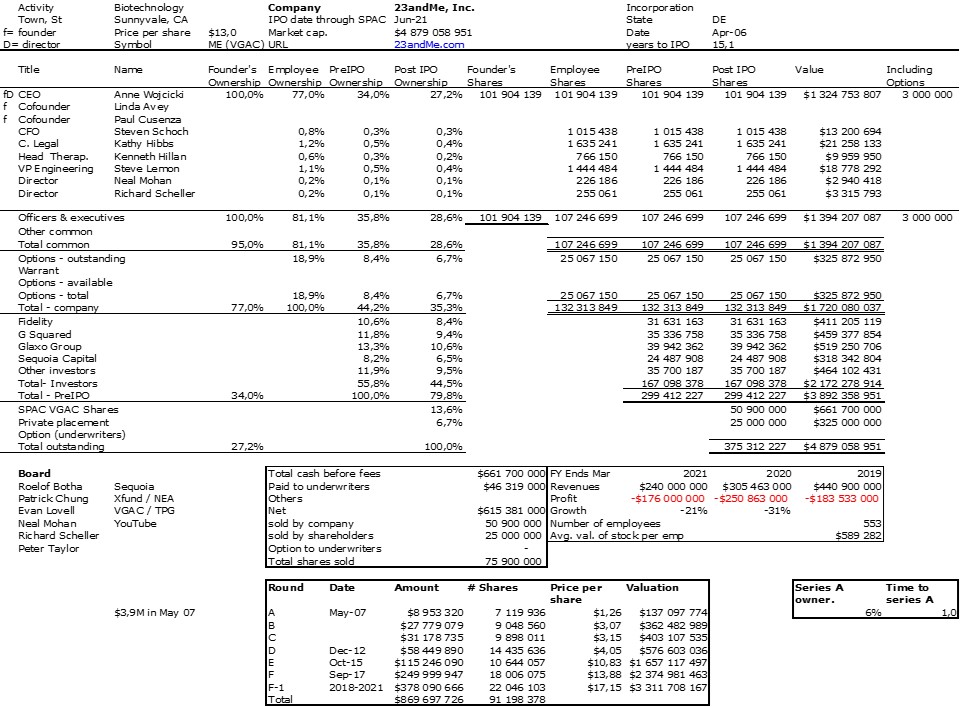

DNA testing 23andMe, Anne Wojcicki‘s startup, just went public through a SPAC, Virgin Group Acquisition Company (VGAC) of Richard Branson.

So what is a SPAC? It took me some time to understand and I am still not sure about the details… If you are interested about general information, you may want to read the Wikipedia link below or the following articles:

– OK, What’s a SPAC? from the New York Times, Feb. 2021 or

– The Pied Piper of SPACs from the New Yorker, June 2021.

A standard IPO is a process where a private company becomes public by offering its existing shares for sale to the public with the possibility of creating new shares bought by the public at the IPO.

A SPAC (Special Purpose Acquisition Company as explained on Wikipedia) is a process where an empty shell or “blank check” company is created by raising money on a public stock exchange, it becomes a public company with no activity and just new shareholders. Then it may acquire an existing private company by a negociation where the existing shareholders of the SPAC and of the private company agree on a balanced value between the two companies. By this reverse merger company, the private company becomes the public company and the SPAC name disappears.

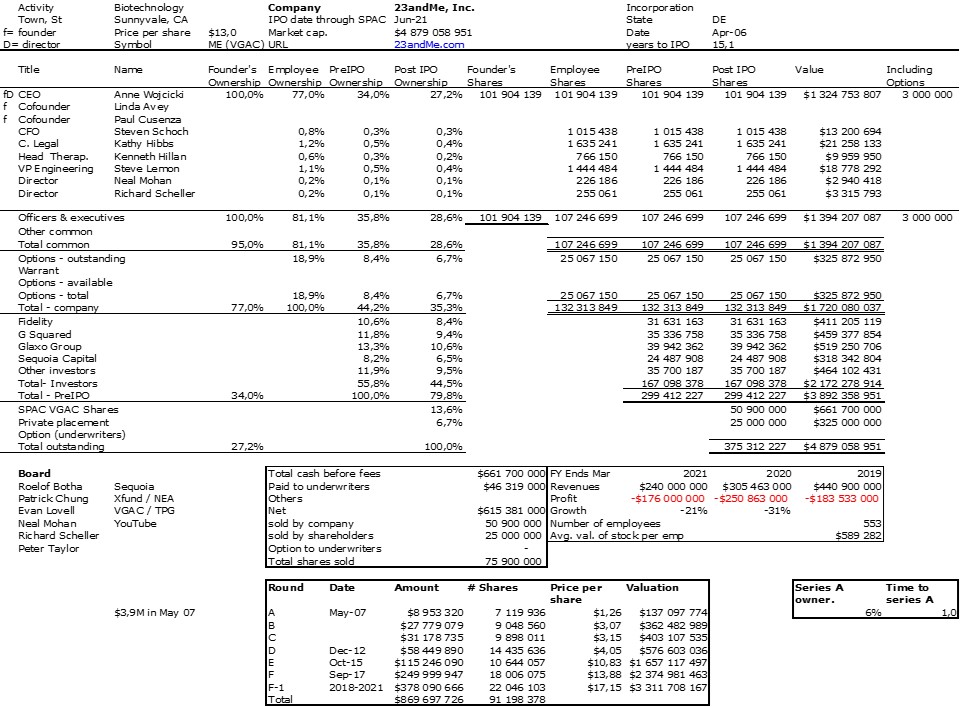

So 23andMe followed such a process and I understood the following to build the cap. table of the new public company. VGAC, the SAPC, had raised $509M at IPO in October 2020. Then Richard Branson proposed to Anne Wojcicki to acquire 23andMe. It worked and they agreed on a price per share of $10, so that the $509M would give 50.9M shares to the VGAC shareholders.

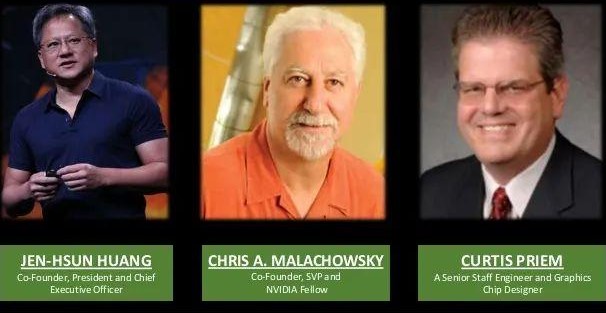

23andMe had its own shareholders, including Anne Wojcicki (about 100M shares), Sequoia (24M shares), Glaxo (39M shares). There were shares detained by managers and board memebers and about 28M stock options too. (The two other cofounders are not mentioned in the IPO document.)

What makes it a little more complex is the additional fact that there was an “private placement” at the IPO of $250M at $10 per share, i. e. 25 new shares in the cap. table.

I am not full sure about all this. It could be that I am mixing the Private Placement, the SPAC shareholders and the 23andMe shareholders, but in a way this is a detail. Where I am confused is that the press annouces a value of $3.9B and I obtain $4.9B which the stock options are not sufficient to explain… Please react if you see a good explanation!