Steve Blank is a famous Silicon Valley figure. I mentioned him recently in my Steve Blank on Entrepreneurship. Pascal Marmier, head of Swissnex in Boston, just mentioned to me an article Blank wrote in Xconomy about Chile and an entrepreneurial culture: Creating the Next Silicon Valley—The Chilean Experiment. His slides are also avalaible and worth look at.

Author Archives: Hervé Lebret

Is there something rotten in the state of IP?

I have been surprised not to read more about Intellectual Ventures’ recent legal actions. You can read more about the companies they are suing for infringing IV’s IP.

If you do not know about Intellectual Ventures, you should know they have filed or bought about 30’000 patents or patent applications and raised billions of dollars. Until now, nobody really knew why, but their recent actions show IV is just another patent troll.

Around the same period, Paul Allen has been dismissed by a judge about the complaint he had filed for another patent infringment. More here. I should add I read about both pieces of news thanks to the Xconomy web site.

This is an opportunity to say that I have never been a big fan of IP, intellectual property, patent applications and copyrights. I do not have good alternatives to propose, but innovation is often more a matter of speed and being more advanced that being protected by IP. I am aware it is not so simple though. I have worked in the field for a while and I still give general courses on the topic. Those interested may click on the picture below or on this link.

Intellectual Ventures was founded by Nathan Myhrvold, who was formerly CTO at Microsoft. Not need to add which role Paul Allen had at Microsoft. All this could be funny when you think about the fact Microsoft success was not based on patents (and Microsoft did not suffer that much from all the people who copied all their software…)

Snow in Lausanne

Christmas is coming, the snow is already in Lausanne. Enjoy the holidays as well as this nice video!

Early mornings on innovation at the Swiss National Radio

I was invited this morning on RSR, the (french-speaking) Swiss National Radio, to talk about innovation and start-ups in their morning (5am to 6am!) Petits Matins. For those who know about the topic, nothing fundamentally new, with the slight exception that I learnt recently that a common feature to many entrepreneurs would be dyslexia (two studies were made in the USA and the UK). In total, a 30-minute conversation on my favorite topic, that you may listen on the RSR website if French is a language you like. Many thanks to Manuela Salvi, the talended RSR journalist.

More importantly, I could invite a guest on the phone at 5:45am (what a gift!) I was delighted to let Peter Harboe-Schmidt talk about his novel The Ultimate Cure, a beautiful thriller with a Lausanne-based biotech start-up as the background. I had already mentioned that book on this blog. Peter just announced the novel had just been translated in French.

Steve Blank’s on entrepreneurship

Steve Blank is famous in Silicon Valley as an entrepreneur and teacher of entrepreneurship. In particular, he has a Secret History of Silicon Valley which shows the importance of the military and cold war in its development.

He recently published a very optimistic blog When It’s Darkest Men See the Stars.

He claims entrepreneurship barriers are changing. These were:

1. long technology development cycles (how long it takes from idea to product),

2. the high cost of getting to first customers (how many dollars to build the product),

3. the structure of the venture capital industry (a limited number of VC firms each needing to invest millions per startups),

4. the expertise about how to build startups (clustered in specific regions like Silicon Valley, Boston, New York, etc.),

5. the failure rate of new ventures (startups had no formal rules and were a hit or miss proposition),

6. the slow adoption rate of new technologies by the government and large companies.

And we are facing a new world he calls “The Democratization of Entrepreneurship” and he sees

– A Compression of the Product Development Cycle

– Startups Built For Thousands Rather than Millions of Dollars

– A New Structure of the Venture Capital industry

– Entrepreneurship as Its Own Management Science

– Consumer Internet Driving Innovation

I reacted on his blog and wrote this: I have to admit I am puzzled. Let me elaborate.

On the positive side, the optimism expressed is very refreshing and I felt really good after reading it. I tend to agree with the lower barriers to entrepreneurship, and probably I kept my sun glasses in the dark too long, so I do not see the stars. (But I will think this is a great article that I want to mention to my own little network.) But on the other side, I am concerned that the same barriers still exist in biotech, semiconductor (and most hardware products if they embed radical innovations) or even in cleantech/greentech (which by the way maybe be more a bubble than a real new field). In these fields, product development is as long, VCs are afraid sometimes of the capital requirements, Richard Newton, the Berkeley professor (http://www.eecs.berkeley.edu/~newton/presentations), had noticed a long time ago, that most talents go out of these tough fields to easier or more promising fields (it was from electronics to internet in the 90s). It might be that we do not (have to) innovate as much in these classical fields anymore, in which case you are totally right. But if not, we are just moving to the low hanging fruits of innovation, and we are blinded by superstars but do not see the myriads of others (needs, opportunities) we should also focus on…

Start-up Soldier vs. Start-Up Hero

I just discovered a Techcrunch post about “Silicon Envy”. It’s entitled Is the search for the Startup Hero holding back startup teams?

