I promised a continuation to my post Against Intellectual Monopoly and here it is. The book is really a must-read for anyone interested in innovation. But maybe you want to begin with an direct explanation by the authors. Check the following audio interview.

So, as a follow-on, here are some very interesting elements about:

– Does IP increase innovation?

– Non-compete labor contract clauses inhibit innovation.

This is something I have been particularly sensitive to, as you will see below through past links. But before this, let us follow the book from where I had stopped.

Criticism of the Schumpeterian Theory

“Although originally not a mainstream view in economics, the Schumpeterian view is now close to becoming an orthodoxy in most circles. Schumpeter celebrates monopoly as the ultimate accomplishment of capitalism. He argues that in a world in which intellectual property holders are monopolists, competition is a dynamic process that is implemented via the process of creative destruction. […] How many industries can [one] mention where the mechanism described in the Schumpeterian model has been at work, with innovators frequently supplanting the incumbent monopolist, becoming a monopolist in turn to be ousted shortly after by yet another innovator?” [Pages 189- 190]

About secrecy and disclosure through patents/copyrights

“A common argument in favor of patent law is that in order to get a patent you must reveal the secret of your invention. […] Suppose that each innovation can be kept secret for some period of time, with the actual length varying from innovation to innovation, and that the length of legal patent protection is 20 years. Then the innovator will choose secrecy in those cases where it is possible to keep the secret for longer than 20 years, and choose patent protection in those cases where the secret can be kept only for less than 20 years. In this case, patent protection has a socially damaging effect. Secrets that can be kept for more than 20 years are still kept for the maximum length of time, while those that without patent would have been monopolized for a shorter time, are now monopolized for 20 years. Indeed, it is important to realize that outside the pharmaceutical industry, where the regulatory system effectively forces revelation, trade-secrecy is considerably more important than patent. Repeatedly, in surveys of R&D lab and company managers only 23%-35% indicate that patents are effective as a means of appropriating returns. By way of contrast, 51% argue that trade-secrecy is effective.” [Page 186]

“If instead there is a race for a patent, the incentive is to keep intermediate results secret so as to keep competitors from winning the race. In fact there is much evidence that secrecy and legal monopoly are complementary rather than alternatives. Despite copyright, producers of books, music and movies have aggressively attempted to encrypt their work with Digital Rights Management (DRM).” [Page 187]

Worse, [for Amazon 1-click purchase patent], “as can be seen, the “secret” that is revealed is, if anything, less informative than the simple observation that the purchaser buys something by means of a single click.” [Page 189]

“In the case of copyrightable creations, it can be argued that technological change – computers and the Internet – are greatly lowering the cost of reproduction, and so the conventional model in which ideas trade instantly at zero price is relevant. However, it is cost relative to the amount of competitive rent that matters. If indeed the Internet is reducing competitive rents, bear in mind that the same computer technology is reducing the cost of producing copyrightable creations. Take music, for example. Music editing capabilities that required millions of dollars of studio equipment ten years ago now require an investment in computer equipment of thousands of dollars. And long before the Internet swamps the markets with music and movies, authors will be able to create movies on their home computers with no greater difficulty than writing a book – and entirely without the assistance of actors, cinematographers, and all the other people that contribute to the high cost of movie making. […]Whether price falling to zero implies revenue falling to zero depends on the elasticity of demand, the mathematics of infinity times zero is complicated at times and this is one of them. If, in fact, demand is elastic, then price falling to zero implies (because so many more units are sold) revenue increasing to infinity. [Pages 193-194]

About the global economy

One often finds the argument that the increasingly freer trade, the growth of many Asian economies, and the lowering of transportation costs are creating a dangerous mix for our economic stability. In particular, it is argued, our ideas and products are increasingly being “unrightfully copied”, and this requires some kind of serious intervention by our governments. In other words, globalization is risky for our innovators, and we need to strengthen intellectual property protection and force emerging countries to do the same we do. [Page 194]

There is a […] perhaps more subtle but certainly not less relevant argument. As market size increases, two things happen. More consumers are added for all those ideas you are already producing or you would have produced in any case. Let us call these “good” ideas since they were good enough to be profitable even when the market was small. Also, additional ideas from new guys getting into the game become available. Let us call these “marginal” ideas, since if they had been good ideas they would have been introduced even when the market was small. Now, lowering intellectual property protection decreases the monopoly distortions for all consumers of the “good” ideas. With a larger market, many more consumers benefit from the greater usefulness and availability of all these “good” ideas. Second, lowering intellectual property protection makes it harder for “marginal” ideas to make it into the market. But in a larger market, more of these “marginal” ideas are going to be produced anyway, as there are more consumers to pay for the cost of inventing them. So the bottom line is that as the size of the market increases, by lowering intellectual property protection, you can get a lot more use out of “good” ideas at the cost of not getting quite as many “marginal” ideas as you would have.

“This simple rule of thumb would be that if the size of market grows by 4%, the length of protection should be cut by 1%. […]Unfortunately, in the case of copyright, terms have been moving in the wrong direction; they have grown by a factor of about four, while world GDP has grown by nearly two orders of magnitude. Hence, if the copyright term of 28 years at the beginning of the 20th century was socially optimal, the current term should be about a year, rather than the current term of approximately 100 years!” [Page 196]

And the authors add regularly that only already successful ideas are copied, not all of them, so yes there is less revenue and profit. Again how much is enough…?

