Once again the Paris Innovation Review (formerly ParisTech Review) publishes a series of excellent articles, this time dedicated to start-ups. These are:

– Companies like others? A sociological survey of French startup. http://parisinnovationreview.com/2017/03/21/sociological-survey-french-startups/

– Startups Employees Perks & Incentives – 1 – Wages. http://parisinnovationreview.com/2017/03/23/startups-employees-perks-incentives-1-wages/

– Startups Employees Perks & Incentives – 2 – Equity. http://parisinnovationreview.com/2017/03/23/startups-employees-perks-incentives-2-equity/

The article about the sociology of start-ups shows (in fact confirms) interesting things. I will let you read and jump directly to some of their concluding points: “Some of these results can provide pause for thought for public policies aimed at fostering startup creations. The survival of these businesses seems relatively unpredictable, both for the people involved (entrepreneurs, employees, support bodies) and for analysts who observe them from the outside. We have interpreted this unpredictability as the result of two causes. The first is the selection operated by the support agencies, a selection that has largely guided ours, since a claim of technical innovation, which was our main criterion for inclusion in our survey, is generally associated with subsequent monitoring and aid by these agencies. One might think that a number of projects considered very unrealistic could have been excluded by these services, which in fact limits the variety of the companies we studied. The second, more fundamental cause is the very variety of factors that make or break businesses: outlets that emerge and disappear along with the flow of global economic changes, strategies of major industrial groups and initiatives by competitors, internal conflicts, resources which become abundant or scarce depending on the context, financial problems which are difficult to anticipate, etc. This may encourage governments and public agencies to foster a much greater number of projects and not merely be satisfied with those that they consider to be the most promising. Watering a whole field is often more efficient than dumping all the available water on but a few square meters… Securing solid support by authorities, companies that are deemed innovative are doing better than the others if one considers their survival rate. Perhaps it would not be absurd to offer an equivalent support to businesses in other economic circles.”

