How much equity universities take in start-ups for a license of intellectual property? It is sometimes not to say often a hot topic and information is not easy to obtain. However there are some standards or common practice. I have already published posts on the topic: University licensing to start-ups in May 2010 followed by a Part 2 in June 2010.

To oversimplify, I used to say that the license was made of 3 components:

– first, universities take about 5% post-series A (a few million $) or similarly about 10% at creation (investors often take half of the company at round A,)

– second, there is also a royalty based on sales of products using the licensed technology, about 2% but the range might be 0.5% to 5%. A minimum yearly amount is usually asked for, like $10k or more.

– third, a small but important detail: start-ups pay for the maintenance of the IP from the date of the license.

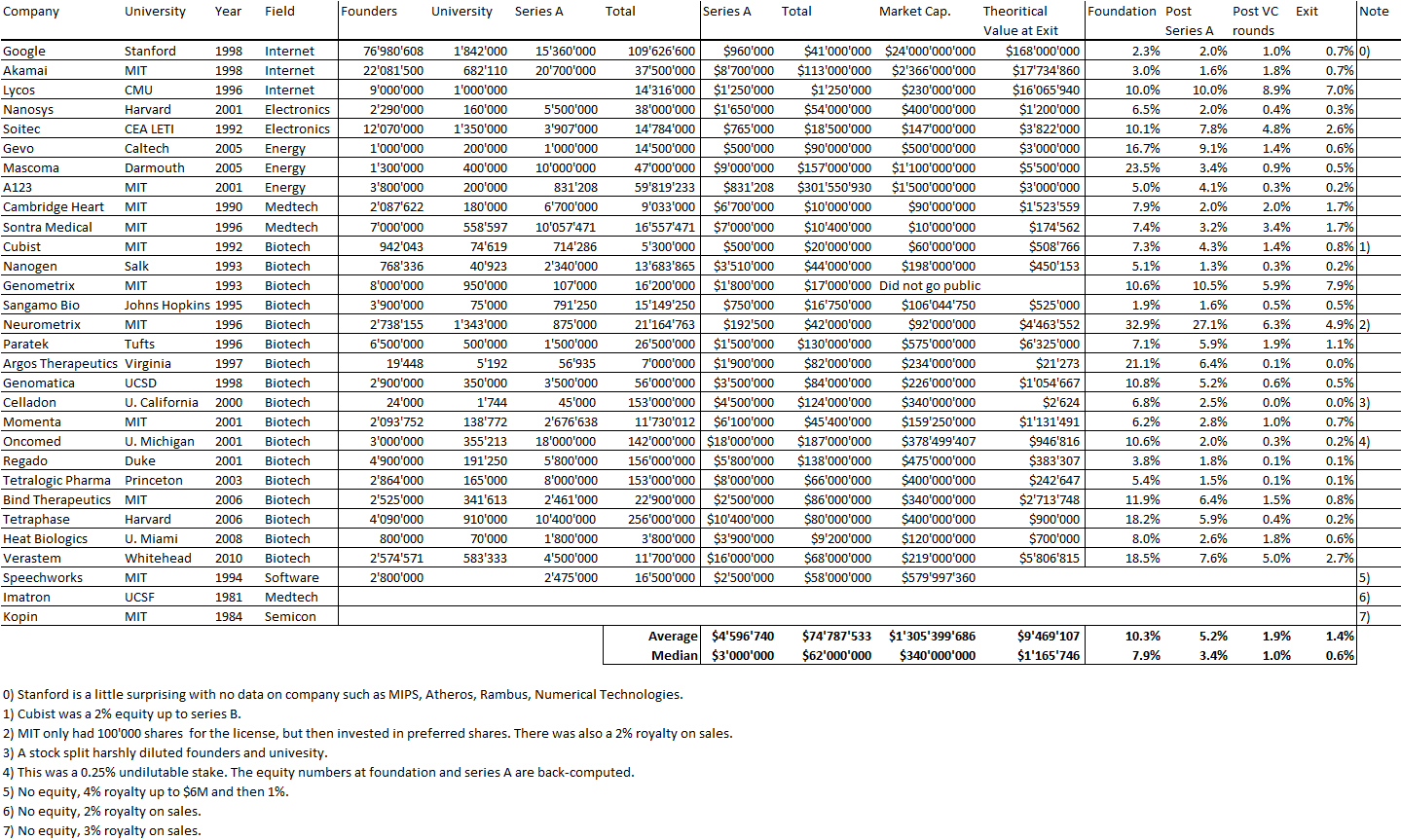

I decided to look at data again through the S-1 documents, which start-ups write when they prepare their Initial Public Offering (IPO), usually on Nasdaq. I found about 30 examples of academic spin-offs which gave details about the IP license. Here is the result.

A couple of comments:

This was not an easy exercise and I would not claim it is mistake-free. You should read it as indicative only, hopefully it is mostly accurate! Assuming the data is accurate, universities own about

– 10% at creation or

– 5% post–series A (average: $5M)

– Universities keep a 1-2% equity stake at exit,

– Worth a few $M (Median is $1M)

With an average of $70M VC investment and market value in the $1B range (Median is $300M)

(Median values are as important as Averages).

Royalties are in the 1-4% range.

All this is consistent with information given in my prior posts!

You can also check the following Slideshare document

My friend Dominique asked me on Facebook: “hanks Hervé for this interesting post, as usual. I see that CMU considers the case of non exclusive licensing to the spin-offs. Is this common? I would have thought that in most cases the license would be exclusive. Any data concerning this last point?” and I said: “Well non-exclusive is not so rare, particularly in software where it is not always easy to identify which piece of the code is uniquely owned by the university. Even the famous cohen-boyer patent in biotech was licensed non exclusively to many, many partners, this can make sense when you have a platform useful for many actors, Think similarly about MPEG by the Fraunhofer I think. I do not have quantitative data on exclusive vs. not, but again not so rare…”

Mais quid des royalties ?

L’exercice est beaucoup plus difficile à faire car les documents sont moins prolixes donc difficile de faire des moyennes.

En biotech/medtech, les royalties sont de 2% (et une est 4%) ; mais le plus souvent c’est « low single digit » (en opposition a mid single digit- je vous laisse imaginer..)

Dans les autres domaines, j’ai du 0.2% pour A123 (électronique), et le plus souvent 0% mais sans absolue certitude.

Il y a aussi des cas de royalties sans equity

– 3% pour une dans le semicon et

– 4% jusque $6M puis 1% pour une dans le SW

Pingback: Tech Spinout Equity Guide (Part 2): Startup Cap Table Review - Terem