You will find on the French part of the blog an article entitled Prix d’exercice des BSPCE, BSA et autres stock options that describes (in French) the mechanisms of fixing the price of stock options, with some very specific habits and rules of French law. If you read French, this may be useful…

Category Archives: Start-up data

Silicon Valley will soon be 65. Should it be Retired ? – The Darwinian Dynamics of the Region

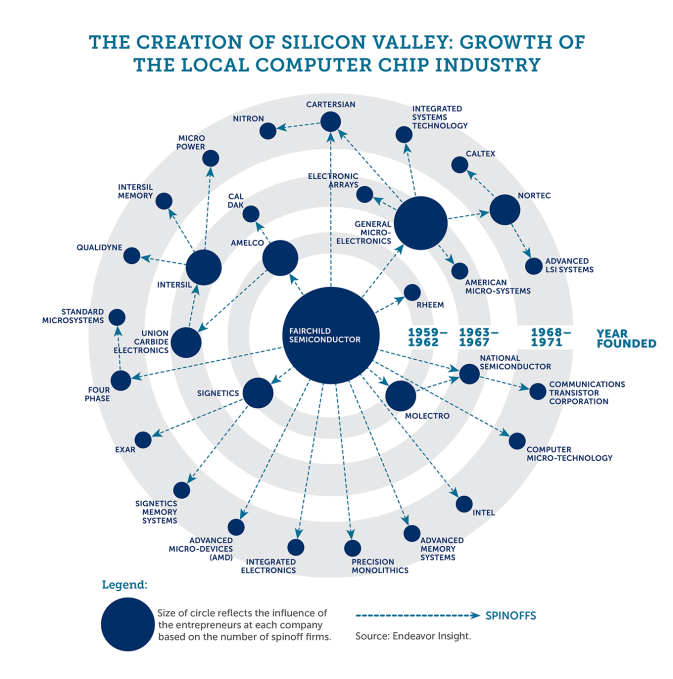

Silicon Valley will soon be 65. 65? Yes, I usually say that the region began its growth with the foundation of Fairchild Semiconductor in 1957 (even if the name itself was created in 1971).

The region is increasingly criticized for both good and bad reasons (see for example here and there) and perhaps it is a little out of breath. Too old ? Ten years ago I had looked at its “Darwinian dynamics” in Darwinian and Lamarckian innovation – by Pascal Picq. I had noted there the remarkable dynamics of creation (and destruction) of businesses. “Twenty of the top 40 SV companies in 1982 did not exist anymore in 2002 and twenty one of the 2002 top 40 companies had not been created in 1982.” So I just did the exercise again.

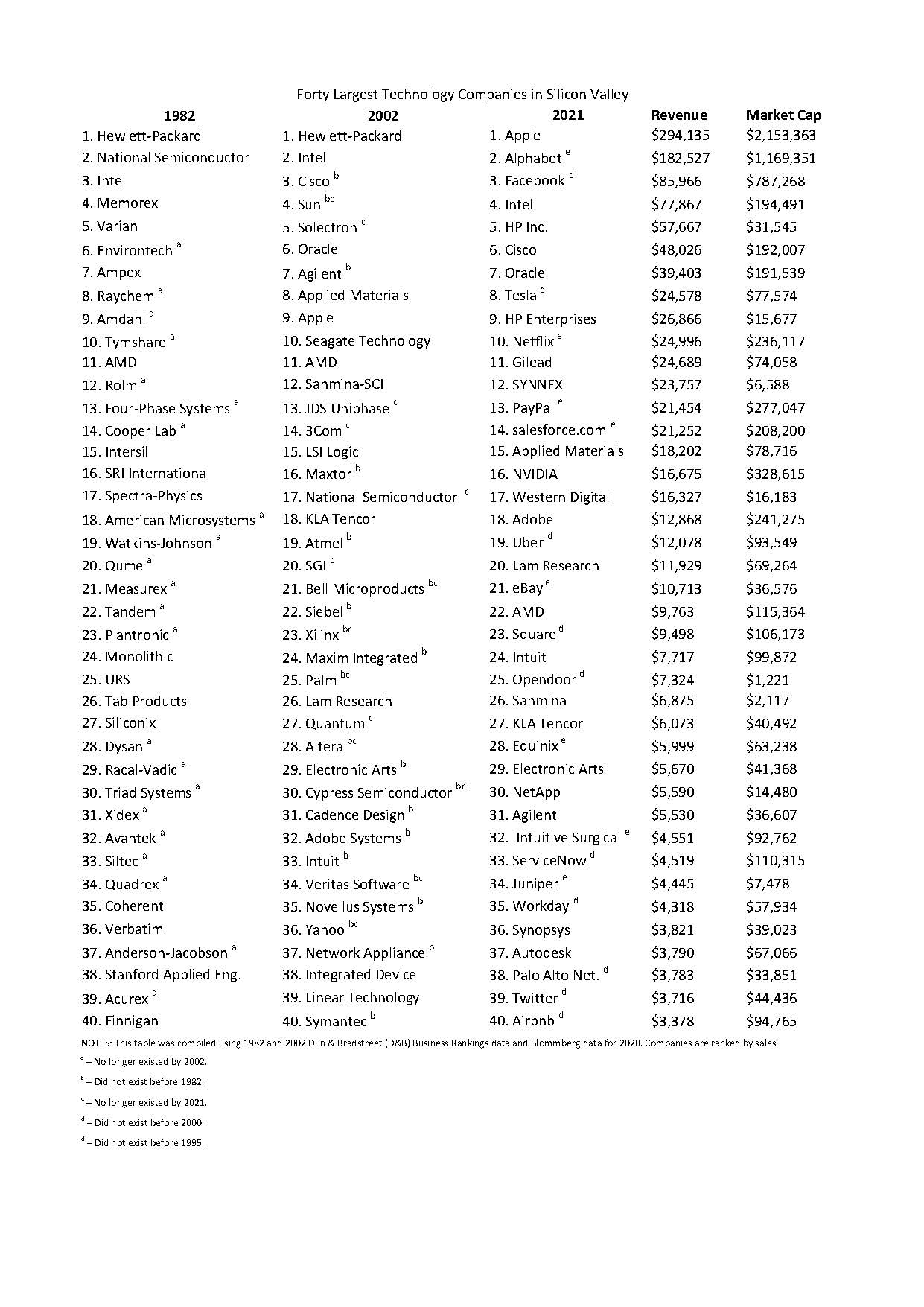

The table below gives the data for 1982 and 2002 again, then those for 2020. I should have waited for 2022 and the 65th birthday of Silicon Valley, but I didn’t have the patience! Ten of the 40 largest companies did not exist in 2000 and seven more did not exist in 1995. Sixteen of the top 40 of 2002 no longer exist in 2021. The region is therefore a little less dynamic but it remains quite remarkable… The retirement seems to me far away in reality !

As a final comment, five years ago, I had mentioned the evolution of the American capitalism in The top US and European (former) start-ups and in particular The Largest Companies by Market Cap Over 15 Years. You could compare it with the dynamics of French CAC40.

Forty Largest Technology Companies in Silicon Valley

(the same data are provided in jpg format at the end of the post)

| 1982 | 2002 | 2021 | Revenue | Market Cap |

| 1. Hewlett-Packard | 1. Hewlett-Packard | 1. Apple | $294,135 | $2,153,363 |

| 2. National Semiconductor | 2. Intel | 2. Alphabet e | $182,527 | $1,169,351 |

| 3. Intel | 3. Cisco b | 3. Facebook d | $85,966 | $787,268 |

| 4. Memorex | 4. Sun bc | 4. Intel | $77,867 | $194,491 |

| 5. Varian | 5. Solectron c | 5. HP Inc. | $57,667 | $31,545 |

| 6. Environtech a | 6. Oracle | 6. Cisco | $48,026 | $192,007 |

| 7. Ampex | 7. Agilent b | 7. Oracle | $39,403 | $191,539 |

| 8. Raychem a | 8. Applied Materials | 8. Tesla d | $24,578 | $77,574 |

| 9. Amdahl a | 9. Apple | 9. HP Enterprises | $26,866 | $15,677 |

| 10. Tymshare a | 10. Seagate Technology | 10. Netflix e | $24,996 | $236,117 |

| 11. AMD | 11. AMD | 11. Gilead | $24,689 | $74,058 |

| 12. Rolm a | 12. Sanmina-SCI | 12. SYNNEX | $23,757 | $6,588 |

| 13. Four-Phase Systems a | 13. JDS Uniphase c | 13. PayPal e | $21,454 | $277,047 |

| 14. Cooper Lab a | 14. 3Com c | 14. salesforce.com e | $21,252 | $208,200 |

| 15. Intersil | 15. LSI Logic | 15. Applied Materials | $18,202 | $78,716 |

| 16. SRI International | 16. Maxtor b | 16. NVIDIA | $16,675 | $328,615 |

| 17. Spectra-Physics | 17. National Semiconductor c | 17. Western Digital | $16,327 | $16,183 |

| 18. American Microsystems a | 18. KLA Tencor | 18. Adobe | $12,868 | $241,275 |

| 19. Watkins-Johnson a | 19. Atmel b | 19. Uber d | $12,078 | $93,549 |

| 20. Qume a | 20. SGI c | 20. Lam Research | $11,929 | $69,264 |

| 21. Measurex a | 21. Bell Microproducts bc | 21. eBay e | $10,713 | $36,576 |

| 22. Tandem a | 22. Siebel bc | 22. AMD | $9,763 | $115,364 |

| 23. Plantronic a | 23. Xilinx bc | 23. Square d | $9,498 | $106,173 |

| 24. Monolithic | 24. Maxim Integrated b | 24. Intuit | $7,717 | $99,872 |

| 25. URS | 25. Palm bc | 25. Opendoor d | $7,324 | $1,221 |

| 26. Tab Products | 26. Lam Research | 26. Sanmina | $6,875 | $2,117 |

| 27. Siliconix | 27. Quantum c | 27. KLA Tencor | $6,073 | $40,492 |

| 28. Dysan a | 28. Altera bc | 28. Equinix e | $5,999 | $63,238 |

| 29. Racal-Vadic a | 29. Electronic Arts b | 29. Electronic Arts | $5,670 | $41,368 |

