When you come from the world of research or the “normal” world, that of startups can sometimes seem mysterious. Many acronyms and specific terms are used there which can make it difficult to understand this world, which is however not so complicated. So here are some explanations, they show probably my bias but hopefully they will be useful for the curious mind.

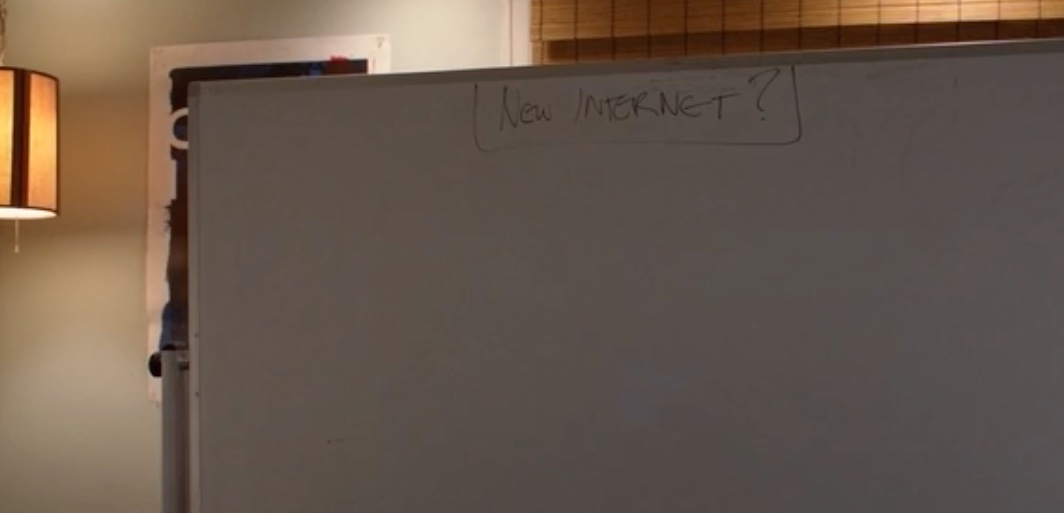

Startup: perhaps obvious as the term is used or even overused! A young innovative company? The best definition of a startup is undoubtedly that of Steve Blank: a temporary organization in search of a repeatable and scalable business model.

Spinoff: a company (a startup in particular) created out of another entity (a team leaving another company, an intellectual property from a research laboratory)

Business model and business plan: An enterprise has (often) the goal of making money, at least in the long or middle term. Its founders must have in mind how it will make money, what they sell, to whom and how the service or product is sold. We speak of a “business model” which has given rise to a rich literature, including the “business model canvas”, a tool for building this model.

The business plan is the structured writing, among other things, of this business model and more generally of all the components of a company allowing it to find stability and growth. We speak of a “roadmap” to describe this multi-annual plan, the path that leads to prosperity, or at least to finding the means to survive. Financial projections and finance is a whole science or art in itself. The “burn rate” is, for example, what a company spends each month or each year and must be well known to entrepreneurs who do not wish to go bankrupt (find themselves without resources).

The business plan is sometimes a difficult or premature exercise. The pitch is an oral or written presentation in the form of slides (the “pitch deck”) which can last one minute (“elevator pitch”), 5 or 10 minutes, rarely more than 20 minutes. It is an exercise that has become essential for any entrepreneur and its practice makes the exercise easier over time, in particular by using all the jargon in this glossary! The pitch deck is a summary of the Business Plan with a clever dose of storytelling. The reference is Guy Kawasaki’s book, Art of Start.

In this literature, we find the concepts of lean startup, agile startup, pivot, which describe flexible, fast and frugal ways of moving forward and changing direction when the path is blocked (the “pivot”).

The term “pricing” is one of the simplest to understand but most difficult to implement: at what price to sell your service or product? Certainly not at the production cost because you have to integrate all the indirect costs of a company (R&D, G&A, S&M) and in a capitalist world, even make a profit (we talk about margins).

– R&D: Research and Development,

– G&A: General and Administration (including accounting, finance, human resources – HR),

– S&M: Sales and marketing.

All these terms speak for themselves, except perhaps the word “Marketing”.

Marketing

Marketing is not advertising, but the analysis of a company’s market, as well as all the actions taken by a company relating to this market. But what is a market? A market is made up of consumers or customers who buy a product or service, with the price paid, its size is obtained by multiplying the number of customers by the price. We talk about TAM (“Total Available Market”), some talk about the size of the universe, because the TAM is rarely accessible to a single company. We are talking more about SAM (Served Available Market), which a company can realistically address. Finally, there is the SOM (“Serviceable Obtainable Market”), the market that can realistically be captured.

