Is there anything nicer than being interviewed by your Alma Mater. The Stanford School of Engineering asked me why I wrote “Start-Up” and for whom. You will find it on the Stanford SOE web site. I tried to explain that the book is not (only) about the innovation infrastructure which failed in Europe but (mostly) about the need to encourage young individuals in taking more risks. A debate about nature and culture which I develop at length in the book.

Monthly Archives: April 2008

Cap. table: Skype

Following the mysql case, here is the Skype capitalization. Skype was founded in November 2003 and acquired by eBay in September 2005 for about $2.6B. The deal was complex as it had a cash component as well as an equity one and because there was an upside potential, up to $4B. The SEC document said “Skype shareholders were offered the choice between several consideration options for their shares. Shareholders representing approximately 40% of the Skype shares chose to receive a single payment in cash and eBay stock at the close of the transaction. Shareholders representing the remaining 60% of the Skype shares chose to receive a reduced up-front payment in cash and eBay stock at the close plus potential future earn-out payments which are based on performance-based goals for active users, gross profit and revenue.” In October 2007, eBay announced the final earn-out to be $530M. I consider here the acquisition was $2.6B.

The two founders, Janus Friis (Danish) and Niklas Zennström (Swede) were the previous founders of Kazaa and had created a holding company, Maitland Holdings, which would own their founder’s shares in Skype. It is not clear if other people had shares in Maitland and I made the assumption that the team of Estonian early developers (Toivo Annus, Jaan Tallinn, Pritt Kasesalu and Ahti Heinla) had such shares but it is possible they had options only. Because the sharing is unknown, I plainly assume that the two founders had about 40% each and the Estonians shared equally the remaining 20%. This is not fully consistent with SEC documents where the Estonians seem to have 5.6% of the eBay shares at acquisition. But I could not find hard facts. However the number of common shares, stock options and preferred A and B shares comes from Legilux, the

Skype had two main rounds and also a seed round before the creation of the company (a convertible loan). The Legilux documents help is assuming that Skype raised €600k of seed money in 2002-2003 with Bill Draper and other angels, its first round of €1.5M in Nov. 2003 (led by Mangrove and Bessemer) and a €14.5M B round in March 2004 (led by DFJ and Index Ventures). The number of shares and the amounts in each round imply in each case a specific price per share.

Skype seemed to have a strong board with its investors, Tim Draper (DFJ), Danny Rimer (Index) and Mike Volpi (Cisco). Volpi later became CEO of Joost, Friis and Zennström’s new venture. Skype had about 200 employees at acquisition; its revenues were $7M in 2004 and expected to be $60M in 2005.

Click on pictures to enlarge or download

Sources: SEC, Legilux, Kazaa and Skype, Eestit Ekspress

Next posts: Kelkoo, Addex.

Nurturing Science-based Ventures

Nurturing Science-based Ventures – An International Case Perspective by Seifert, Ralf W., Leleux, Benoît F., Tucci, Christopher L.

A new book about start-ups has recently been published and it is mainly centered on Swiss (including EPFL) ventures. The authors do indeed have a strong knowledge of this environment as they are faculties from IMD or EPFL. What is unique with this book is that it does not describe success stories only, but also failures or not famous firms. Indeed failures are often better lessons than successes. You do not always know why you succeed and it may be easier to understand a failure. The authors have built their book as a process and describe in detail the development of start-ups; they begin with the opportunity recognition (chapter 1), they follow with writing a business plan (chapter2), financing a start-up (chapter 3), growing a company (chapter 4) to finally harvesting value creation (chapter 5). The final chapter is dedicated to corporate entrepreneurship (“Intra-preneurship”). I have not read it yet (it is more than 700 pages!) but the numerous case studies (more than 20) look rich and detailed. It is not the first book on the subject but it might be the first one with such a focus on European start-ups.

Cap. table: mysql

As a follow-up to my recent post on Scandinavia, I begin, with mysql, a series of posts which are close to Chapter 3 “Founders of start-ups”: it is quite interesting to analyze the capitalization table of a start-up at an exit event (IPO or M&A). Entrepreneurs and employees may learn there what to expect in terms of dilution because of investors, stock-option plan.