| 30. Triad Systems a | 30. Cypress Semiconductor bc | 30. NetApp | $5,590 | $14,480 |

| 31. Xidex a | 31. Cadence Design b | 31. Agilent | $5,530 | $36,607 |

| 32. Avantek a | 32. Adobe Systems b | 32. Intuitive Surgical e | $4,551 | $92,762 |

| 33. Siltec a | 33. Intuit b | 33. ServiceNow d | $4,519 | $110,315 |

| 34. Quadrex a | 34. Veritas Software bc | 34. Juniper e | $4,445 | $7,478 |

| 35. Coherent | 35. Novellus Systems b | 35. Workday d | $4,318 | $57,934 |

| 36. Verbatim | 36. Yahoo bc | 36. Synopsys | $3,821 | $39,023 |

| 37. Anderson-Jacobson a | 37. Network Appliance b | 37. Autodesk | $3,790 | $67,066 |

| 38. Stanford Applied Eng. | 38. Integrated Device | 38. Palo Alto Net. d | $3,783 | $33,851 |

| 39. Acurex a | 39. Linear Technology | 39. Twitter d | $3,716 | $44,436 |

| 40. Finnigan | 40. Symantec b | 40. Airbnb d | $3,378 | $94,765 |

NOTES: This table was compiled using 1982 and 2002 Dun & Bradstreet (D&B) Business Rankings data and Blommberg data for 2020. Companies are ranked by sales.

a – No longer existed by 2002.

b – Did not exist before 1982.

c – No longer existed by 2021.

d – Did not exist before 2000.

e – Did not exist before 1995.

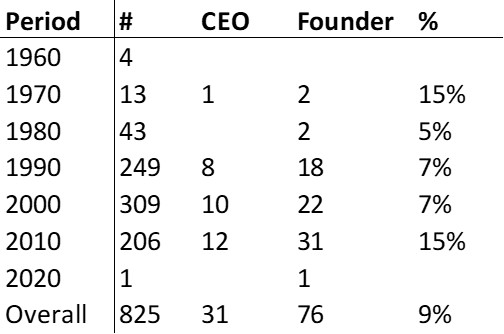

Female founders – an analysis from 800 (former) startups

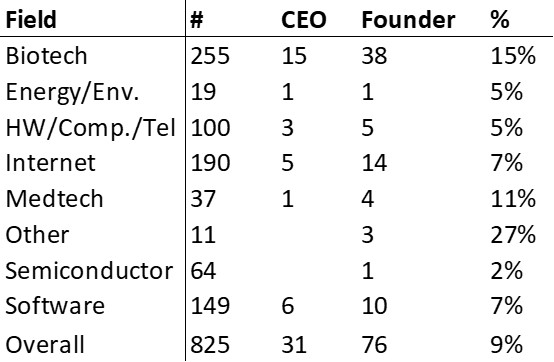

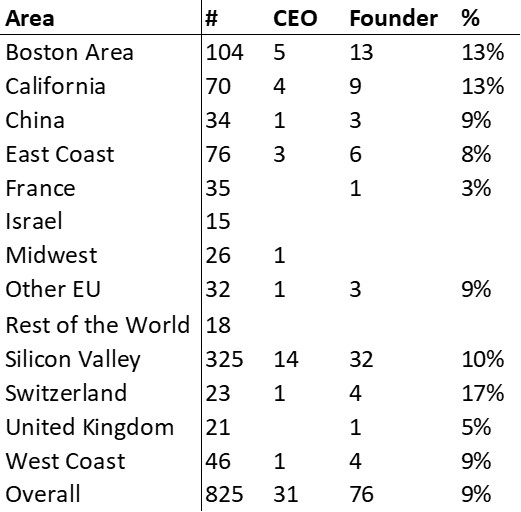

I just decided to add a new analysis to my recent study of 800 (former) startups. Although the topic is an important one in high-tech entrepreneurship, I had never looked at it except anectoticaly in the posts with the tag #women-and-high-tech.

Eight female founders or entrepreneurs. I am not sure how many I would have automatically recognized. And you?

And here are the results I found. My apologies in advance as this work is far from perfect: I tried to identify female founders from their name and this is not always easy. I believe however I cannot be too far from the exact results.

So what does this say?

– There are 76 female founders in 825 companies, which says 9% of these former startups had a female founder. Now to make it worse, the total number of founders identified is 1644.

– It is in the biotech field, that they are most represented (hence Boston, Switzerland, California outside Silicon Valley)

– The good news is that the number is up to 15% for the last decade. Still…

– Now there are only 31 female CEOs, this is only 4% (remember that founding CEOs are a little more than 60% so this is even worse as some of these female CEOS are not even founders – see here if you don’t know what I am talking about). In fact, 20 of these women were founders and 11 were not…

Updated data in equity of 800 (former) startups

As you might know, I regularly compile capitalization tables from companies which filed to go public or were acquired with shareholder data. The last time I published posts about it was in April 2020 with 600+ such tables. I have now more than 800.

I just posted two articles using these updated data:

– The age of founders and non-founding CEOs on August 4,

https://www.startup-book.com/2021/08/04/the-age-of-founders-and-non-founding-ceos/.

– Employee ownership in startups – The stock option millionaire on August 6, https://www.startup-book.com/2021/08/06/employee-ownership-in-startups-the-stock-option-millionaire/.

The content is as follows:

– Individual cap tables: pages 8-834.

– Updated statistics: pages 835-850.

– Table of content: pages 851-860.

I do not plan to do a new analysis. The one with 600 was rich enough I think. Still the individual cap table are available here:

Equity List 800 Startups – Lebret – Aug2021

or on Scribd but you might need an account to fully benefit from them.

Here is the link to the document or to more similar ones on my Scribd account.

Employee ownership in startups – The stock option millionaire

August is a good month to look back at data and previous posts. I just published one about the age of founders. Here is a quick look again about what employees may gain in startups when succesful. In addition to hopefully what they do with more pleasure than in big established companies, they usually have access to stock options and one of the myths of Silicon Valley is that in the most succesful startups, everyone becomes a millionaire.

A few years ago, I published some data about employee onwernship based on 600 startups. Have a look here. I also commented a guide about stock options in Rewarding Talent – A guide to stock options for European entrepreneurs by Index Ventures.

