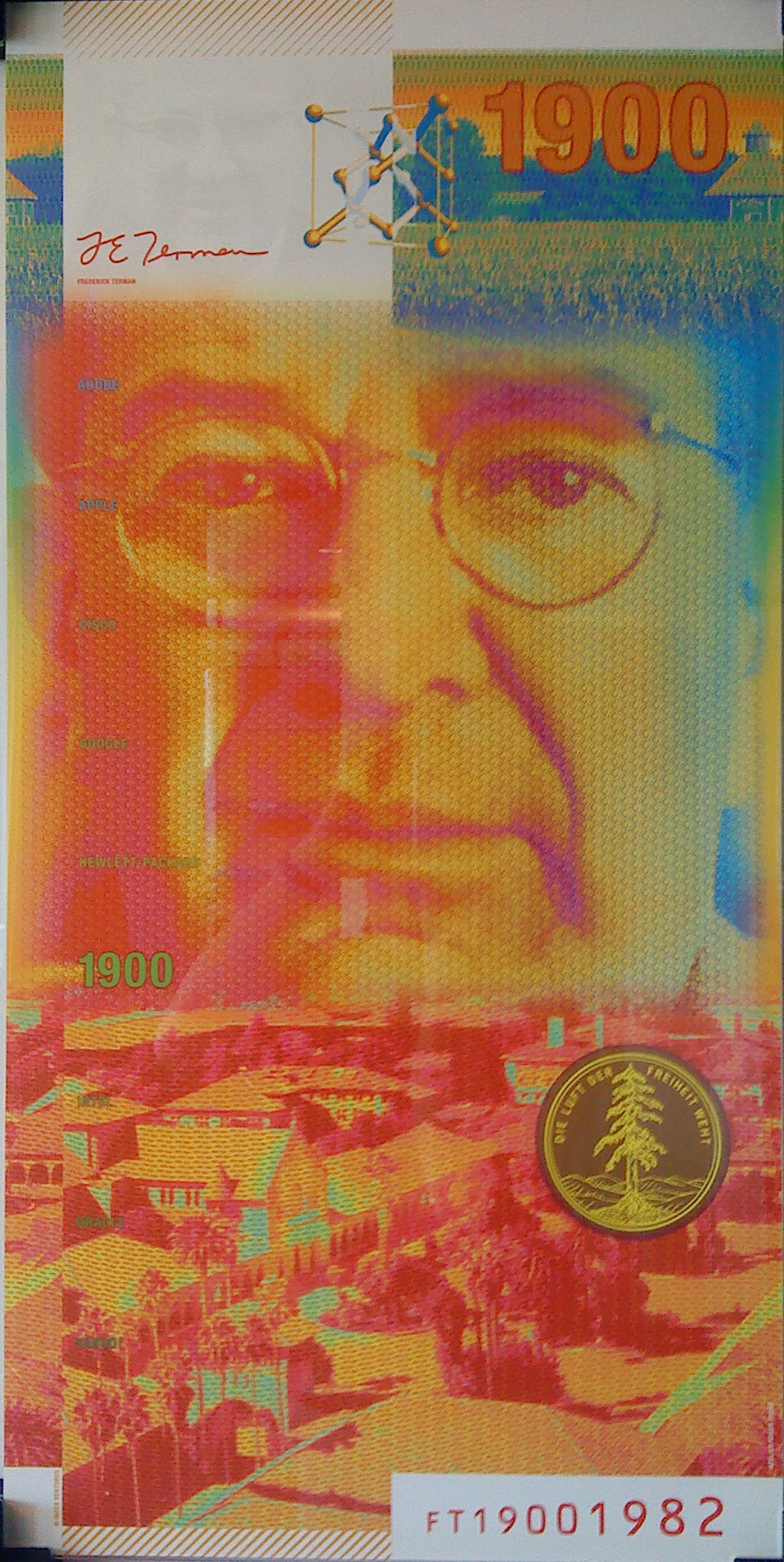

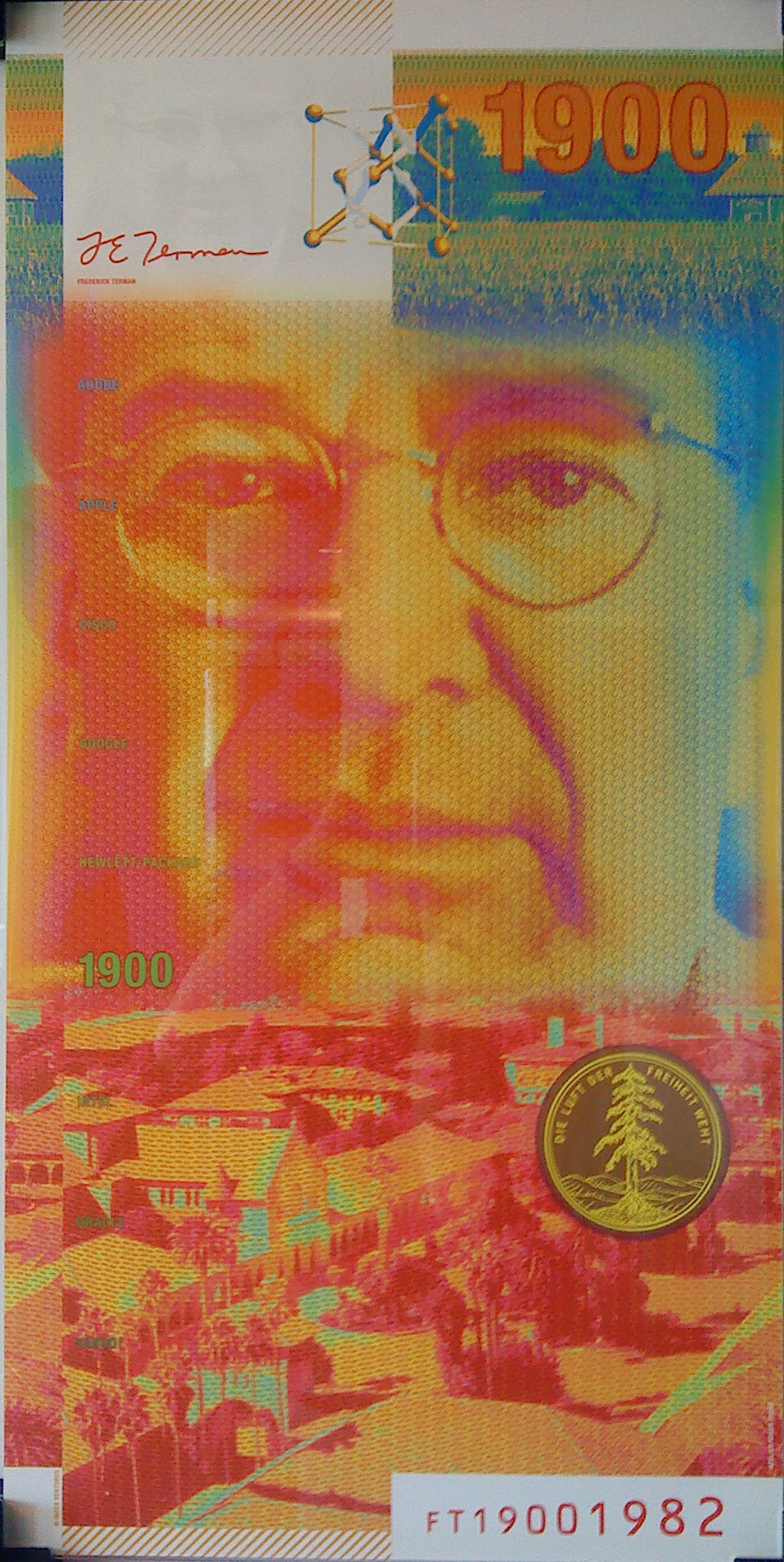

If you have the opportunity to visit VC firm Index Ventures in Geneva, you may see the following:

I had a closer look, was allowed to take the picture and learnt that the Index partners have four such “pictures”, one for each meeting room which has the following names: Frederick Terman, Ahmet Ertegün, Ernest Rutherford and Leo Castelli. What do have these very different people in common? In their own activity, they were the best supporters of “creators”, of “talent” and contributed to the success of people they supported. What ever critics may say, great venture capitalists help entrepreneurs in their success.

It was striking for me to discover this the week I published my post on the Black Swan. In particular, I quoted Taleb when he talks about creation: “Intellectual, scientific, and artistic activities belong to the province of Extremistan. I am still looking for a single counter-example, a non-dull activity that belongs to Mediocristan.” and later “You not only see that venture capitalists do better than entrepreneurs, but publishers do better than authors, dealers do better than artists, and science does better than scientists.” (I can add that gold seekers made less money than the people who sold them picks and shovels.) This is not fully true, one should probably add “on average”.

It’s not the first time I see connections made between scientists, entrepreneurs/innovators and artists. I am convinced of the similarities. It was the second time only that I saw a connection made between academic mentors, publishers, art dealers and venture capitalists. Interesting… I think.

PS: if you click and enlarge the picture you my recognize the pictures, read the names of famous start-ups, Adobe, Apple, Cisco, Google, Hewlett-Packard, Intel, Oracle, Yahoo and probably lesser known Stanford University motto “Die Luft der Freiheit weht” I had used as an introduction to Chapter 2 of my book about Stanford start-ups.