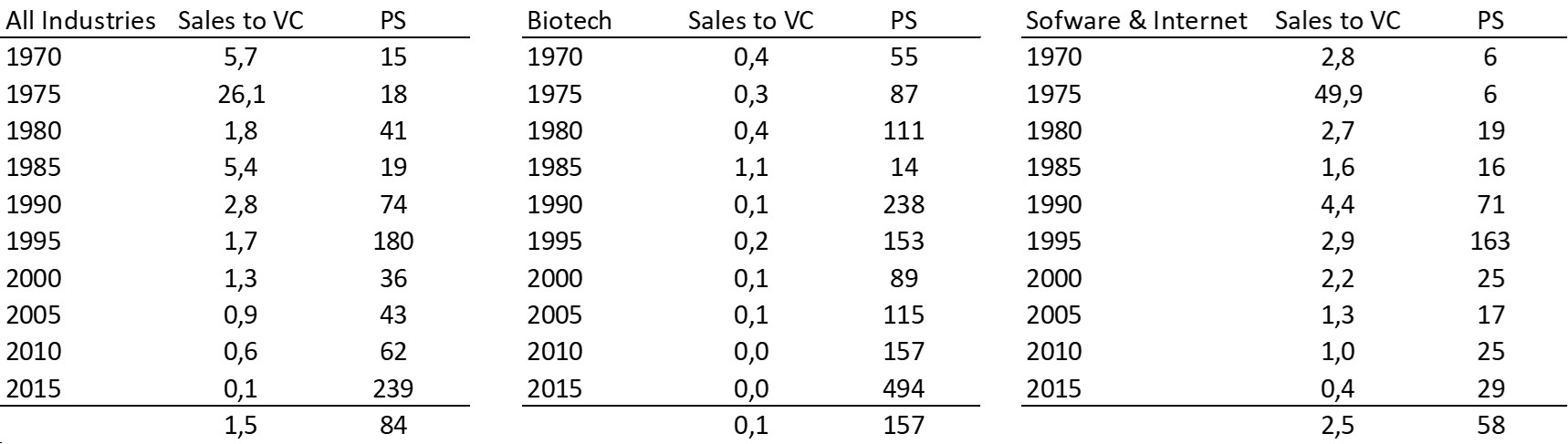

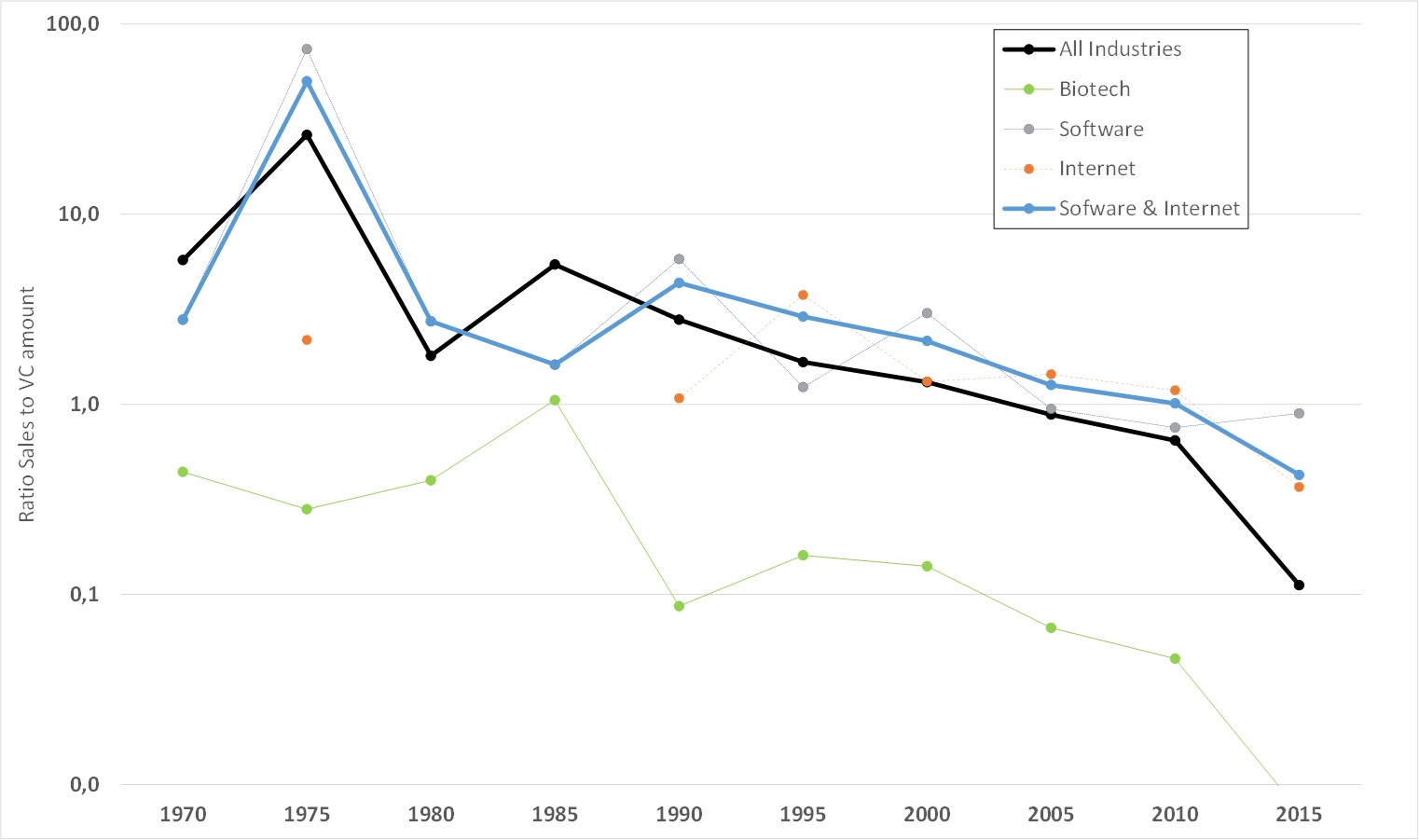

Reading a few articles about Deepmind (part 1 of this post) and the founders of Adallom and wiz.io, I remembered other stories of European startups or those founded by Europeans. I’m thinking of Spotify (see my posts in 2022 and 2018) or VMWare (see an older post from 2010). We see that more or less curbed ambition has led to different results. Wiz or Spotify have valuations in the tens of billions, Deepmind, Adallom and VMWare (first acquisition) in the hundreds of millions, while the second acquisition of VMWare was also in the tens of billions. I don’t know if there’s a pattern or if I’m creating it artificially, but it’s a bit as if an acquisition in the hundreds of millions was a semi-failure linked to the fear of too much competition or the impossibility of pursuing an independent adventure.

