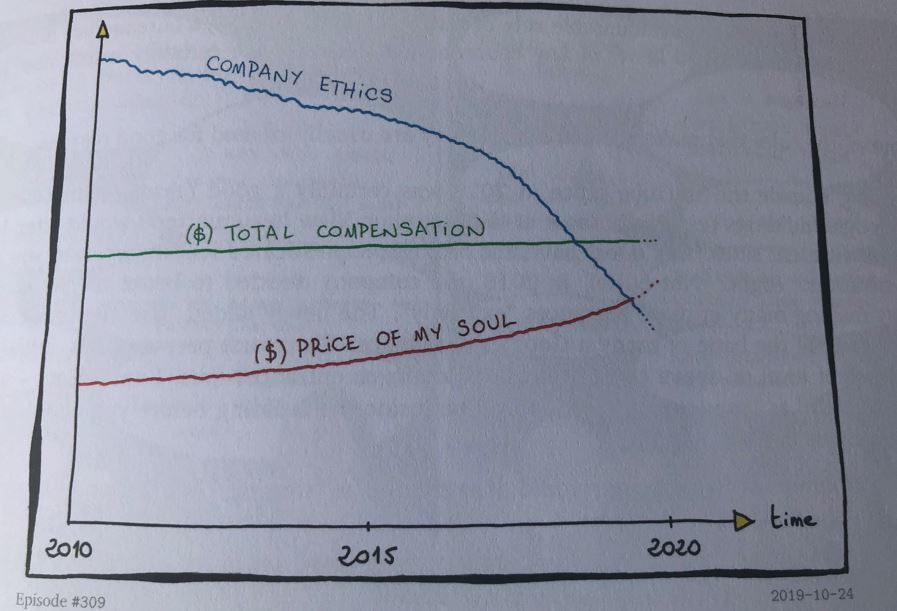

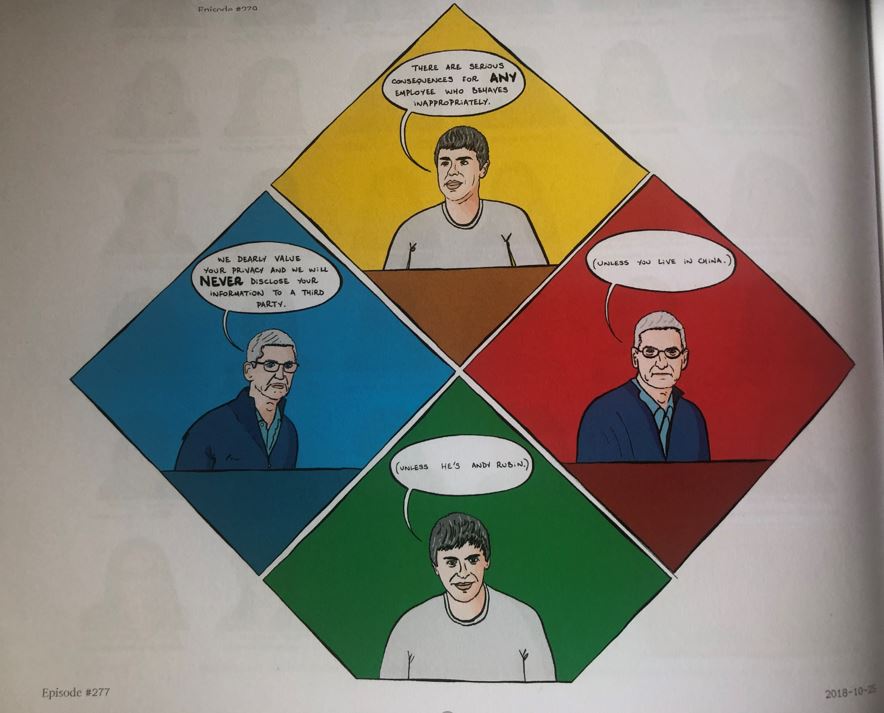

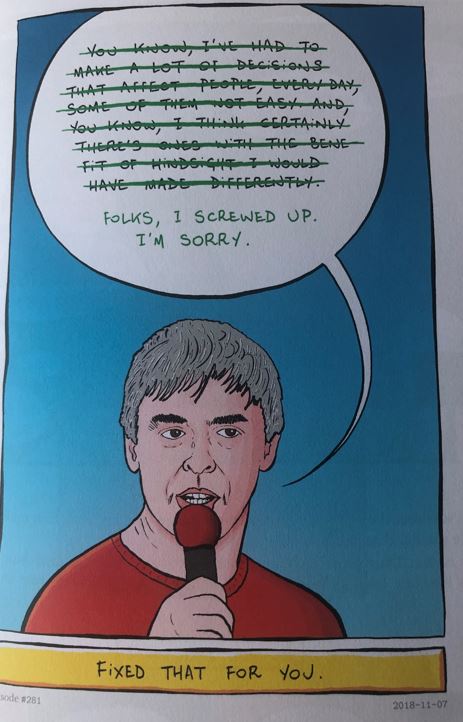

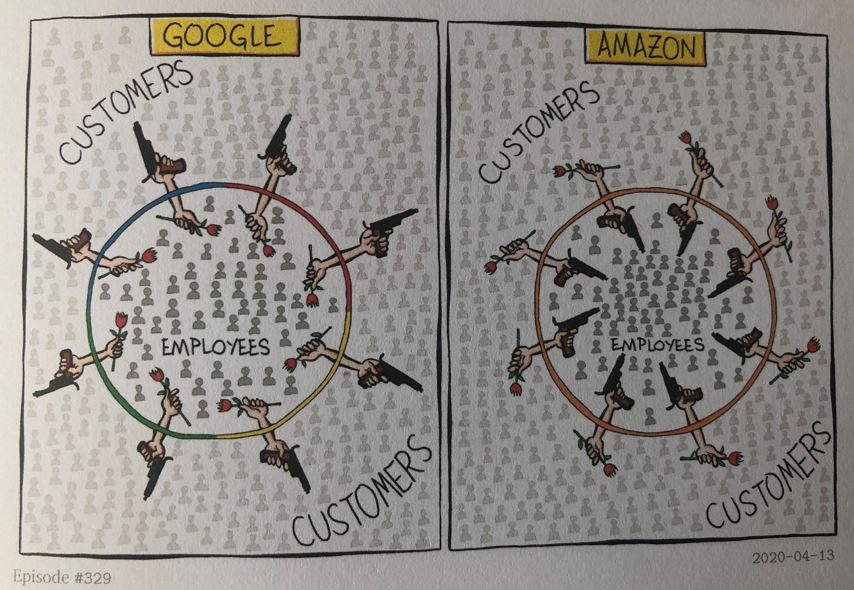

In fact this article is more about Y Combinator. It could be that what I liked about Google is dead as it was hinted in Goomics. So no real need to talk about Google. I have done it so often with the tag #google. But I first need to describe shortly the accelerator’s arguments against Google.

BRIEF OF Y COMBINATOR, LLC AS AMICUS CURIAE IN SUPPORT OF PLAINTIFFS

The remedies stage of this case has important implications for technology startup founding and funding. We respectfully submit this brief to share our view, based on two decades of frontline experience, that robust antitrust enforcement here can help to foster a healthier, more resilient, and more vibrant U.S. innovation ecosystem. The startups we work with every day should be able to exercise their “vigor, imagination, devotion, and ingenuity,” United States v. Topco Assocs., Inc., 405 U.S. 596, 610 (1972), in markets that are free from restrictive conduct and illegally maintained monopoly power. YC supports Plaintiffs’ proposed remedy package as a whole. To aid the Court’s analysis, we also highlight below particular components of the proposed remedy as to which we believe our first-hand experience has given us unique insight and perspective.

Anticompetitive measure have been constant in the history of the USA and the brief reminds it :

Experience has taught us that technological inflection points are critical moments for competition and innovation. The rise of novel, transformative technology can create an opening for nimble startups to disrupt established incumbents. […] Dominant incumbents often respond by using exclusionary conduct to try to slow down or coopt the future. […] For example, during the mid-1990s, Microsoft recognized the disruptive potential of web-based software applications and reacted by anticompetitively blocking rival internet browsers from reaching users. United States v. Microsoft Corp., 253 F.3d 34, 60 (D.C. Cir. 2001). More recently, Facebook recognized the explosion in usage of mobile applications and reacted by acquiring mobile-native startups that it viewed as competitive threats. See FTC v. Meta Platforms, Inc., No. CV 20-3590 (JEB), 2024 WL 4772423, at *29–30 (D.D.C. Nov. 13, 2024) (“[T]he case for buying Instagram focused heavily on neutralizing a competitive threat.”).