Let me come back to mysql. In the same way I built data about many success stories in chapter 3 and 8 of “Start-Up”, here is some data point about mysql: mysql (as a project) was formed in 1987 by three founders, two Swedes and a Finn: David Axmark, Allan Larsson and Michael “Monty” Widenius who had worked together in the 80’s. Marten Mickos, their CEO, joined the company in

Year Revenues

2002 $6’500’000

2003 $12’600’000

2004 $20’000’000

2005 $34’000’000

2006 $50’000’000

2007 $75’000’000

The board of the company included strong personalities such as Bernard Liautaud, founder of Business Objects and Tim O’Reilly. Finally, the capitalization table at the time of acquisition is probably not far from the one below. I had to use different (public) sources to build the table but just as with revenues, these numbers might be subject to errors.

Click on pictures to enlarge or download

Next posts should be about Skype, Kelkoo, Addex.

Finland

I am not the only one complaining about the weakness of

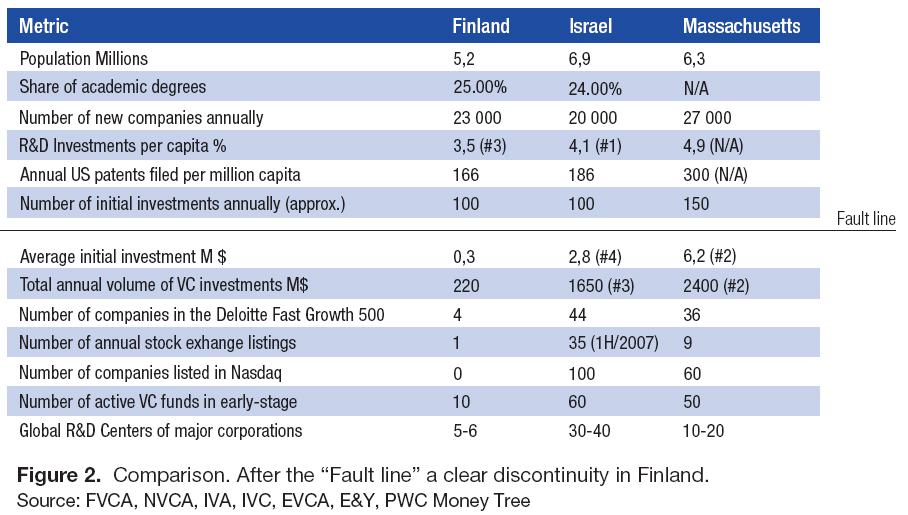

His comparison table is self-sufficient:

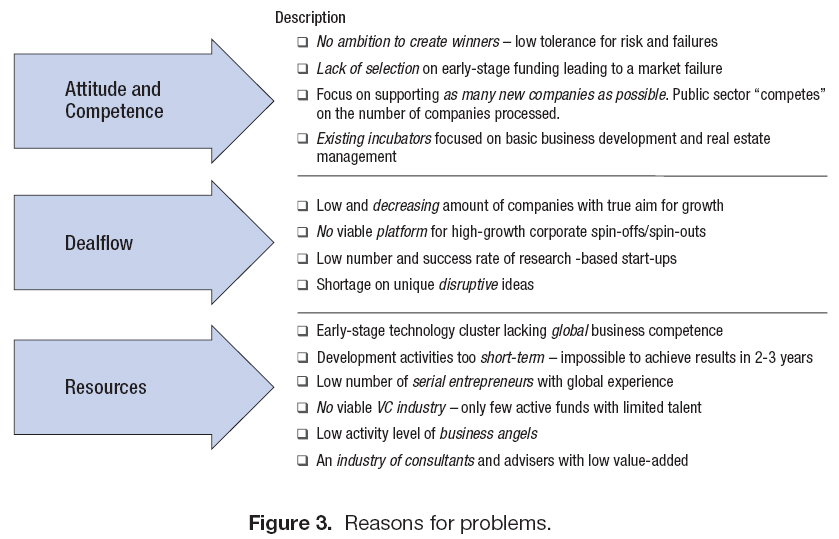

And his analysis of the reasons for problems are:

Finally his conclusions: There is a clear need in

- To create a viable high-growth ecosystem

- To multiply the number of VC capable growth companies

- To eliminate the waste of resources to lifestyle companies

- To provide a viable platform for fast international growth

- To increase the corporate involvement and the number of corporate spin-offs/-outs

- To better facilitate the transformation from research project into a fast growth start-up.

This can be achieved by:

- shifting focus from quantity into quality

- moving from project-based development to efficient long-term structures

- creating structures to enable success of commercial players

- attracting much more international talent into Finnish early-stage community.

My comment: you can replace