A new and interesting report on Swiss startups has just been published by Startupticker, the Swiss Startup Radar.

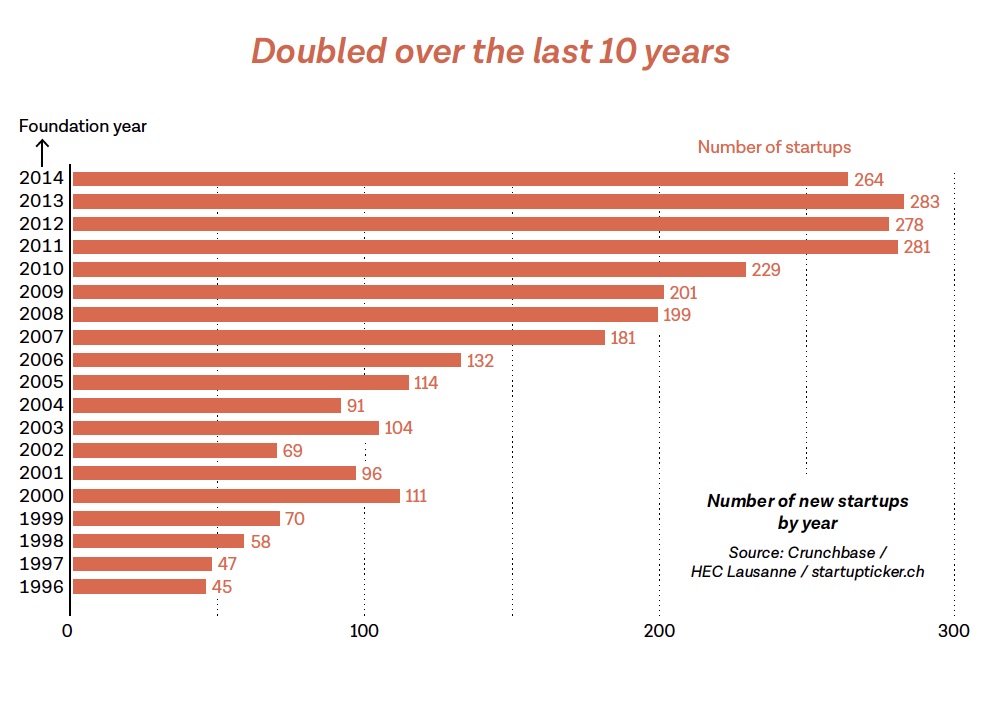

It shows a fairly new information, the number of startup created a year, about 300,

Interesting testimonials also:

Is it due to the much-cited conditions? (Page 80)

No, Switzerland’s regulatory and fiscal framework is first-rate. But I identify two deficits in the support services available in Switzerland: first, there is a lack of contact points for entrepreneurs in the low and no-tech sectors, and, second, we tend to address young people.

More money is one thing, but is it spent differently? Page 89)