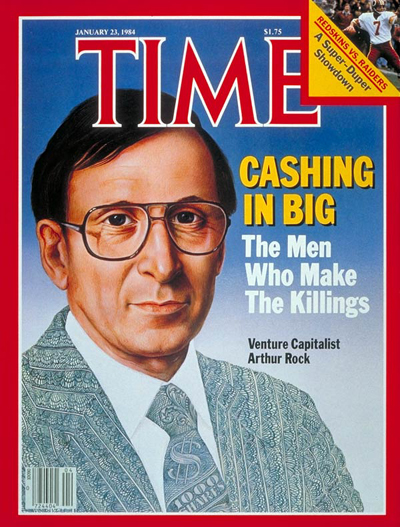

Antitrust remedies have a long track record of unlocking American dynamism and ingenuity. An antitrust consent decree in 1956, for example, required AT&T to provide open access to its patents and technical manufacturing information. That remedy order helped usher in the modern digital age, in large part because it enabled “young and small” firms—what we think of today as “little tech” companies—to compete. See Martin Watzinger et al., How Antitrust Enforcement Can Spur Innovation: Bell Labs and the 1956 Consent Decree, 12 AM. ECON. J. ECON. POL’Y 328, 330 (2020). A new generation was able to enter and expand in a multitude of markets, helping to vault the United States into position as the world’s leader in technological innovation. Id. Economists have called the 1956 antitrust decree “one of the most unheralded contributions to economic development” in history, and the co-founder of Intel called it “one of the most important developments for the commercial semiconductor industry.” This tradition has continued in the modern era. In 2022, for example, the U.S. Federal Trade Commission blocked Nvidia Corp.’s proposed acquisition of Arm Ltd., a semiconductor technology firm. Arm’s CEO later explained that the structural separation “helped us” focus on delivering better products at a time when “more applications [were] moving towards the cloud” and “AI [was] starting to raise its head.” An Interview with Arm CEO Rene Haas. Arm has since gone public on the Nasdaq stock exchange, delivered record revenues, and is now worth more than $100 billion. Meanwhile, Nvidia’s earnings have nearly quintupled as its chips helped to fuel the rise of generative AI technology.

But by foreclosing competition, Google has chilled independent firms like YC from funding and accelerating innovative startups that could otherwise have challenged Google’s dominance. The result is a landscape that has been artificially stunted and stagnant. In our view, Plaintiffs’ proposed remedy package would help to unlock a more dynamic, globally competitive U.S. technology startup ecosystem.

Y combinator proposes the following remedies:

A. The Remedy Should Open Access to Google’s Datasets and Search Index.

B. The Remedy Should Prevent Google from Extending Its Monopolies into Query-Based AI Tools.

C. The Remedy Should Prevent Google From Entering Pay-to-Play Arrangements with Distributors.

D. The Remedy Order Should Deter Circumvention and Retaliation.

I’m not sure I understand all of this, but the implications would certainly be major. I will not go into more details, but for sure this is deep and quite fascinating.

ABOUT Y COMBINATOR

The brief mentions an article about Y Combinator, subtitled The Inside Story of Tech’s Most Influential Startup Accelerator. It is a great reading. I loved it and illustrates with a few comments.

First their philosophy is what mainly attracts me. And once again, this is linked to the people who founded it, in particular Paul Graham and Jessica Livingston. I will not count how many times Graham is quoted here, his essays are famous (I just counted 228 different articles since 2005) and in a way they are close to Montaigne’s. Just check one for example, The Two Kinds of Moderate.

