Here is my second contribution to Créateurs, the Geneva newsletter, where I have been asked to write short articles about famous success stories. I began last quarter with Adobe and its founders John Warnock and Charles Geschke, here is now Bob Swanson, Herbert Boyer, founders of Genentech.

Bob Swanson and Herbert Boyer: Genentech

In the start-up world, biotechnologies do not seem to belong to the same world: they seem to always be reserved to high-caliber scientists not to say Nobel prize winners that investors would back with their money. So… where is the entrepreneur?

The story about the Genentech beginnings is probably the best illustration that a visionary entrepreneur is also necessary in biotechnologies. Much more than just a start-up, it is an entire industry that Bob Swanson founded.

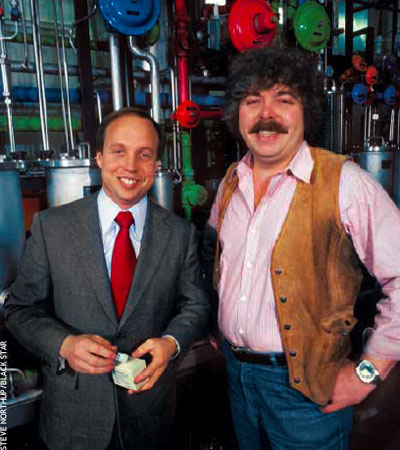

The legend says that Bob Swanson, a 29-year old venture capitalist, met Herbert Boyer, a professor at the University of California in San Francisco (UCSF). The money of Bob and the ideas of Herbert made possible the creation of Genentech in 1976, followed by its IPO in 1980. The story deserves however a little more attention. Bob Swanson was not really an investor. He is an entrepreneur. he has been hired by Kleiner and Perkins (KP) who had understood that the real value of a venture capital firm is to create company and not only to fund them. They understood this after the success of Tandem and Jimmy Treybig whom they financed from day 1 in 1974. (See KP first fund).

Bob Swanson is fascinated by the potential of biology and genetics. (He has a BS in chemistry from MIT and an MBA). After helping KP for one their portfolio company, he leaves the fund to dedicate himself to his new passion. He meets many professors in the Bay Area but all of them explain him that their work is about science, leading edge science for sure and very far from commercial applications.

Herbert Boyer is not a typical professor. Together with Stanley Cohen, he is the inventor of a patented technology, which was not common in the academic world of the seventies. Known as the Cohen-Boyer patent, it describes how to manipulate the DNA and it is so fundamental that any new technology in the field needs to use this patent, which means obtaining a license on the technology and paying royalties to its owners, Stanford University and UCSF. In total, more than $250M was generated in royalties over 20 years.

The beginnings of Genentech are a combination of history and legend. Swanson calls Boyer who tells him he is very busy but he agrees on a 10-minute talk on a Friday afternoon. Swanson is obsessed about one single thing: the applications of research. Boyer replies that there is certainly some potential but it will require another 10 years of research. “Why, why, why?” Swanson does not stop saying to the point that Boyer finally concludes “why not? May be it can be faster.” The 10-minute talk has become a 3-hour discussion. Genentech is born, at least in two minds full of beer!

They still have to convince the skeptics. Among them, the potential investors. A week later, Tom Perkins meets with the two men and he remembers: “the technical risks were huge. I was very skeptical. I did not know anything in biology.” Kleiner is however very impressed by the energy of Swanson and the expertise of Boyer. He decides to try, step by step in order to diminish the risks and minimize the initial investment. Kleiner invests $100’000 which will last nine months.

The rest is History. Genentech synthesizes insulin in 1978 and growth hormone in 1979. Genentech also raised $10M with private investors before going public on Nasdaq in 1980. For the first time, a biotech company goes public with no revenue and its first product is not approved yet (it will be in 1985 only). In 1990, Roche and Genentech will sign a strategic partnership which makes the Swiss company its major shareholder. In 2009, Roche acquired all the remaining shares of Genentech.

Swanson was not an investor, but a visionary entrepreneur. Boyer was not a professor in his ivory tower. They were also lucky to have the best of mentors, Tom Kleiner. A lot of energy and passion, great ideas, some money. It is an almost accidental meeting which is responsible for the growth of a industry worth tens of billions of dollars.