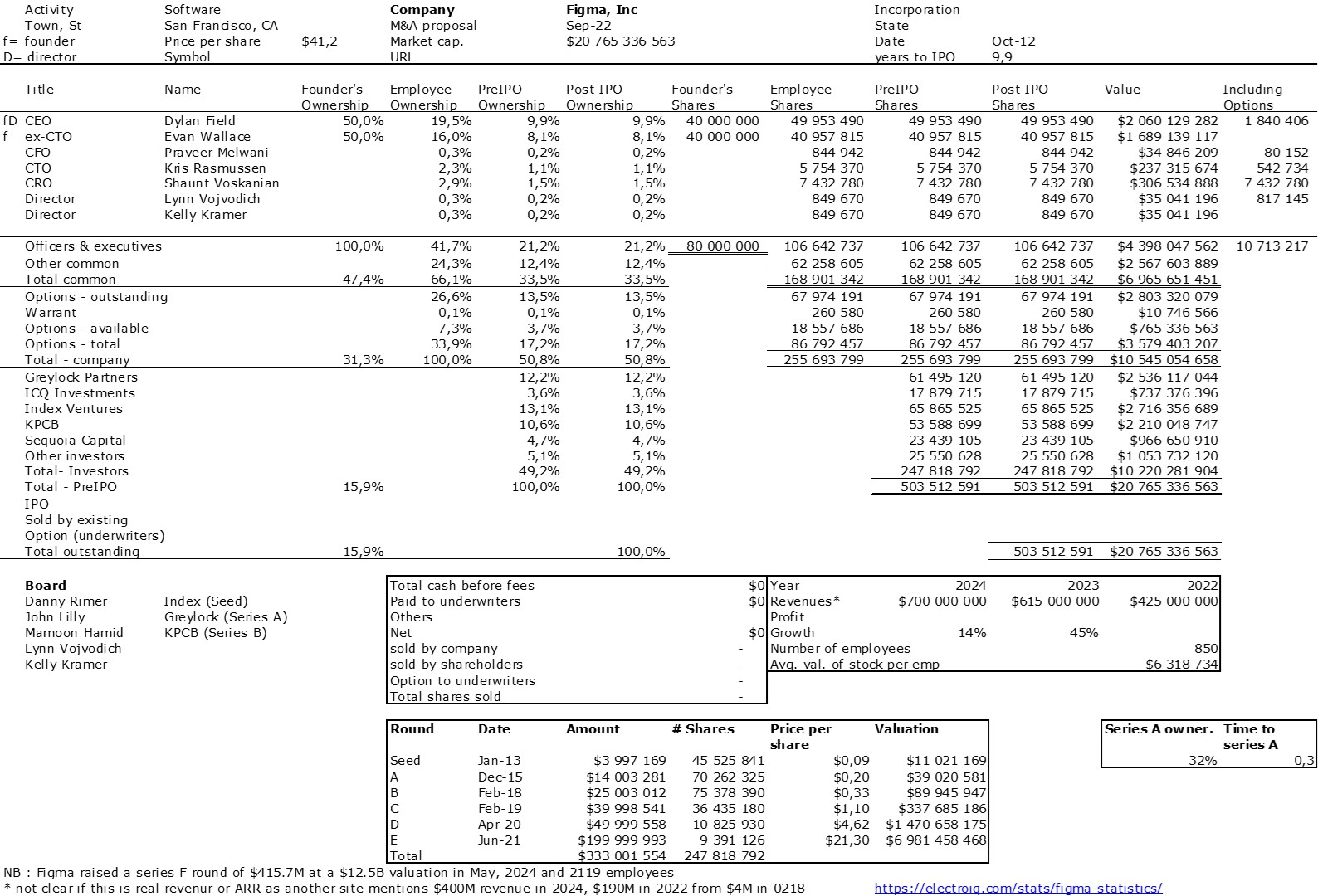

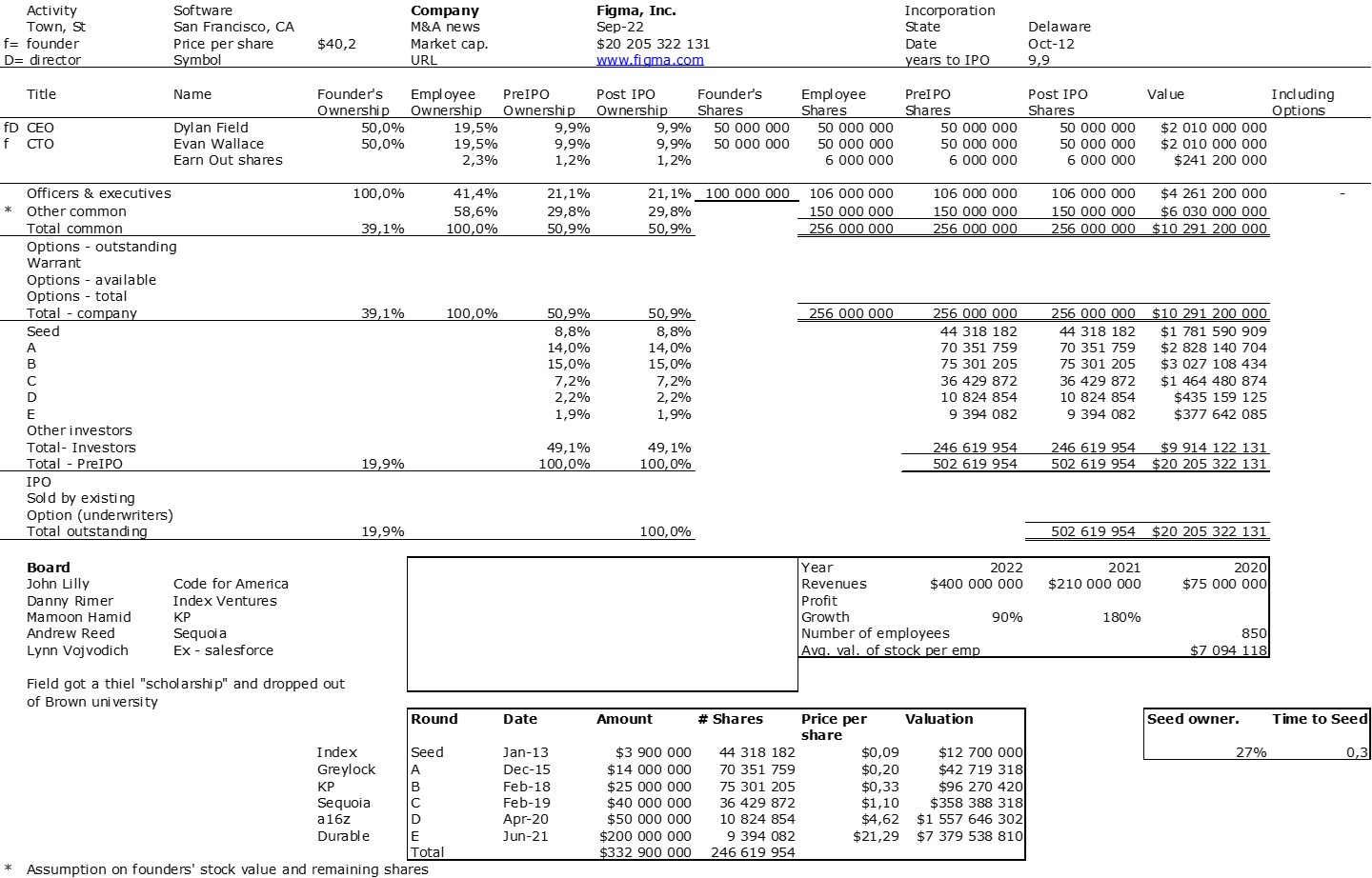

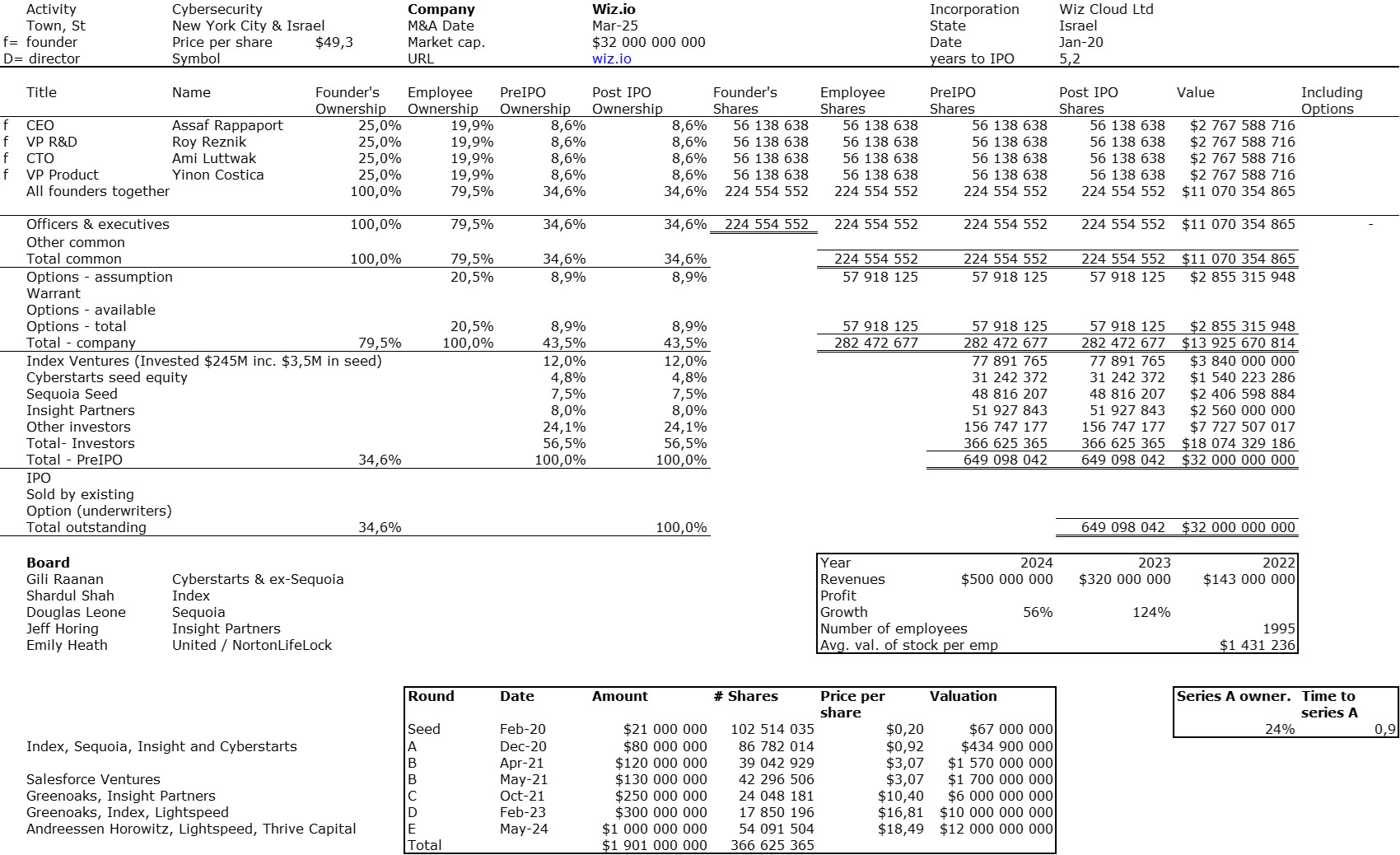

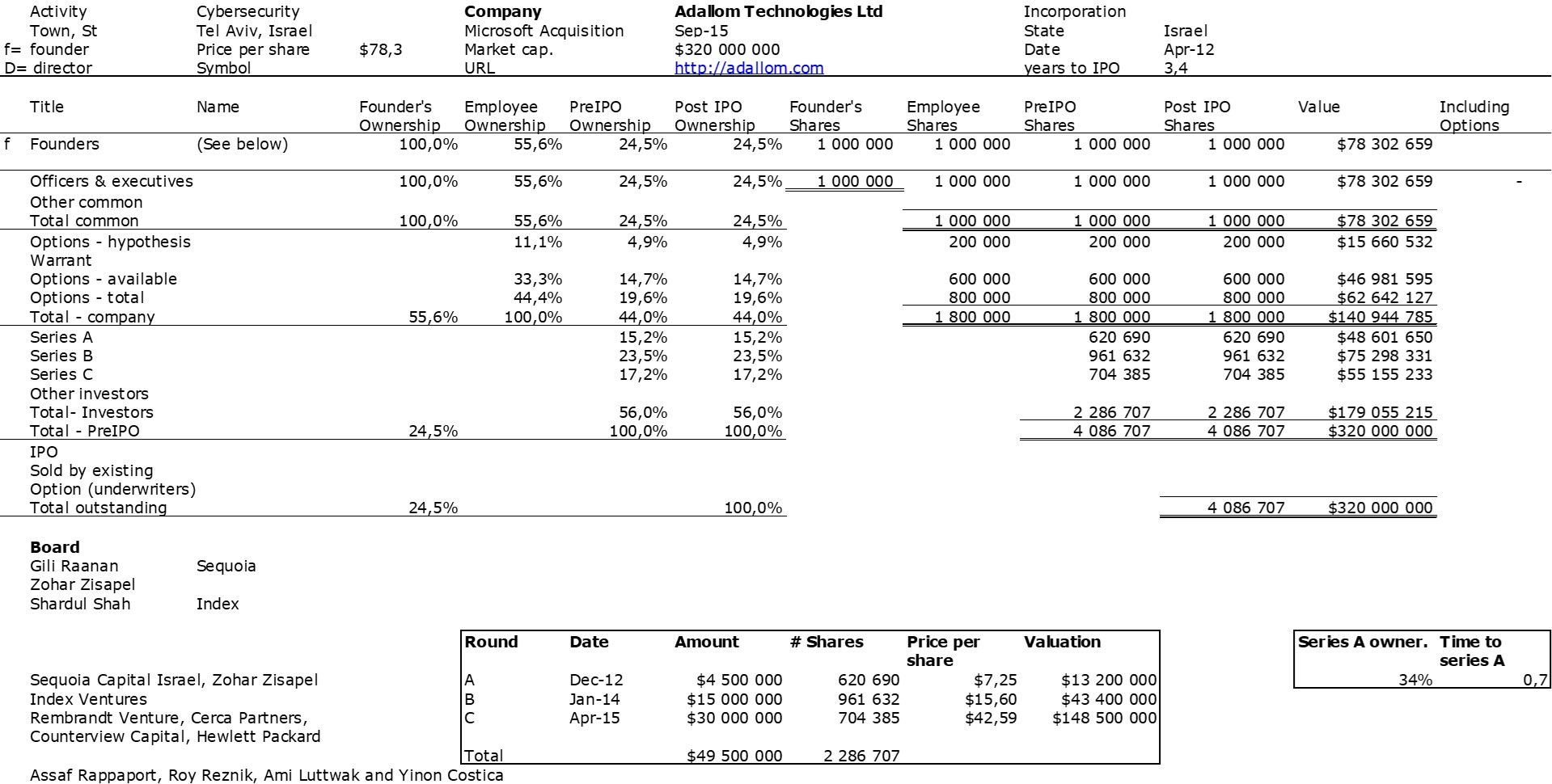

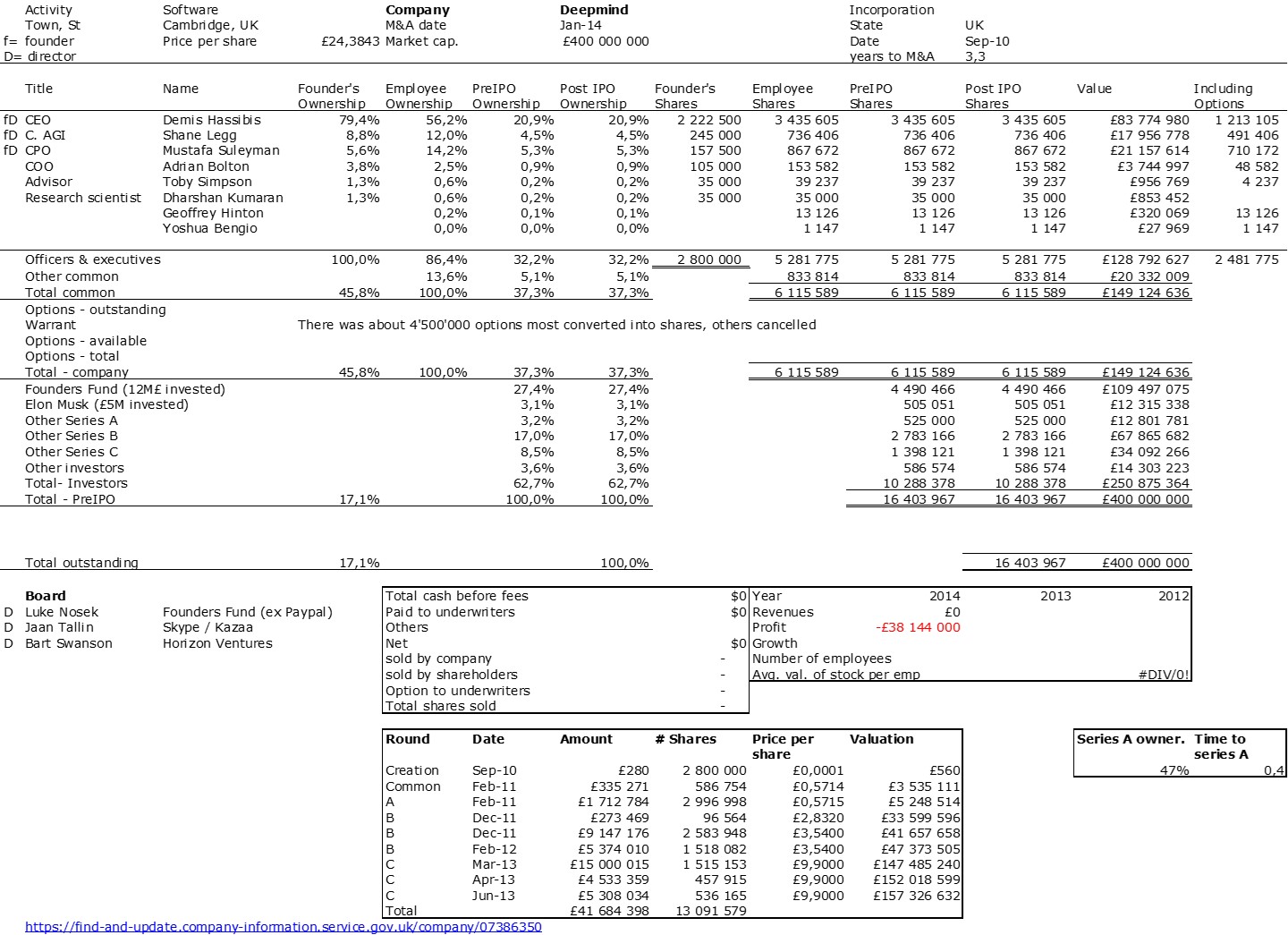

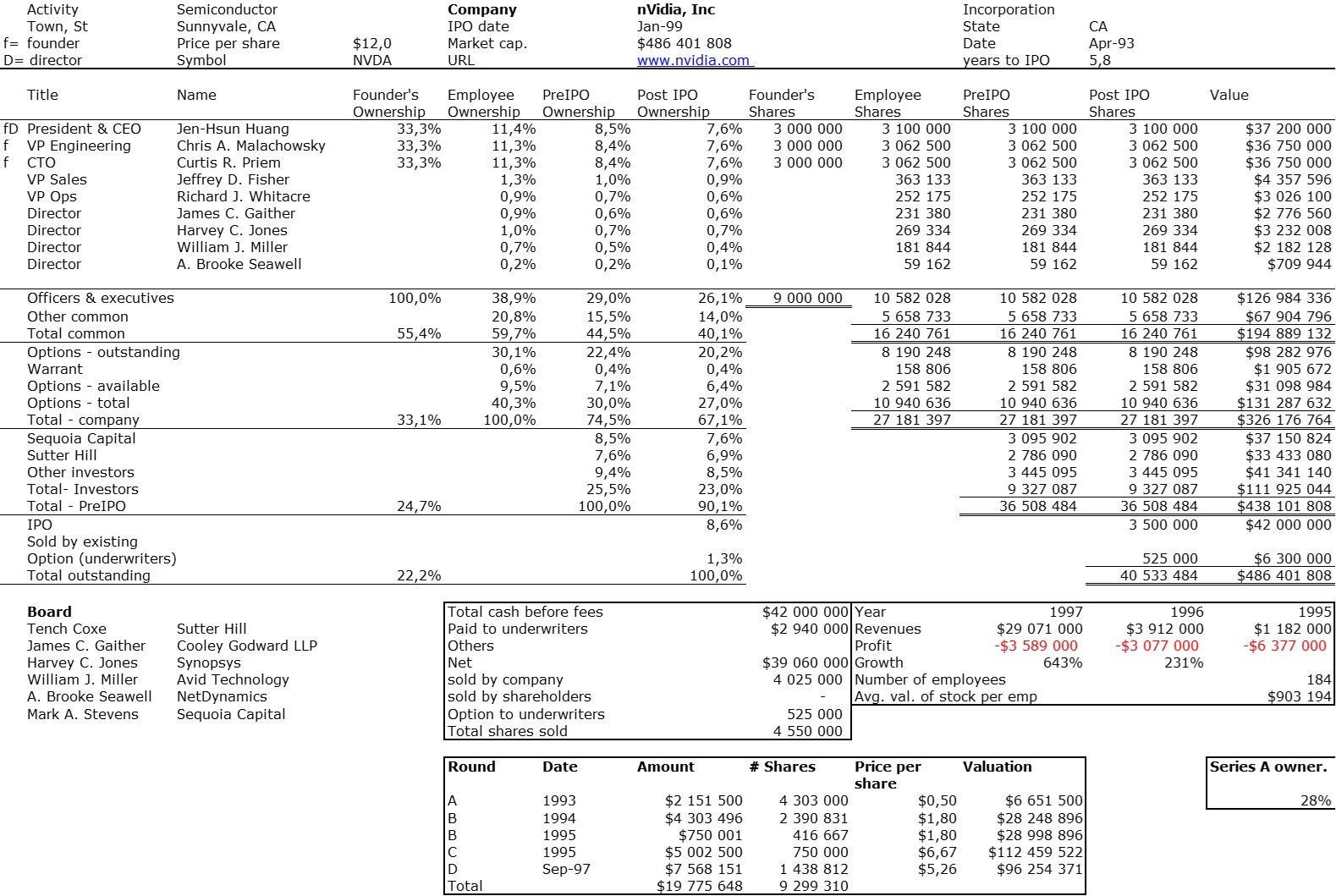

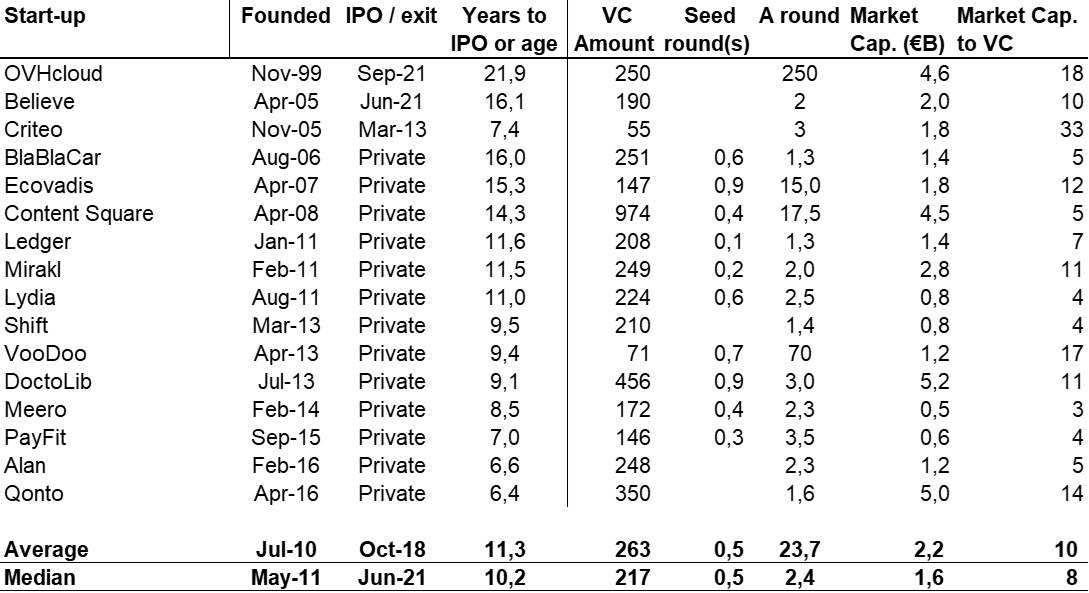

