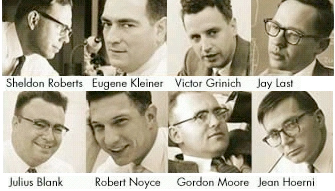

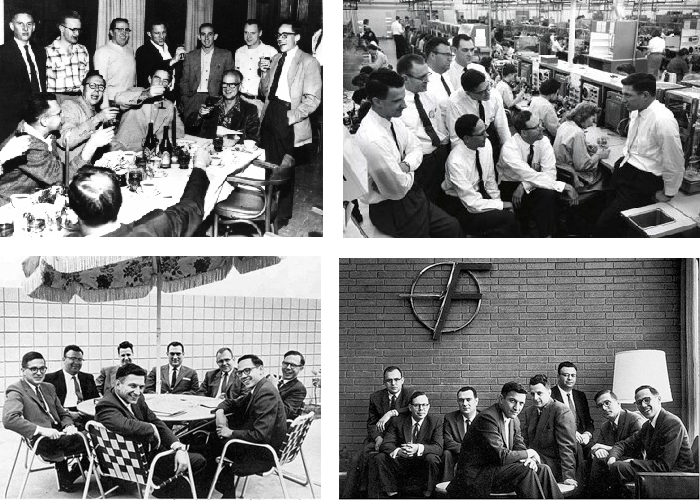

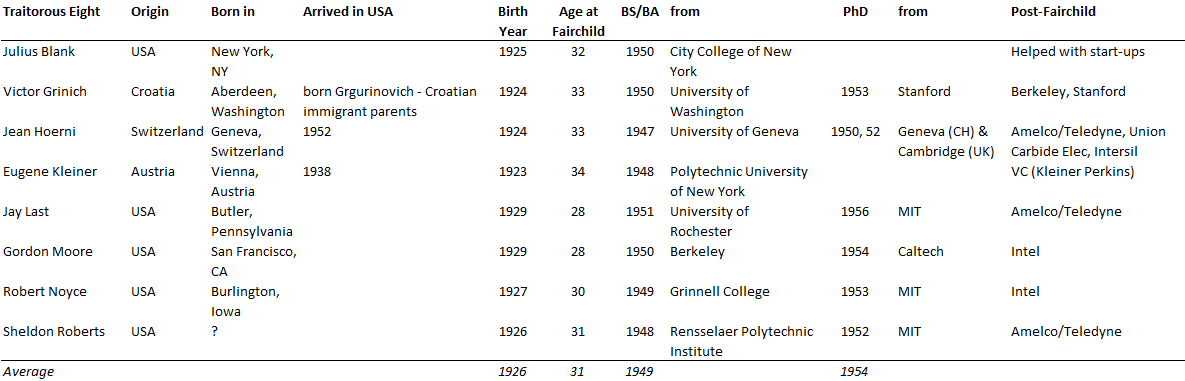

Gordon Moore passed away last Friday, March 24, 2023. He was the last of the Traitorous Eight and there is not only one living founding father of Silicon Valley, Arthur Rock.

I could build a short video of the two of them out of the great documentary movie Something Ventured.

