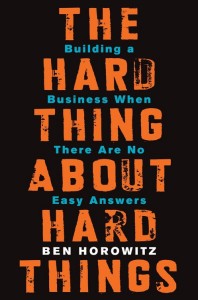

I began my previous blog about Horowitz’ The Hard Thing About Hard Things by quoting the first page. I will begin here with his final page:

“Hard things are hard because there are no easy answers or recipes. They are hard because your emotions are at odds with your logic. They are hard because you don’t know the answer and you cannot ask for help without showing weakness. When I first became a CEO, I genuinely thought that I was the only one struggling. Whenever I spoke to other CEOs, they all seemed like they had everything under control. Their businesses were always going “fantastic” and their experience was inevitably “amazing”. But as I watched my peers’ fantastic, amazing businesses go bankrupt and sell for cheap, I realized I was probably not the only one struggling.” […] “Embrace your weirdness, your background, your instinct. If the keys are not there, they do not exist.”[Page 275]

Again the book is not an easy read. It is more advice about processes than anything else, so you may not enjoy the book if you do not need to apply it now. If you are not an ambitious entrepreneur who needs to scale his venture, reading the book may not be useful. Still it is a great book. Let me give you a couple of examples.

“Figuring out the right product is the innovator’s job, not the customer’s job. The customer only knows what she thinks she wants based on her experience with the current product. The innovator can take into account everything that’s possible, but often must go against what she knows to be true. As a result, innovation requires a combination of knowledge, skill, and courage. Sometimes only the founder has the courage to ignore the data.” [Page 50]

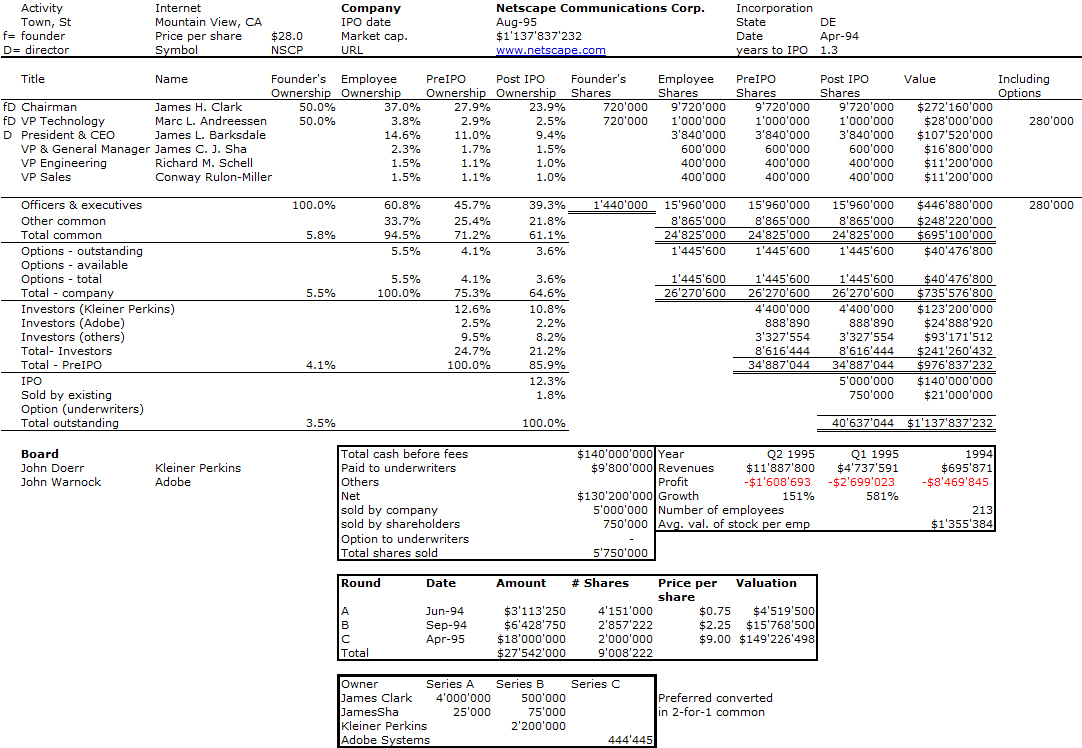

Funnily enough, Horowitz quotes Thiel. (By the way, quotes on the back page supporting Horowitz’s book are from Page, Zuckerberg, Costolo and Thiel…) “I don’t believe in statistics, I believe in calculus”. And his advice “when things fall apart” are

– Don’t put it all on your shoulders.

– This is not checkers, this is motherfuckin’ chess.

– Play long enough and you might get lucky.

– Don’t take it personally.

– Remember that this is what separates the women from the girls.

I summarize his advice from pages 64 to 93 as when things fall apart, face the truth and tell the truth. Tell the truth to your employees, tell the truth to your future ex-colleagues, tell the truth to your friends and more importantly, tell the truth to yourself.