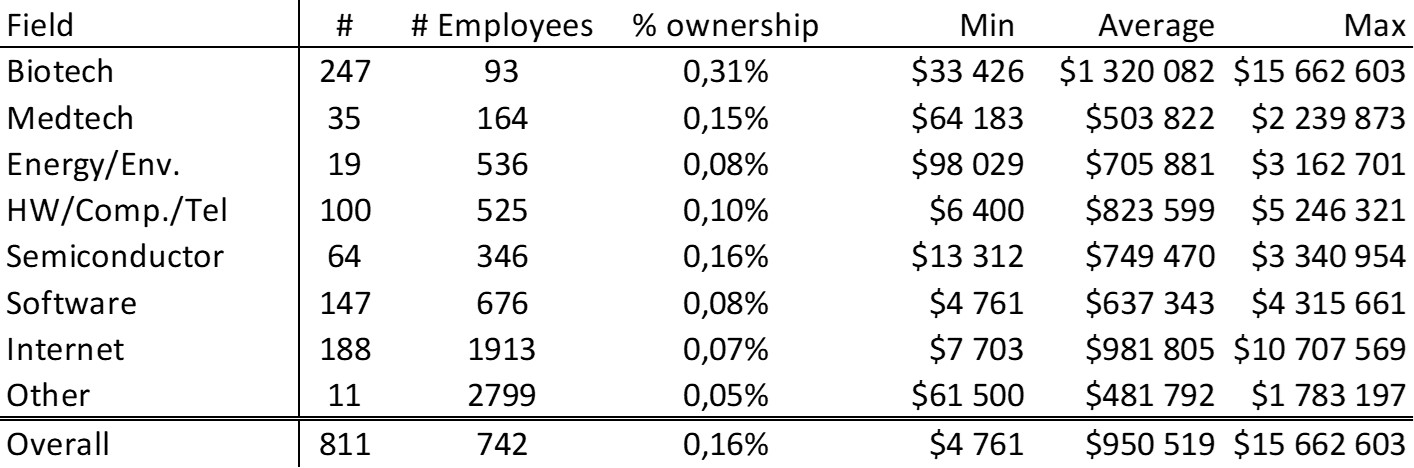

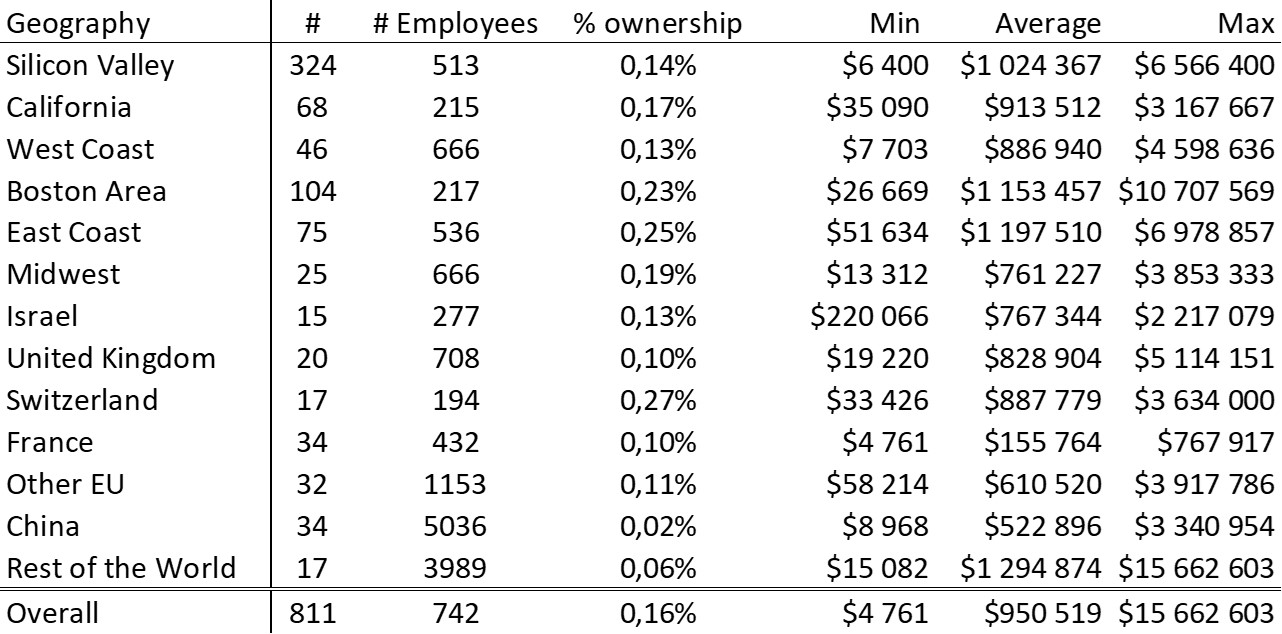

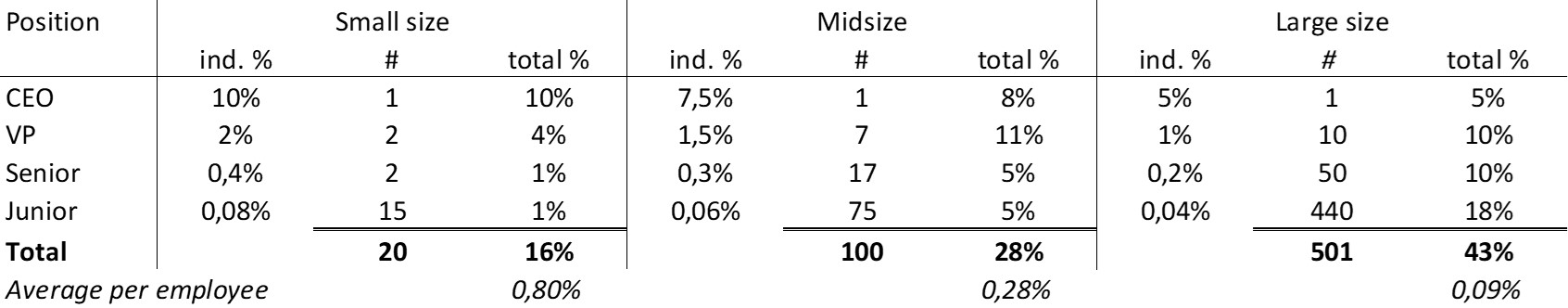

So how much ownership an employee have in a startup. I looked at my 800-startup database, and built the following tables. Please go to the end of the post for another analysis.

The three tables show some nuances depending upon the field, geography and period but with an ownership around 0.1%, yes employees are close to being millionaires. Now as the next table show, the situation might be different depending who you are in the company from a manager to a junior.

This last table is an extended version from the one used in the presentation I make about equity sharing in startups:

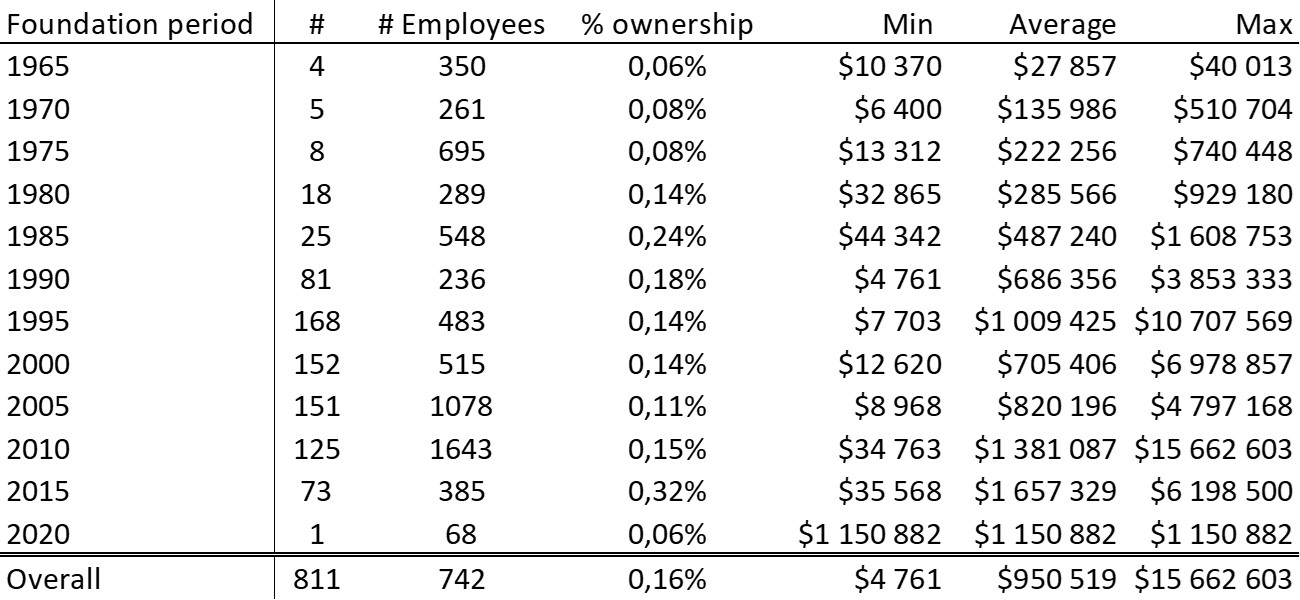

The age of founders and non-founding CEOs

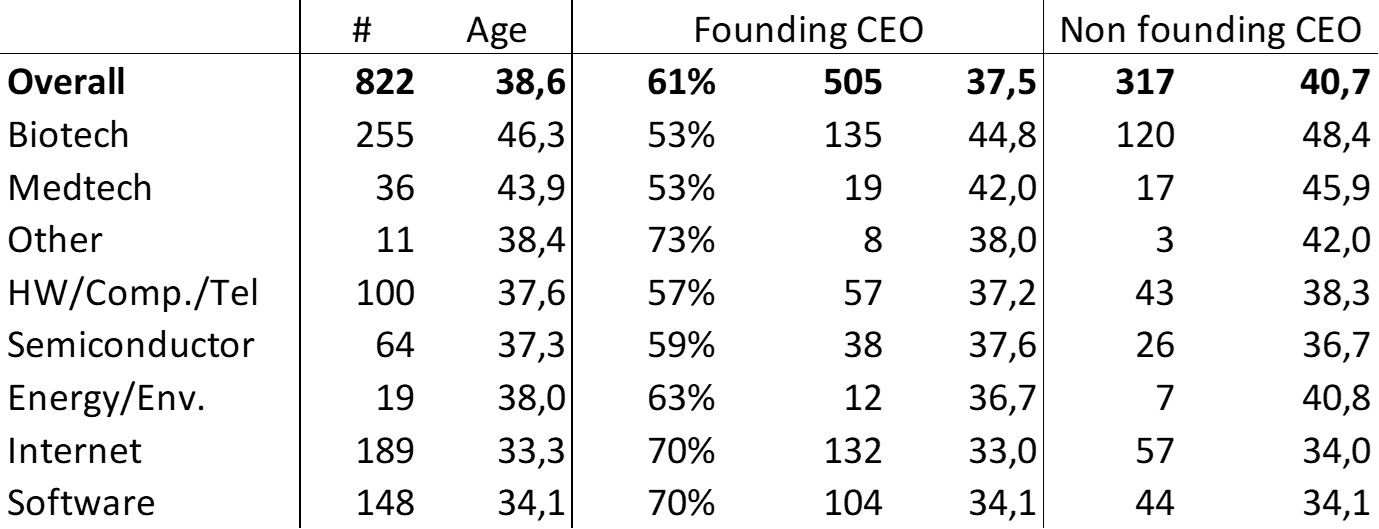

The age of founders has been a recurrent topic here as you might see from tag #age. In my analysis about hundreds of startups (822 at this time, and 600 lately), I just thought it would be interesting to check the correlation, if any, there might be between the age of founders and a CEO among these founders or not. Intuitively, one might think that the less experimented founders may induce a non-founding CEO. So here are the results:

The numbers speak and may seem counterintuitive. A majority (and often an overwhelming majority in the digital world) of startups have a founding CEO and the average age of founders is lower in this case. Question of dynamism, of envy of the team, I do not know …. Do not hesitate to react and comment.

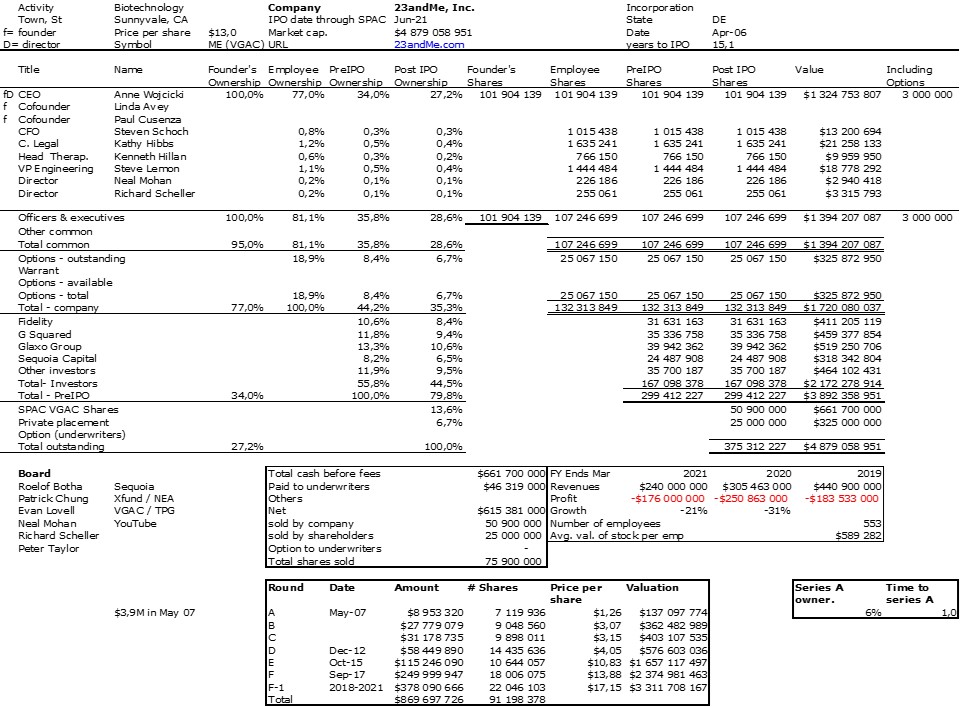

23andMe goes public (IPO) through a SPAC

DNA testing 23andMe, Anne Wojcicki‘s startup, just went public through a SPAC, Virgin Group Acquisition Company (VGAC) of Richard Branson.

