After a short analysis of Amgen through the book by Gordon Binder – Science Lessons – here’s a more statistical description of the world of biotech. I am considering a third part about Genentech as a conclusion of this group. For several years, I have been manually building the capitalization tables of start-ups in general thanks to their IPO documents. They probably contain errors as the exercise requires attention and accuracy, but I imagine that these errors are averaged. I have today more than 350 cases, which are published on Slideshare.

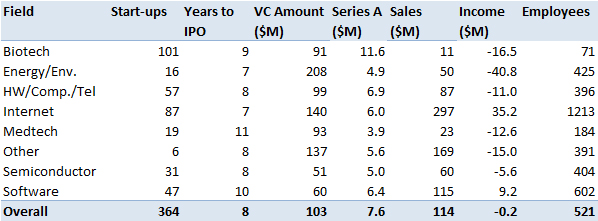

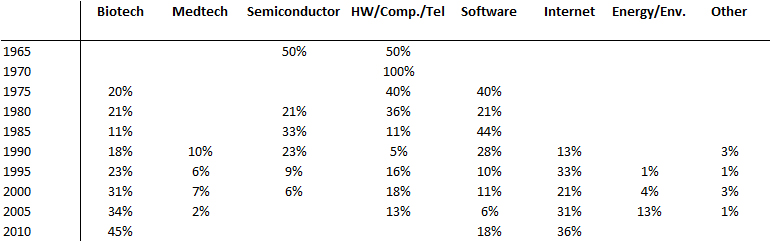

At the end of this document, I have added some synthetic data from which I extract the following. Remember that my sampling is done as I find new companies, so it is not totally random or statistically neutral …

Biotechnology represents a significant part of my data, I will return to this later. VC fundraising is not more important than in other areas, which may seem surprising but it is because a biotech start-up goes public in term of maturity well before the start-ups of other fields. Besides their sales level ($11M on average) is much lower than the others ($114M for the average of all). Also they count 71 employees against 521 for the full set. The Amgen example illustrated that an IPO in fact more a complementary VC round than a market validation. However the first round is much bigger, probably because of the resources required for the initial proof of concept. The (profits and) losses are similar to other areas (excluding software and internet).

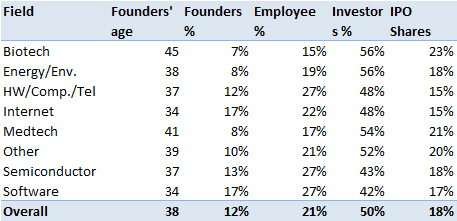

Now a small digression about the founders and the sharing of equity. They are much older (45 years) than average (38 years) and only come close the founders of medtech start-up. Probably because of the specific domain (length of academic curriculum and difficulties in inventing without a long experience). Another consequence of the dynamics of the field (including the uncertainties), the founders retain less equity at the IPO and investors get a larger share.

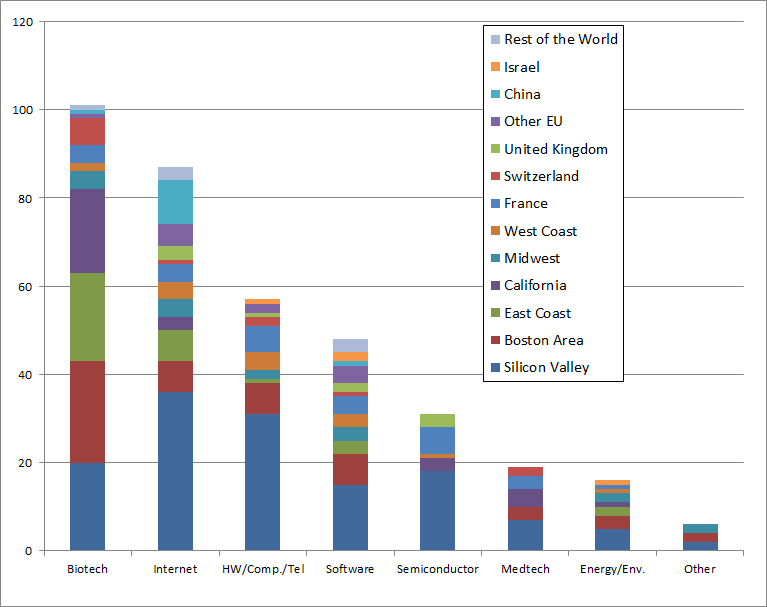

I now return to the biotech industry through its geography first and its timeline later. One known fact – the importance of the Boston area and the East Coast of the USA in general – and perhaps a surprise – the just as great importance of Silicon Valley and California more generally. It is often believed that the Boston area is the site of biotechnology, which is true with respect to other areas, but the West Coast is just as creative and entrepreneurial.

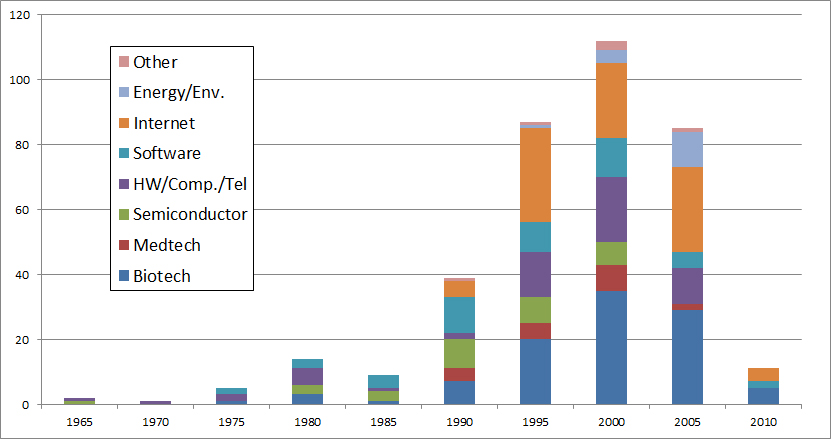

Finally it would be wrong to believe that the Internet has removed biotech. The periods here represent the years of creation of the startups. Biotech is the main field (over one third) since the 2000’s whereas they accounted for less than a quarter before. Again remember that my sample is not statistically validated …