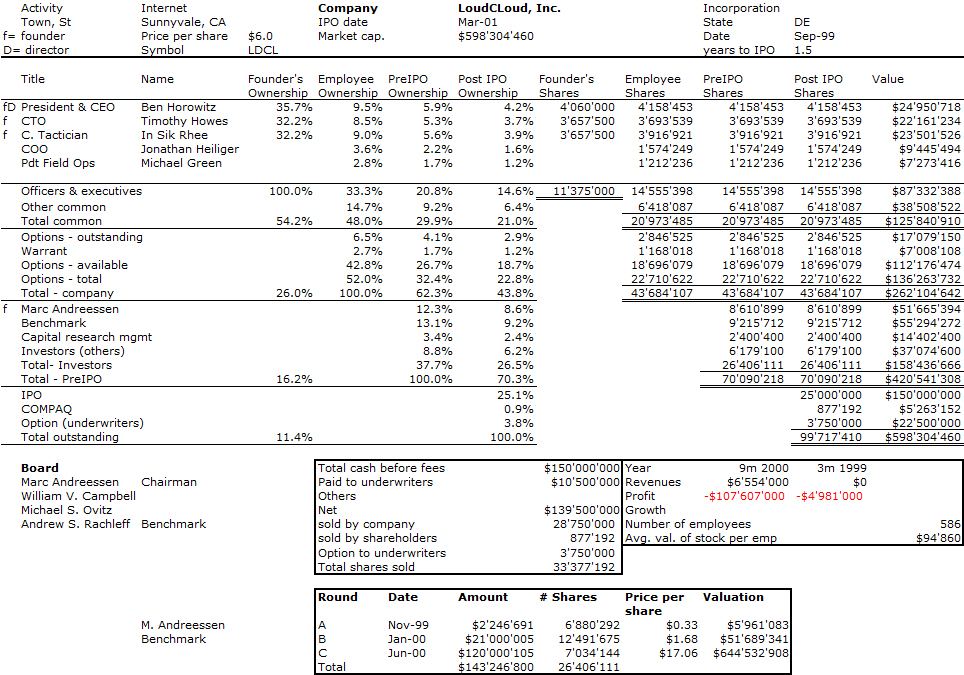

I understand now why Andreessen-Horowitz is seen as a firm which has put in place tons of processes. Horowitz describes many tasks founders should be utmost careful about. Taking care of people, first. He also describes how you can do mistakes by trying to do good. Just one example: “our hockey stick [the shape of the revenue graph over the quarter] was so bad that one quarter we booked 90% of our new bookings on the last day of the quarter. […] I designed an incentive to closed deals in the first two months. […] As a result, the next quarter was more linear and slightly smaller… deals just moved from the third month to the first two months of the following quarter.”

Other interesting examples are about smart people and bad employees. “Sometimes, you will have a player that’s so good that you hold the bus for him, but only him.” And senior (old) people: “When the head of engineering gets promoted from within, she often succeeds. When the head of sales gets promoted from within, she almost always fails”. [Page 172] Horowitz explains also there is not one rule, it is company-dependent. Andreessen favors giving titles easily, Zuckerberg has opposite views.

“Perhaps the most important thing that I learnt as an entrepreneur was to focus on what I needed to get right and stop worrying about all the things that I did wrong or might go wrong.” [Page 200] Again focus on the strengths, not the weaknesses.

Ones and Twos

Horowitz quotes Collins’ “Good to Great”. “Internal candidates dramatically outperform external candidates.” And then adds that “Collins does not explain why internal candidates sometimes fail as well”. There are “two core skills for running an organization: First, knowing what to do. Second, getting the company to do what you know. While being a great CEO requires both skills, most CEOs tend to be more comfortable with one or the other. I call managers who are happier setting the direction of the company Ones and those who more enjoy making the company perform at the highest level Twos.” When they are not competent at both, “Ones end up in chaos and Twos fail to pivot when necessary.” [Pages 214, 216]

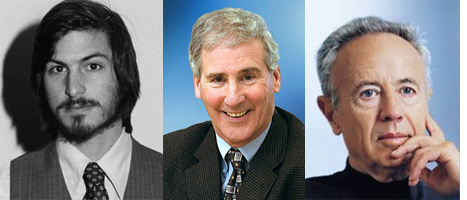

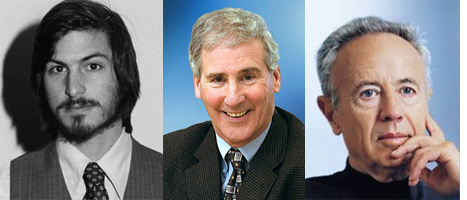

Horowitz shows that great CEOs need vision like Steve Jobs had, competence in implementing like Andy Grove had, and ambition like Bill Campbell. One of Horowitz favorites references is indeed Andy Grove and his “High output Management.” Horowitz shows how much respect is has for Jobs and Campbell, but the systematic processes remain his favorite, therefore Grove.

Wartime/peacetime

Horowitz also strongly believes that “life is struggle” (quoting Karl Marx) and that CEOs have to be ready to be both peacetime CEOs (when a company has a large advantage over competition in a growing market – Eric Schmid at Google until Page took over) and wartime CEOs (companies facing existential threats – Grove at Intel when they switched from memories to microprocessors or Jobs at Apple when he came back).

“Be aware that management books tend to be written by management consultants who study successful companies during their times of peace. As a result, the books describe the methods of peacetime CEOs. In fact, other than the books written by Andy Grove, I don’t know of any management books that teach you how to manage in wartime like Steve Jobs or Andy Grove.” [Page 228]

Horowitz hates the idea that founders should be replaced, that companies need professional CEOs who know how to scale companies or who “should be the number-one salesperson.” CEOs define the Strategy (“The story and the strategy are the same thing.”) and do Decision making (“with speed and quality”).

You may like the “Freaky Friday Management Technique” [Page 252] and “Should You Sell Your Company?” [Page 257] but let me finish with some of his final thoughts: “First technical founders are the best people to run technology companies”. […] “Second, it is incredibly difficult for technical founders to learn to become CEOs while building companies.” [Page 268] Which is why VCs should help these founders becoming CEOs, by helping them acquire the skill set as well as building a network.

Finally if you wonder why Andreessen-Horowitz web-site is www.a16z.com, you just have to count the number of letters in the name between the a and the z…