I recently read Mind the Gap: The University Gap Funding Report published by innovosource.

Disclaimer: I usually do not mention my activities at EPFL on this blog and this report deals exactly with the type of funds I manage there: the Innogrants. I was indeed interviewed for this report as one of the active members of the Gap Funding community and the Innogrants are one of the examples mentioned.

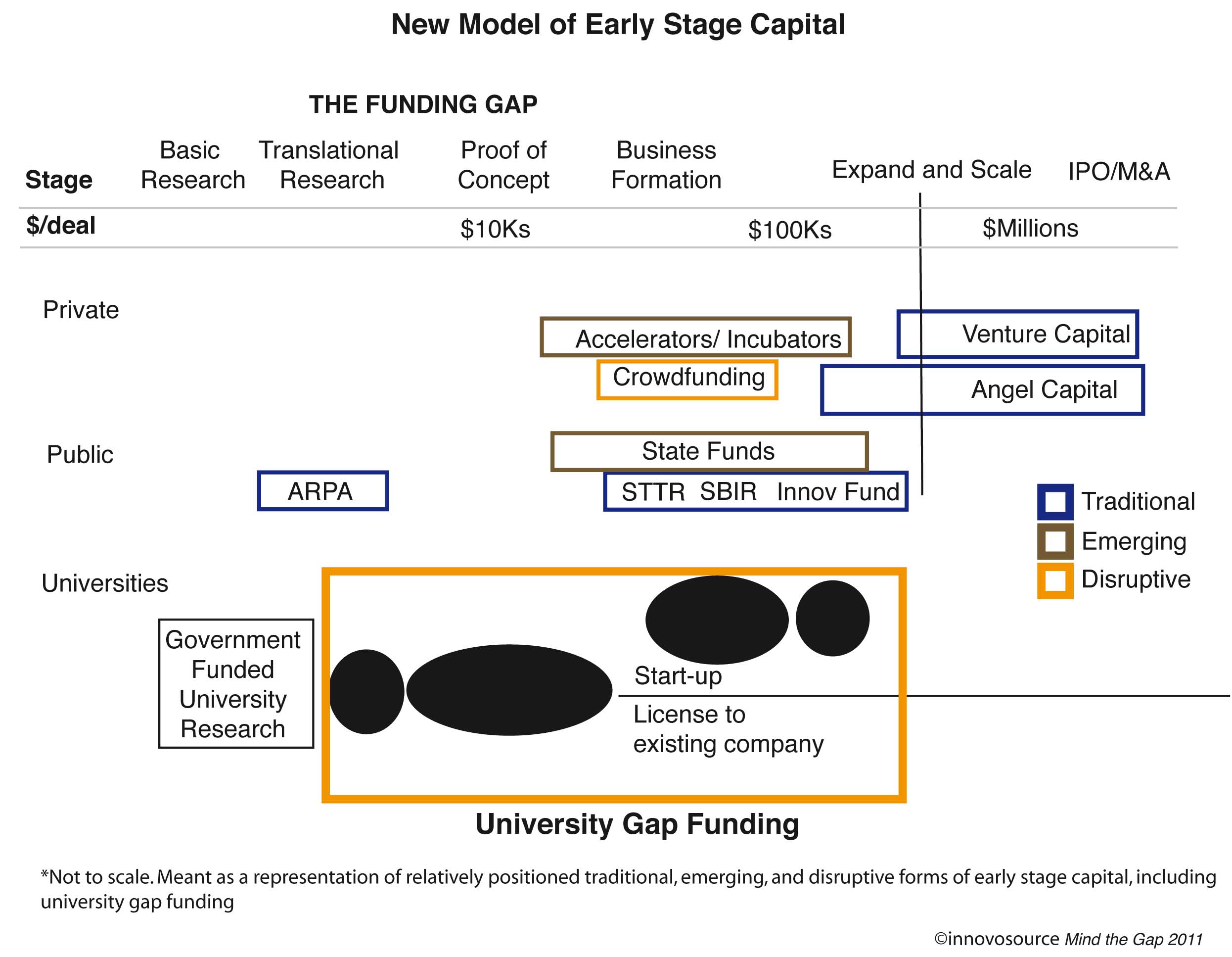

Mind The Gap is a great report because it describes a concept which was born a little before 2005, the seed funding, I should even say the pre-seed funding, by universities of their innovations, including start-ups. The next figure illustrates not only gap funding but all the existing tools enabling academic innovation.