As the article says, Jessica Livingston has an underrated role, “If Paul Graham was Y Combinator’s philosophical architect, Jessica Livingston was its social architect—quietly and effectively shaping YC’s culture and community from the earliest days.” If you have never heard of her, it is never to late to read Founders at Work. And indded Paul Graham felt the need to right an essay entitled Jessica Livingston 🙁

Their philosophy is simple and complex at the same time. Again read the article mentioned above and here are their “mantras, distilled from hard-earned experiences, are now part of global startup culture:

THE PERFORMANCE OF Y COMBINATOR

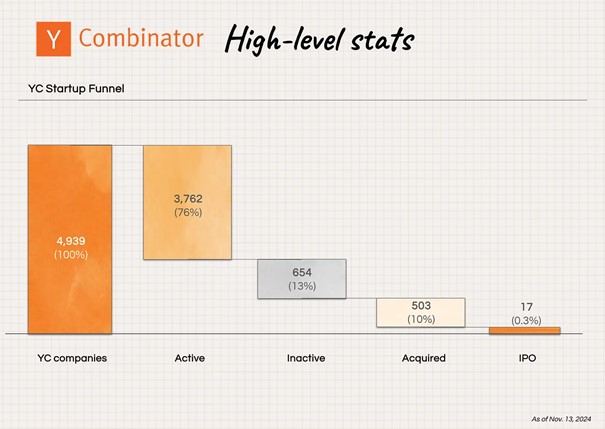

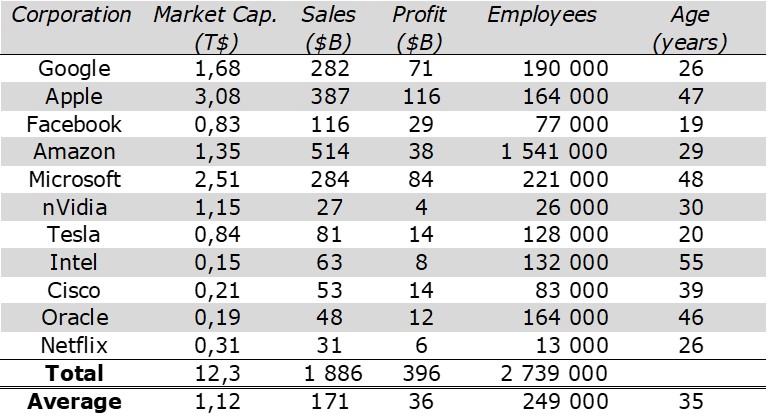

Don’t get me wrong. All this does not mean Y Combinator has found the recipe for success. Let met add just figures from the article:

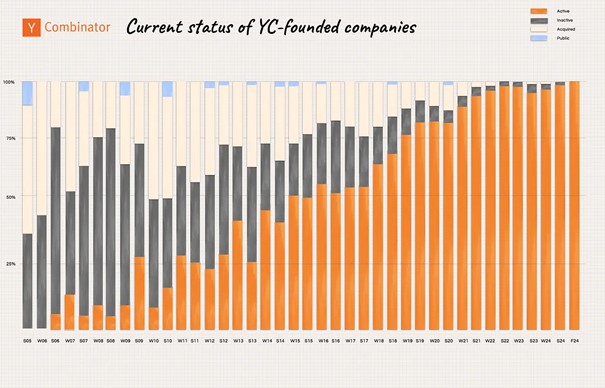

You can have you own thoughts about these numbers. What I read is :

– out of 5000 startups, 17 went public (less than 1%) and about 500 were acquired (about 10%) and remember an acquisition can be at a very low value.

– not that many fail, particularly in the first years , so the “fail fast” mantra is not that obvious.

Is Y Combinator more sucessful than others. I do not know but I loved their approach to entrepreneurship.

ABOUT THE EVOLUTION AND DEATH OF INNOVATIVE ENTITIES

I just said “loved” and not “love”. I begin to feel that old structures lose their agility and creativity. It is what Y Combinator thinks of Google. I discovered that Graham and Livingston have retired from YC. I also believe that a culture is difficult to maintain when the founders leave. And I had a similar feeling with YC when Sam Altman & others began to lead it. There is somethind depressing about the comment but maybe not.

My first article on this blog was about the speech of Steve Jobs at Stanford. Read it again and again :

Death is very likely the single best invention of Life. It is Life’s change agent. It clears out the old to make way for the new. Right now the new is you, but someday not too long from now, you will gradually become the old and be cleared away. Sorry to be so dramatic, but it is quite true.

Your time is limited, so don’t waste it living someone else’s life. Don’t be trapped by dogma – which is living with the results of other people’s thinking. Don’t let the noise of others’ opinions drown out your own inner voice. And most important, have the courage to follow your heart and intuition. They somehow already know what you truly want to become. Everything else is secondary.