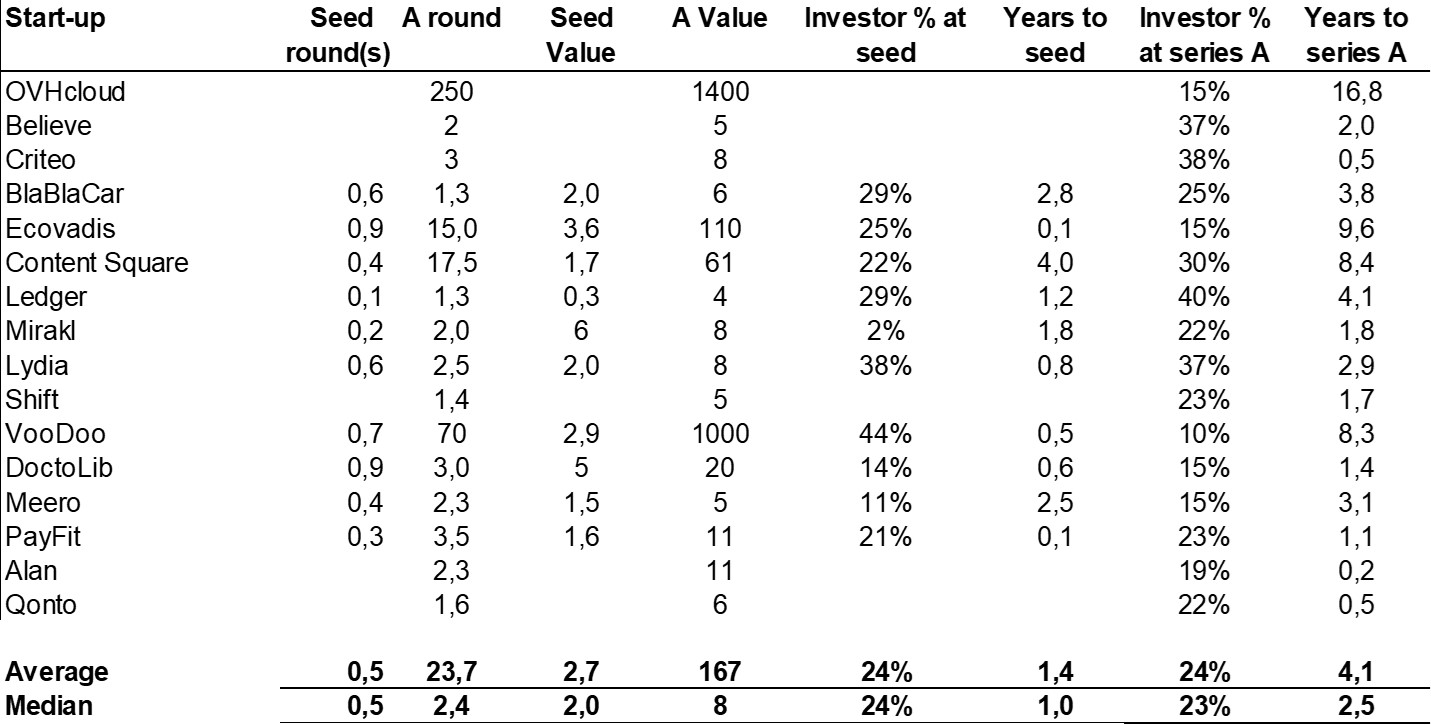

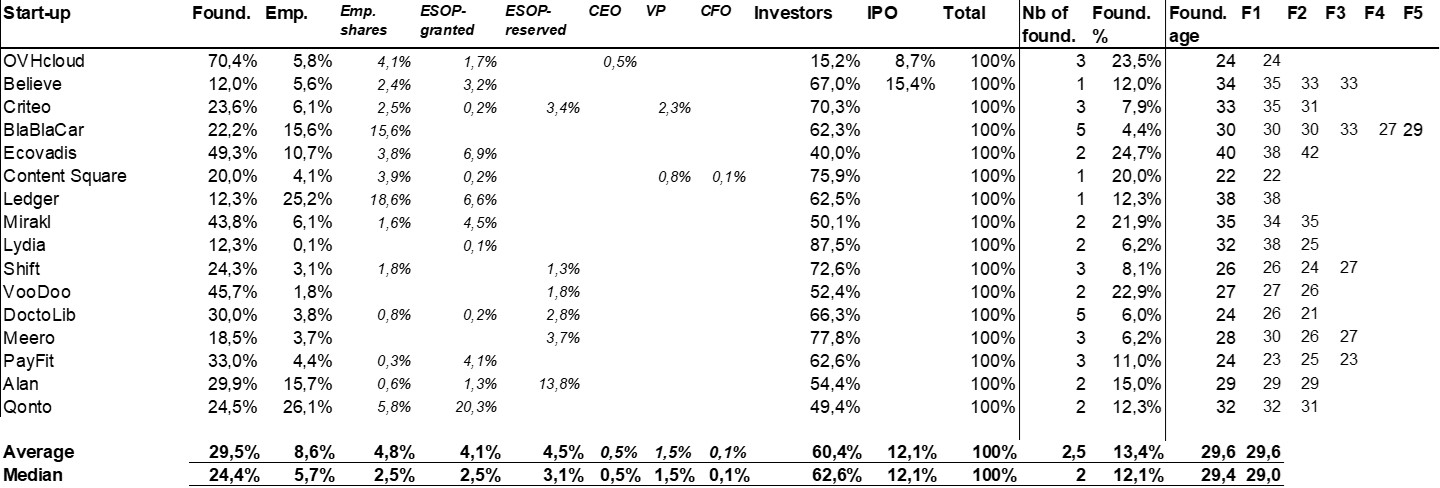

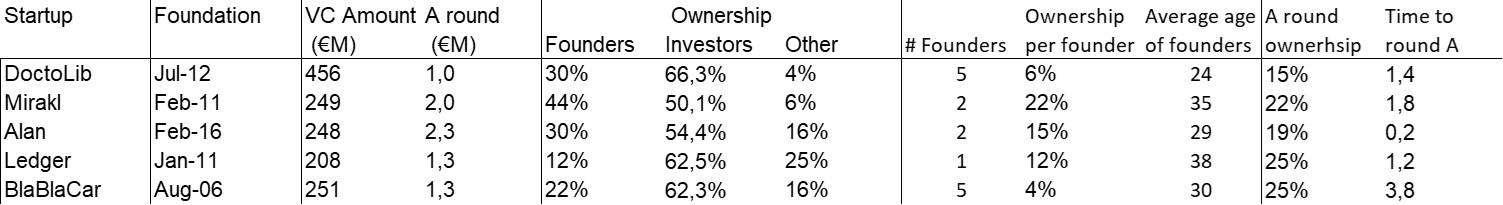

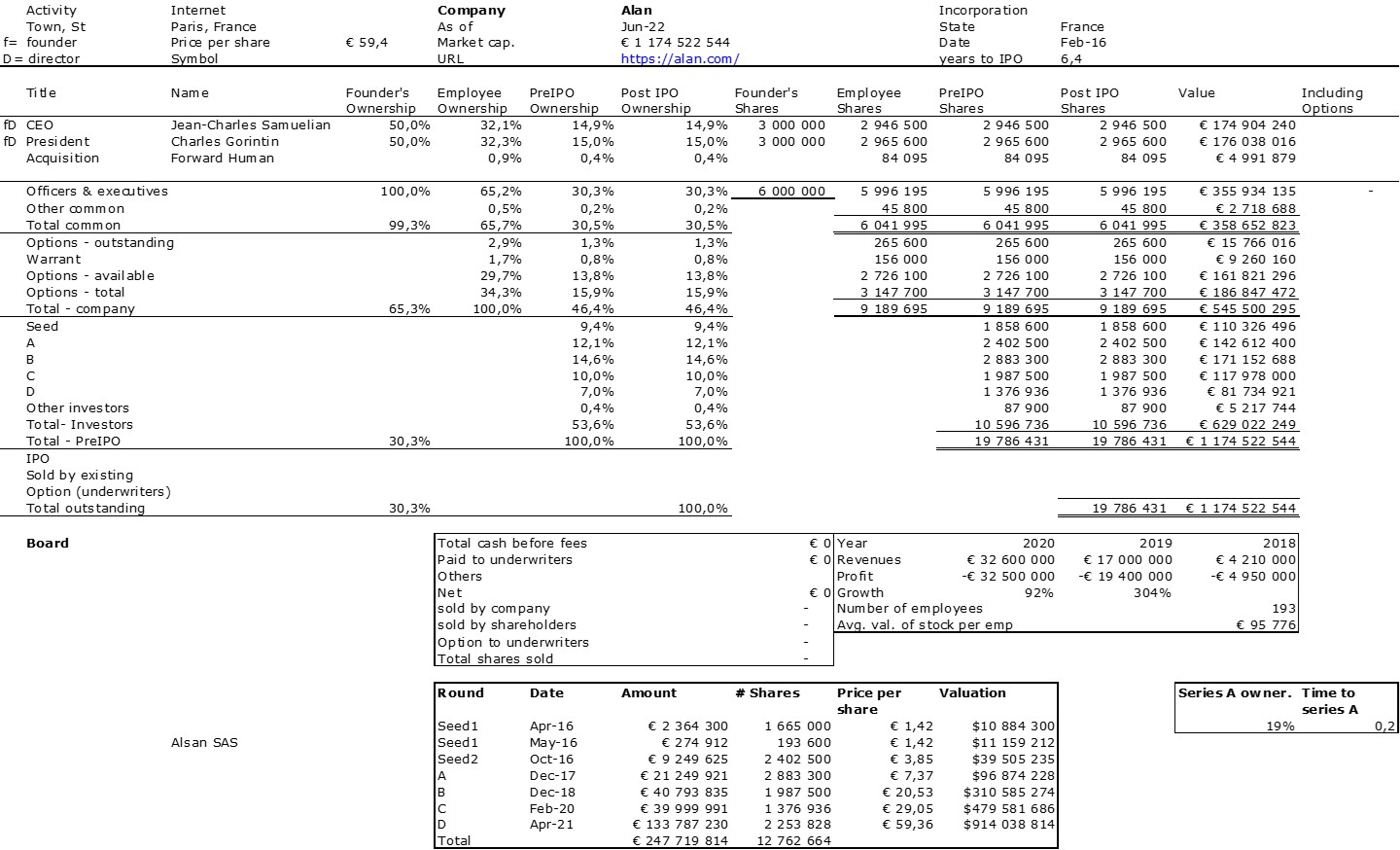

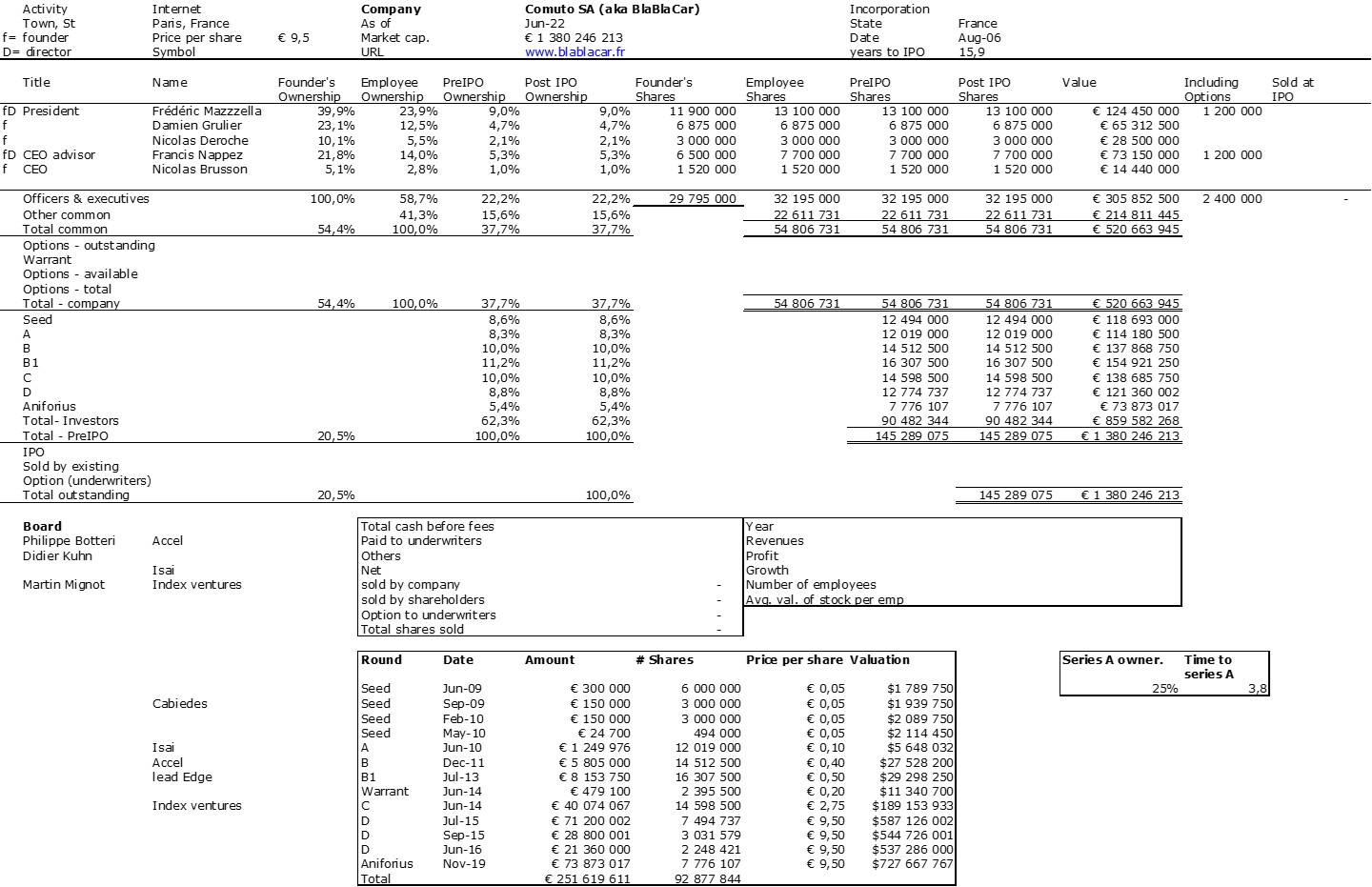

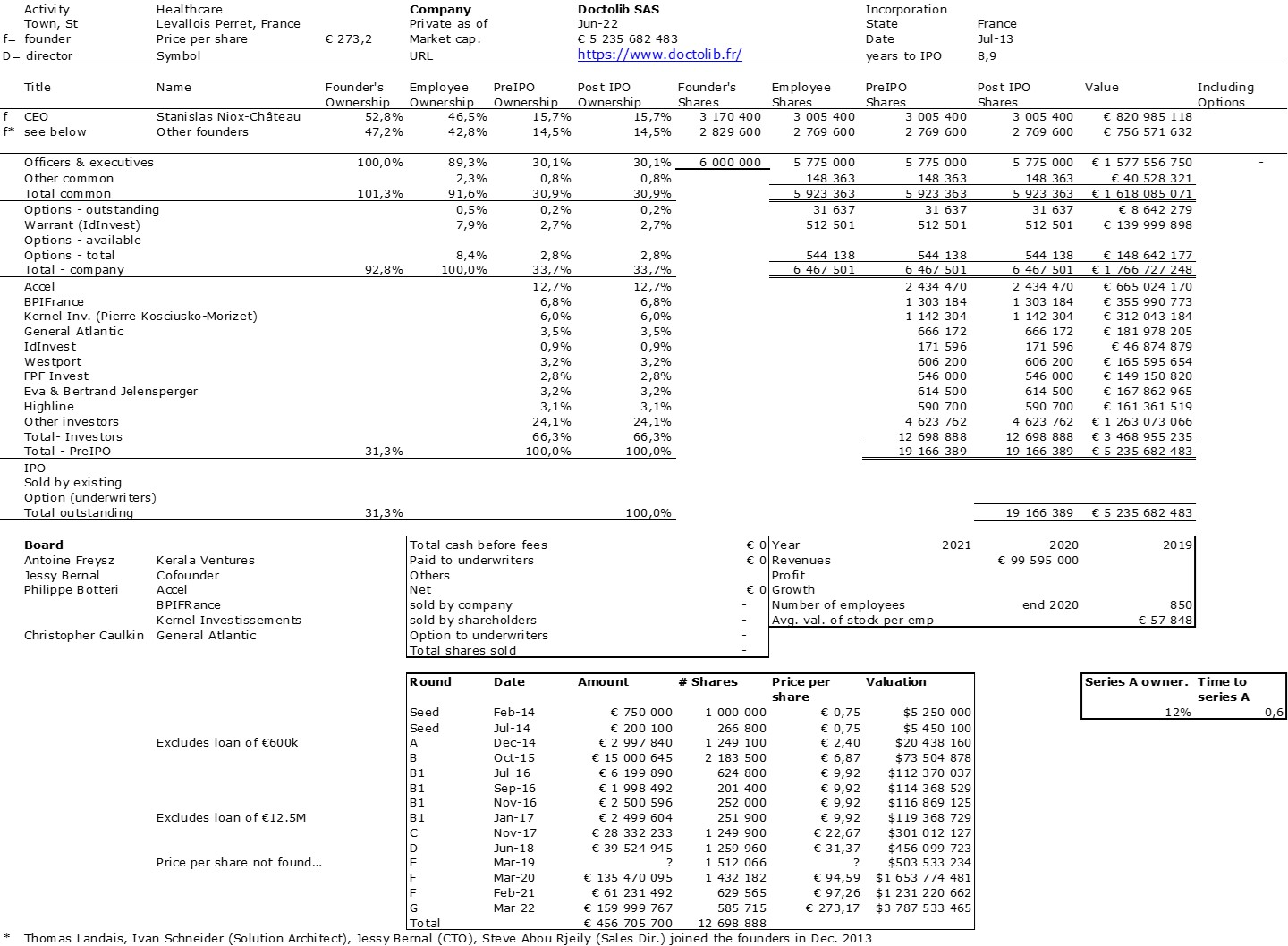

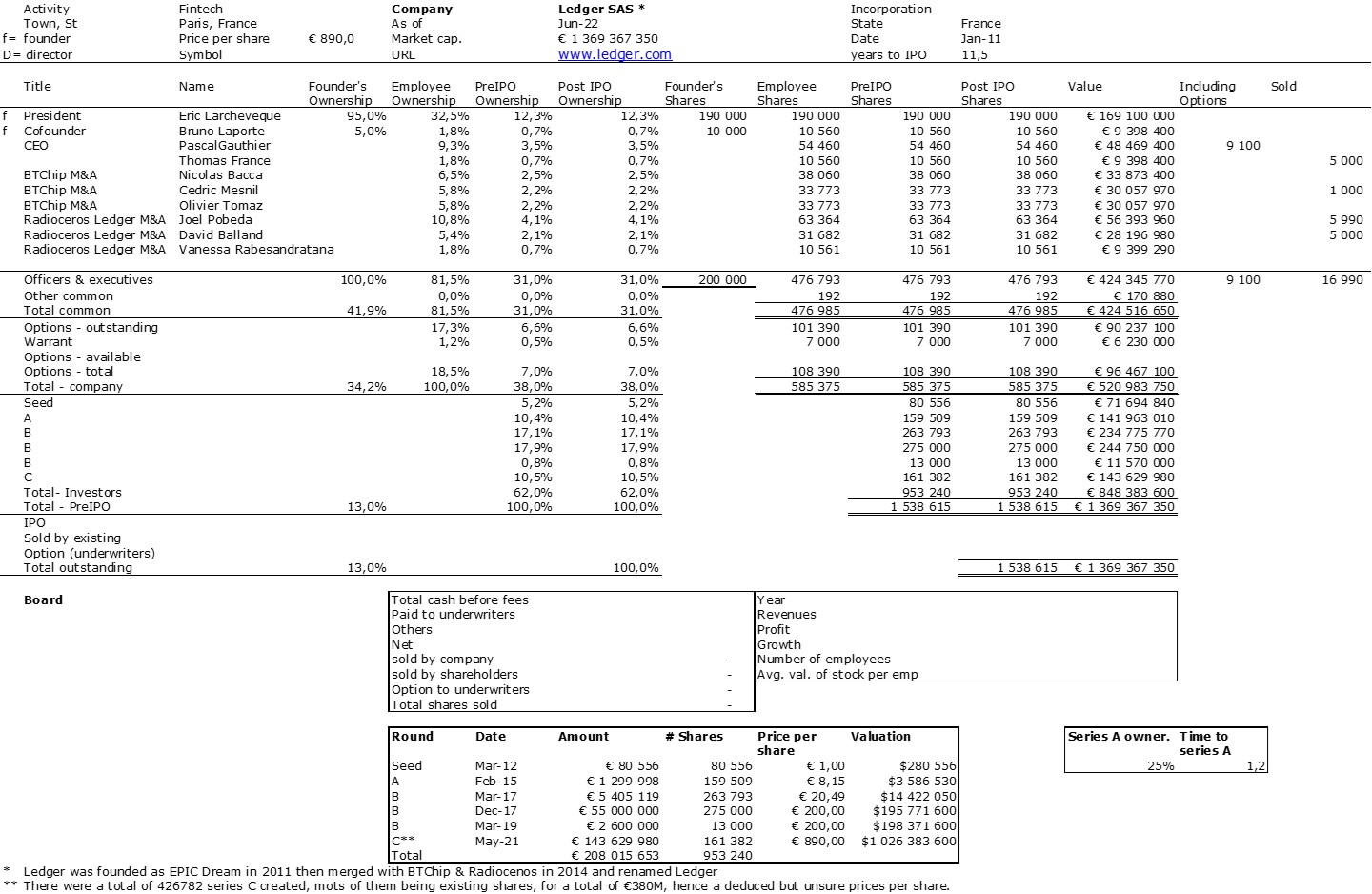

