I was asked this week about how big venture capital is in Switzerland. And also in Silicon Valley. So I checked the data and found what comes below. But try to ask yourself how much money is invested in countries such as Germany, France, the UK, and regions such as Silicon Valley or the Boston area. Any clue? Before providing some answers, I should clarify one point: there are at least two definitions. How much money is raised by funds located in a given area. And how much money is invested in companies established in that area. I focus on the second one as funds can artificially be established in strange places such as Jersey for example. Then you have to remember that money can be invested in a Swiss start-up by Silicon Valley investors. It therefore shows the dynamism of entrepreneurs, not of local investors.

A second point I want to mention again is that high-tech start-ups and venture capital are about exceptions. If you are not convinced, read Peter Thiel or what follows. Marc Andreessen pronounced this at class 9 of How to Start a Startup: “The venture capital business is one hundred percent a game of outliers, it is extreme outliers. So the conventional statistics are in the order of four thousand venture fundable companies a year that want to raise venture capital. About two hundred of those will get funded by what is considered a top tier VC. About fifteen of those will, someday, get to a hundred million dollars in revenue. And those fifteen, for that year, will generate something on the order of 97% of the returns for the entire category of venture capital in that year. So venture capital is such an extreme feast or famine business. You are either in one of the fifteen or you’re not. Or you are in one of the two hundred, or you are not. And so the big thing that we’re looking for, no matter which sort of particular criteria we talked about, they all have the characteristics that you are looking for the extreme outlier.”

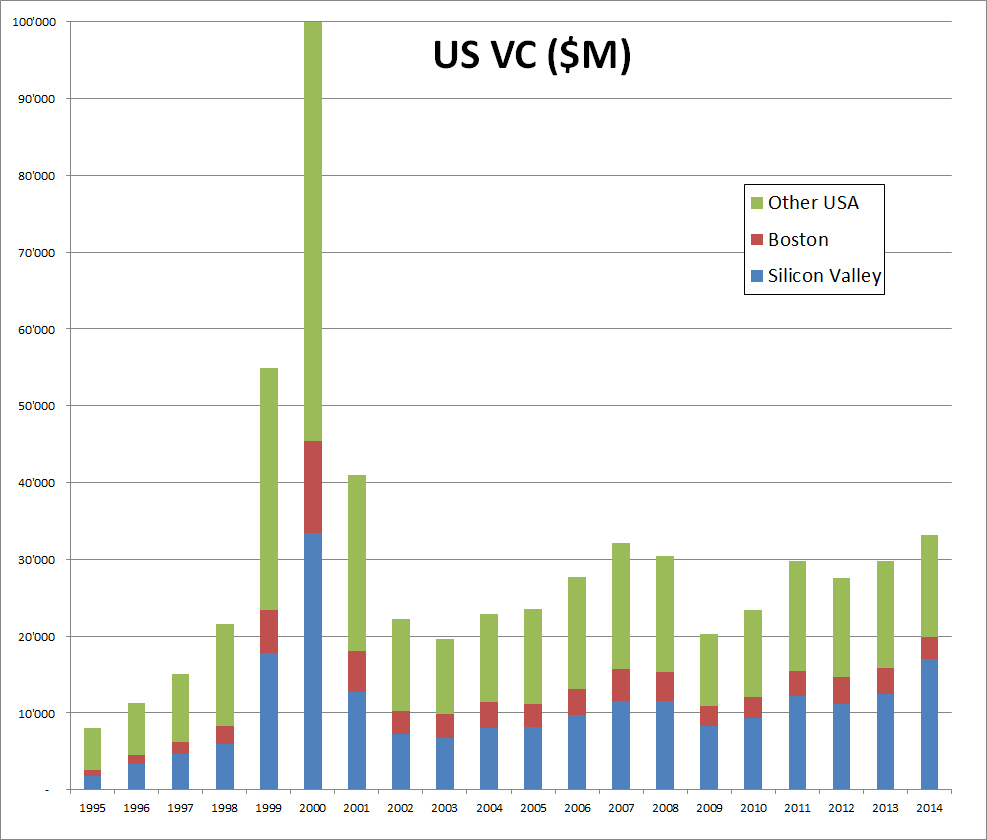

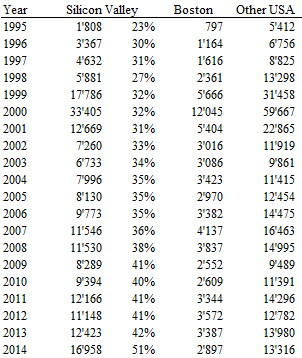

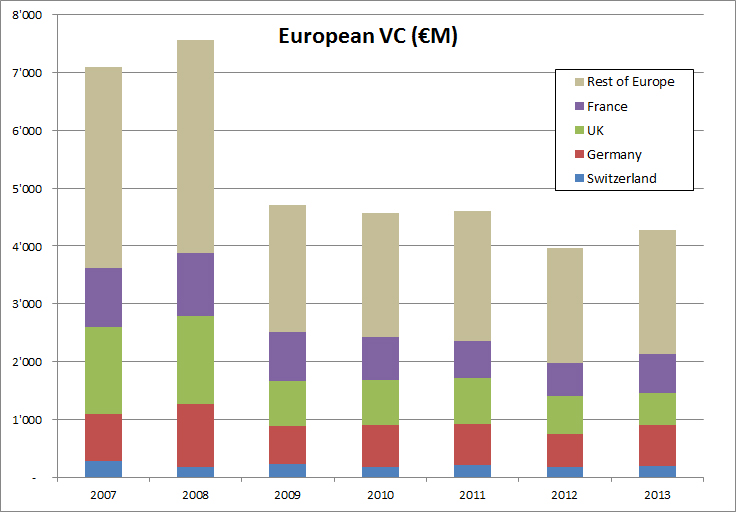

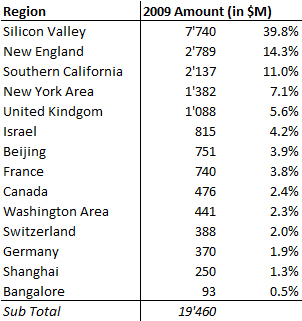

Now the numbers through tables:

Many striking facts. Not new ones, I knew about them. but still…

– Silicon Valley leads. By far.

– There had been a bubble in 2000! But the amounts of VC funding post 2000 have remained extremely high compared to the 90s. Would there be too much money?

– The USA easily recovered from the 2008 crisis. Not Europe…

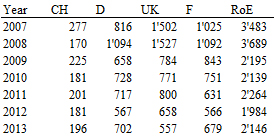

NB: I had done the exercise in 2011 in Venture Capital according to WEF. Let me just add again this table. Notice the numbers are not fully consistent with what I showed above. Just an illustration of the difficulty of definitions (stages, origins…) but the order of magnitude is what matters.