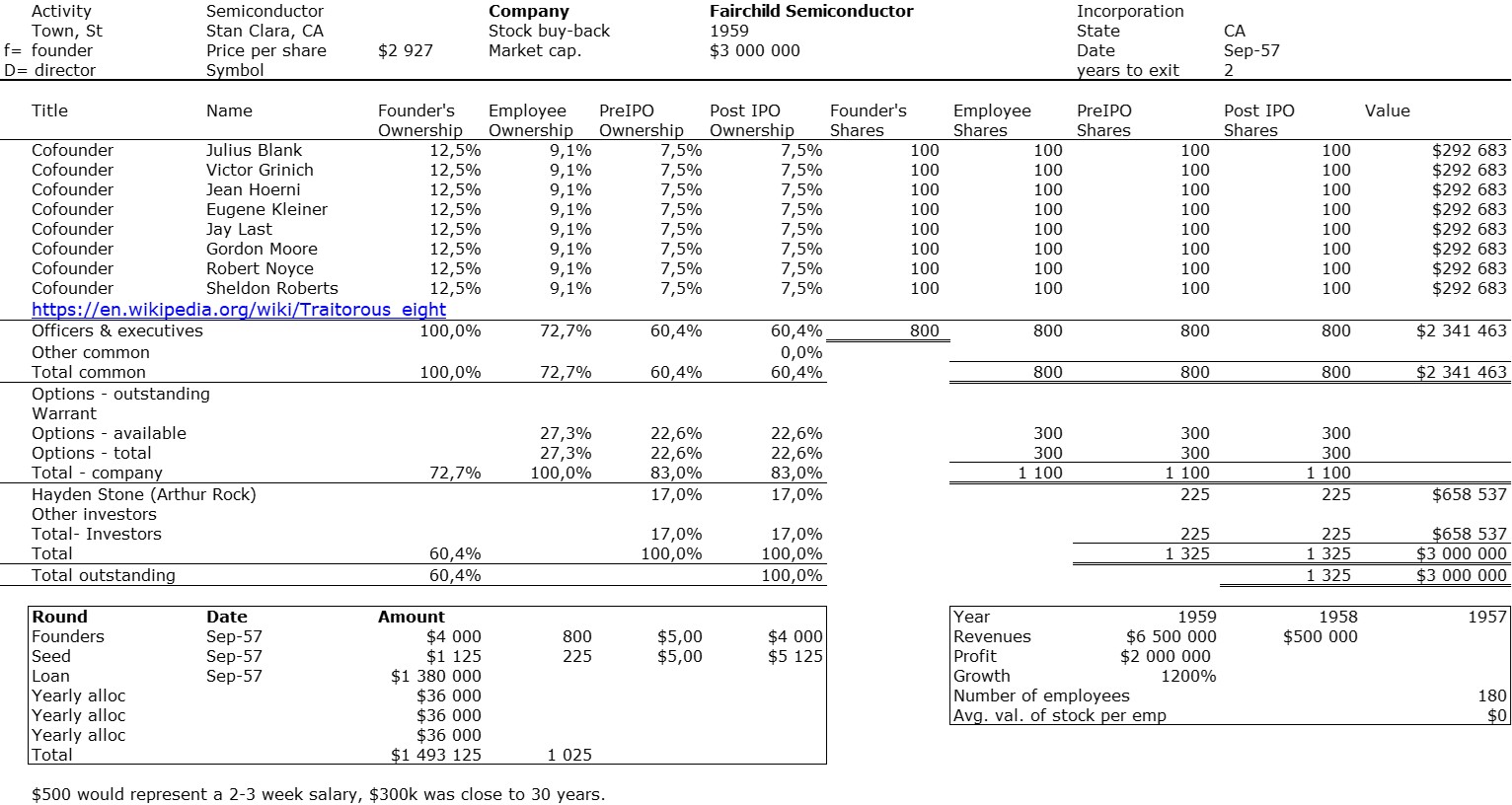

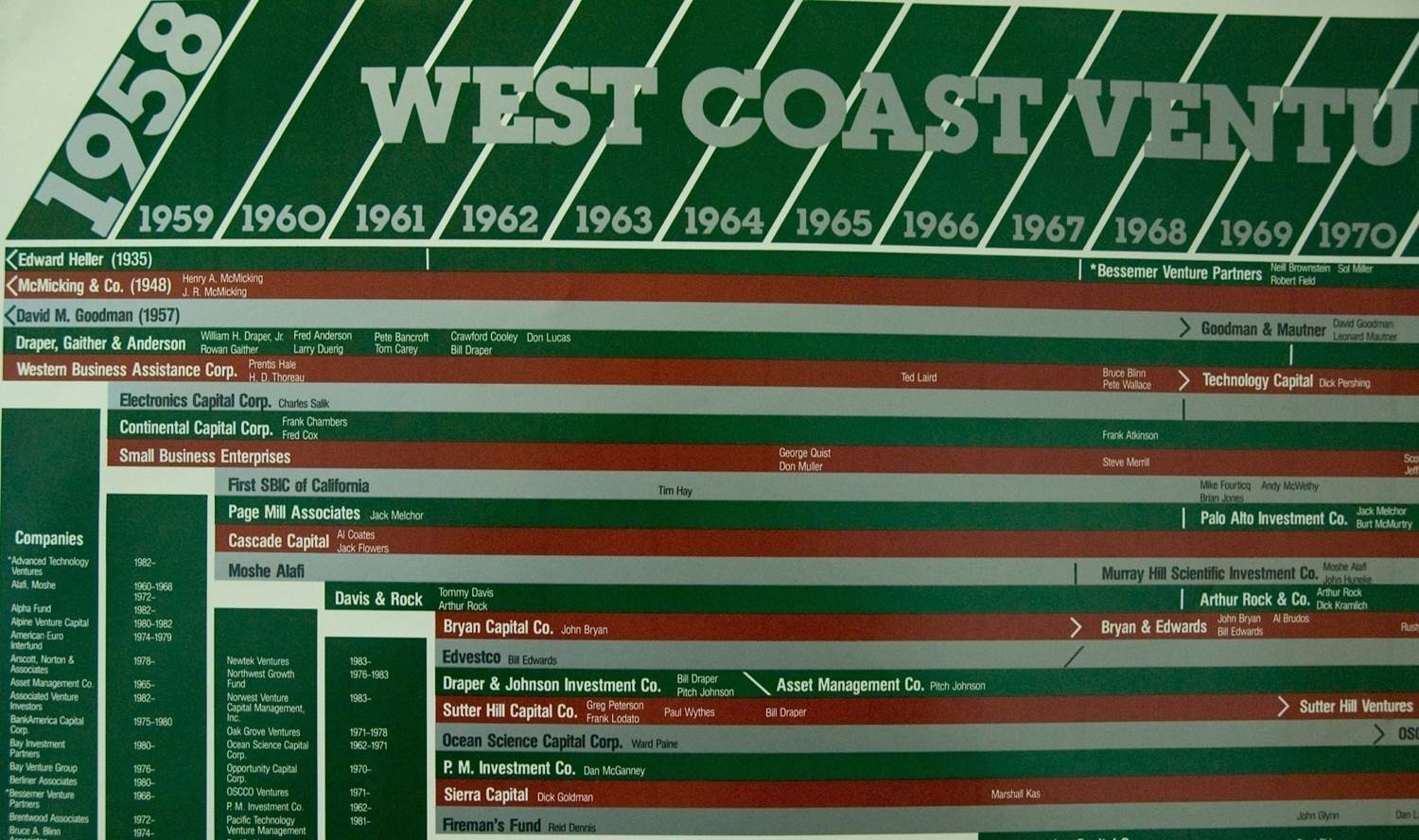

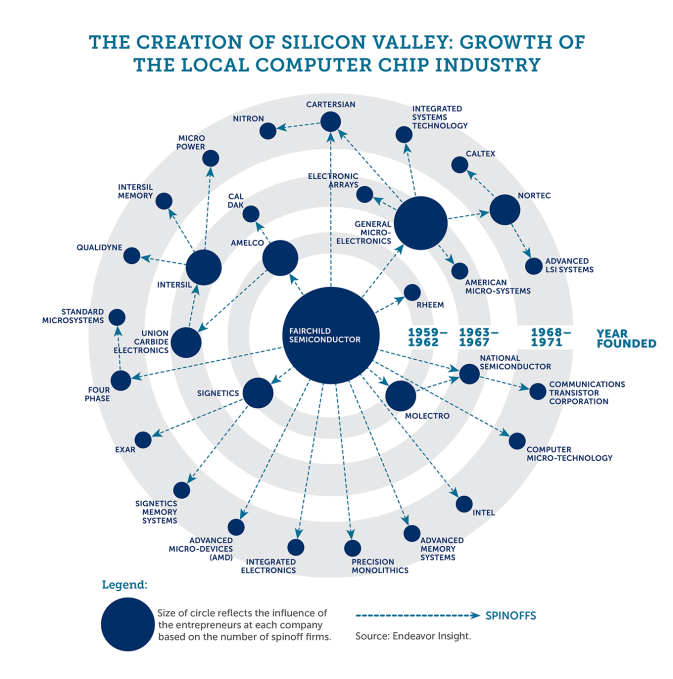