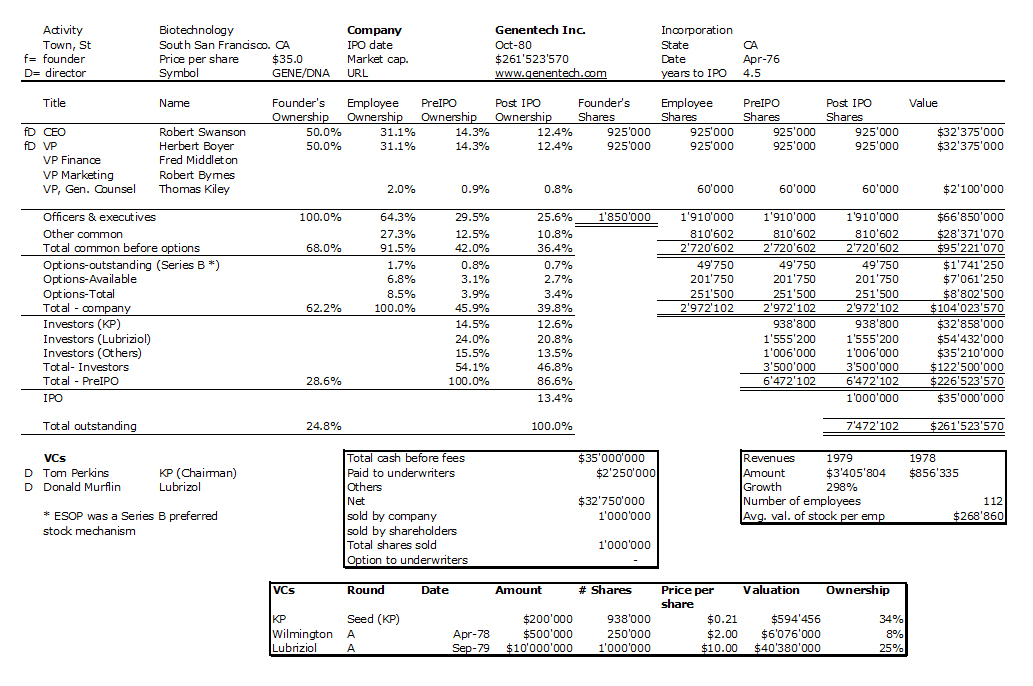

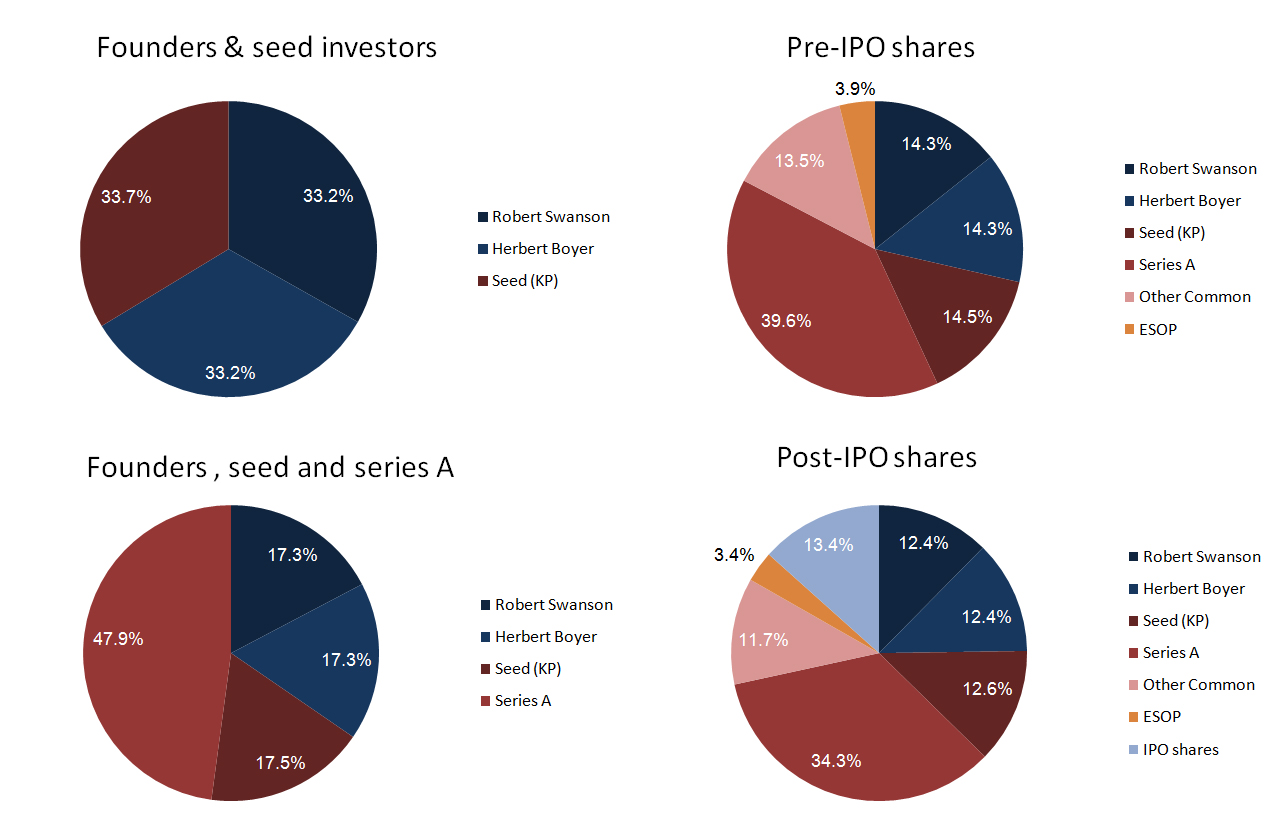

Icing on the cake, the Genentech capitalization table at its IPO:

Pour en savoir plus:

Internet Archive:

http://www.archive.org/search.php?query=genentech

The Genentech web site:

http://www.gene.com

Next quarter: Women entrepreneurs, Carol Batz and Sandy Kurtzig

Pingback: Start-Up: the book » Blog Archive » What Have VCs Really Done for Innovation?

Good post and nice design, is this a regular template?.

yes it is a regular template post and you may find all of them under the tag “createurs”, a newsletter where I write a one-page article on entrepreneurs.

Pingback: Start-Up: the book » Blog Archive » Biotech data - part 1/3: Chiron

Pingback: Start-Up: the book » Blog Archive » Biotech data - part 3/3: A short synthesis

Pingback: Start-Up: the book » Blog Archive » Biotech data - part 2/3: Genzyme

Pingback: Start-Up: the book » Blog Archive » Robert Swanson, 1947-1999