So what is a SPAC? It took me some time to understand and I am still not sure about the details… If you are interested about general information, you may want to read the Wikipedia link below or the following articles:

– OK, What’s a SPAC? from the New York Times, Feb. 2021 or

– The Pied Piper of SPACs from the New Yorker, June 2021.

A standard IPO is a process where a private company becomes public by offering its existing shares for sale to the public with the possibility of creating new shares bought by the public at the IPO.

A SPAC (Special Purpose Acquisition Company as explained on Wikipedia) is a process where an empty shell or “blank check” company is created by raising money on a public stock exchange, it becomes a public company with no activity and just new shareholders. Then it may acquire an existing private company by a negociation where the existing shareholders of the SPAC and of the private company agree on a balanced value between the two companies. By this reverse merger company, the private company becomes the public company and the SPAC name disappears.

So 23andMe followed such a process and I understood the following to build the cap. table of the new public company. VGAC, the SAPC, had raised $509M at IPO in October 2020. Then Richard Branson proposed to Anne Wojcicki to acquire 23andMe. It worked and they agreed on a price per share of $10, so that the $509M would give 50.9M shares to the VGAC shareholders.

23andMe had its own shareholders, including Anne Wojcicki (about 100M shares), Sequoia (24M shares), Glaxo (39M shares). There were shares detained by managers and board memebers and about 28M stock options too. (The two other cofounders are not mentioned in the IPO document.)

What makes it a little more complex is the additional fact that there was an “private placement” at the IPO of $250M at $10 per share, i. e. 25 new shares in the cap. table.

I am not full sure about all this. It could be that I am mixing the Private Placement, the SPAC shareholders and the 23andMe shareholders, but in a way this is a detail. Where I am confused is that the press annouces a value of $3.9B and I obtain $4.9B which the stock options are not sufficient to explain… Please react if you see a good explanation!

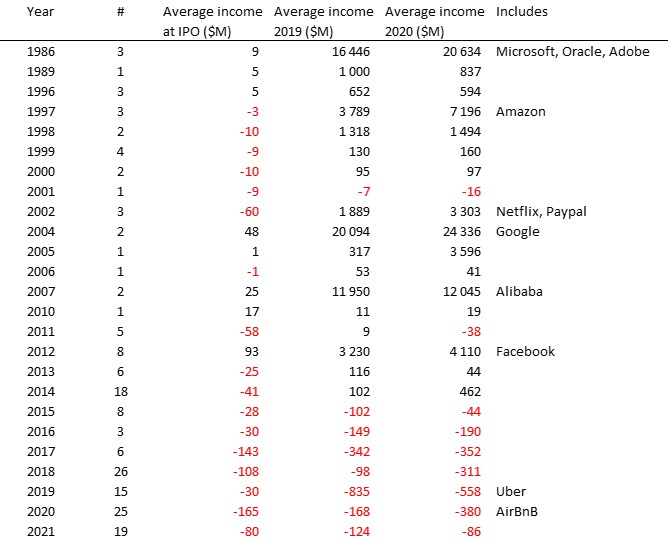

Another quick look at data on public tech companies : loss, loss and more loss? (2/2)

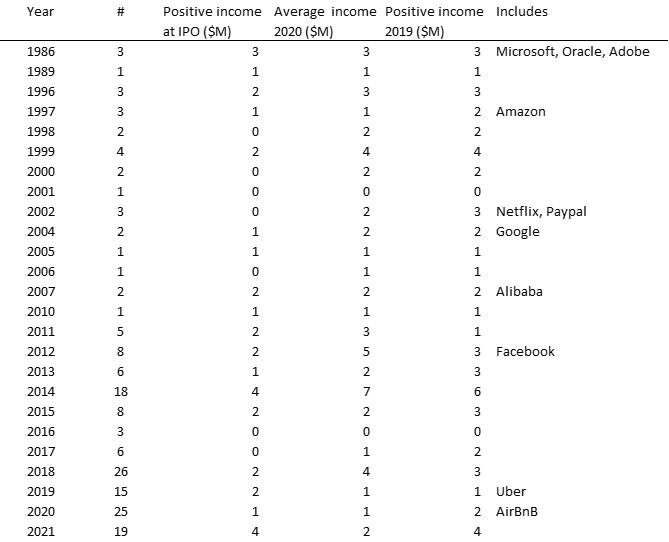

Following the initial post introducing the topic of loss (see here), here is the promised of profit/loss of 168 IT companies (software, internet, ecommerce) extracted from the 787 companies mentioned before. You will find at the end of the post the full list of companies with their IPO year, profit at IPO, in 2019, and in 2020. So are these companies losing or making money?

Here are some results, but be careful, they are not statiscally relevent and not a proof of anything, but I hope an interesting illustration: in the 90s, the companies going public seem to be profitable, then the companies seem to be losing money at IPO ine th 21st century, with the exception of the famous outliers that Google, Facebook or Alibaba have become. These were profitable at IPO. The following table gives the average values by year of listing.

More recently, beginning in 2015, the companies are (on average) losing money at IPO but also in 2019 and 2020. Following a comment on LinkedIn that I copied in the comments below, I agree that the averages are misleading if outliers hide the number of profit or loss making companies. So here is the table of the number of profit making companies per IPO year:

Again, if you want to look at the performance of individual companies, check the table below. And as a kind of conclusion, all this reminds me a great article from the New Yorker that you may like: How Venture Capitalists Are Deforming Capitalism

