Criteo is the latest European story. Not yet, some may say, but its numbers are impressive. How do I know? Well in France the Register of Commerce provides a lot of data if you are prepared to pay a small fee (about €10 per document you download). It is possible to know about the rounds of financing, about the revenues, about the founders. It was not as easy as I imagined and maybe I should have bought more documents. (The revenues are not what I had read, stockholders’ shares is probably not accurate as things may be missing. But it looks good enough to me.)

I also know people involved do not always like such publications. Wealth, money is still a taboo, in France particularly. What is important is the message of value creation that entrepreneurs and their investors contribute to create for others. As I copied from the Slicing Pie recently: “Entrepreneurs give security to other people; they are the generators of social welfare. The country needs entrepreneurs, the world needs entrepreneurs. Without them not much would happen. In spite of the exciting life and important role of entrepreneurs, most people never become entrepreneurs. To most people, life is too risky. Most people can’t handle the ambiguity. Most people are afraid of failure. Every entrepreneur fails more often than they succeed.”

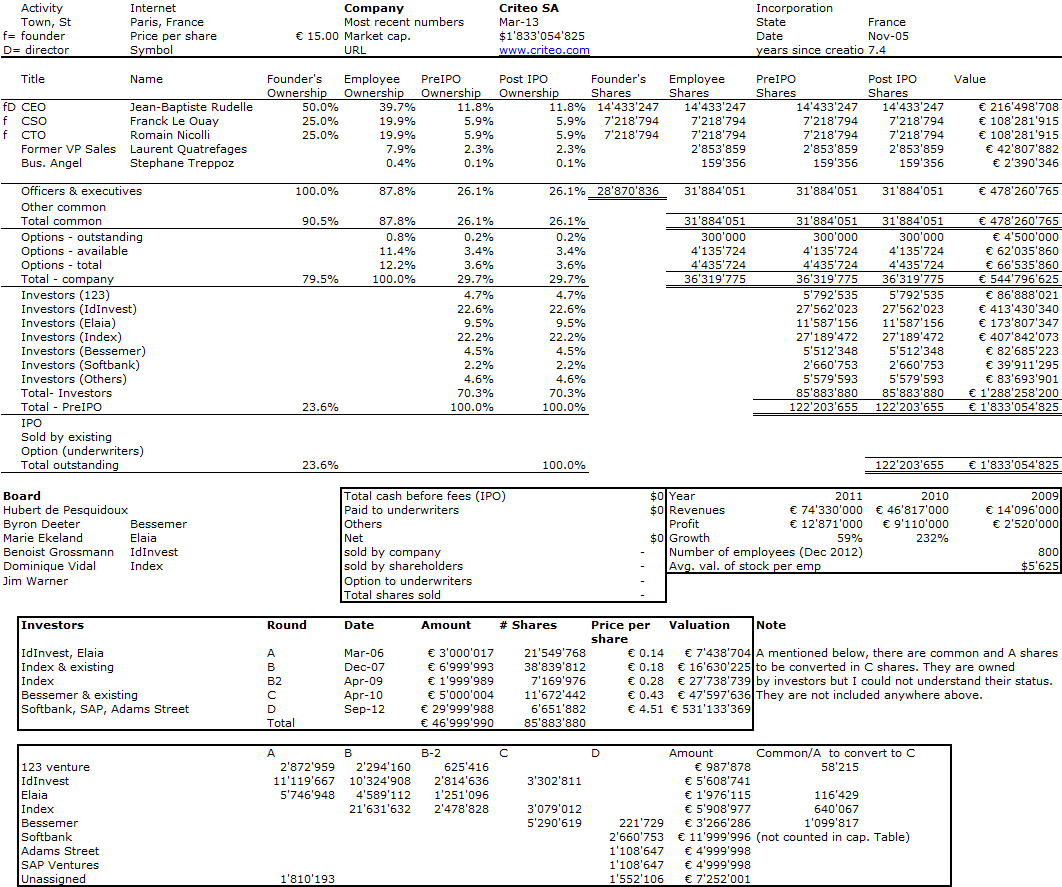

So I publish here again, one of my favorite tools, the capitalization table of Criteo with its rounds of financing (€47M raised), its revenues (at least €74M in 2011), its investors and its founders. But the wealth is virtual, it corresponds to a €15 price per share, more than 3 times the price paid by the series D investors…

I do not think Criteo’s journey was easy and simple. When I first heard of the company, it was developing recommendation systems, not ‘personalized retargeting’. It had Plan B related Pivot. So here it is and my apologies for inaccuracies / frustrations.

Here are some more references.

– Criteo Nabs $40 Million in Funding at $800 Million Valuation

– Criteo Hires Bank for Imminent IPO

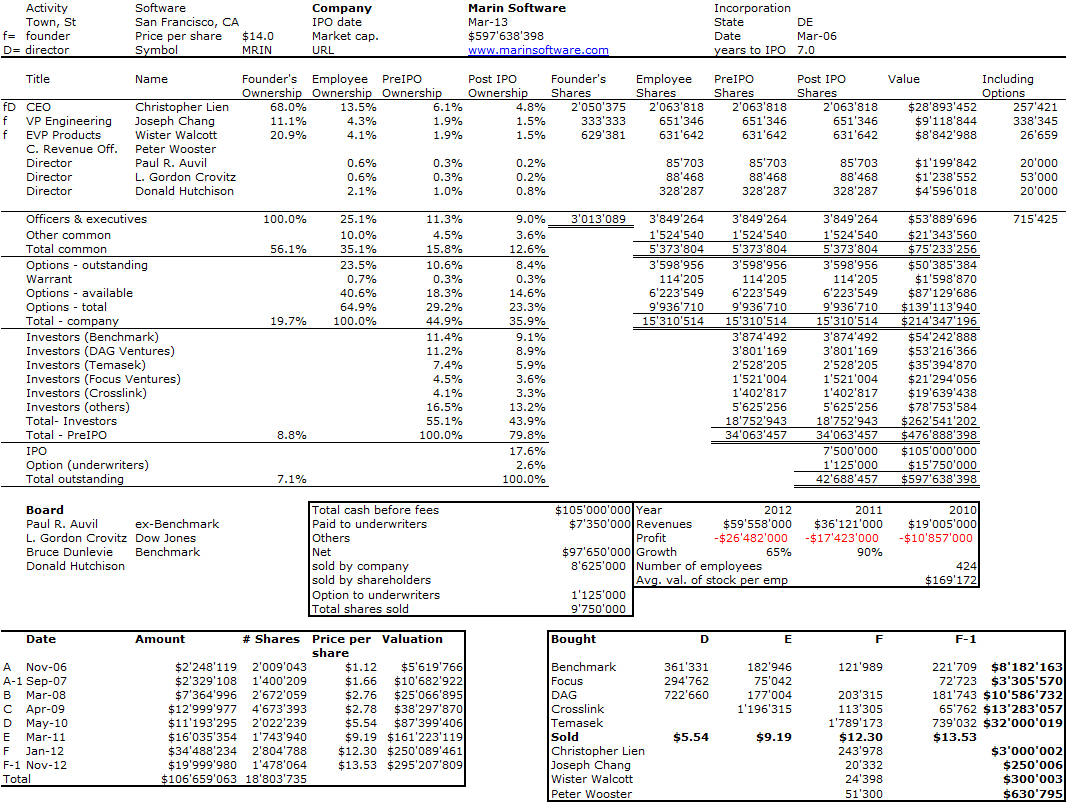

This last article mentions the IPO of Marin, which I had followed too. The comparison is interesting…