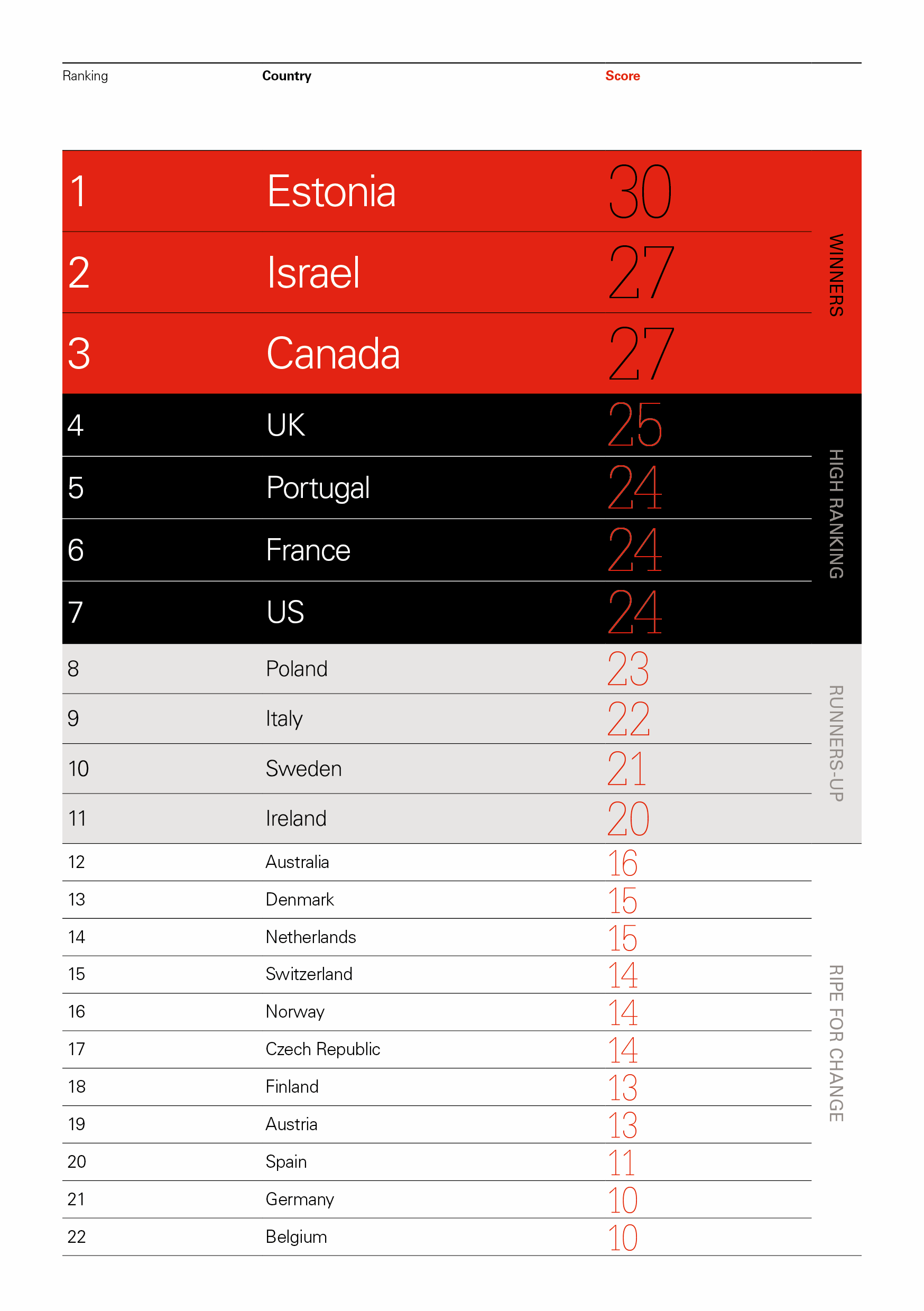

In Switzerland, I observe a strong focus on the survival rate. Startups are encouraged if they have collateral, such as patents, and take a cautious course. As a result, eight out of 10 startups from ETH Zurich are still active five years after their foundation. In Israel, on the other hand, more attention is paid to the economic impact. What matters when assessing a project is the prospect of growth and the creation of new jobs.

The awareness that investing in startups can lead to losses is undoubtedly more pronounced in Israel. This is particularly evident in the financing of very young projects. In Switzerland, seed rounds are worked on with thick business plans, PowerPoint presentations and sales projections. In Israel, this paper war has been largely dispensed with. The business angels and VCs accept that there can be no absolute security in the high-tech segment.

In an article by Techcrunch, 30 European startup CEOs call for better stock option policies, we also talk about the gaps in the framework conditions in Switzerland:

with the following recommendations:

1. Create a stock option scheme that is open to as many startups and employees as possible, offering favourable treatment in terms of regulation and taxation. Design a scheme based on existing models in the UK, Estonia or France to avoid further fragmentation and complexity.

2. Allow startups to issue stock options with non-voting rights, to avoid the burden of having to consult large numbers of minority shareholders.

3. Defer employee taxation to the point of sale of shares, when employees receive cash benefit for the first time.

4. Allow startups to issue stock options based on an accepted ‘fair market valuation’, which removes tax uncertainty.

5. Apply capital gains (or better) tax rates to employee share sales.

6. Reduce or remove corporate taxes associated with the use of stock options.