(this is a quick and dirty translation of a French post as it is linked to a French radio broadcast – sorry for the bad english if any)

I was a guest yesterday of French radio Culturesmonde France Culture in a series about capitalsim entitled Des capitalismes (1/4) – Silicon valley: l’émancipation par l’argent. I had to give my views abotu SV and capitalism. Is it unique or extreme? Does the area care, does it have an ideology or is it indifferent to capitalism?

The topic is rich and complex because with 7 million people, opinions in SV are also diverse and were built over 50 years. Each decade brough a new generation of entrepreneurs and investors. You can listen to the broadcast (in French) who also involved Yann Moulier-Boutang, who talked about « cognitive capitalism » and Sébastien Caré, a spécialist of libertarian thinking.

A big thank you to Clémence Allezard who prepared the series, pushing me to think about the region in a manner I was not used to. 🙂 So I thought about it as follows. Is SV an extreme form or a unique form of capitalism? or as I have a tendency to think a region quite indifferent to capitalism? On the one hand you have large powerful firms who do not really pay taxes, you have a fast Schumpterian creative destruction, the government is not active as it is in Europe (health, schools, transportation) so that firms (at the anecdote level or not?) do the work (Google buses, Apple And FB recent initiative about freezing women eggs, Peter Thile encouraging school dropouts) and even induce the SF authorities in changing housing laws. One the other hand, it is not just extreme, it is unique, SV created venture capital, systematized stock options, and has active co-opetition. Richard Newton was saying SV is the firm and all the companies are its divisions. People move from one to the other easily with market dynamics.

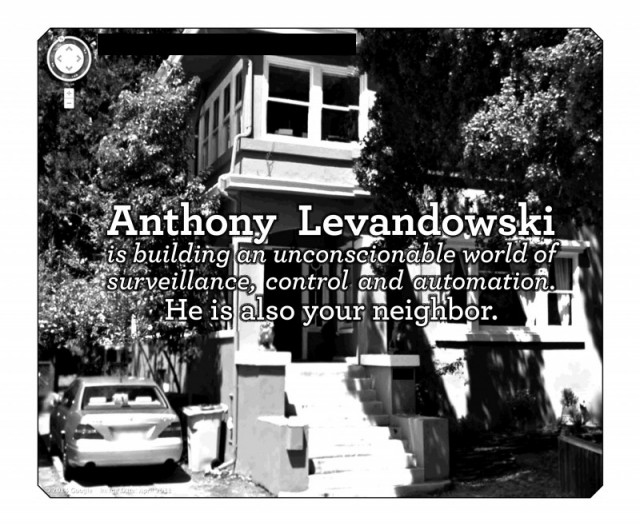

Finally, it is the “revenge of the nerds”. They are problem solvers, and do not care about society (hence the libertarians) and even about capitalism (making money is a by-product and if an objective, far from being the only one). I read a great New Yorker article where George Packer explains that these nerds hate the friction created by negotiation and compromises politics and society necessarily induce. So they avoid it as long as they can. And do more when they feel limited by the government but are quite neutral about it. They are selfish. But i doubt “changing the world to make it a better place” is totally convincing at the same time. It is more selfish than generous. These people are mild versions of Asperger and are obsessed by solving their problems. If it solves others’, good, not critical. (Of course SV is 7 million people and is a diverse region, I am focusing on what is visible). I was saying to the journalist when we prepared the talk, that I see more indifference than real strategy, I see some lobbying in SF or Washington, but rather limited compared to general lobbying in the USA.

Another way to summarize is: is there a particular ideology of capitalism in Silicon Valley? I would say that rather than a strategy, there has been a practice that was put in place over decades, by iteration, by trial and error. Ultimately, Silicon Valley is the meeting of ideas (entrepreneurs, and academics sometimes) and money (investors). But unlike the rest of the world where investors are bankers who lend money, in SV they are often former entrepreneurs who “give” money (in the sense that they take the risk of not finding it back), in fact they take shares in the company (often around 50%). They literally invented venture capital, which has found its final form in the 80’s. In addition, the “stock options” decried in Europe are recognized in the SV as a motivation. Secretaries at Apple or Microsoft did sometimes become millionaires, something unthinkable at home in Europe. I have also said, there is an optimism that encourages risk-taking. Moreover, there is no real risk because the skill allows you to find a new job quickly. The risk lies in the possible error in the choice of the project and nobody is ever ruined normally, except one’s health. And as the model works, it is enriched in new areas beyond which the electronics is the root, through the electric car (Tesla Motors), aeronautics (SpaceX) and even the food 2.0 movement (for synthetic food). And the last frontier, aging, death, trans-humanism … which seems to me personally crazy, but …

As a post-scriptum, some comments I got… very interesting! i think SV is more diverse these days. there are the really old school types, like intel, cisco, even apple. then there are places like google and Facebook, that actually do something valuable. and then there are the startups with a hand full of 20 year olds that do not much, but have valuations measured in billions. i think the question should be answered differently for the different groups. and it’s important to not lump cisco in with, say, whatsapp or snapchat.

i’d say for many of them, it’s indifferent to mildly positive feeling abotu politics, as you say. for some (many of the VCs) it’s definitely capitalism on steroids. (or at least, they like to think of themselves that way; they blabber all the time about “wealth creation”, making sure that much of that new wealth goes to them.) more than capitalism, i think what’s concentrated in SV is talent, especially, technical talent. creative destruction resonates *very strongly* with people here; the whole idea of SV is that a handful of kids can change an entire industry, or even create a new one. they usually fail, and sometimes they succeed. imagine how steve jobs or the google guys would have done in europe. the google guys would have gone to the librarians and asked, how can we help you find information? steve jobs would have run long, extensive marketing tests to determine what people want. or maybe he’d go to siemens to try to convince some high level manager that a smart phone was a good idea. of course what happened is way cooler. steve jobs had better taste than everyone else, so he made stuff he liked, period. and the google guys just forged a new path, without seeking the endorsement or buy in of the librarians. in europe, a startup would try to get some giant company to use their product/technology, a long, boring, and tedious process.

typically, a handful of EPFL students would not imagine/believe that they can change the world. stanford students (who are not more talented) do. so, i think it’s mostly a cultural difference, and not something that has to do with capitalism.