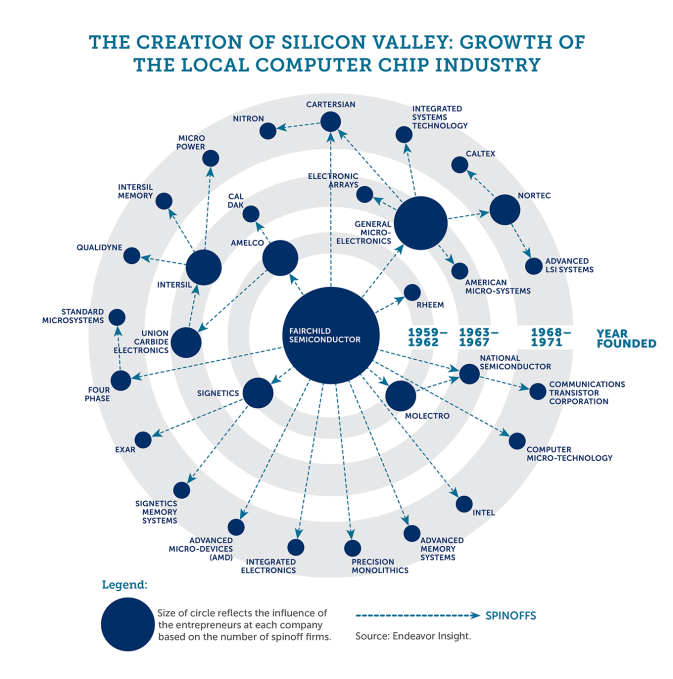

Silicon Valley will soon be 65. 65? Yes, I usually say that the region began its growth with the foundation of Fairchild Semiconductor in 1957 (even if the name itself was created in 1971).

The region is increasingly criticized for both good and bad reasons (see for example here and there) and perhaps it is a little out of breath. Too old ? Ten years ago I had looked at its “Darwinian dynamics” in Darwinian and Lamarckian innovation – by Pascal Picq. I had noted there the remarkable dynamics of creation (and destruction) of businesses. “Twenty of the top 40 SV companies in 1982 did not exist anymore in 2002 and twenty one of the 2002 top 40 companies had not been created in 1982.” So I just did the exercise again.

