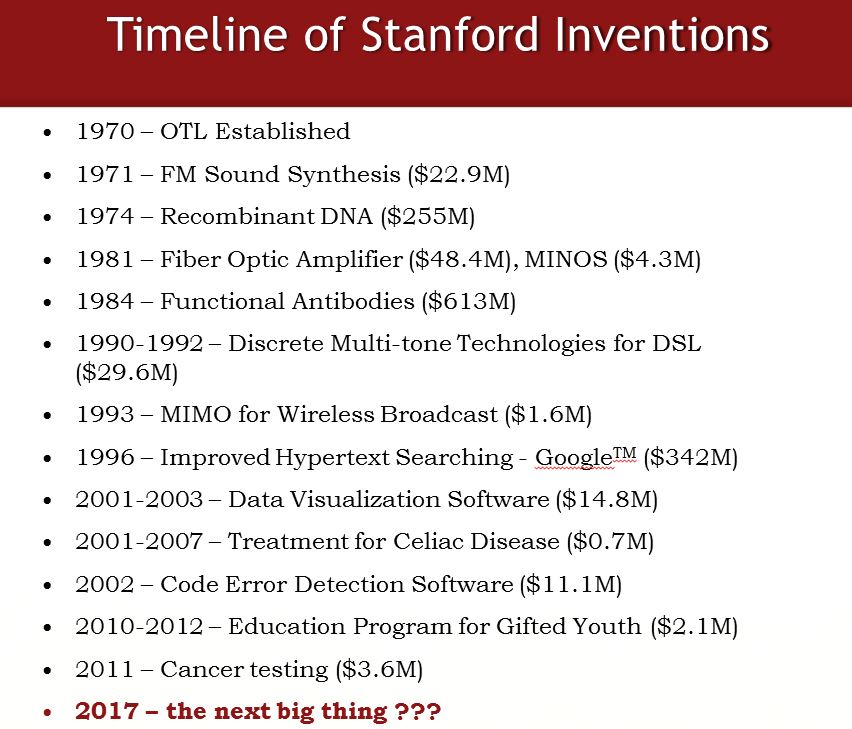

Until early this morning, I thought that the Google license (i.e. the rights Stanford University had granted the startup on the PageRank patent) was the largest generator of licensing revenue for the Californian university. I was wrong! If you read the annual reports of OTL, its Office of Technology Licensing, for example the pdf of the 2016 Annual Report, you may notice that the largest royalty revenue generator had another source: intellectual property/patents about functional monoclonal antibodies. Here are what these reports say of the largest amount of revenue in a given year from a single invention:

2016: $64M

2015: $62.77M

2014: $60.53M

2013: $55M

2012: $51M

2011: $44M

2010: $45M

2009: $38M

2008: $37M

2007: $33.5M

2006: $29M

These numbers give a total of $363M and another book mentions $125M cumulatively before 2006. But a more recent powerpoint document shows that the total cumulative revenue is … $613M!!

As a side note, in 2005, the Google patent gave proceeds of $336M following the company IPO. The 2004 and 2003 reports do not say the amount of the largest source of income whereas in 2002, it was “an unexpected $5.8M in one-time royalties” and in 2001, “for the first time in over 20 years, a physical science invention – an optical fiber amplifier – generated the most income”.