| Start-up | Founded | IPO | Income at IPO | Income 2020 | Income 2019 |

| Airbnb | Jun-08 | Nov-20 | -674 | -4 584 | -674 |

| Accolade | Jan-17 | Feb-20 | -56 | -50 | -290 |

| Adobe | Dec-82 | Aug-86 | 1 | 5 260 | 2 951 |

| Adyen | Nov-06 | Jun-18 | 71 | 261 | 204 |

| Affirm | Jun-12 | Nov-20 | -112 | -124 | -134 |

| C3.ai | Jan-09 | Dec-20 | -70 | -69 | -33 |

| Akamai | Aug-98 | Nov-99 | -28 | 557 | 478 |

| Anevia | Jun-03 | Jun-14 | 0,03 | -1 | |

| Wallix Group | Oct-03 | Jun-15 | 0 | -7 | -6 |

| Visiativ | May-94 | Jul-14 | 0 | 1 | 3 |

| AmWell | Jun-06 | Aug-20 | -88 | -224 | -87 |

| Amazon | Jul-94 | May-97 | -5 | 21 581 | 11 388 |

| Ansys | Jun-70 | Jun-96 | -1 | 433 | 451 |

| Applovin | Jul-11 | Mar-21 | -125 | -125 | 76 |

| Asana | Dec-08 | Aug-20 | -118 | -211 | -118 |

| Avalara | Aug-99 | May-18 | -64 | -49 | -50 |

| Avast Plc | Oct-88 | Oct-18 | -33 | 240 | 352 |

| Alibaba | Jun-99 | Nov-07 | 40 | 24 049 | 23 882 |

| BrightCove | Aug-04 | Feb-12 | -17 | -6 | -22 |

| Baidu | Jan-00 | Aug-05 | 1 | 3 596 | 317 |

| BigCommerce | Jun-09 | Aug-20 | -42 | -38 | -41 |

| BiliBili | Jun-09 | Mar-18 | -28 | -482 | -206 |

| Bill.com | Jun-07 | Nov-19 | -7 | -31 | -7 |

| Box | Apr-05 | Mar-14 | -168 | -43 | -144 |

| Chegg | Jul-05 | Oct-13 | -49 | -6 | -9 |

| Checkpoint | Jul-93 | Jun-96 | 15 | 846 | 825 |

| Coinbase | Jun-12 | Feb-21 | 322 | 322 | -30 |

| Compass | Oct-12 | Mar-21 | -270 | -270 | -388 |

| Coursera | Oct-11 | Mar-21 | -66 | -66 | -46 |

| Coupang | May-10 | Mar-21 | -474 | -593 | -770 |

| Salesforce.com | Feb-99 | Jun-04 | -9 | 455 | 463 |

| Criteo | Nov-05 | Mar-13 | 12 | 106 | 135 |

| CrowdStrike | Aug-11 | May-19 | -140 | -92 | -141 |

| Castlight Health | Jan-08 | Mar-14 | -62 | -62 | -40 |

| Casper Sleep | Oct-13 | Jan-20 | -98 | -89 | -93 |

| Citrix | Apr-89 | Dec-96 | 2 | 504 | 681 |

| Cyber-Ark Soft. | Apr-99 | Jun-14 | 7 | -5 | 63 |

| DoorDash | May-13 | Nov-20 | -668 | -461 | -667 |

| Dropbox | May-07 | Feb-18 | -111 | -256 | -52 |

| Datadog | Jun-10 | Sep-19 | -10 | -24 | -16 |

| Delivery hero | May-11 | Jun-17 | -202 | -1 404 | -680 |

| DigitalOcean | Dec-11 | Feb-21 | -43 | -43 | -40 |

| Docusign | Apr-03 | Mar-18 | -115 | -243 | -208 |

| Domo | Sep-10 | Jun-18 | -176 | -84 | -125 |

| Electronic Arts | May-82 | Aug-89 | 5 | 837 | 1 000 |

| Eventbrite | May-03 | Sep-18 | -38 | -224 | -68 |

| eBay | May-96 | Sep-98 | -1 | 2 150 | 1 786 |

| eGain Corp. | Sep-97 | Sep-99 | -11 | 7 | 4 |

| Elastic NV | Feb-12 | Sep-18 | -52 | -167 | -102 |

| Jul-04 | Feb-12 | 1 000 | 32 671 | 24 932 | |

| Funding Circle | Aug-10 | Sep-18 | -38 | -154 | -120 |

| 1-800-Flowers | Aug-76 | Aug-99 | 3 | 58 | 34 |

| Flywire | Jul-09 | May-21 | -11 | -15 | -17 |

| Jfrog Ltd | Apr-08 | Aug-20 | -5 | -9 | -5 |

| Fastly | Mar-19 | Apr-19 | -30 | -105 | -45 |

| F-secure | Dec-88 | Nov-99 | 1 | 17 | 5 |

| Farfetch | Oct-07 | Sep-18 | -112 | -3 200 | -353 |

| Fiverr International | Apr-10 | Jun-19 | -36 | -11 | -34 |

| Go Daddy | Jan-97 | Jun-14 | -199 | -404 | 218 |

| Globant SA | Aug-13 | Aug-13 | -1 | 85 | 74 |

| Sep-98 | Aug-04 | 105 | 48 217 | 39 725 | |

| Groupon | Jan-08 | Jun-11 | -413 | -260 | 10 |

| GrubHub | Feb-04 | Apr-14 | 15 | -147 | -6 |

| Guidewire | Sep-01 | Jan-12 | 35 | -6 | 29 |

| HelloFresh | Oct-11 | Nov-17 | -15 | 405 | 1 |

| The Honest Co | Jul-11 | Apr-21 | -14 | -13 | -31 |

| Hubspot | Apr-05 | Aug-14 | -34 | -43 | -27 |

| JD.com | Nov-06 | May-14 | -50 | 8 311 | 2 307 |

| KnowBe4 | Aug-10 | Mar-21 | -2 | -1 | -124 |

| LendingClub | Oct-06 | Dec-14 | 7 | -187 | -30 |

| Lemonade | Jun-15 | Jun-20 | -108 | -122 | -108 |

| Lyft Inc. | Mar-07 | Mar-19 | -910 | -1 764 | -2 702 |

| Medallia | Jul-00 | Jun-19 | -82 | -138 | -114 |

| Mimecast | Mar-03 | Oct-15 | 1 | 34 | 4 |

| Model N | Dec-99 | Mar-13 | -5 | -6 | -15 |

| Mogu | Feb-11 | Nov-18 | -81 | -110 | -92 |

| Momo | Nov-11 | Nov-14 | -8 | 476 | 552 |

| Marin Software | Mar-06 | Mar-13 | -26 | -16 | -17 |

| Microsoft | Jan-75 | Mar-86 | 24 | 56 627 | 46 374 |

| nCino | Dec-11 | Jun-20 | -27 | -40 | -28 |

| CloudFare | Jul-09 | Aug-19 | -87 | -100 | -103 |

| Netflix | Aug-97 | May-02 | -37 | 4 585 | 2 688 |

| Nuance Comm | Jul-94 | Apr-00 | -18 | 103 | 145 |

| Xing / New Work | Aug-03 | Dec-06 | -1 | 41 | 53 |

| Okta | Jan-09 | Mar-17 | -76 | -193 | -183 |

| Olo | Jun-05 | Feb-21 | 3 | 3 | -8 |

| OneMedical | Jul-02 | Jan-20 | -44 | -76 | -53 |

| ON24 | Jan-98 | Jan-21 | -17 | 21 | -16 |

| OpenDoor Tech. | Mar-14 | Dec-20 | -339 | -218 | -229 |

| Oracle | Jun-77 | Mar-86 | 2 | 14 | 14 |

| Oscar Health | Oct-12 | Feb-21 | -405 | -402 | -259 |

| Overstock.com | May-97 | Jun-02 | -14 | 49 | -134 |

| Procore | Jan-02 | Feb-20 | -83 | -95 | -82 |

| PagerDuty | Feb-09 | Mar-19 | -38 | -62 | -49 |

| Pinduoduo | Apr-15 | Jul-18 | -83 | -1 040 | -1 096 |

| PDF Solutions | Nov-92 | Jul-01 | -9 | -16 | -7 |

| Phreesia | Feb-05 | Jun-19 | -15 | -25 | -15 |

| Oct-08 | Apr-19 | -62 | -126 | -1 358 | |

| Anaplan | Jun-08 | Oct-18 | -47 | -153 | -148 |

| Palantir | Jun-03 | Aug-20 | -579 | -1 164 | -564 |

| Poshmark, Inc. | Jan-11 | Dec-20 | -49 | 23 | -49 |

| PluralSight | Jun-04 | Apr-18 | -96 | ||

| Pintec | Jul-12 | Jul-18 | -13 | -137 | -728 |

| PubMatic | Nov-06 | Dec-20 | 7 | 31 | 8 |

| Paypal | Dec-98 | Feb-02 | -130 | 5 274 | 3 113 |

| Qad Inc | Aug-79 | Aug-97 | 1 | 11 | -2 |

| QuinStreet | Apr-99 | Feb-10 | 17 | 19 | 11 |

| Qutoutiao | Jun-16 | Sep-18 | -14 | -171 | -324 |

| Coupons.com | May-98 | Feb-14 | -59 | -50 | -22 |

| Roblox | Mar-04 | Nov-20 | -86 | -266 | -76 |

| Redfin | Oct-02 | Jun-17 | -22 | 1 | -71 |

| Renren | Oct-02 | May-11 | -62 | -95 | -141 |

| RealNetworks | Feb-94 | Nov-97 | -4 | -5 | -19 |

| Deliveroo | Aug-12 | Mar-21 | -312 | -323 | -453 |

| Rovio | Nov-03 | Nov-07 | 10 | 41 | 18 |

| Rapid7 | Jul-00 | May-15 | -32 | -72 | -40 |

| Shopify | Sep-04 | Nov-15 | -22 | 249 | -141 |

| SmartSheet | Jun-05 | Mar-18 | -49 | -120 | -103 |

| Snap Inc | Jul-10 | Feb-17 | -514 | -828 | -1 000 |

| SnowFlake | Jul-12 | Aug-20 | -348 | -543 | -358 |

| Splunk Inc | Oct-03 | Apr-12 | -10 | -777 | -235 |

| Spotify | Dec-06 | Feb-18 | -1 606 | -655 | -88 |

| Sprout Social | Apr-10 | Oct-19 | -20 | -31 | -46 |

| Square | Jun-09 | Oct-15 | -154 | 272 | 26 |

| Swissquote | Aug-99 | May-00 | -2 | 91 | 44 |

| Squarespace | Oct-07 | Apr-21 | 30 | 32 | 65 |

| StoneCo | Mar-14 | Oct-18 | -27 | 279 | 274 |

| Sumo Logic | Mar-10 | Aug-20 | -92 | -78 | -91 |

| SurveyMonkey | Mar-00 | Sep-18 | -24 | -80 | -62 |

| Teladoc | Jun-02 | Jun-15 | -17 | -515 | -80 |

| ThredUp | Jan-09 | Mar-21 | -47 | -46 | -36 |

| Atlassian | Oct-02 | Dec-15 | 6 | -296 | -565 |

| Tenable | Sep-02 | Jul-18 | -41 | -36 | -90 |

| Talend SA | Sep-05 | Jul-16 | -22 | -70 | -58 |

| TrustPilot | Feb-07 | Mar-21 | 6 | -15 | -29 |

| Tufin Software | Jan-05 | Mar-19 | -4 | -33 | -27 |

| Tuya | Jun-14 | Feb-21 | -70 | -69 | -73 |

| Twilio | Mar-08 | Jun-16 | -35 | -472 | -369 |

| 2U | Apr-08 | Feb-14 | -27 | -190 | -241 |

| Jun-06 | Nov-13 | -79 | 101 | 528 | |

| Unity Software | Aug-04 | Aug-20 | -163 | -274 | -150 |

| Uber | Jul-10 | Apr-19 | 987 | -6 488 | -7 874 |

| Upland | Jul-10 | Sep-14 | -9 | 100 | 90 |

| Upstart | Feb-12 | Nov-20 | -5 | 6 | -1 |

| Upwork | Dec-99 | Oct-18 | -4 | -21 | -15 |

| VipShop Holding | Aug-08 | Mar-12 | -156 | 1 134 | 804 |

| Vroom, Inc. | Jan-12 | Jun-20 | -143 | -193 | -128 |

| Verisign | Apr-95 | Feb-98 | -19 | 837 | 849 |

| Wayfair | May-02 | Aug-14 | -11 | 351 | -929 |

| WorkDay | Mar-05 | Oct-12 | -79 | -206 | -423 |

| Windeln | Oct-10 | May-15 | -8 | -13 | -14 |

| Wisekey | Feb-99 | Mar-16 | -33 | -27 | -21 |

| Wish | Jun-10 | Nov-20 | -129 | -631 | -144 |

| X financial | Mar-14 | Sep-18 | 51 | -1 308 | 774 |

| Yelp | Sep-04 | Mar-12 | -16 | -34 | 35 |

| Yext | Nov-06 | Mar-17 | -26 | -93 | -120 |

| Yandex | Sep-97 | May-11 | 100 | 554 | 321 |

| YY | Apr-05 | Oct-12 | -12 | 102 | 716 |

| Zillow | Dec-04 | Jul-11 | -6 | -14 | -207 |

| Zalando | Feb-08 | Oct-14 | -113 | 377 | 175 |

| Zendesk | Aug-07 | May-14 | -22 | -169 | -141 |

| Zhihu | Dec-10 | Mar-21 | -79 | -96 | -169 |

| ZipRecruiter | Jun-10 | Apr-21 | 63 | 65 | -5 |

| Zoom Video | Apr-11 | Mar-19 | 7 | 659 | 12 |

| Zynga | Oct-07 | Aug-11 | 90 | -375 | 64 |

| Zscaler | Sep-07 | Feb-18 | -35 | -107 | -35 |

| Zuora | Sep-06 | Mar-18 | -46 | -73 | -85 |

Another quick look at data on public tech companies : loss, loss and more loss? (1/2)

I was motivated a few days ago to look at the work I have been doing for years on public tech. companies, their cap. tables, their overall financial performance. If you do not know what I am talking about, you can have a look at my past analyses on 600, then 700 companies through the tag 600 (former) startups. I’ve now 787 such cap. tables.