There is a lot of interesting content and if you have the time, listen to the full roundtable. It’s a good summary of our current or maybe complexity crisis. I do not agree with all arguments, for example the ones saying Europe is weak because of regulations. I believe it’s cultural. But probably, regulations change culture over the long term.

I noticed the usual-suspect arguments:

– You need a culture of rivalry and competition.

– You need money which means smart capital.

– We need an education to build (products and companies) not only academic skills.

– You need to be international from day one and not local only, so do not be modest. The topic of language was seen as much as an asset as a liability for Europe.

Esther Dyson is quite convincing in our need for the skills to build company. “In Europe, your mother tells you to work for SAP or Coca Cola.” Then she added it’s easy to create a 5-people company but it is tough to scale to 1’000 and there you need middle managers and skills. You may read Esther Dyson directly in her own post The Dangerous Myth of the Hero Entrepreneur. As important, Esther Dyson shows it is a complex topic.

As she nicely wrote in her post:

“But there are two benefits that do redound to a hero entrepreneur’s home country. First, the local entrepreneur serves as a role model. He (rarely she) encourages people to dream – and also to take risks, persist in the face of long odds, and generate economic activity.

(…)

Yet sometimes I think this hero-entrepreneur myth is dangerous. In an economy such as the United States, where start-ups are revered, people who would make perfectly good project supervisors or salespeople establish their own companies, starving the ecosystem of middle managers. Thousands of perfectly smart and highly useful people feel inadequate because they are not heroes. Many make the wrong career choices in search of glory.

(…)

In cultures where start-ups are considered risky and not quite honorable, it’s also hard for entrepreneurs to find troops to play the non-starring roles. Most people would rather work for an established company, or for the government.

So, rather than focusing on the supposed shortage of entrepreneurs, consider for a moment the very real shortage of qualified people willing to work for them.”

A typical success story (not Silicon Valley though)

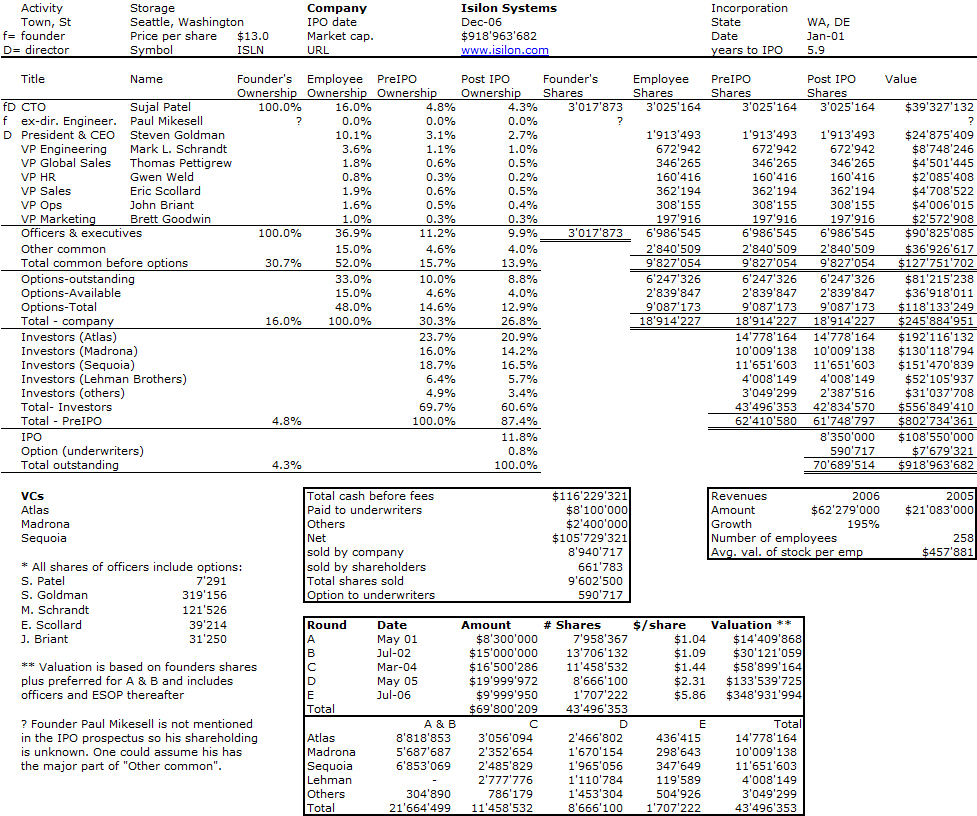

I just learnt about Isilon yesterday. It certainly shows how disconnected I have been from the start-up world these days :-(. Isilon was backed by Atlas and Sequoia and went public in December 2006. It finally got acquired this week by EMC for $2.2B!