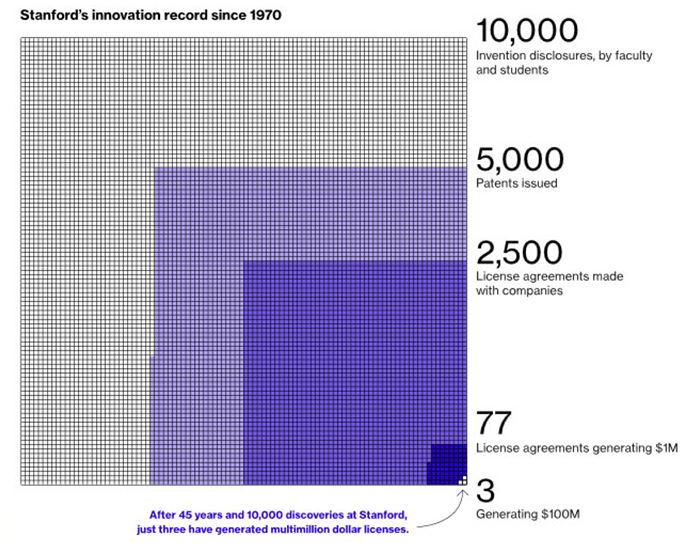

As Lita Nelsen from MIT said (see my previous post), “Even nationwide, you can show that tech transfer is, at best, a lottery if you want to make an ability to influence [a university’s financial position]. The primary winners—not 100 percent of them, but damn close—are single pharmaceuticals. Because if a pharmaceutical hits the market, it’s going to be in the multi-billon dollar [range]. The equity is seldom worth a lot, unless of course you can follow up with preferred investments. But that’s not what we’re in the business of doing. Any university that counts on its tech transfer to make a significant change in its finances is statistically going to be in trouble.” Google was a big exception with the equity proceeeds whereas the patent around monoclonal antibodies or the Cohen Boyer patent are about pharma. Have a look at the next figure from the same powerpoint document.

Interestingly enough I am reading a very interesting book (more when I am finished) which describes the early days of Silicon Valley and in particular the creation of the office of Technology Licensing by Niels Rimers.

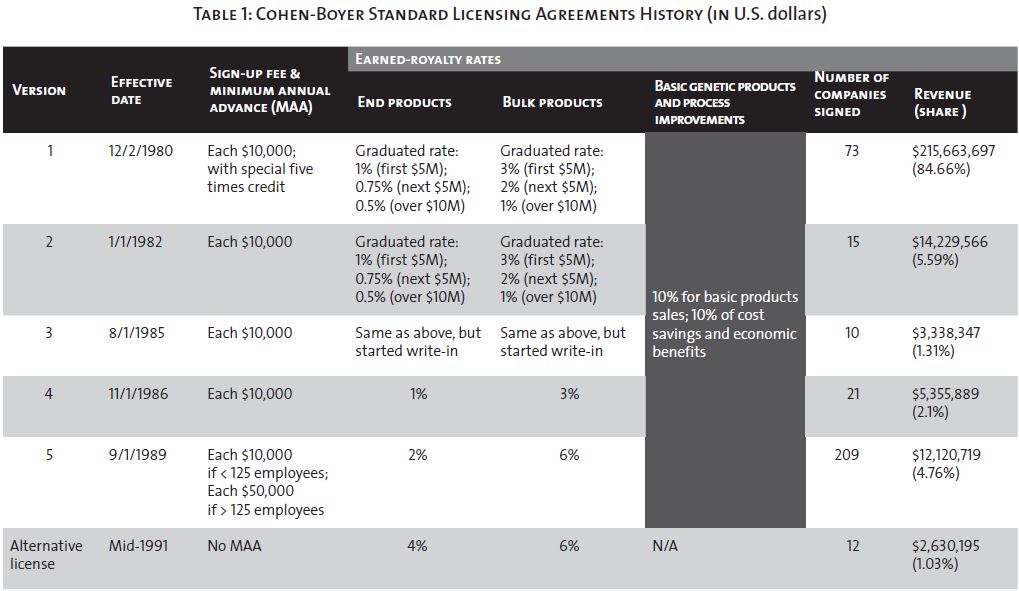

In Troublemakers, author Leslie Berlin extensively describes the Cohen Boyer patent. In note 32 (page 450), she describes the terms of the Cohen-Boyer license. You can also find them in Lessons from the Commercialization of the Cohen-Boyer Patents: The Stanford University Licensing Program.

73 companies has signed for the initial $10k upfront payment, but “ten companies alone provided 77% (US$197 million) of the total licensing income” and 3 (Amgen, Genentech and Lily) provided close to 50% of the total. All this is well-known but I thought it would be interesting to blog about it today.