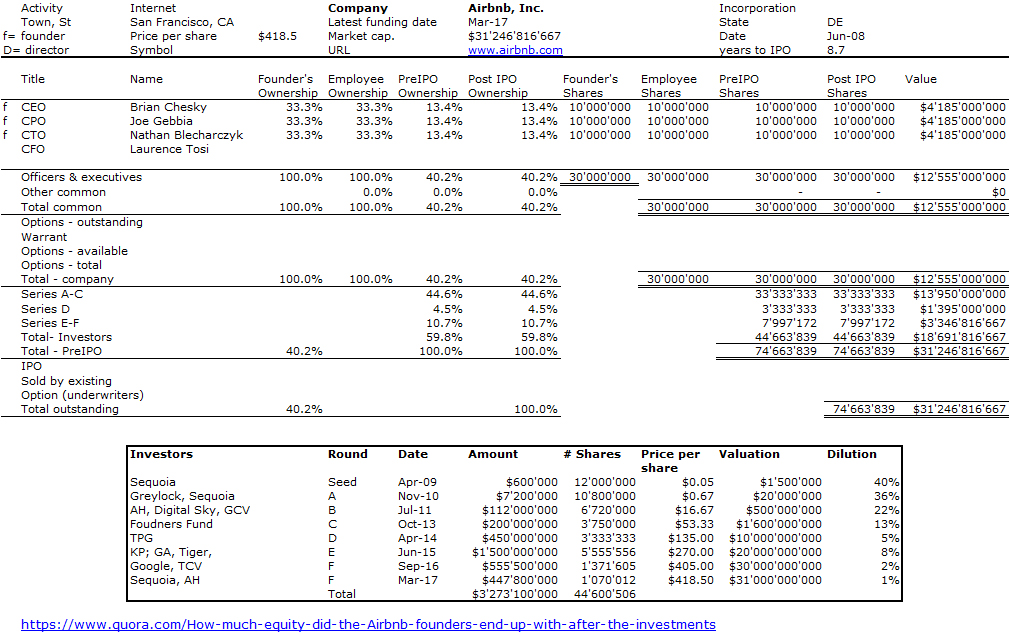

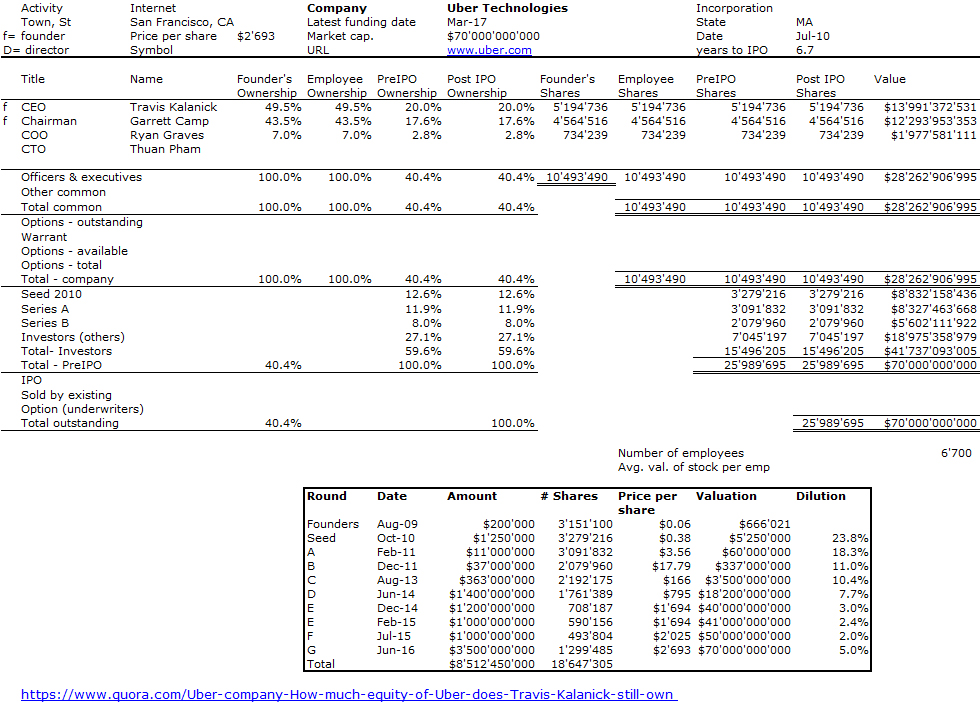

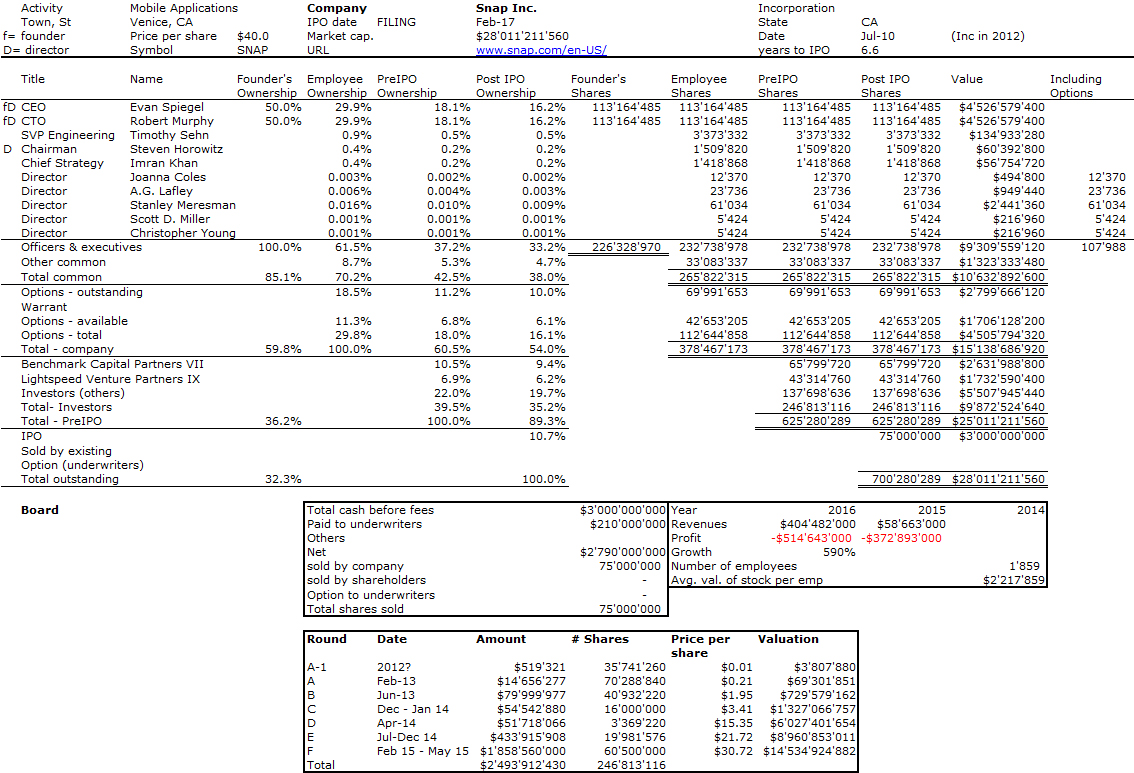

The incentive topic is one I have covered at length as you may see with my Slideshare link below. On the salary side, I fully agree with their claim: Be as objective as possible: this ensures fairness and acknowledges a basic truth: people talk. On the equity side, know the rules of vesting and cliffs, and build a granting mechanism based on experience of employees and layers of early and late comers, i.e. the same number of stock options could be granted per year (so more shares to early employees as there are more employees per year when the company grows. If it does not, stock options are probably worthless…)