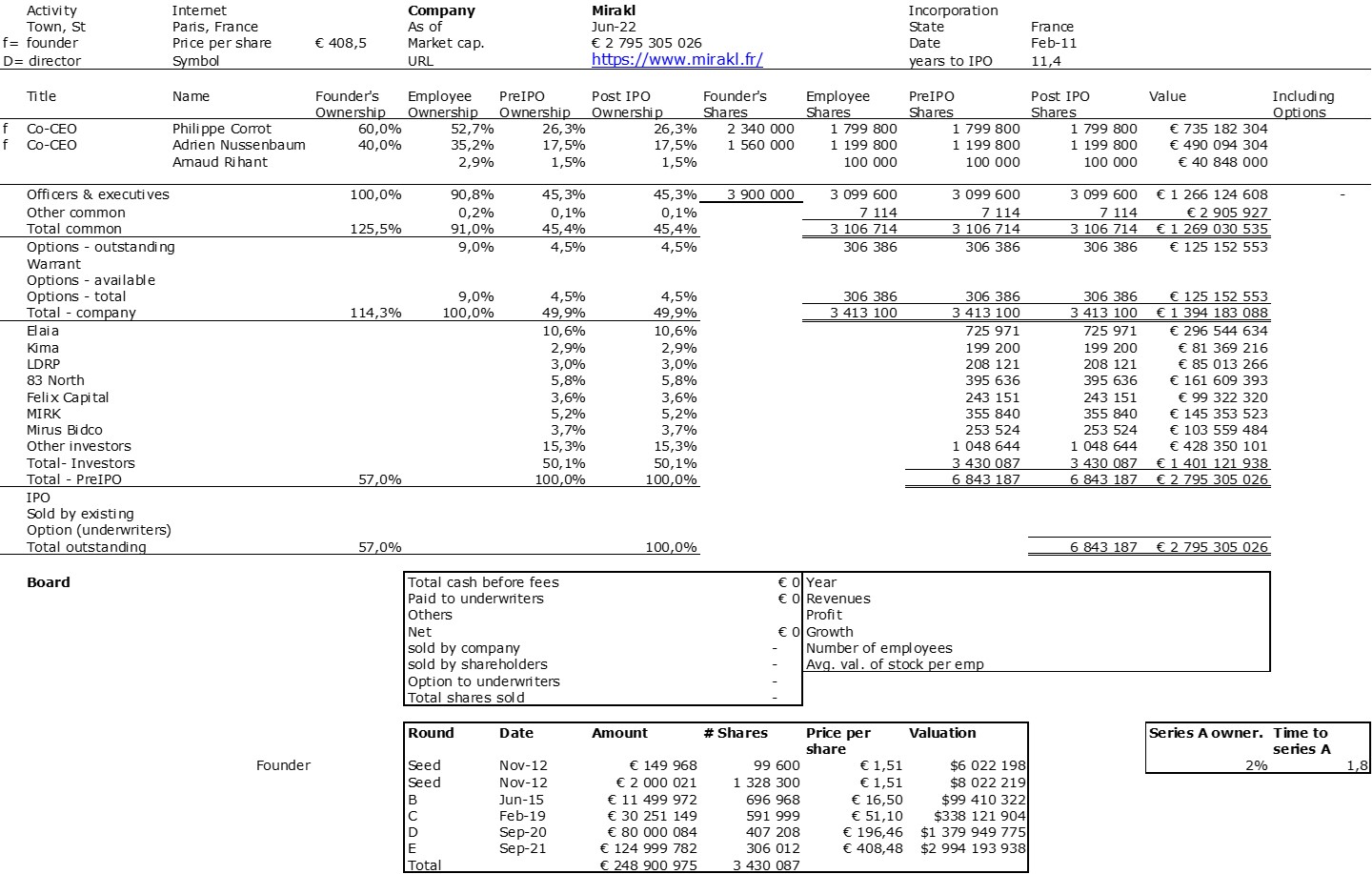

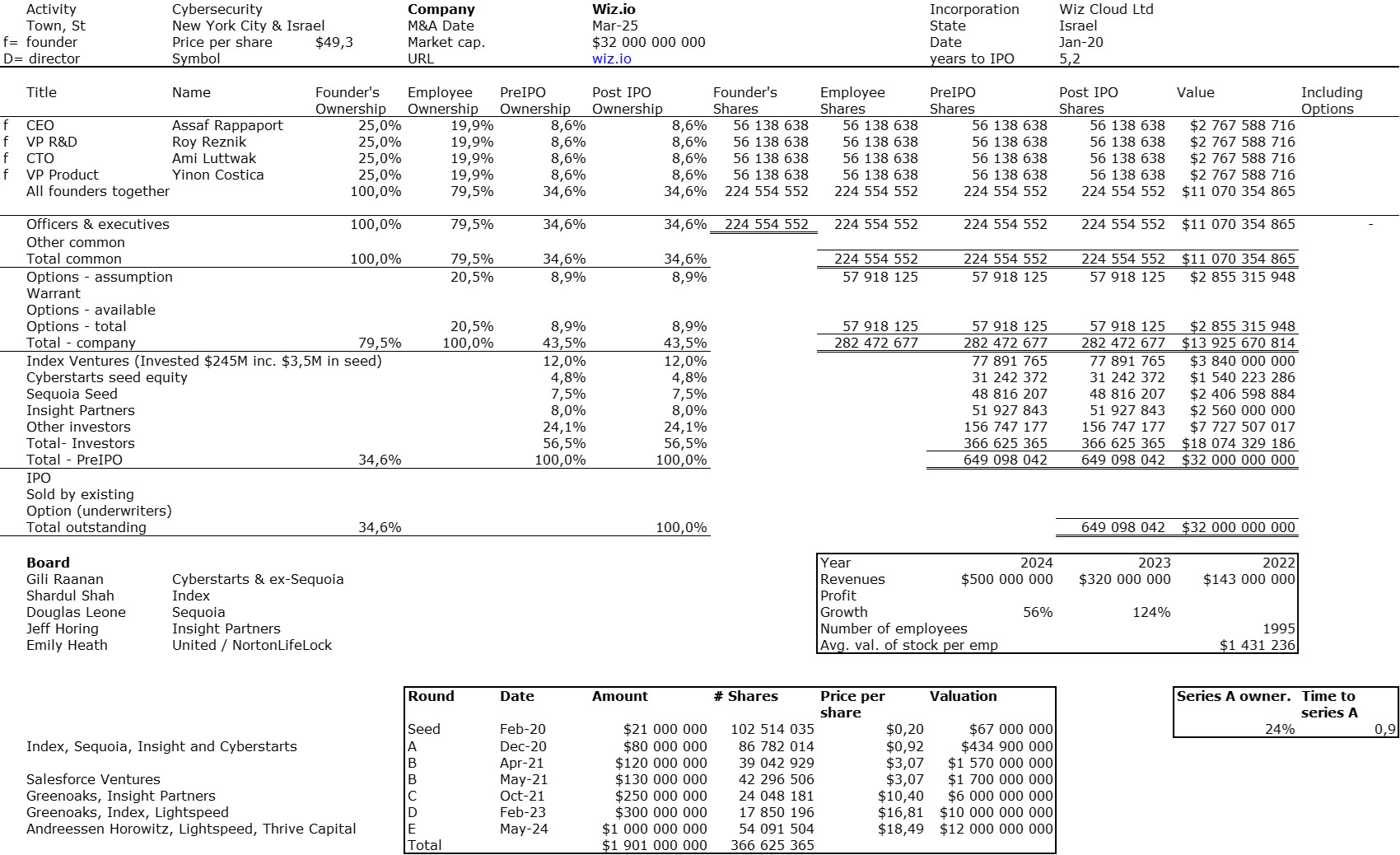

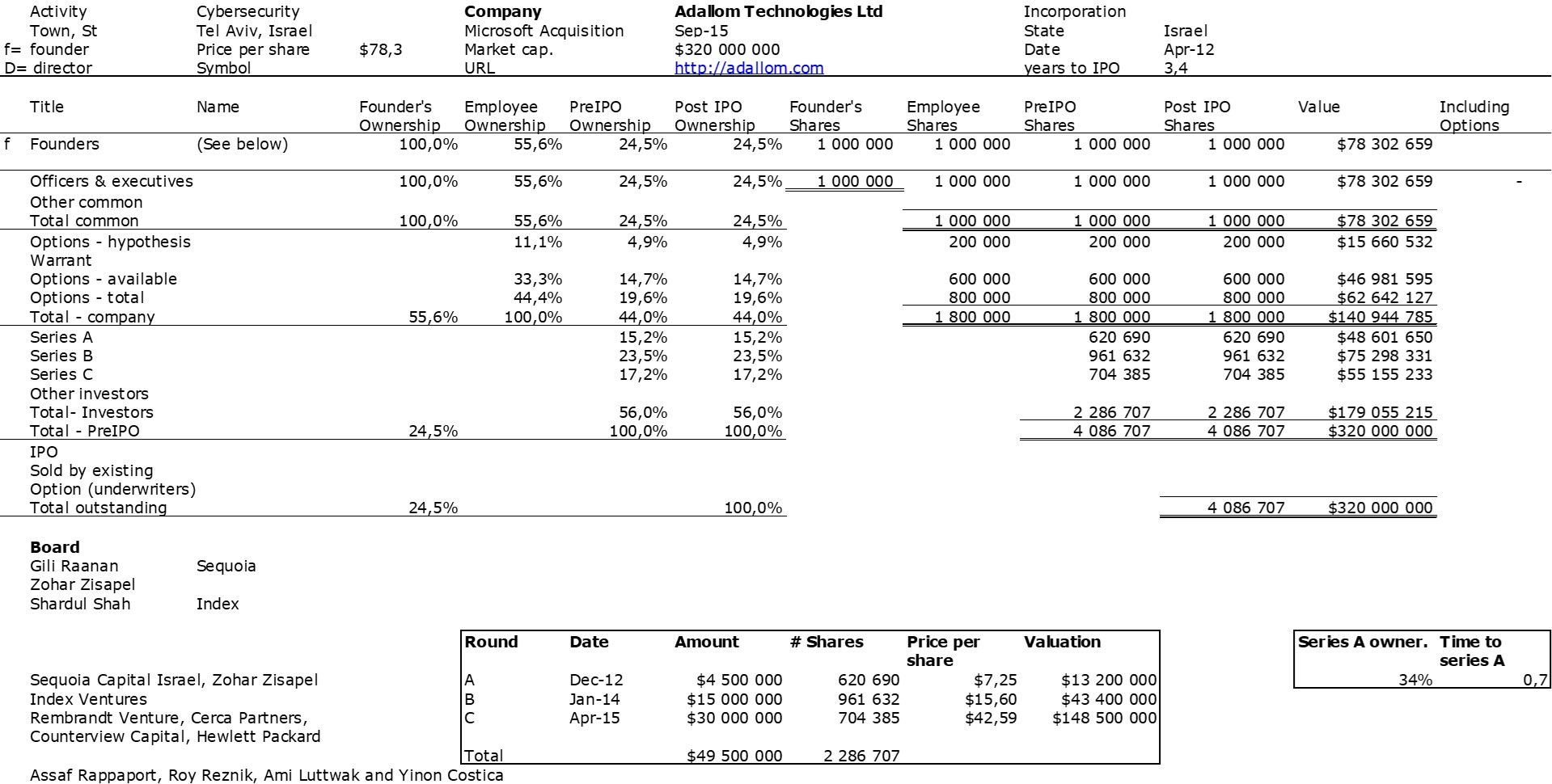

The double adventure of the founders of Adallom and Wiz.io goes a little in that direction. I read a few articles which reference you will find at the end of the article. And I will give the lessons learned by Assaf Rappaport from these two stories. A first success, Adallom bought in 2014 by Microsoft for $320M then a second, wiz.com which Google offered to buy a few days ago for $32B (i.e. 100 times more…) Unlike Deepmind, I did not have access to specific documents, so I had to make some assumptions like some others (see [2]) and cross-check the information available online. Here are the two capitalization tables. But here too, the advice given (which I repeat below) is just as important as this data.