Let me just briefly quote it (but you should know the report is not free, so I cannot summarize it in too much detail. The author allowed me however to give you a 25% discount code: USHAPE). In any case, it is extremely rich in data and information.

“This “gap” extends from where the government funding of basic research ends to where existing companies or investors are willing to accept the risk to commercialize the technology.” [page 9]. The author reminds us that “Failure is commonplace in these sorts of pursuits, but ask where you would find yourself (or where you are going) without GPS and the internet, and most recently a little iPhone “assistant” named Siri that originated from the DARPA funded CALO (Cognitive Agent that Learns and Organizes) program through a university consortium.” [page 20]

As a side element, there are also the emerging accelerators, “Popularized in recent years with the likes of Y Combinator and TechStars, accelerators combine access to talent and support services with “stage-appropriate” capital in return for a stake in the company or other repayment structures.” [page 22] but this is another subject!

There are already some “famous” gap funding tools: “another study by the Kauffman Foundation [1] investigated two well-known proof of concept centers at MIT (Desphande Center) and UC-San Diego (von Lebig Center) and reported general process and impacts.” [page 26]

[1] C. and Audretsch, D. Gulbranson, “Proof of Concept Centers: Accelerating the Commercialization of Univeristy Innovation,” Kauffman Foundation, 2008.

I do not want to quote much more this 100-page deep and very interesting analysis. My final comment is that a critical element is the leverage gap funding enables. You will find a full analysis on pages 88-90. In his Report Summary, the author depicts the value of gap funding through:

High commercialization rates

– 76-81% of funded projects commercialized on average

Attraction of early stage capital

– $2.8B leveraged from public and private investment sources

Business formation and job creation

– 395 new start-up companies

– 188 technology licenses to existing companies

– 7,761 new jobs, at cost of $13,600 gap fund dollars per job

Building a community of innovation

– Thousands of faculty and students engaged in the process

– Incorporate networks of technical and business professionals in the evaluation, mentorships, and leadership of these technologies

Organizational returns

– $75M returned to the organizations through repayments, royalties, and equity sales

– Maximize resource allocation and downstream savings, by permitting early failures through exploratory and evaluation tactics

– Empower universities to continue to take risks that support the type of breakthroughs that define our present, and the type of innovation that will carry us into the future

Let me finish with what I contributed to the report, i.e. a short description the EPFL innogrants:

When I met Jochen Mundinger in October 2006 it did not take me much time to make up my mind. I had previously seen many startup ideas and Jochenʼs Internet project looked to me original and powerful. Prior to any due diligence, I told him that if my analysis was positive, he would get a 12-month grant to work on his start-up. Because of this program, I am lucky enough to be able to make fast decisions and by January 2007, Jochen was working on his project. He did not wait until the end of his grant to found routeRank and by October 2007, with the support of business angels. Today, the service has grown and been recognized by the famous MIT TR35 award in 2010.

And then there was Andre Mercanzini, a Canadian citizen, who certainly has the drive and enthusiasm of many North-Americans. Andre obtained his PhD at EPFL following a few start-up experiences in the US. Andre has developed electrodes for Deep Brain Stimulation. The path was not as fast and easy as for Jochen. Though Aleva Neurotherapeutics was founded in mid-2008, Andreʼs prototypes needed further validation to attract venture capital (a major use of the grants). The Swiss ecosystem is rich with mentors and support so that Andre developed further his project to the point of raising $10M in his series A round in August 2011.