Does IP increase innovation? [Chapter 8]

“A number of economic historians, Douglass North and his followers foremost among them, have argued that the great acceleration in innovation and productivity we associate with the Industrial Revolution was caused by the development of ways to protect the right of inventors, allowing them to profit from their innovations. Central among such ways was the attribution of patents to inventors, and their upholding either by Parliament or by the courts. Relative to the very poorly defined contractual rights of pre-seventeen century Europe, plagued by royal and aristocratic abuses of property and contracts, there is no doubt that allowing individuals a temporary but well defined monopoly over the fruits of their inventive effort was a major step forward. Even monopolistic property is much better than a system that allows arbitrary seizure by the rich and powerful. This does not, however, contradict our claim that widespread and ever growing monopolistic rights are not as socially beneficial as well defined competitive property rights.” [Page 209] “The issue, then, is the one we posed at the outset: does monopoly really lead to more innovation, on average, than competition? Theory gives an ambiguous answer, so let us look at evidence, supported by a bit of statistical common sense.” [page 210]

After an interesting analysis of music composition before and after copyrights [pages 211-213], the authors analyze patenting. “A number of scientific studies have attempted to examine whether introducing or strengthening patent protection leads to greater innovation using data from post WWII advanced economies. We have identified twenty three economic studies that have examined this issue empirically. The executive summary: these studies find weak or no evidence that strengthening patent regimes increases innovation; they find evidence that strengthening the patent regime increases … patenting! They also find evidence that, in countries with initially weak IP regimes, strengthening IP increases the flow of foreign investment in sectors where patents are frequently used.” [Page 216]

Innovation may lead to more patenting but more patents and stronger patent protection do not lead to more innovation. [Page 219]

About labor contract clauses: [Pages 224-227]

(Route 128 and Silicon Valley and restrictive “non-compete” labor contract clauses)

Legally preventing workers from spreading the knowledge they acquired in previous occupations is an inefficient way to internalize knowledge spillovers.

In 1965 both Silicon Valley and Route 128 were centers of technology employment of equal importance, and with similar potentials and aspirations for further growth. … By 1990, Silicon Valley exported twice the amount of electronic products as Route 128, a comparison that excludes fields like software and multimedia, in which Silicon Valley’s growth has been strongest.

What explains this radical difference in growth of the two areas? […] The only significant difference between the two areas lay in a small but significant difference between Massachusetts and California labor laws: A postemployment covenant not to compete prevents knowledge spillover of an employer’s proprietary knowledge not, as does trade secret law, by prohibiting its disclosure or use, but by blocking the mechanism by which the spillover occurs: employees leaving to take up employment with a competitor or to form a competing start-up. Massachusetts law is generally representative of the approach taken toward postemployment covenants not to compete by the great majority of states. California law governing covenants not to compete is both unusual and radically different from that of Massachusetts. “every contract by which anyone is restrained from engaging in a lawful profession, trade, or business of any kind is to that extent void.”

The paradox of Silicon Valley was that competition demanded continuous innovation, which in turn required cooperation among firms. [Quoted from Saxenian. This is as you know one of my favorite topics as you might read from Silicon Valley – more of the same? or The spin-off virtuous circle].

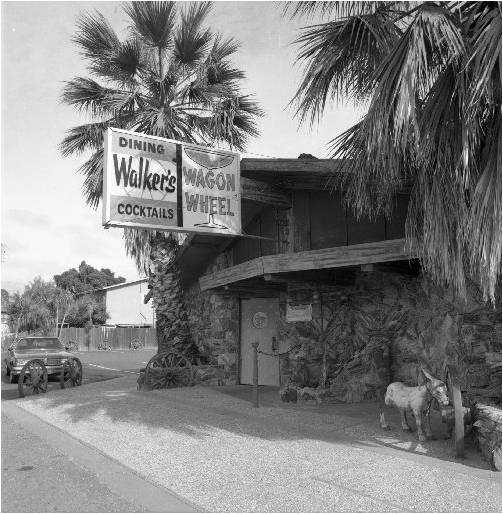

The (not so) famous Wagon Wheel Bar, incarnation of knowledge spillover.

We know that there are good economic reasons why it must be so: competition is the mechanism that breeds innovation, and sustained competitive innovation, paradoxical as that may sound to those that do not understand it, often is best implemented via cooperation among competing firms.

While Route 128 companies spent resources to keep knowledge secret – inhibiting and preventing the growth of the high tech industry – in California this was not possible. And so, Silicon Valley – freed of the milestone of monopolization – grew by leaps and bounds as employees left to start new firms, rejoined old firms and generally spread socially useful knowledge far and wide.

About simultaneous inventions [Pages 229-235]

The authors add interesting examples when simultaneous discoveries were made, including the sad story of tesla vs. Marconi. “So, why did N. Tesla Broadcasting Co. not hold a complete monopoly over radio communications in the U.S. until late in the 1920s? Why did Nikola Tesla die poor while Marconi enriched himself, on his way to a Nobel prize? Because now like then, the game of patenting and intellectual monopoly is not all that democratic and open to the little guys as Ms. Khan’s recent and altogether interesting book would have us to believe. So it is the case that Marconi, supported by the likes of Edison and Carnegie, kept hammering the U.S. Patent Office until, in 1904, they reversed course and gave Marconi a patent for the invention of radio. We read that “The reasons for this have never been fully explained, but the powerful financial backing for Marconi in the United States suggests one possible explanation.”[…] The story of injustice to Nikola Tesla has a tragicomic ending: in 1943 the U.S. Supreme Court upheld Tesla’s radio patent reversing the earlier decision of the U.S. Patent Office. Of course, Tesla was dead by this time – and indeed that is why he was awarded the patent. The United States Government had been sued by the Marconi Company for use of its patents during the First World War. By awarding the patent to Tesla, they eliminated the claim by Marconi – and faced no similar claim from Tesla, who, being dead, was unable to sue. [Pages 232-33]

For reference Khan, Z. [2005], The Democratization of Invention. Patents and Copyrights in American Development, 1790-1920. Cambridge University Press.

More in part 3, soon…