It’s been known that there are differences with fields such as biotech. vs. software/internet. About biotech, check Are Biotechnology Startups Different? Regarding software, and more specifically Internet or ecommerce companies, I have not done a similar analysis but I began to notice a while ago that these companies were also money-losing companies at IPO. In the past, you were only going public in IT when you were beginning to be profitable. This was more than 20 years ago! The recent argument for going public while losing money was that these companies would make a profit once they have reached a threshold in size. Amazon was not profitable for many years after its IPO.

But isn’t that argument flawed? Will Uber or AirBnB and similar platform companies ever make a profit? Too early to say and the future is unpredictable. But I thought I would look at the current situation of my 787 companies and have a quick look. So before studying the profit profile of IT companies (this will be in part 2, my next post), here are the basics. There is a total of 435 public companies – 353 companies have been acquired, liquidated (315) and a few are still private (37). My next post should follow soon.

| Market Cap | # | $B |

| $1T | 4 | 7’253 |

| $100B | 17 | 5’274 |

| $10B | 88 | 3’273 |

| $1B+ | 168 | 623 |

| <$1B | 150 | 55 |

| Total | 427 | 16’478 |

These numbers again show the power law distribution (and not Gaussian) and here is the long list of names for those interested:

| $1,000B+ | $100B+ | $10B+ | $1B+ |

| Amazon | Adobe Inc. | 10x Genomics, Inc. | 1-800-FLOWERS.COM, Inc. |

| Apple | Alibaba Group | Advanced Micro Devices, Inc. | 1Life Healthcare, Inc. |

| Amgen Inc. | Adyen N.V. | 2U, Inc. | |

| Microsoft | Cisco Systems, Inc. | Affirm Holdings, Inc. | 8×8, Inc. |

| Facebook, Inc. | Airbnb, Inc. | 908 Devices Inc. | |

| Intel Corporation | Akamai Technologies, Inc. | AbCellera Biologics Inc. | |

| JD.com, Inc. | Alnylam Pharmaceuticals, Inc. | ACADIA Pharmaceuticals Inc. | |

| Netflix, Inc. | ANSYS, Inc. | Acceleron Pharma Inc. | |

| NVIDIA Corporation | AppLovin Corporation | Accolade, Inc. | |

| Oracle Corporation | Arista Networks, Inc. | Adaptive Biotechnologies Corp | |

| PayPal Holdings, Inc. | Atlassian Corporation Plc | Agios Pharmaceuticals, Inc. | |