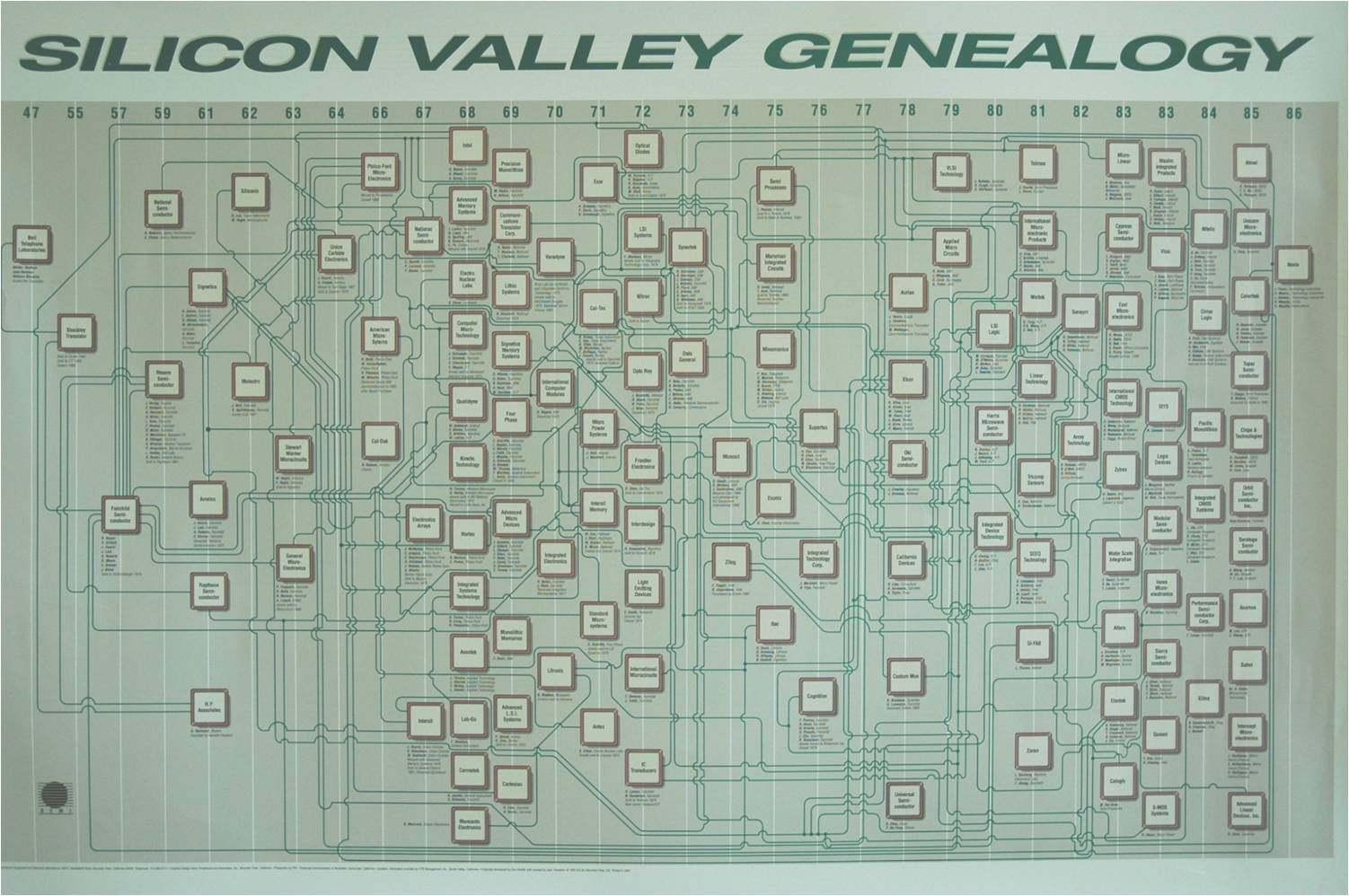

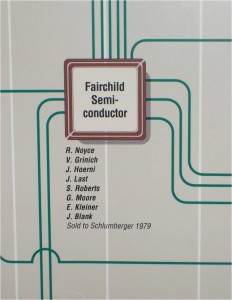

The text is interesting and funny: Throughout the 1960s, Fairchild was bleeding talent. The lure of stock options and independence inspired many of the brilliant young engineers to peel off and start their own companies.