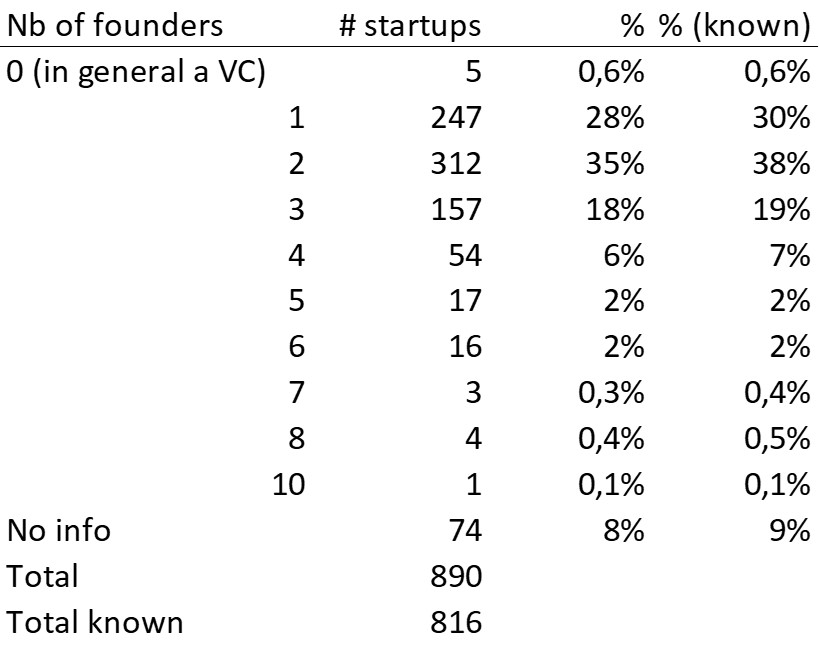

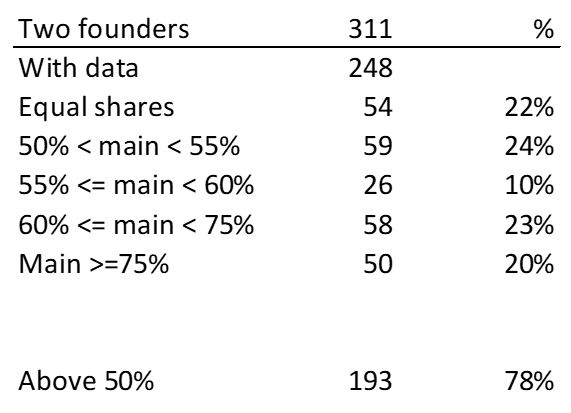

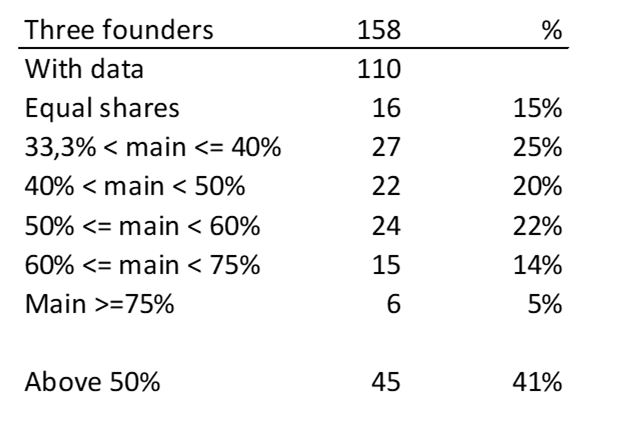

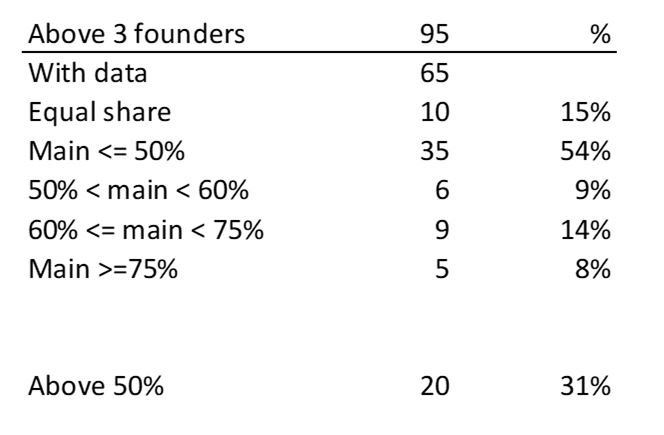

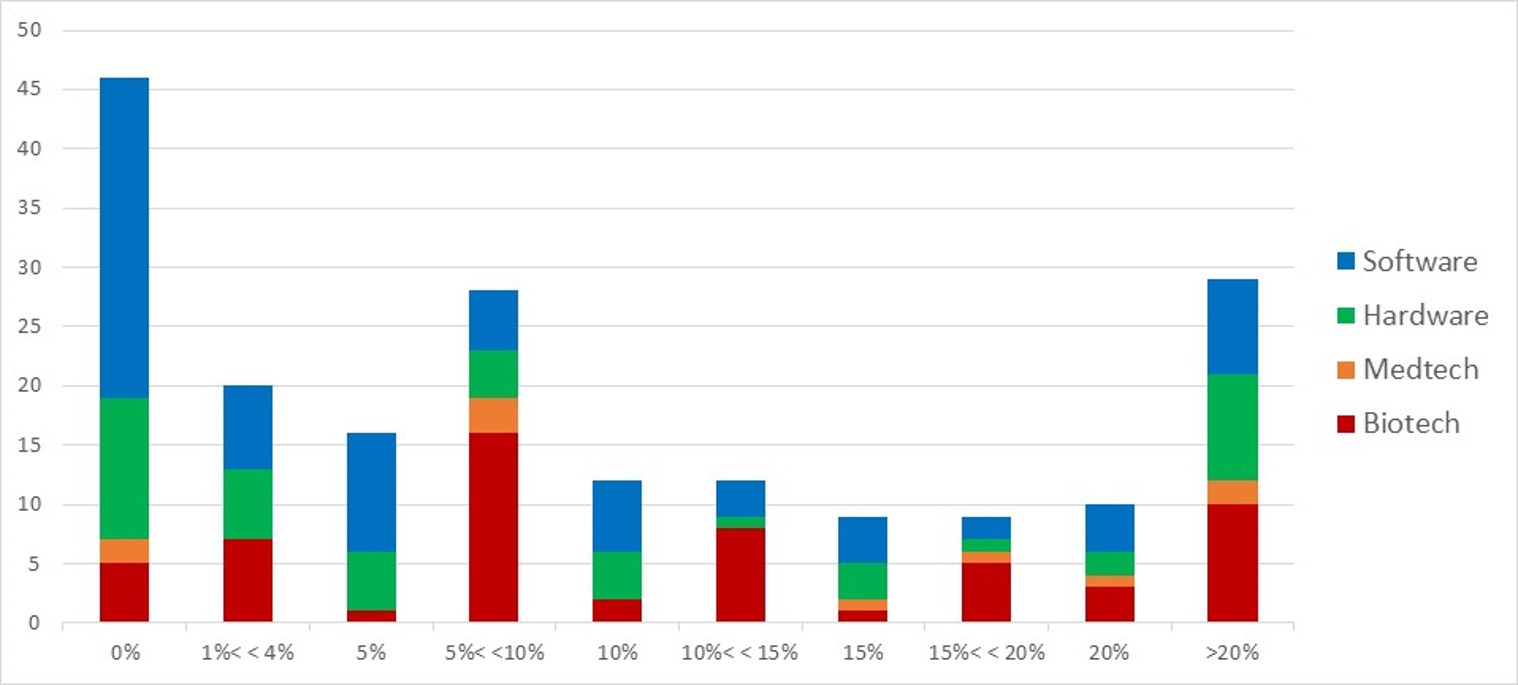

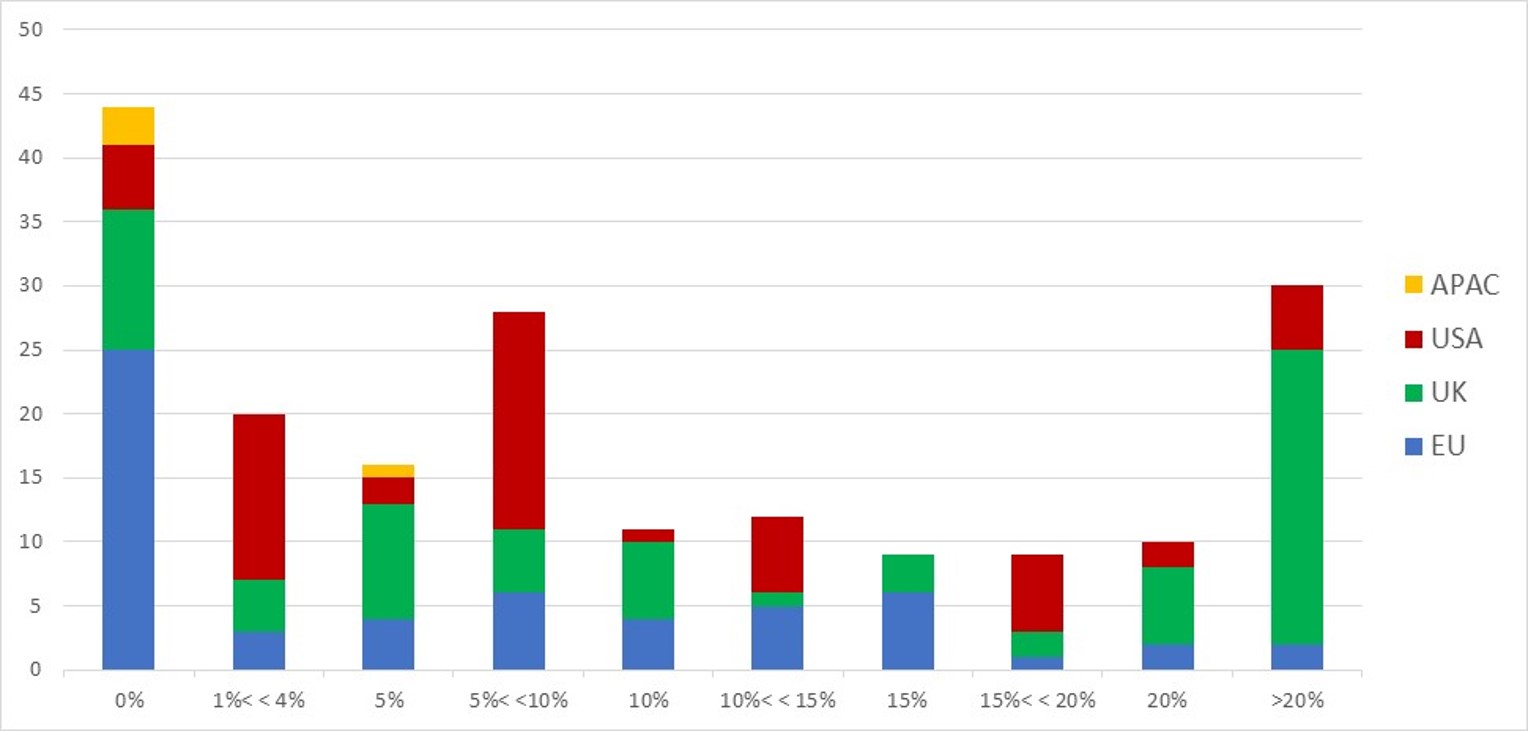

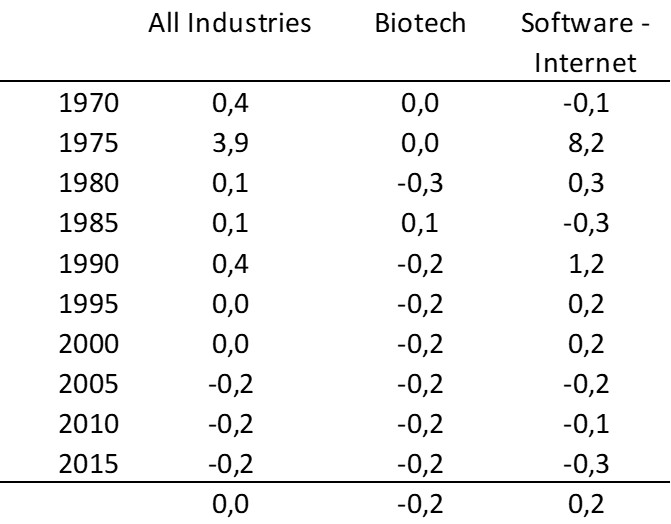

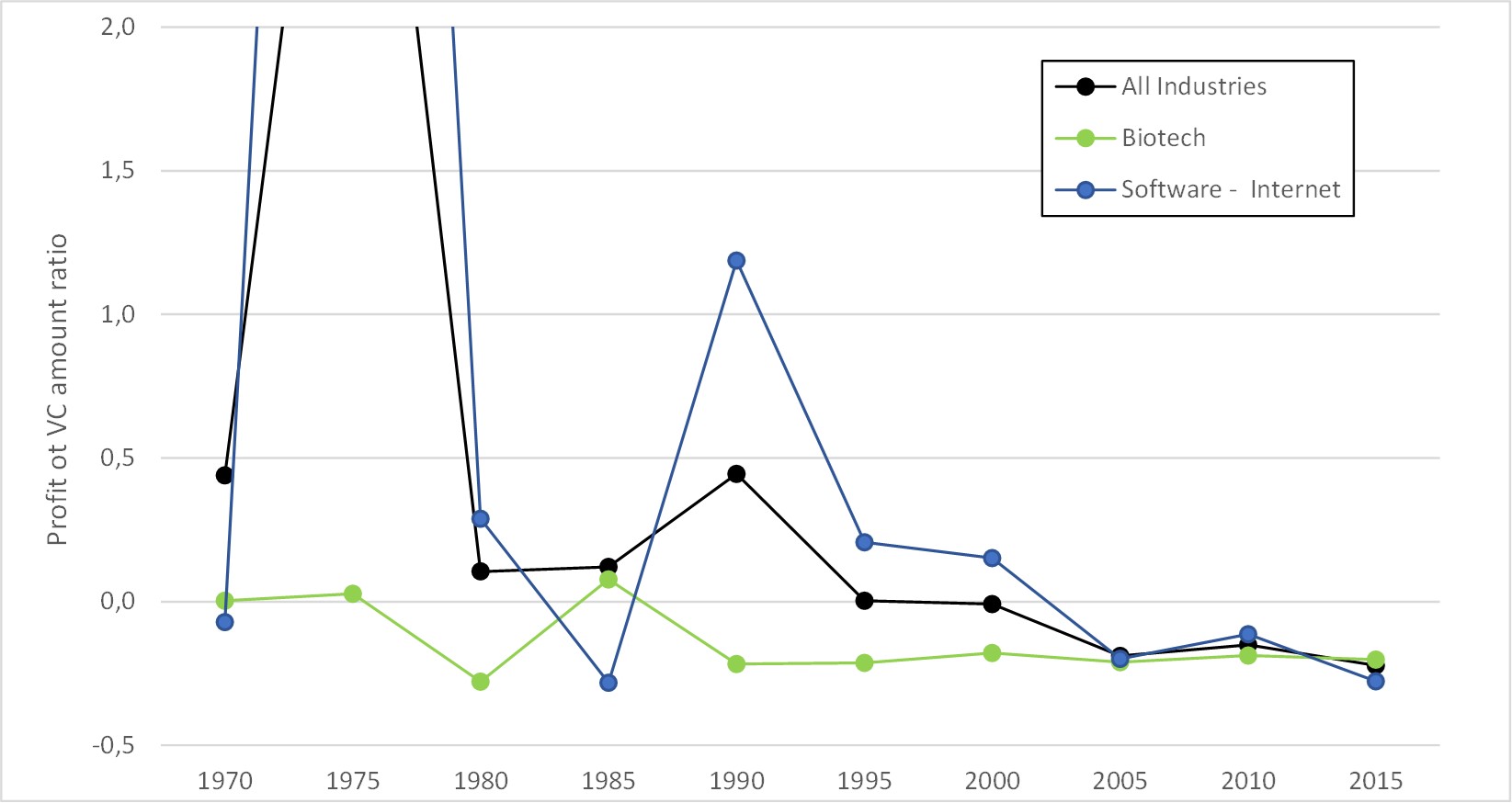

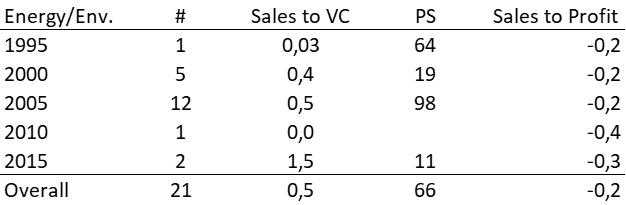

First of all, what I take from the tables:

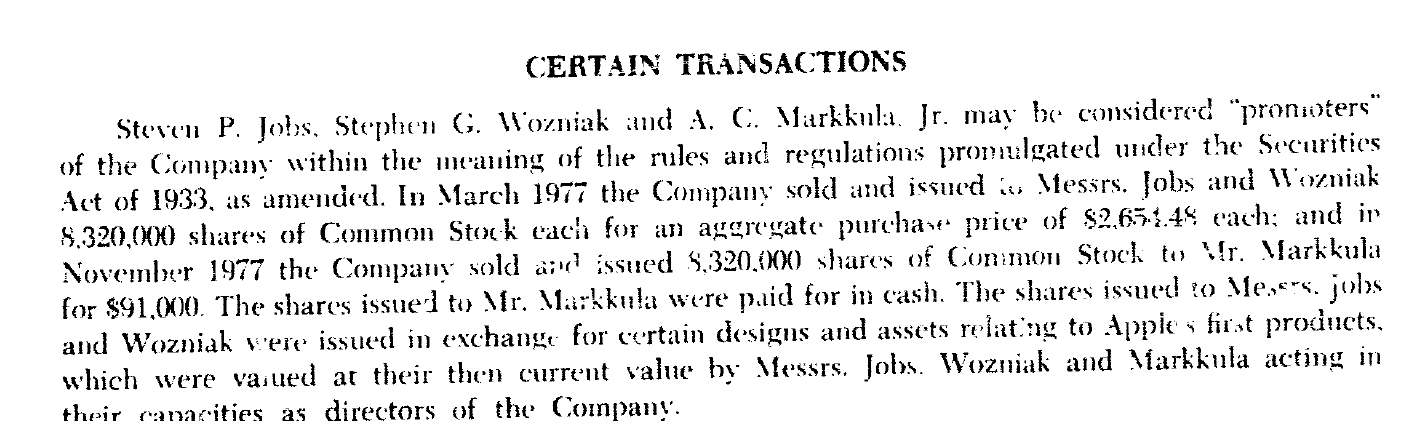

– Four founders whose story is a classic in Israel (see [1]) created Adallom and then wiz.io. In reality, I am not a big fan of the concept of serial entrepreneurs, but wonder if wiz.io is not rather the scaling up of Adallom like VMWare (2nd period) was for VMware (1st period) or by pushing very hard the Nobel Prize of Demis Hassabis the scaling up of Deepmind! We read in the press that the founders had earned around $25M with Adallom according to some sources and $3B with wiz.io, also a factor of about 100x.

– The same venture capital funds and partners are the investors – Gili Raanan for Sequoia then Cyberstarts and Shardul Shah for Index. These are rare enough to be mentioned especially since these funds intervened at the seed stage.

– For Adallom, multiples of 24x for Series A, 7x for Series B, and approximately 2x for Series C.

– For wiz.io, multiples of 475x for Seed, 73x for Series A, 20x for Series B, 5x, 3x, and 2.7x for Series C, D, and E.

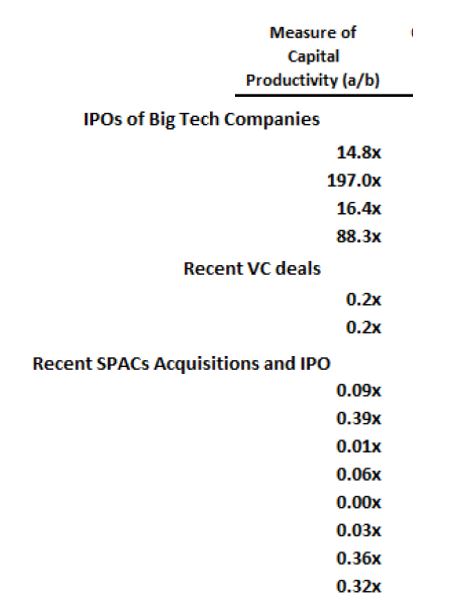

All of this is arguable, but not uninteresting, and there’s a bit of a lottery aspect to it. Don’t get me wrong. Success is rare, never guaranteed. I remember a startup that was offered a $300 million acquisition. The founders and/or investors declined, thinking they were worth more. In the end, the acquisition price was $10 million.

About the ambition and uncertainty, it is also worth reading Shardul Shah (Index) on LinkedIn (Index Ventures just cemented its place as one of the all-time VC greats). Here are some quotes : “I don’t know why we’re talking about averages — none of us are in the business of mean reversion.” […] “I’m not seeking average returns. I’m not seeking good deals—I’m looking for outliers.” […] “I don’t seek comfort. You have to be comfortable with being uncomfortable. We’re in the business of taking risk. I’m not a value investor, right? I believe in the power law.” […] “The hardest thing is identifying if you’re delusional or if you have conviction. Sometimes it can feel like a thin line.”

Finally I extract the lessons from Assaf Rappaport:

1. The team is more important than the idea. A startup is built not around an idea, which is going to change anyway, but around a team. The really good VC funds invest in talent, and not in products, ideas or business plans. And also: Don’t drag your feet when it comes to meeting with the best funds. Don’t leave them till the end.

2. One who listens to problems will find ideas. When you meet with customers, you’re not coming to convince them; rather, you’re there to learn from them. If you’re the one who spoke for more than a quarter of the meeting, it wasn’t a good conversation. Customers have problems that you didn’t even know existed, and the way to discover them is with question marks, not exclamation marks.

And also: You need some luck.

3. ‘No’ is the correct answer to determine whether the investor is serious. No matter what kind of offer you get – investment or acquisition – there’s only one response: ‘I really appreciate your offer, but no thanks.’ This kind of answer never deterred a determined investor or company – and if they’re not determined, they won’t invest in any case. And also: You need to prepare a media plan, both internal and external; when things leak, you’ll have only enough time to hit the Send button.

4. The exit is just the beginning of the hard work. On the day after being merged into a giant corporation, don’t sit back and wait until the options mature. Instead, adopt the commando approach: We’re part of a big army, but we belong to an elite unit.

5. Don’t be afraid of activism. In every company, a moment comes when you have to give the conservative corporate people a kick, and then go ahead and act. To be the best workplace and to recruit the best workers, you need to be brave and take a stand, engaging in social activism that gives rise to tremendous team spirit.

6. Take a deep breath and don’t exhale too soon. You shouldn’t be blinded by big money, instead, use it to quickly acquire paying customers, turn down acquisition offers of hundreds of millions of dollars, and grow the company rapidly so it will become a unicorn.

7. Today, it’s possible to overtake everyone with a computer and Zoom

Once again, risk-taking and limitless ambition.

References :

[1] : 7 lessons from reaching a $1.7 billion valuation in just one year https://www.calcalistech.com/ctech/articles/0,7340,L-3904610,00.html

[2] : WIZ, Esprit, es-tu là? Comment les fondateurs de Wiz refont des miracles après le succès d’Adallom https://trivialfinance.substack.com/p/wiz-esprit-es-tu-la