| Pinduoduo Inc. | Avalara, Inc. | Alector, Inc. | |

| salesforce.com, inc. | Baidu, Inc. | Aligos Therapeutics, Inc. | |

| Shopify Inc. | Bilibili Inc. | Allogene Therapeutics, Inc. | |

| Square, Inc. | Bill.com Holdings, Inc. | AlloVir, Inc. | |

| Tesla, Inc. | BioNTech SE | American Well Corporation | |

| Xiaomi Corporation | Check Point Software | Amyris, Inc. | |

| Chegg, Inc. | Anaplan, Inc. | ||

| Citrix Systems, Inc. | Arcutis Biotherapeutics, Inc. | ||

| Cloudflare, Inc. | Asana, Inc. | ||

| Coinbase Global, Inc. | Asetek A/S | ||

| Coupang, Inc. | Avast Plc | ||

| CrowdStrike Holdings, Inc. | Axonics, Inc. | ||

| CureVac N.V. | Beam Therapeutics Inc. | ||

| Datadog, Inc. | Berkeley Lights, Inc. | ||

| Delivery Hero SE | Beyond Meat, Inc. | ||

| DocuSign, Inc. | BigCommerce Holdings, Inc. | ||

| DoorDash, Inc. | BlackBerry Limited | ||

| Dropbox, Inc. | Bloom Energy Corporation | ||

| eBay Inc. | bluebird bio, Inc. | ||

| Elastic N.V. | Blueprint Medicines Corp | ||

| Electronic Arts Inc. | Box, Inc. | ||

| Enphase Energy, Inc. | C3.ai, Inc. | ||

| Equinix, Inc. (REIT) | C4 Therapeutics, Inc. | ||

| F5 Networks, Inc. | Ciena Corporation | ||

| Farfetch Limited | Cimpress plc | ||

| Fortinet, Inc. | Cirrus Logic, Inc. | ||

| Garmin Ltd. | Compass, Inc. | ||

| GoDaddy Inc. | ContextLogic Inc. | ||

| HelloFresh SE | Corcept Therapeutics | ||

| Horizon Therapeutics | Coursera, Inc. | ||

| HubSpot, Inc. | CRISPR Therapeutics AG | ||

| Illumina, Inc. | Criteo S.A. | ||

| Intuitive Surgical, Inc. | CyberArk Software Ltd. | ||

| Jazz Pharmaceuticals plc | Deliveroo plc | ||

| Lam Research Corporation | Denali Therapeutics Inc. | ||

| Logitech International S.A. | Design Therapeutics, Inc. | ||

| Lyft, Inc. | Dicerna Pharmaceuticals, Inc. | ||

| Marvell Technology, Inc. | DigitalOcean Holdings, Inc. | ||

| Micron Technology, Inc. | Domo, Inc. | ||

| Moderna, Inc. | Eargo, Inc. | ||

| NIO Inc. | Edgewise Therapeutics, Inc. | ||

| Nuance Communications, Inc. | Editas Medicine, Inc. | ||

| Okta, Inc. | Enanta Pharmaceuticals, Inc. | ||

| Palantir Technologies Inc. | Eventbrite, Inc. | ||

| Palo Alto Networks, Inc. | Exelixis, Inc. | ||

| Pinterest, Inc. | Extreme Networks, Inc. | ||

| Procore Technologies, Inc. | Fastly, Inc. | ||

| Qorvo, Inc. | Fate Therapeutics, Inc. | ||

| QuantumScape Corporation | FireEye, Inc. | ||

| Roblox Corporation | Five Prime Therapeutics, Inc. | ||

| Seagen Inc. | Fiverr International Ltd. | ||

| Snap Inc. | Flywire Corporation | ||

| Snowflake Inc. | FormFactor, Inc. | ||

| SolarEdge Technologies, Inc. | Generation Bio Co. | ||

| Splunk Inc. | Gevo, Inc. | ||

| Spotify Technology S.A. | Glaukos Corporation | ||

| StoneCo Ltd. | Globant S.A. | ||

| Synopsys, Inc. | GoPro, Inc. | ||

| Teladoc Health, Inc. | Gracell Biotechnologies Inc. | ||

| Tuya Inc. | Groupon, Inc. | ||

| Twilio Inc. | Grubhub Inc. | ||

| Twitter, Inc. | Guidewire Software, Inc. | ||

| Uber Technologies, Inc. | Idorsia Ltd | ||

| Unity Software Inc. | Inari Medical, Inc. | ||

| Upstart Holdings, Inc. | Infinera Corporation | ||

| VeriSign, Inc. | InMode Ltd. | ||

| Vipshop Holdings | Inogen, Inc. | ||

| Wayfair Inc. | Inphi Corporation | ||

| Workday, Inc. | Inspire Medical Systems, Inc. | ||

| XPeng Inc. | Instil Bio, Inc. | ||

| Yandex N.V. | Intellia Therapeutics, Inc. | ||

| Zalando SE | iRobot Corporation | ||

| Zendesk, Inc. | Ironwood Pharmaceuticals, Inc. | ||

| Zillow Group, Inc. | JFrog Ltd. | ||

| Zoom Video | JOYY Inc. | ||

| Zscaler, Inc. | Juniper Networks, Inc. | ||

| Zynga Inc. | Karuna Therapeutics, Inc. | ||

| Keros Therapeutics, Inc. | |||

| Kymera Therapeutics, Inc. | |||

| Lemonade, Inc. | |||

| LendingClub Corporation | |||

| MacroGenics, Inc. | |||

| MaxLinear, Inc. | |||

| Medallia, Inc. | |||

| Mimecast Limited | |||

| Model N, Inc. | |||

| Momo Inc. | |||

| NanoString Technologies, Inc. | |||

| Natera, Inc. | |||

| nCino, Inc. | |||

| New Work SE | |||

| nLIGHT, Inc. | |||

| Nutanix, Inc. | |||

| Olo Inc. | |||

| ON24, Inc. | |||

| Opendoor Technologies Inc. | |||

| Oscar Health, Inc. | |||

| Overstock.com, Inc. | |||

| PagerDuty, Inc. | |||

| Phreesia, Inc. | |||

| Pluralsight, Inc. | |||

| Poshmark, Inc. | |||

| Power Integrations, Inc. | |||

| Prelude Therapeutics Inc | |||

| PTC Therapeutics, Inc. | |||

| PubMatic, Inc. | |||

| Pulmonx Corporation | |||

| Pure Storage, Inc. | |||

| QAD Inc. | |||

| Qualys, Inc. | |||

| Quotient Technology Inc. | |||

| Rambus Inc. | |||

| Rapid7, Inc. | |||

| Recursion Pharmaceuticals, Inc. | |||

| Redfin Corporation | |||

| Revolution Medicines, Inc. | |||

| Ribbon Communications Inc. | |||

| Rubius Therapeutics, Inc. | |||

| Sana Biotechnology, Inc. | |||

| Sangamo Therapeutics, Inc. | |||

| Schrödinger, Inc. | |||

| Seer, Inc. | |||

| Silicon Laboratories Inc. | |||

| Smartsheet Inc. | |||

| Soitec S.A. | |||

| Sonos, Inc. | |||

| Sprout Social, Inc. | |||

| Squarespace, Inc. | |||

| Stoke Therapeutics, Inc. | |||

| STORE Capital Corporation | |||