But Gordon Moore and Bob Noyce, its two most important founders, remained loyal to their company until May of 1968, when Fairchild’s East Coast management made a fatal mistake.

[Moore] Noyce was the logical internal candidate to be the next C.E.O. But they decided they were gonna look on the outside.

That changed the whole ball game. Noyce said, “I’m gonna leave. Are you interested?”

So I said, “Okay. Let’s do it.”

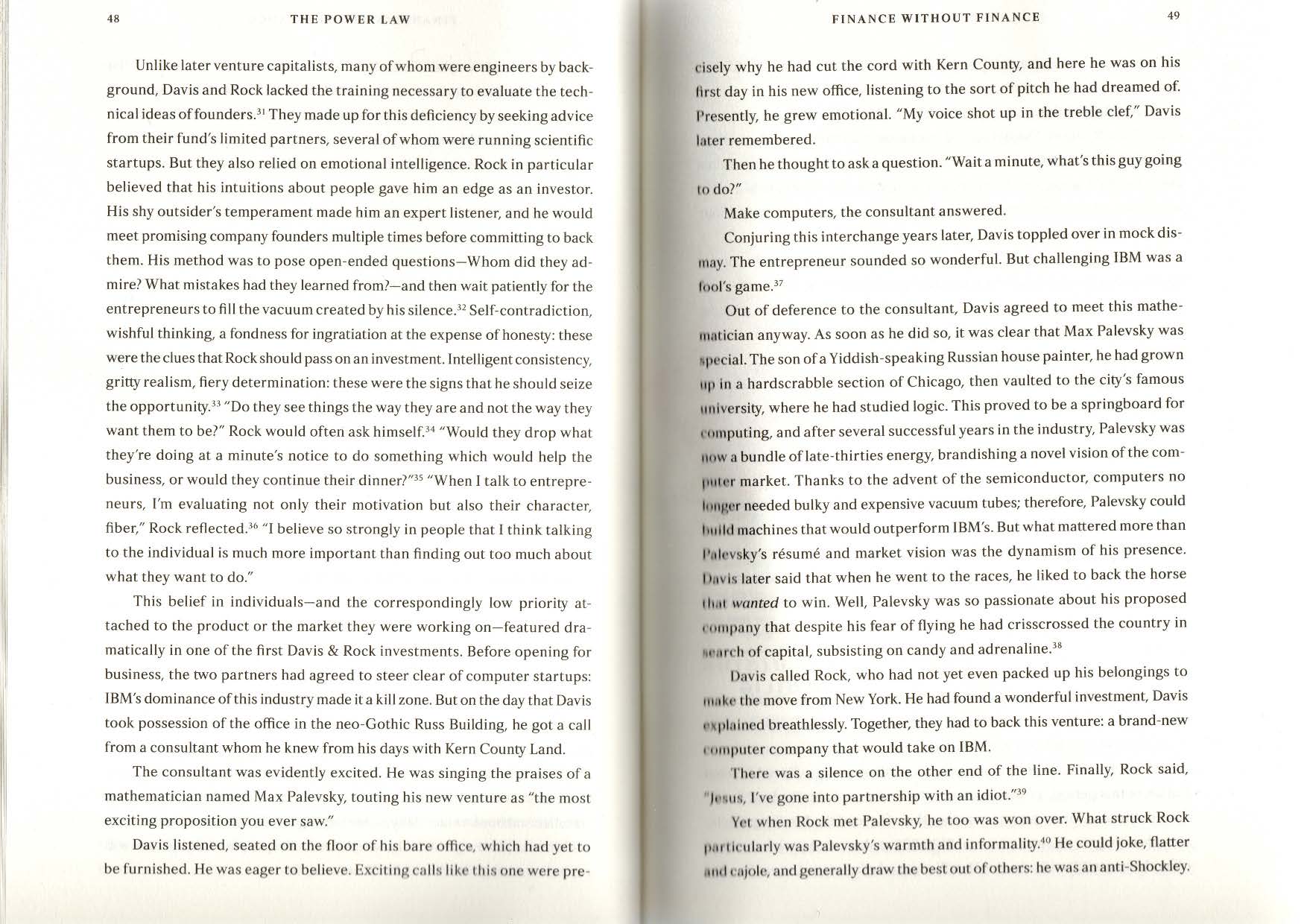

[Rock] They needed financing, and they called me to see whether I’d be interested.