These are just two examples of EPFL innogrants. Initially backed by Swiss bank Lombard Odier, it has since received support from KPMG and Helbling, an engineering firm. The fact that similar initiatives were launched in Switzerland is another illustration that gap funding attracts and seduces. The Innogrants are a bet on young people. Since 2005, 48 projects have been funded out of more than 300 ideas and 24 companies created. We admit at EPFL that failure is part of the process and even if no start-up is ever launched, the grant is a learning experience. We also have the vision that Innogrants become role models and hope that more and more students will be less shy about expressing their dreams.

The report is super expensive 🙁 so I couldn’t check one point and that is:

From your argument, you claim that this type of pre seed funding in the universities has been successful. My question is that “what is the percentage of successful “university Gap funded” in comparison to those university spin-offs who didn’t get this money and were successful. I am seeking to know if there has been any significant difference.

Because anyway to show the impact (or your hypothesis), your “university Gap funded” should bring in significant correlation coefficients compared to non-“university Gap funded”. is it so?

As a support that tech companies have better chance to receive money, As I know VCs are really interested to know if tech companies have technical patents; patent increases the chances that they have for receiving seed money/angel in my opinion.

At the end, I want to argue whether university should do fundamental research or should it promote entrepreneurial lucrative activities? Now I see a combination in work at EPFL. Could you please write a post about how EPFL manages to balance?

extremely interesting post : the scheme above seems to forget about private foundations, which have been playing and increasingly important role to act in this gap (and not only venturekick.ch, i.e. we’ve been listing the supports on startup.ch, a very large number of them, only in Switzerland). Of course, does not cover all of the expressed needs.

@Kourosh: Yes it is expensive, so not for students but for policy makers. I have a copy for EPFL only. Now your first question: let me answer it with another question: how do we measure success? I am not sure! So if I gave the feeling Gap Funding is successful, it is time to be cautious. Gap Funding has emerged, not to say, is emerging as a new tool to support entrepreneurship. I prefer to say even to “encourage entrepreneurship”. To compare universities who have and do not have gap funding, you would have to make all things equal, which is a very complex analysis. The answer today is probably we do not know.

On your second question, the answer is easy, universities main missions are teaching and research. Indeed, they do not make money with entrepreneurship. they probably lose money with it. BUT… when I say encouraging entrepreneurship, there is a “teaching” element, perhaps experience. Remember: Stanford is making about 1-2% of its revenues with licensing, about 5-7% of its research is funded by the industry, so it would not achieve its missions without public money but this small piece is contributing to (let us hope) the well-being of society in general.

Now as I said in my book, let us always be clear and careful: entrepreneurs need to be at the center of innovative ecosystem and the tools should be there to support them. The tools should never be considered as elements which will provide success, but they may enable a small piece of it. Without smart entrepreneurs, no innovation.

I can give you more data but as I said initially, it would requite another book and both this blog and my book try to contribute to the question..

As a summary, I would tend to agree with your concerns and I hope this comment balances the feeling you may had before.

@Jordi. Well the author does not really forget them. He focuses first on who manages the fund. Are they public or private entities, Then the source of funding comes second. University Gap Funding are initiatives from universities (by definition) but they are sometimes private entities, and their sources of funds is a combination of public and private money, including foundations (in fact the Innogrants had “sponsor” money from foundations). Venture kick is different because it is a private initiative sponsored by foundations but focusing on university gap funding. A point which might not be covered is Gap Funding for not university-related innovation. I would claim it is addressed by SBIR and State funds

Thanks Herve, great stuff as always! Will

Herve, as an FYI. I just released a new Mind the Gap “open” website (www.gapfunding.org) for those interested in translational research, proof of concept, seed funds as a follow-on to the report. My goal is to create a community that shares exciting new developments with their programs, and upcoming associated events in order to assist current and aspiring fund managers.