| Sumo Logic, Inc. | |||

| Sunrun Inc. | |||

| Supernus Pharmaceuticals, Inc. | |||

| SVMK Inc. | |||

| Swissquote Group Holding Ltd | |||

| Synaptics Incorporated | |||

| Talend S.A. | |||

| Tandem Diabetes Care, Inc. | |||

| Tenable Holdings, Inc. | |||

| The Honest Company, Inc. | |||

| ThredUp Inc. | |||

| Trustpilot Group plc | |||

| Turning Point Therapeutics, Inc. | |||

| Upland Software, Inc. | |||

| Upwork Inc. | |||

| Vaxcyte, Inc. | |||

| Veracyte, Inc. | |||

| Viasat, Inc. | |||

| Vroom, Inc. | |||

| Xencor, Inc. | |||

| Xperi Holding Corporation | |||

| Yelp Inc. | |||

| Yext, Inc. | |||

| Zhihu Inc. | |||

| ZipRecruiter, Inc. | |||

| Zuora, Inc. | |||

| Zymergen Inc. |

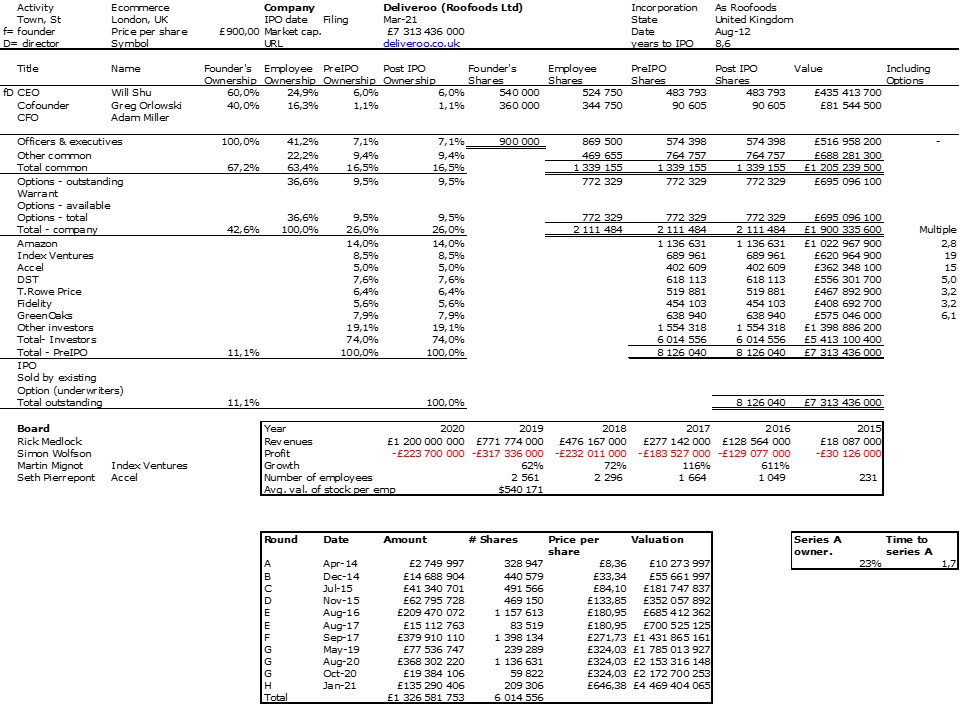

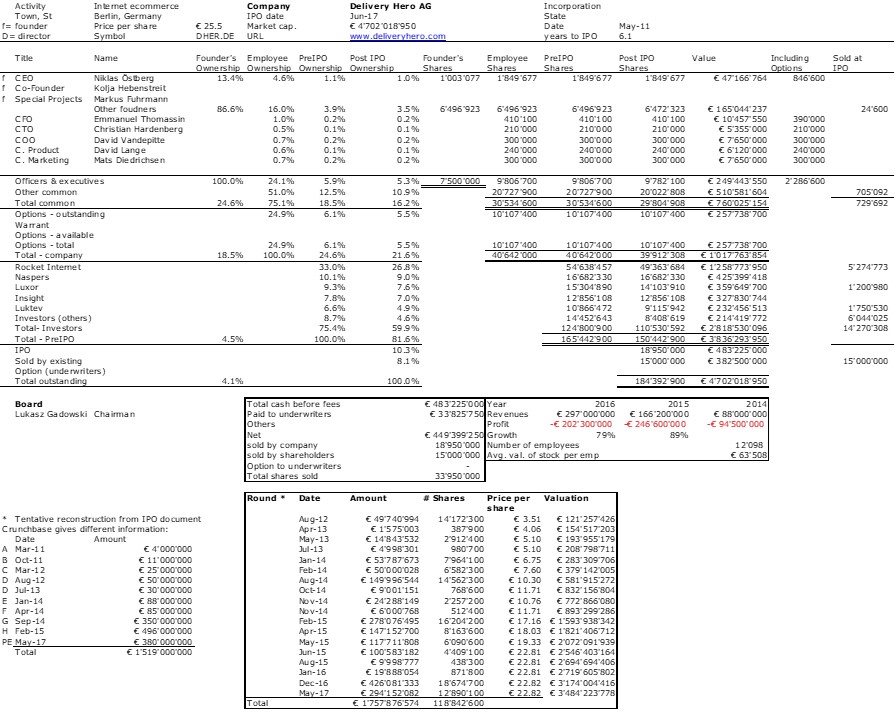

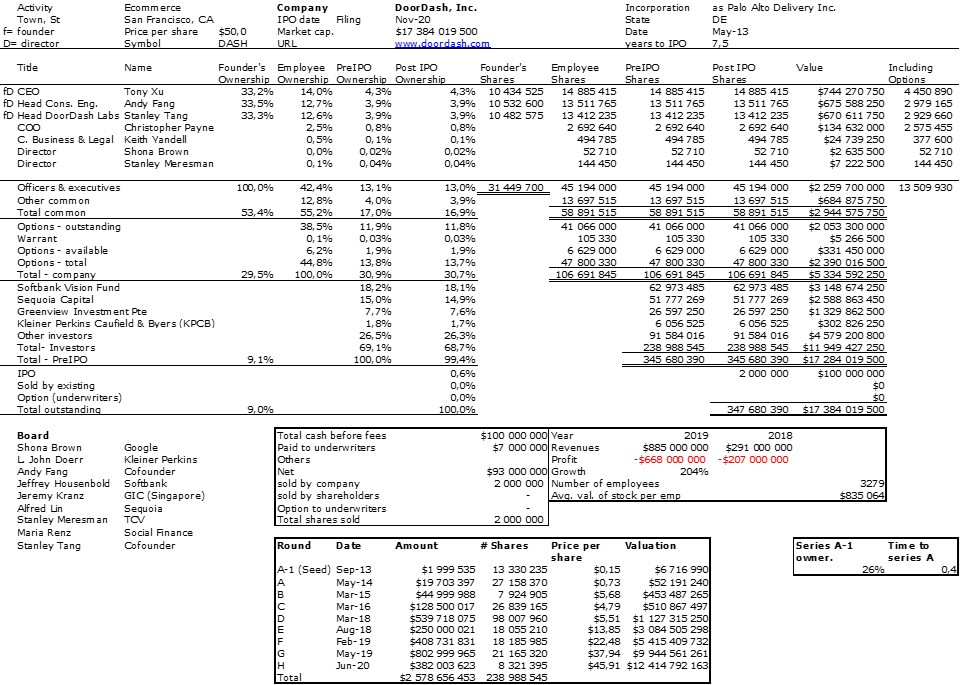

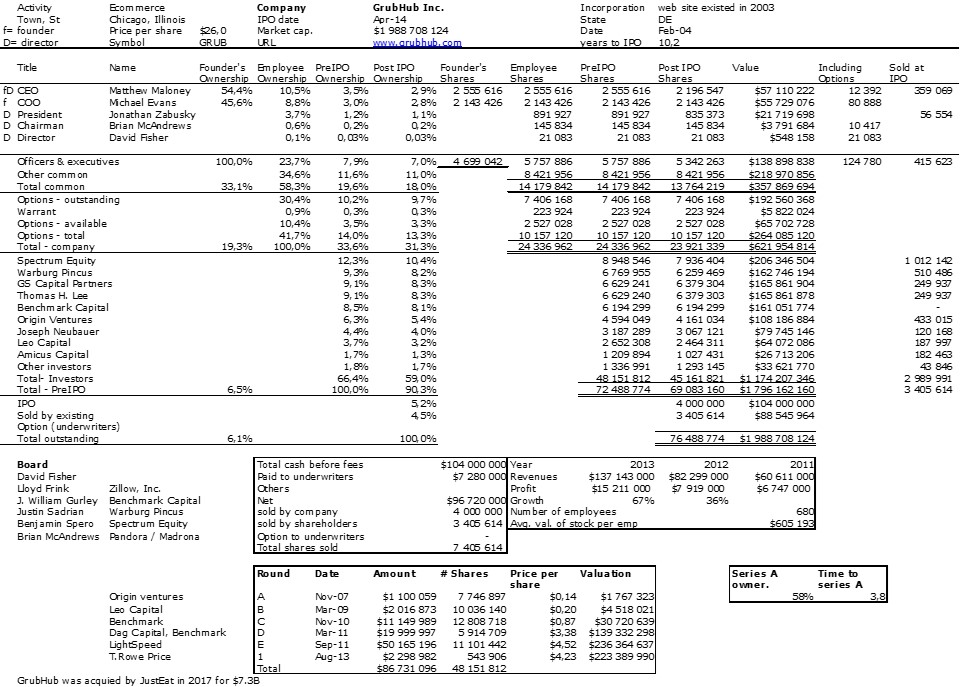

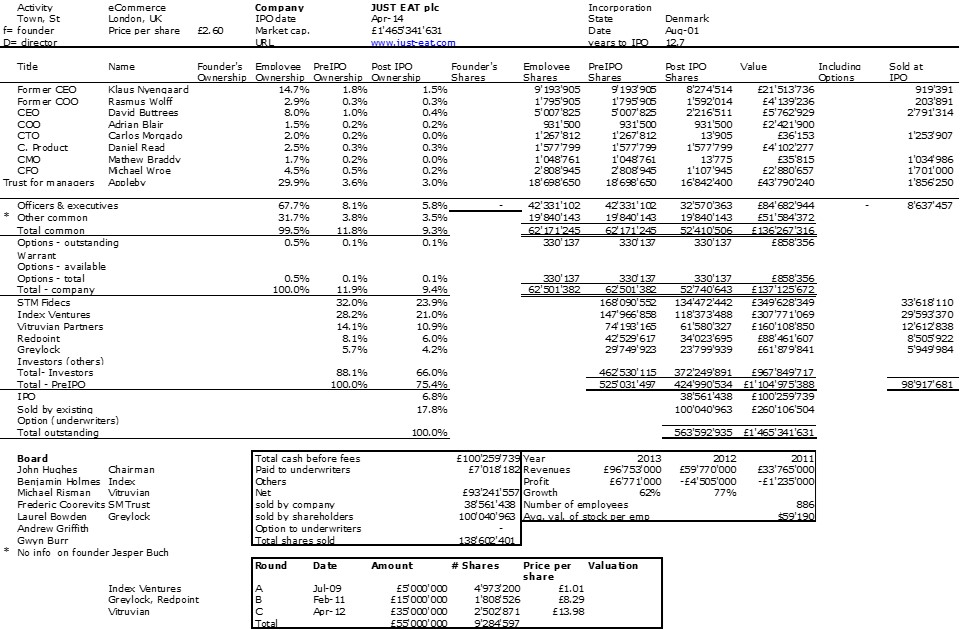

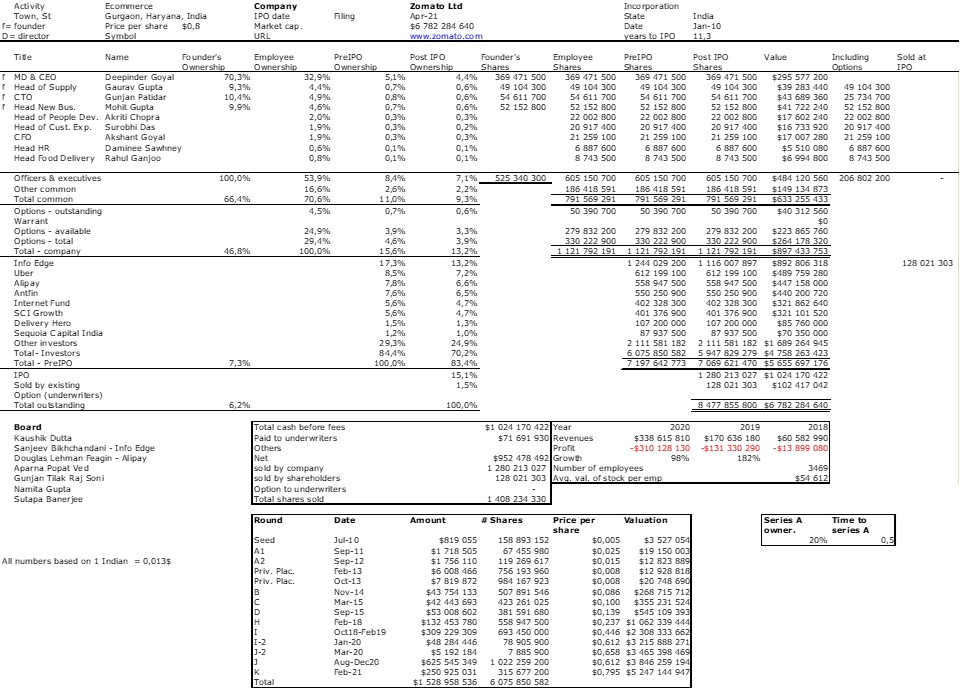

Food delivery startups – a quick analysis

Yesterday I discovered an Indian startup filed to go public on its national stock exchange. I did not know it, shame on me. Zomato is the latest filing in a small number but extremely visible services in the food delivery sector. Who does not know Deliveroo, Just Eat, Uber Eats and others.

I am not sure that twenty years ago I would have pu the sector in technology innovation, but I have to admit innovation has many faces. On Crunchbase, the sector is said to have 616 organizations with $12.5B in funding (see Crunchbase Food Delivery Startups). Traxn gives the largest players here. So thanks to my database of 777 cap. tables, I could have a look at some statistics, with the exception of FoodPanda (acquired by Delivery Hero, funded with $318M including Rocket Internet), iFood (Brazil, owned by Movile, $587M in funding) and Swiggy (India, $2.5B in funding including Accel). Here are the data at time of the IPO filings.

| Start-up | JustEat | GrubHub | Zomato | Delivery Hero | Deliveroo | DoorDash | Median * | |

| Geography | United Kingdom | Illinois | India | Germany | United Kingdom | Silicon Valley | ||

| Founded | Aug-01 | Feb-04 | Jan-10 | May-11 | Aug-12 | May-13 | Sep-02 | |

| IPO / exit | Apr-14 | Apr-14 | Apr-21 | Jun-17 | Mar-21 | Nov-20 | Mar-13 | |

| Years to IPO | 12,7 | 10,2 | 11,3 | 6,1 | 8,6 | 7,5 | 7,4 | |

| VC Amount | 88 | 86 | 1529 | 1711 | 1856 | 2578 | 84 | |

| 1st round | 8 | 1 | 1 | 4 | 4 | 2 | 4,4 | |

| Sales ($M) | 150 | 137 | 338 | 297 | 1 680 | 885 | 23 | |

| Income ($M) | 10 | 15 | -310 | -202 | -312 | -668 | -14 | |

| Market Cap. | 1 465 | 1 988 | 6 782 | 4 700 | 10 220 | 17 384 | 560 | |

| PS | 10 | 15 | 20 | 16 | 6 | 20 | 17 | |

| PE | 147 | 133 | 102 | |||||

| Nb of Emp. | 886 | 680 | 3 469 | 12 098 | 2 561 | 3 279 | 189 |

*: the median value is based on 777 startups compiled over years. PS and PE are the ratios of market caps to sales and earnings (profit)

Just Eat has no data on founders as the initial Danish company with 5 founders has been bought and moved/launched in the UK.

Here are the data to date (GrubHub has been acquired by Just Eat in 2020):

| Market Cap. $B | Sales – $B | Loss – $M | PS | Employees | |

| Just Eat | 15,4 | 2,8 | -151 | 5,4 | 9 000 |

| Delivery Hero | 39,4 | 2,0 | -939 | 19,5 | 35 528 |

| DoorDash | 46,0 | 2,9 | -458 | 15,9 | 3 886 |

| Deliveroo | 6,3 | 1,6 | -225 | 3,9 | 2 060 |

| Zomato | 6,8 | 0,3 | -310 | 20,1 | 3 469 |

What is interesting is the difference in dynamics between companies launched before 2010. Something not really new if you follow this blog, in terms of growth dynammics. Here are some more data about shareholders

| Start-up | JustEat | GrubHub | Zomato | Delivery Hero | Deliveroo | DoorDash | Median * | |

| Found. | 5,7% | 6,2% | 4,5% | 7,1% | 12,0% | 9% | ||

| Emp. | 9,4% | 25,1% | 7,0% | 17,2% | 18,9% | 18,5% | 21% | |

| Emp. shares | 9,3% | 12,1% | 3,1% | 11,7% | 9,4% | 4,8% | 8% | |

| ESOP-granted | 0,1% | 9,7% | 0,6% | 5,5% | 9,5% | 11,8% | 8% | |

| ESOP-reserved | 3,3% | 3,3% | 1,9% | 5% | ||||

| Dir. | 0,2% | 0,06% | 0% | |||||

| CEO | 1,0% | 3% | ||||||

| VP | 0,2% | 1,1% | 0,2% | 0,2% | 0,8% | 1% | ||

| CFO | 0,2% | 0,3% | 0,2% | 1% | ||||

| Investors | 66,0% | 59,3% | 70,2% | 59,9% | 74,0% | 68,7% | 51% | |

| IPO | 24,6% | 9,7% | 16,6% | 18,4% | 0,6% | 16% | ||

| Total | 100% | 100% | 100% | 100% | 100% | 100% | 100% | |

| Nb of Dir. | 2 | 2 | 2 | |||||

| Dir % | 0,1% | 0,03% | 0,2% | |||||

| Nb of found. | 2 | 4 | 3 | 2 | 3 | 2 | ||

| Found. % | 2,9% | 1,6% | 1,5% | 3,6% | 4,0% | 4,5% | ||

| Found. age | 27 | 31 | 31 | 33 | 23 | 37,6 | ||

| F1 | 28 | 27 | 31 | 33 | 29 | |||

| F2 | 26 | 29 | 33 | 21 | ||||

| F3 | 31 | 20 | ||||||

| F4 | 38 |

The founders are young, own little. How teh sector will develop, I do not know. There is already concentration. Barriers to entry look low. Some experts have doubt about long term profitability… tough to say. Deliveroo shows no IPO shares as the initial filing did not include any new shares. It may have changed at the recent IPO which was not a success; and here are the individual cap. tables.