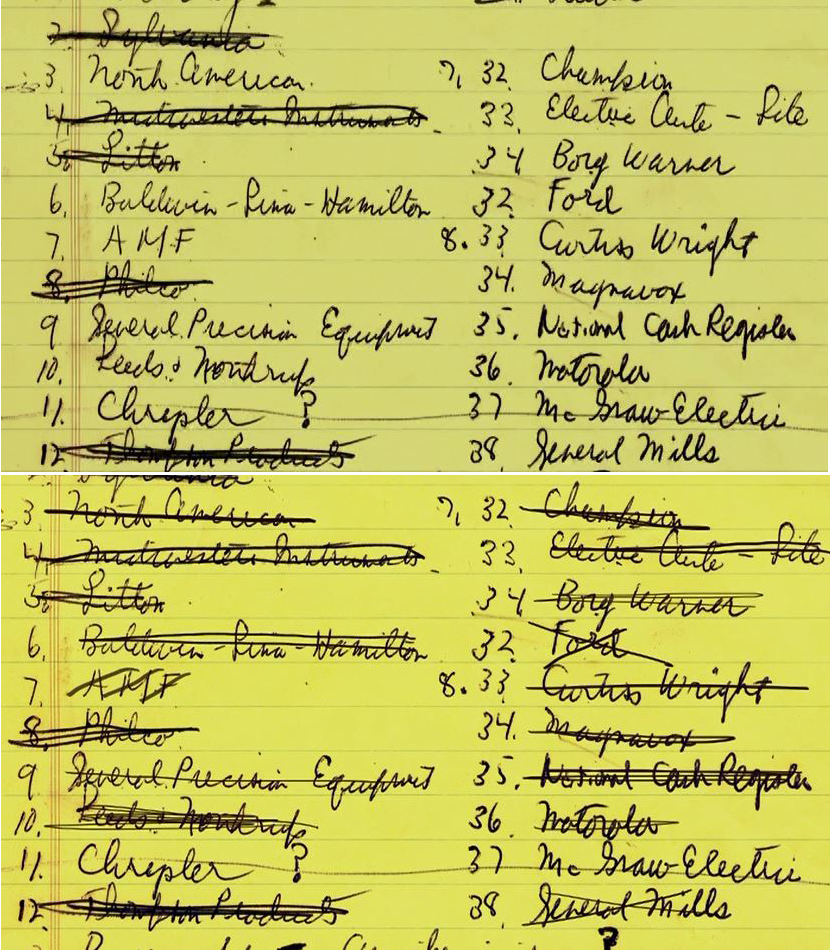

They came to me with no business plan, other than what they verbally said they wanted to do.

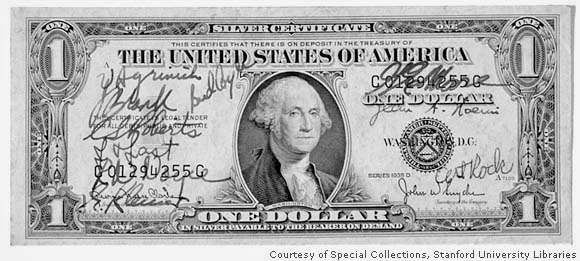

Arthur said he needed something to talk to potential investors with.

Just to give people something.

[Moore] We wrote a business plan, and it was one page- Double-spaced, and that was it.

It just says we were going to make things out of silicon, and some interesting electronic devices.

Oh, I said in general terms we were going to make memories.

[Rock] It has lots of typos in it. I think Bob typed it himself.

It’s not a very profound document, but it’s really kind of cute.

I said, “How much money do you need?”

