I just read two reports about innovation. The one in French is very deep (see my post on the French part of the blog). The one in English is also full of interesting lessons and learning. “What is the right strategy for more innovation in Europe? Drivers and challenges for innovation performance at the sector level” was published last June by the Austrian Institute of Economic Research. (Direct link to pdf file)

The authors try to differentiate innovation with sectors and geography (economic advancement.) For example “The data show that firms in economically less advanced member states are less likely to be innovators than firms in countries with more developed economies such as Germany or Sweden, and if they are innovators they are more likely to be technology users.” and “It has also proposed a new classification of industries that is based on the characteristics of entrepreneurship and a broad concept of innovation that transcends the conventional R&D-based classifications.”

I like some of the conclusions such as “Knowledge acquisition from external sources is of particular importance in sectors with large shares of technology users, whereas R&D activities are important in sectors where firms that are technology producers prevail. […] For firms based in countries that are at a distance from the world technological frontier, technology transfer and non-R&D related innovation activities are extremely important to promote innovation. […] On the other hand, for firms located in countries on or close to the technological frontier, intensive innovation activity is a driver of competitiveness. In order to maintain a competitive edge firms need to invest in R&D, acquire and adapt new technologies.

Of course all this is not obvious and may be counterintuitive. Look at Cisco in the USA, which does A&D more than R&D (they acquire start-ups and then develop). Is Cisco at the Frontier or not?

In terms of national policies, an interesting lesson: “The results show that the impact and the magnitude of these factors vary greatly across industries and countries. In fact, most variables can have either a positive or a negative influence depending on the sector. For the energy sector, the ICT industries and the aerospace industry public R&D subsidies have a positive effect, whereas R&D spending by the government seems to crowd out R&D investment in the textile, chemical and ICT industries.” I see a slight contradiction here but…

Then the authors address the issue of human capital: “Engineering and science skills contribute directly to international competitiveness” and “the returns to higher education will be higher for countries farther away from the technological frontier due to the greater importance of technology transfer and absorptive capacities […] On the other hand, in countries that are on or close to the technological frontier accumulated knowledge and experience are a precondition for sustained innovation performance and growth.”

On the competition side, they explain: “Competition is based on the interplay between the creation of novelty and imitation, i.e. between exploration and exploitation of opportunity. […] Firms that compete mostly with less advanced firms, have an incentive to reduce their risky R&D investments, as they are easily able to keep a competitive advantage over their rivals without incurring the cost of R&D investments. On the other hand, if they compete with firms with similar technological capabilities, they have an incentive to invest more in R&D, as this is a means to explore new opportunities and market niches and therefore set themselves apart from their competitors.

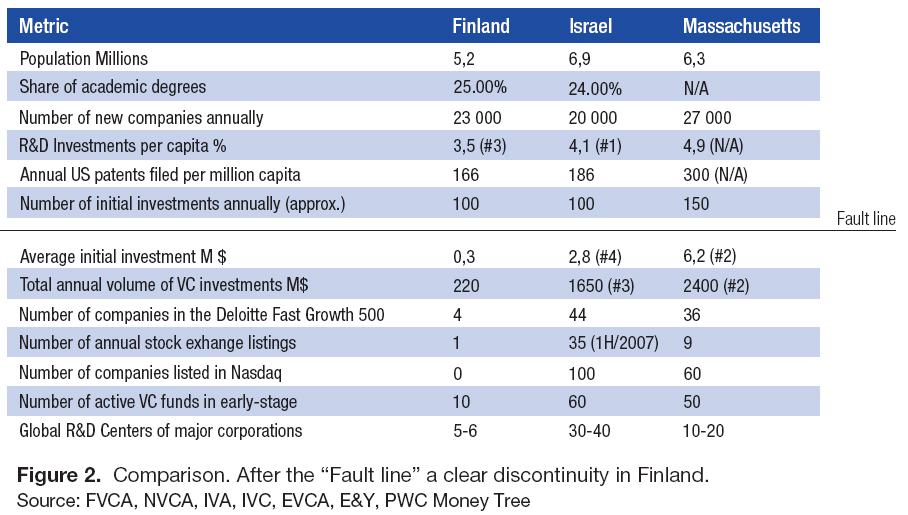

About the gazelles, the fast growing companies: “… a count reveals a significantly higher number of gazelles in the new member states of the European Union than in other EU countries. […] Statistical analyses show that in the more advanced economies of the European Union (continental and northern countries) fast growing firms are mostly of the creative entrepreneurship type and they also have a significantly larger share of turnover from product innovations. For gazelles in the southern European countries and the new member states innovation is much less important.”

Among the challenges for Europe, here are some scary elements:

– There is the danger that firms will increasingly relocate their research activities to countries where conditions concerning human resources and scientific infrastructure are better.

– For technology intensive sectors the problem is that they are not able to hire enough top level science and engineering graduates or attract the best-qualified engineers, scientists and specialists from abroad to their industry. These problems are particularly severe for new and fast growing firms that cannot rely on a long-standing reputation to attract people with top level qualifications and skills.

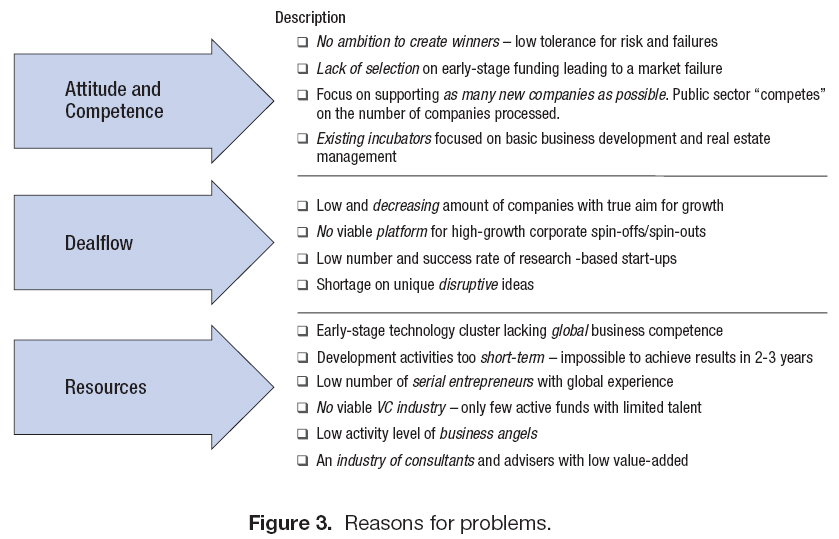

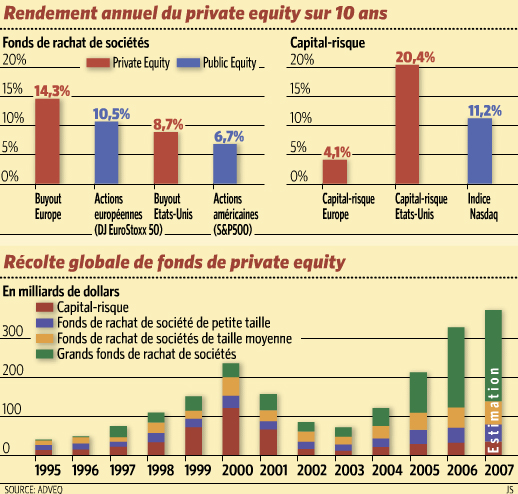

– For firms carrying out high-risk research, for young and small start-up firms and for firms facing extraordinary growth opportunities the lack of financial resources constitutes a serious problem. New financial instruments tailored to the needs of emerging firms remain underdeveloped in most EU countries.