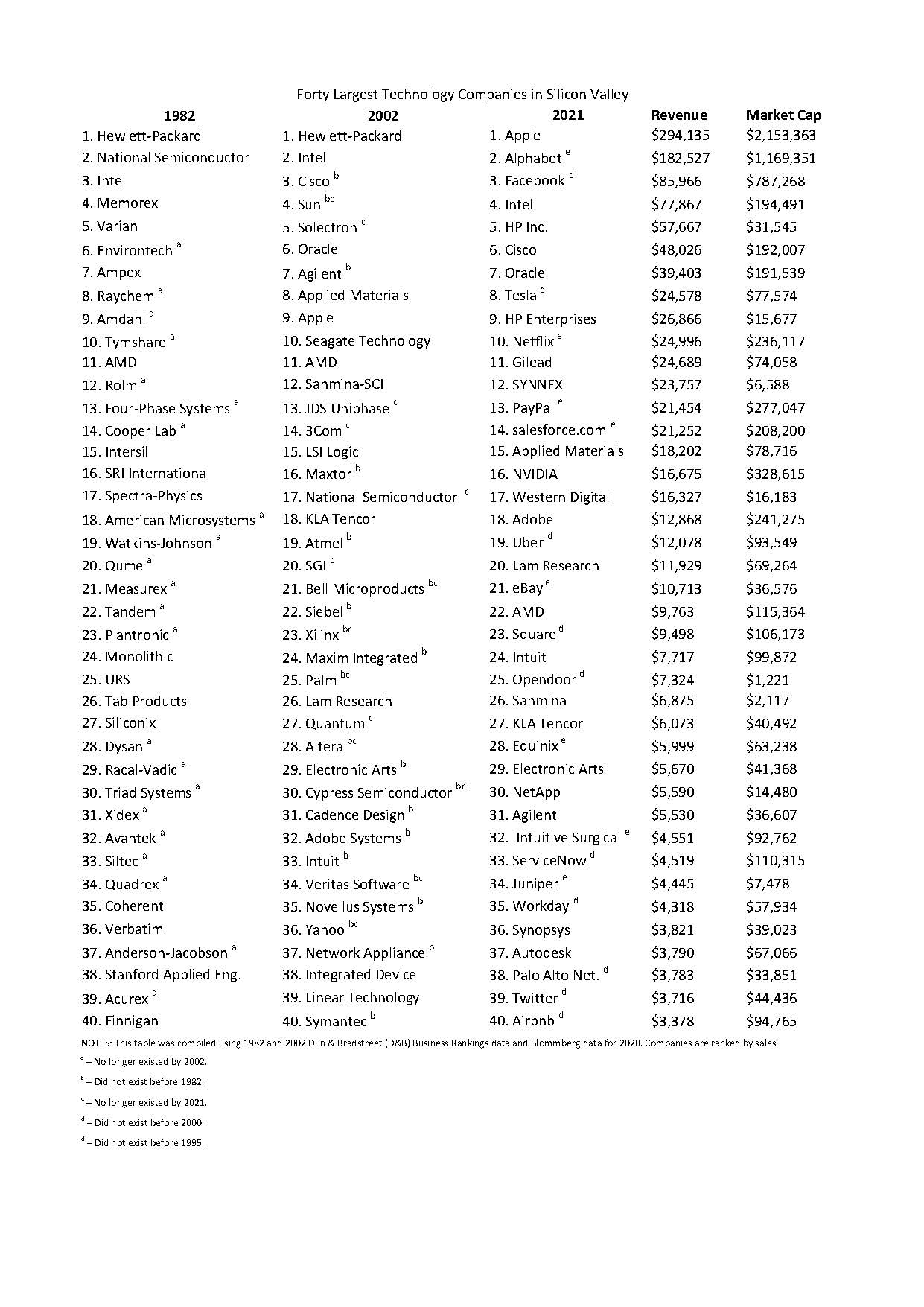

The table below gives the data for 1982 and 2002 again, then those for 2020. I should have waited for 2022 and the 65th birthday of Silicon Valley, but I didn’t have the patience! Ten of the 40 largest companies did not exist in 2000 and seven more did not exist in 1995. Sixteen of the top 40 of 2002 no longer exist in 2021. The region is therefore a little less dynamic but it remains quite remarkable… The retirement seems to me far away in reality !

As a final comment, five years ago, I had mentioned the evolution of the American capitalism in The top US and European (former) start-ups and in particular The Largest Companies by Market Cap Over 15 Years. You could compare it with the dynamics of French CAC40.

Forty Largest Technology Companies in Silicon Valley

(the same data are provided in jpg format at the end of the post)

| 1982 | 2002 | 2021 | Revenue | Market Cap |

| 1. Hewlett-Packard | 1. Hewlett-Packard | 1. Apple | $294,135 | $2,153,363 |

| 2. National Semiconductor | 2. Intel | 2. Alphabet e | $182,527 | $1,169,351 |

| 3. Intel | 3. Cisco b | 3. Facebook d | $85,966 | $787,268 |

| 4. Memorex | 4. Sun bc | 4. Intel | $77,867 | $194,491 |

| 5. Varian | 5. Solectron c | 5. HP Inc. | $57,667 | $31,545 |

| 6. Environtech a | 6. Oracle | 6. Cisco | $48,026 | $192,007 |

| 7. Ampex | 7. Agilent b | 7. Oracle | $39,403 | $191,539 |

| 8. Raychem a | 8. Applied Materials | 8. Tesla d | $24,578 | $77,574 |

| 9. Amdahl a | 9. Apple | 9. HP Enterprises | $26,866 | $15,677 |

| 10. Tymshare a | 10. Seagate Technology | 10. Netflix e | $24,996 | $236,117 |

| 11. AMD | 11. AMD | 11. Gilead | $24,689 | $74,058 |

| 12. Rolm a | 12. Sanmina-SCI | 12. SYNNEX | $23,757 | $6,588 |

| 13. Four-Phase Systems a | 13. JDS Uniphase c | 13. PayPal e | $21,454 | $277,047 |

| 14. Cooper Lab a | 14. 3Com c | 14. salesforce.com e | $21,252 | $208,200 |

| 15. Intersil | 15. LSI Logic | 15. Applied Materials | $18,202 | $78,716 |

| 16. SRI International | 16. Maxtor b | 16. NVIDIA | $16,675 | $328,615 |

| 17. Spectra-Physics | 17. National Semiconductor c | 17. Western Digital | $16,327 | $16,183 |

| 18. American Microsystems a | 18. KLA Tencor | 18. Adobe | $12,868 | $241,275 |

