A colleague of mine (thanks Jean-Jacques) recently mentioned to me this book by Josh Lerner, which full title is Boulevard of Broken Dreams: Why Public Efforts to Boost Entrepreneurship and Venture Capital Have Failed–and What to Do About It. I was all the more interested that Lerner is the author of many academic papers on high-tech entrepreneurship, and particularly of one about serial entrepreneurs: “Performance Persistence in Entrepreneurship” [pdf format here] with Paul Gompers, Anna Kovner, and David Scharfstein, Journal of Financial Economics, 62 (2007), 731-764. I will come back in the future on this topic which I am currently studying.

So what should we do about the public efforts is what Lerner is trying to help us with and his answer shows how challenging the topic is. What is beautiful about the author (my personal point of view) is that he likes history (just like me). Just like Steve Jobs! Just read again what I posted about Jobs on mentors; “You can’t really understand what is going on now unless you understand what came before”.

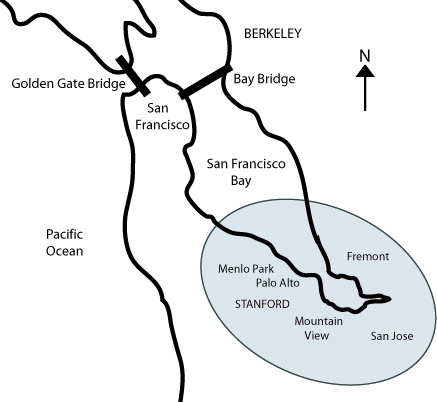

Lerner’s initial chapter is “A Look Backwards” He shows how entrepreneurs and investors benefited and suffered from each other in the 70s and 80s, including the excess of speculative bubbles, the PC burst of the 80s for example. He also shows how important public support was in the very early days through the funding of research (mostly the cold war militaries) and the legal actions to ease venture capital (SBIRs, Erisa Acts) so that he does not really agree with Rodgers (founder of Cypress) who wanted government out of Silicon Valley (page 32) so that he claims that “The Public sector did play a key role in shaping the evolution of Silicon Valley” (page 35).

Then, in the following chapters he shows how complex it is to find facts: “consistent information on venture-backed firms that were acquired or went out of business doesn’t exist” (page 59) which means that quantitative analysis is rare. And remember he is a respected academic, so he knows! What he tried to do then, is to show some of the obvious mistakes: incompetence in allocating public resources (page 73), capture, that is use of subsidies by the wrong groups (page 80), by “organizations that are mandated to help entrepreneurs” (page 83). “Seven of the incubators gave less than 50% of funding in cash to incubated firms” (just one example from Australia, page 84) or the SBIR program which has exhausted its usefulness (page 85).

So his advice is:

– enhancing the entrepreneurial culture (page 90) [through the right laws, the access to technologies, tax incentives and training],

– increasing the venture market’s attractiveness (page 100) [through allowing partnerships, creating local markets, accessing human capital abroad],

– avoiding common mistakes: timing [be patient], sizing [not too small, not too large], flexibility [learn by doing], create the right incentives [and here it is a complex situation as perverse effects from good ideas often occur] and evaluate [which does not happen often enough].

Indeed, his introduction (pages 12 and following ones) summarized it all: you need rules, experience, time, incentives and assessment. But with all his experience and knowledge about high-tech entrepreneurship, Lerner is very humble with the lessons: the topic is really complicated, all these advice have to be implemented together and it is really their careful interconnections which will make an ecosystem lively or not. Then it is my personal conclusion that such favorable conditions will be useful if entrepreneurs use them intelligently. So the reason why all this fails has many roots…

I cannot finish this post without comparing it to my book. It is indeed very similar in its conclusions with slightly different facts and figures. So you would learn complementary and consistent things by reading both! My thesis is we need an entrepreneurial culture and access to people from Silicon Valley who have the experience. Everything else is necessary but not sufficient.