Marketing is a complex discipline with its vocabulary. Strategic marketing represents the overall analysis of a company of its market and its (hoped-for) place in this market, while operational marketing includes all the techniques that will allow it to exist in this market. We talk about segmentation, to define a homogeneous set of customers, we also talk about vertical market. The “go to market” is the market entry strategy. The landing beach (“beachhead”) is an entry into a small market (“niche”) which may or may not give access to a larger market.

Finally, there is also the concept of Minimum Viable Product (“MVP”), the version of a product that allows you to obtain maximum customer feedback with minimum effort. It is more a question of analyzing the viability of hypotheses than of selling anything.

Enough for marketing! The great marketing guru for high-tech startups is Geoffrey Moore, author of Crossing the Chasm and Inside the Tornado. We will talk little about sales here, except that prospective customers are called leads or prospects. We sell in B2C (“Business to Consumer”) to individual consumers or in B2B (“Business to Business”) to companies, but also in B2B2C…

The enterprise

An enterprise is therefore a complex and structured organization (while a startup is only a temporary and often chaotic organization). It often has its hierarchy with its officers (CxO for Chief “x” Officer) and Vice-Presidents (VP). At the very top the CEO or Chief Executive Officer (PDG or DG in France) then the CTO or Chief Technical Officer (Technical Director), CSO or Chief Scientific Officer (Scientific Director), COO or Chief Operating Officer (Director of Operations), CFO or Chief Financial Officer (DAF or Director of Administration and Financz). The list of CxOs is endless. Yahoo had its Chief Yahoos. The most common VP roles are Engineering, Sales, Marketing.

In a startup, it is advisable to forget the titles. The founders do not need to give themselves misleading titles of CEO or CTO (except when facing certain somewhat rigid investors) because all the founders are doing a little of everything (otherwise the risk is the absence of transparency, a miscommunication and loss of trust).

Above the CEO, there is the Board of Directors, headed by the Chairman (the CEO often combines the functions of CEO and Chairman of the Board, the DG becomes the PDG in France). Above the board are the shareholders who hold parts of the company, generally shares (indifferently in English, Share, Stock or Equity). There are different types of shares, preferred (with privileges) or ordinary (common). These shares have a price (the value of which fluctuates). The product of the price multiplied by the number of shares is the value of the company.

The founders create a company with an initial capital (the number of shares multiplied by the nominal price). Then the capital can be increased by fundraising from acquaintances (Friends & Family), individual investors (Business Angels) or institutional investors, such as Venture Capital or VC. The succession of such fundraising is called investment rounds (financing rounds) with series A, B, C… The first rounds are called Seed and even pre-seed. In recent years, this terminology has been linked to the size of the amounts, the series A or first round has a size of a few million ($ or €) while the Seed is a few hundred thousand and at most $1M or €1M. The pre-seed is a few tens of thousands of euros or dollars.

A company can also find funds by going public through an initial public offering (IPO). As long as it is not listed, a company is said to be private (we talk of Private Company and Private Equity). The IPO is quite rare and startups are often acquired by larger players or merge with other companies (we talk about Merger and Acquisitions or M&A).

The value of a company is increased by its fundraising, but sometimes also by the increase in the price per share. During such an event, it is calculated that post-money valuation = pre-money valuation + fundraising amount, each of the three terms being equal to the number of shares multiplied by the share price at the time of the fundraising. Investors expect a return on investment (ROI). This is calculated similarly to the return of a bank account, i.e. the annual percentage increase in the share price.

Employees are compensated in Stock Options (ESOP is the Employee Stock Option Plan), the right to acquire shares in the future at a favorable price. In France, the name is BSPCE for « Bons de Souscriptions de Part de Créateurs d’Entreprises »). Warrants (in France, BSA for “bons de souscriptions d’actions”) are reserved for entities external to the company (investors, consultants, technology or service providers). Stock options have their jargon: they are generally granted at monthly or quarterly dates over a period of 4 or 5 years (the “vesting”) and the option is exercised by paying a small sum (“exercise price”) allocating the shares to the holders. There is a period without vesting, generally the first year called “cliff”.

Many entrepreneurs dream of not going to investors, in particular by developing their business with the income and profits generated by sales. If these are convincing, the banks will agree to lend money. Financial objects that do not modify the capital of a company are said to be non-dilutive (loans, debt, non-convertible bonds and also subsidies). We speak in English of “bootstrapping”.