I confirm I do not like the “how to” books or the ones helping you with recipes, methods. There are exceptions but I always struggle with them. (Same with audio or videos by the way). And same thing about culture. What is it? How do you build it? Here is an element of why it’s tough for me and others: “There are three things they never tell you about culture. First thing is they never tell you anything about culture. No one talks about culture and no one ever tells the need to have strong culture. So there’s tons of articles about building a great product, there’s tons of articles on growth and adaption, and a few things about culture. It’s a mystical thing that’s soft and fuzzy. That’s the first problem. The second problem is it is hard to measure. Things that are hard to measure often get discounted. These are two very hard things. The third thing, the biggest problem, it doesn’t pay off in the short term. If you wanted to start up a company and sell it in one year, the one thing I would tell you to do is fuck up the culture. Just hire people quickly. Culture makes you hire really slowly, makes you deliberate about your decisions that in the near term can slow progress.” This is taken from How to startup a start-up. It’s from Brian Chesky, Founder, Airbnb in class 10.

This being said, there’s a great book about company culture. It’s How Google Works, which I mentioned already in a recent post, Entrepreneurship from First Principles. So let me extract a couple of notes from my reading.

No real businesss plan

“One of the biggest reasons for our success, though, is that the plan we delivered to the board that day in 2003 wasn’t much of a plan at all. There were no financial projections or discussions of revenue streams. There was no market research on what users, advertisers, or partners wanted or how they fit into nicely defined market segments. There was no concept of market research or discussion of which advertisers we would target first. There was no channel strategy or discussion of how we would sell our ad products. There was no concept of an org chart, with sales doing this, product doing that and engineering doing some other that. There was no product roadmap detailing what we would build and when. There was no budget. There were no targets or milestones that the board and company leaders could use to monitor our progress. […] We left that out for the simple reason we didn’t know how we were going to do it. When it came to management tactics, the only thing we could say for sure back then was that much of what [we] had learned in the twentieth century was wrong, and that it was time to start over.” [Page 10]

Smart creative

“The main reason for the lack of business plan is Google population made of Smart Creative. When we contrast the traditional knowledge worker with the engineers and other talented people who have surrounded us at Google over the past decade-plus, we see that our Google peers represent a quite different type of employee. They are no confined to specific tasks. They are not limited in their access to the company’s information and computing power. They are not averse to risk taking, nor are they punished or held back in any way when those risky initiatives fail. They are not hemmed in by role definitions or organizational structures; in fact, they are encouraged to exercise they own ideas. They don’t keep quite when they disagree with something. They get bored easily and shift jobs a lot. They are multidimensional, usually combining technical depth with business savvy and creative flair. In other words, they are not knowledge workers, at least not in the traditional sense. They are a new kind of animal, a type we call a “smart creative,” and they are the key to achieving success in the Internet Century.” [Page 17]

Key attributes of smart creative: expert in doing, comfortable with data, sees a direct line from technical expertise to product excellence to business success, hard-working, understands the user or consumer’s perspective, always questioning, not afraid to fail, self-directed, open, thorough. Communicative, eager and able.