| 19. Watkins-Johnson a | 19. Atmel b | 19. Uber d | $12,078 | $93,549 |

| 20. Qume a | 20. SGI c | 20. Lam Research | $11,929 | $69,264 |

| 21. Measurex a | 21. Bell Microproducts bc | 21. eBay e | $10,713 | $36,576 |

| 22. Tandem a | 22. Siebel bc | 22. AMD | $9,763 | $115,364 |

| 23. Plantronic a | 23. Xilinx bc | 23. Square d | $9,498 | $106,173 |

| 24. Monolithic | 24. Maxim Integrated b | 24. Intuit | $7,717 | $99,872 |

| 25. URS | 25. Palm bc | 25. Opendoor d | $7,324 | $1,221 |

| 26. Tab Products | 26. Lam Research | 26. Sanmina | $6,875 | $2,117 |

| 27. Siliconix | 27. Quantum c | 27. KLA Tencor | $6,073 | $40,492 |

| 28. Dysan a | 28. Altera bc | 28. Equinix e | $5,999 | $63,238 |

| 29. Racal-Vadic a | 29. Electronic Arts b | 29. Electronic Arts | $5,670 | $41,368 |

| 30. Triad Systems a | 30. Cypress Semiconductor bc | 30. NetApp | $5,590 | $14,480 |

| 31. Xidex a | 31. Cadence Design b | 31. Agilent | $5,530 | $36,607 |

| 32. Avantek a | 32. Adobe Systems b | 32. Intuitive Surgical e | $4,551 | $92,762 |

| 33. Siltec a | 33. Intuit b | 33. ServiceNow d | $4,519 | $110,315 |

| 34. Quadrex a | 34. Veritas Software bc | 34. Juniper e | $4,445 | $7,478 |

| 35. Coherent | 35. Novellus Systems b | 35. Workday d | $4,318 | $57,934 |

| 36. Verbatim | 36. Yahoo bc | 36. Synopsys | $3,821 | $39,023 |

| 37. Anderson-Jacobson a | 37. Network Appliance b | 37. Autodesk | $3,790 | $67,066 |

| 38. Stanford Applied Eng. | 38. Integrated Device | 38. Palo Alto Net. d | $3,783 | $33,851 |

| 39. Acurex a | 39. Linear Technology | 39. Twitter d | $3,716 | $44,436 |

| 40. Finnigan | 40. Symantec b | 40. Airbnb d | $3,378 | $94,765 |

NOTES: This table was compiled using 1982 and 2002 Dun & Bradstreet (D&B) Business Rankings data and Blommberg data for 2020. Companies are ranked by sales.

a – No longer existed by 2002.

b – Did not exist before 1982.

c – No longer existed by 2021.

d – Did not exist before 2000.

e – Did not exist before 1995.

There were a number of comments on LinkedIn/Twitter that I paste here for (my) archive :

From SKMurphy : The history of Silicon Valley is properly anchored by the founding of Federal Telegraph in 1909 by Cyril Elwell, marked by California Historical Marker 836. It’s 111. https://www.skmurphy.com/blog/2008/11/05/steve-blank-on-secret-history-of-silicon-valley-at-chm-nov-20/

and I answered: I agree! Indeed Silicon Valley had probably a good number of different seeds like any lively ecosystem. We could add HP in 1939, and not forget Stanford University, not so much from its foundation but from Terman active role (https://www.startup-book.com/2008/08/08/win-win-win/)

From Jeffrey Funk : Today’s startups are losing far more money than those of the past. About half of publicly traded ex-unicorns(76) had cumulative losses greater than their revenues in 2020, and 51 had more than $500m in cumulative losses. https://www.marketwatch.com/story/bullish-optimism-boosting-unicorn-stocks-is-more-like-delirium-11629179583

to which I answered : Fully agreed. The New Yorker analyzed how WeWork was managed. Just one example of strong critics. See e. g. https://www.startup-book.com/2020/11/26/how-venture-capitalists-are-deforming-capitalism/

and then a little later : And let me mention on the topic of loss, a post I wrote in May : https://www.startup-book.com/2021/05/31/another-quick-look-at-data-on-public-tech-companies-loss-loss-and-more-loss-2-2/

From Jack Minas : Retirement is unnecessary as natural selection is in process with extinction on the cards. Irrelevance is obscured by the narcissistic manner enjoyed by many but only for a finite time I wonder what H&P would say if they returned and revisited this new dystopian landscape.

to which I reacted this way : HP could also be mentioned as a seed of SV. I agree there were strong work ethics at the time. They still exist. But the abuse is much more visible.

not to forget for my ego the nice comment from Professor Martin Kenney: Herve, as usual you are one of the most perceptive observers of the way SV works. You should definitely publish this…My perception is that the greatest hits of all time are NOT done by serial entrepreneurs…HP, Cisco, Oracle (i think), Yahoo, Google, 3Com, MSFT, Amazon, etc. The Fairchild-Intel sequence may not be true for the home runs. And yes, I think repeated entrepreneurship (greater than one) may lead to ever worse startups. For sure it does make it easier to get VC.