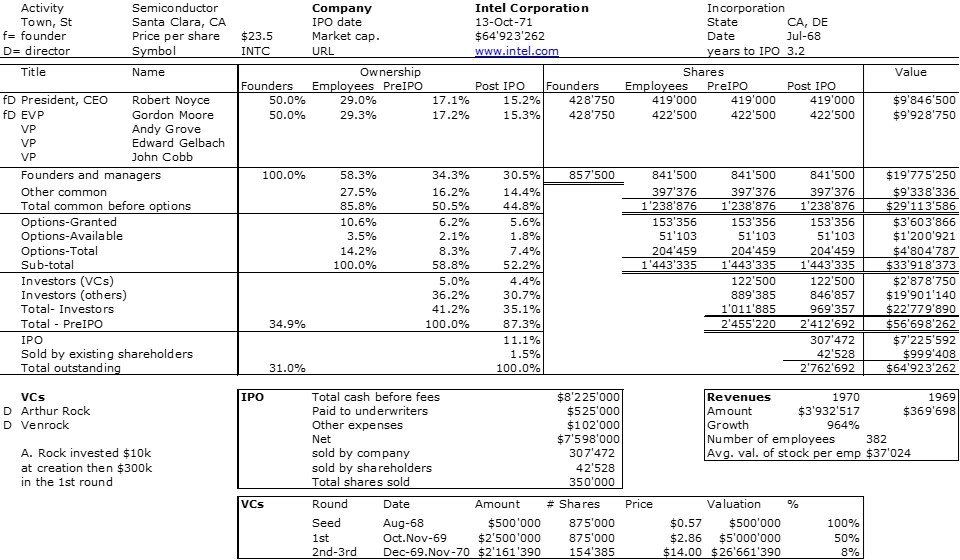

And they said, “Two and a half million dollars.”

And I said, “Okay.”

“What percentage of the company do you think you’d be happy giving up for two and a half million dollars?”

And they thought and said, “Well, how about half?”

And I said, “That’s fine.” And within a day and a half, I had raised two and a half million dollars.

[Narrator] Intel opened its doors in July of’68,

[Moore] We went public the same day that Playboy Enterprises went public. At the same price.

And a few years later one of the analysts says,”The market has spoken. It’s memories over mammaries, 10-to-1.”

Moore’s law

(From Wikipedia page on Gordon Moore – see above)

In 1965, Moore was working as the director of research and development (R&D) at Fairchild Semiconductor. He was asked by Electronics Magazine to predict what was going to happen in the semiconductor components industry over the next ten years. In an article published on April 19, 1965, Moore observed that the number of components (transistors, resistors, diodes, or capacitors) in a dense integrated circuit had doubled approximately every year and speculated that it would continue to do so for at least the next ten years. In 1975, he revised the forecast rate to approximately every two years. Carver Mead popularized the phrase “Moore’s law”. The prediction has become a target for miniaturization in the semiconductor industry and has had widespread impact in many areas of technological change.

The importance of Gordon Moore and of his law for technological innovation

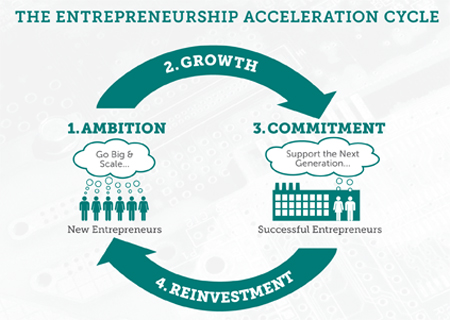

This “law” is not at all scientific but it has remained self-fulfilling, an objective to be achieved, giving engineers and Silicon Valley strong confidence in the future. We can thus partly understand the regular cycles of growth and speculative bubbles that accompanied it for 60 years, in the semiconductor industry (from the 1960s), in computers and software (from the 1970s), in networks and the Internet (from the 80s), in electronic commerce and mobile telephony (90s) then social networks (2000s). The end of the law was announced several times this decade and one wonders if it will not have the opposite effect as technological innovation seems to have slowed down in recent years. I refer you to a recent article on the disillusions of Silicon Valley and a scientific article that illustrates this possible slowdown: Papers and patents are becoming less disruptive over time.

There are so many things about Gordon Moore that I doubted a little before adding the PDFs that follow. But here is what I found in my archives:

– the 1965 article at the origin of Moore’s law,

– an article on the impact of Fairchild (1998)

– an interview with Gordon Moore (2000)