Mentor

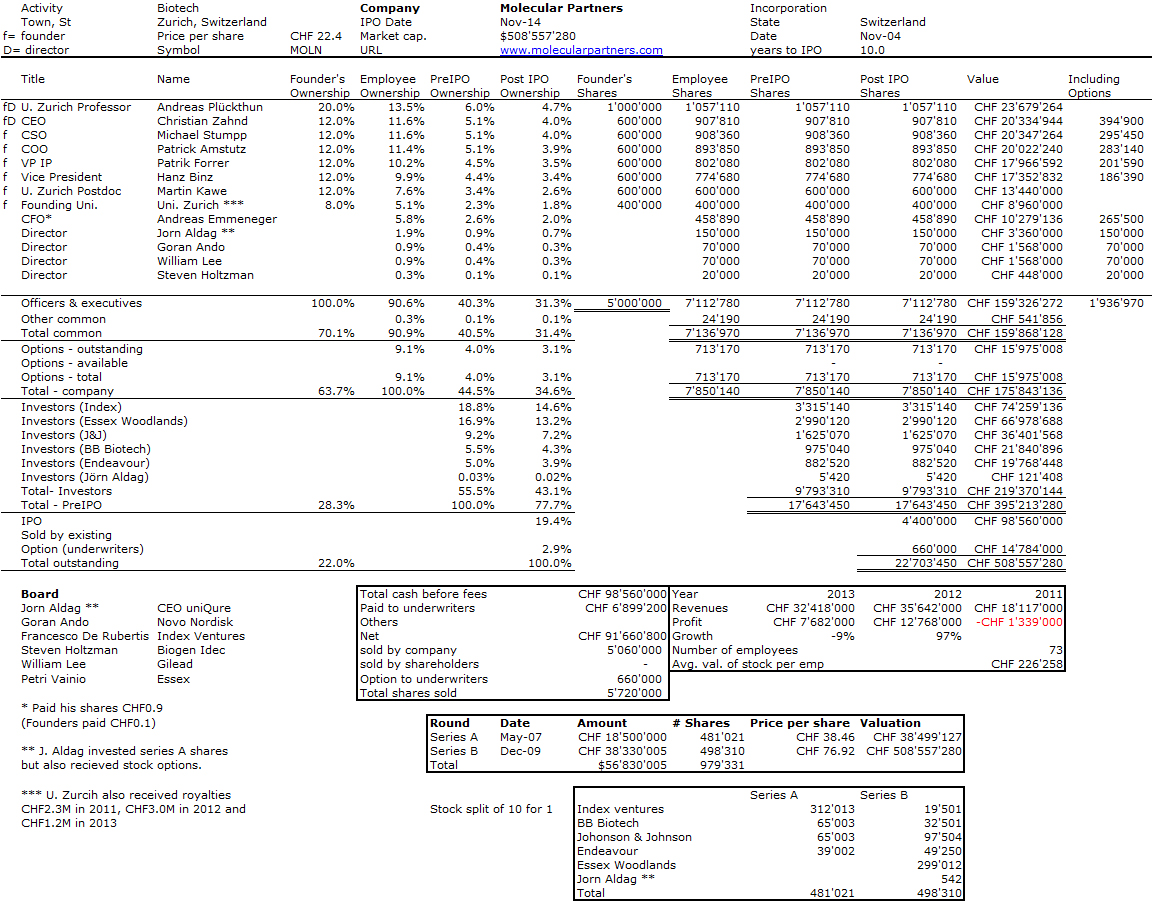

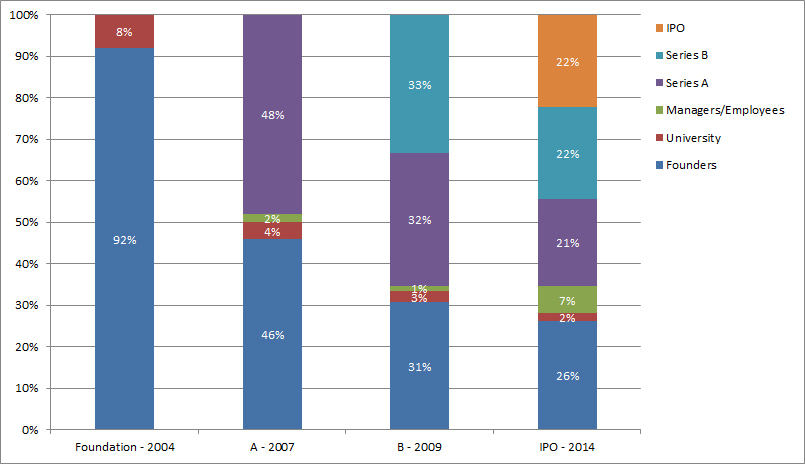

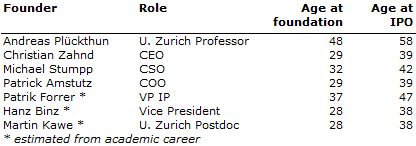

“When they learnt all this, they decided to write this book as if they were mentors. Lew Platt, HP’s CEO explained why he was investing so much time to help out a young executive at another company: “This is the way Silicon valley works. We’re here to help you.” Steve Jobs explained that Noyce helped him discover the tricks. Schmidt agrees that “it’s what you learn after you know it all that counts” and he believes “we had a front-row seat and used it to relearn everything we thought we knew about management, i.e. how to grow a business, attract and motivate smart creative, which start with a culture, then strategy. Business plans aren’t as important as the pillars upon which they are built” [Pages 21-23]. Culture stems from founders, but it is best reflected in the trusted team the founders form to launch their venture. [Page 30]

Slogans (believe in them)

– Keep them crowded

– Work, eat and live together

– Messiness is a virtue

– Don’t listen to the HiPPOs (*)

(later there is “your title makes you a manager, your people make you a leader”)

– The rules of seven (hierarchy is not good but flatness neither)

– Do all reorgs in a day

– The Bezos two-pizza rule

– Exile knaves but fight for divas

– Overworked in a good way

– Establish a culture of Yes

– fun, not Fun

– You must wear something

– Ah’cha’rye

– Don’t be evil

(*): Highest Paid Person’s Opinion

Strategy

Bet on technical insights, not market research

Don’t look for faster horses

Optimize for growth

Specialize

Default to open, not closed

Default to open, except when…

Don’t follow competition

The CEO needs to be the CIO (Chief Innovation Officer).

One of the best chapters is the one entitled Innovation. “To us, innovation entails both the production and implementation of novel and useful ideas. Since “novel” is often just a fancy synonym for “new”, we should also clarify that for something to be innovative, it needs to offer new functionality, but it also has to be surprising. If your customers are asking for it, you aren’t being innovative when you give them what they want; you are just being responsive. That’s a good thing, but it’s not innovative. Finally “useful” is a rather underwhelming adjective to describe that innovation hottie, so let’s add an adverb and make it radically useful, Voilà: For something to be innovative, it needs to be new, surprising, and radically useful.” [Page 206]

[NB. These are the 3 criteria for real patentability: novel, non-obvious and applicable]

“But Google also releases over five hundred improvements to its search every year. Is that innovative? Or incremental? They are new and surprising, for sure, but while each one of them, by itself is useful, it may be a stretch to call it radically useful. Put them all together, though, and they are. […] This more inclusive definition – innovation isn’t just about the really new, really big things – matters because it affords everyone the opportunity to innovate, rather than keeping it to the exclusive realm of these few people in that off-campus building [Google[x]] whose job is to innovate.” [Page 206]

And innovation is critical: “A few years ago, a major consulting firm published a report advising all companies to appoint a Chief Innovation Officer. Why? Allegedly to establish a “uniformity of command” over all the innovation programs. We’re not sure what that means, but we’re pretty sure that “uniformity of command“ and “innovation” don’t belong in the same sentence (unless it’s the one you’re reading now). […] Innovation stubbornly resists traditional, MBA-style management tactics. Unlike most other things in business, it cannot be owned, mandated, or scheduled. Innovative people do not need to be told to do it, they need to be allowed to do it“. [Page 209]

If you really do not want to read this very good book, here is an alternative:

PS: a small detail. The last section is about acknowledgements. It is usually boring, here it’s not. Just because it is more than 7 pages with more than 100 names mentioned…