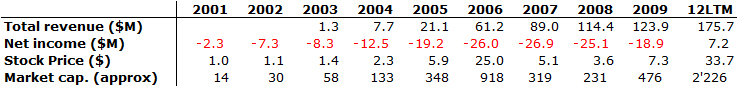

Fred Destin mentions about Isilon in his blog so you will find more info there. What I did since yesterday is looking at the company numbers since its foundation in 2001. So first, here is its stock price history as well as its revenue/profit numbers.

It was not an easy success story. Following its IPO, the company missed its numbers, lost money (no profit) until this year so that the stock price does not show a nice growing curve (even if the VCs always had a nice multiple on their investment). But the company had to wait until the acquisition by EMC to see happy employees and investors. Destin claims Atlas will finally make a 22x multiple over its investment.

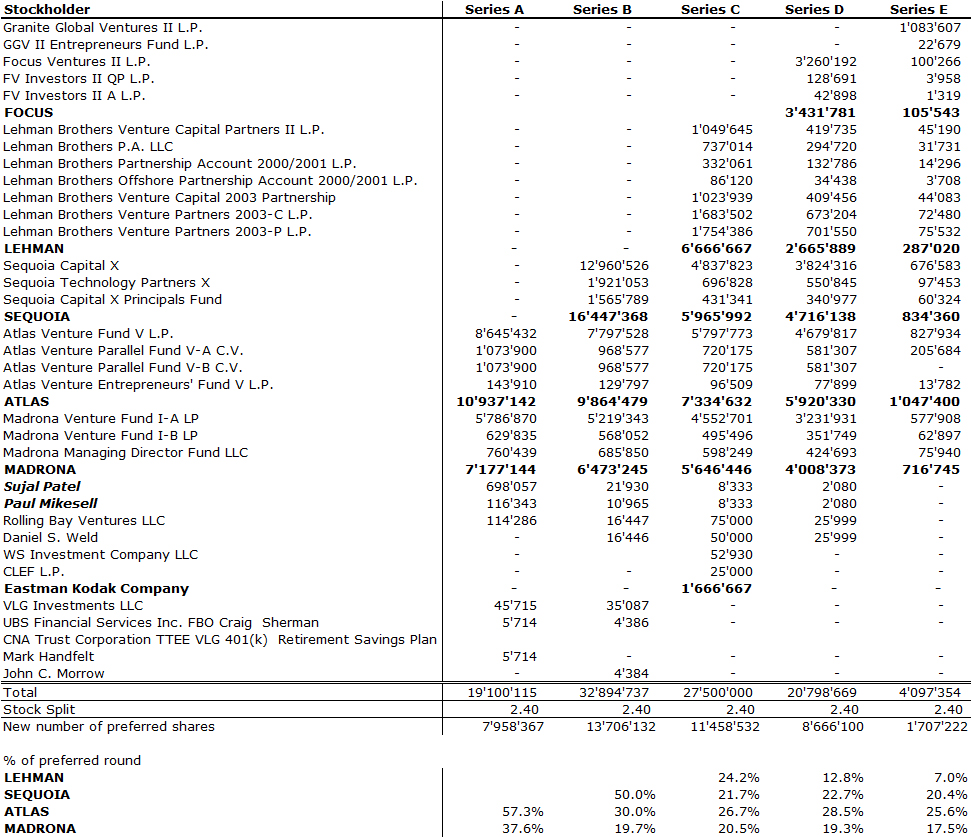

What is for me (and I hope for you too!) of interest is the shareholding structure that the next table illustrates. You will have to click on it to read the details. (As usual, if you want the excel file, just ask me).

What the IPO prospectus did not say is as interesting as the rich information it provides:

– not much info on the series A and B, except the total amount, but I could not distinguish Atlas, Madrona and Sequoia investments. It would probably possible to guess the real numbers as Sequoia invested (and probably led) in the series B whereas Atlas and Madrona invested in the Series A. With prorata rules, you can make your own guess.

– Paul Mikesell, a co-founder, is not mentioned anywhere so I have no clue how much he owns/owned of the company…

Finally, Isilon was not based in Silicon Valley, but in Seattle. It’s interesting to connect this to a recent post by Bill Curley entilted the Silicon Valley IPO’s anxiety. Though Silicon Valley remains a craddle of innovation, the ratio of IPOs its experiences compared to the rest of the USA, is quite low and Curley has some explanations.

PS (November 18): I was wrong, there was more information available online: I could find the precise allocation of preferred stocks (notice there was a 2.4 stock split) and in addition Mikesell is mentioned…

Google vs. Facebook

Is Google losing traction to Facebook? When I begin to read such things as Google Offers Employee $3.5 Million Not to Join Facebook or Google-Facebook : la guerre des talents est déclarée (the war for talents is declared) in the serious French newspaper Le Monde, it is probably time to wonder.

The funny thing is that when I had lunch last week with a Swiss entrepreneur who needed contacts in Silicon Valley, I discovered that one my eBay contact was now at Facebook, one of my Microsoft contact was now at LinkedIn, so at the micro or macro level, there is something going on.

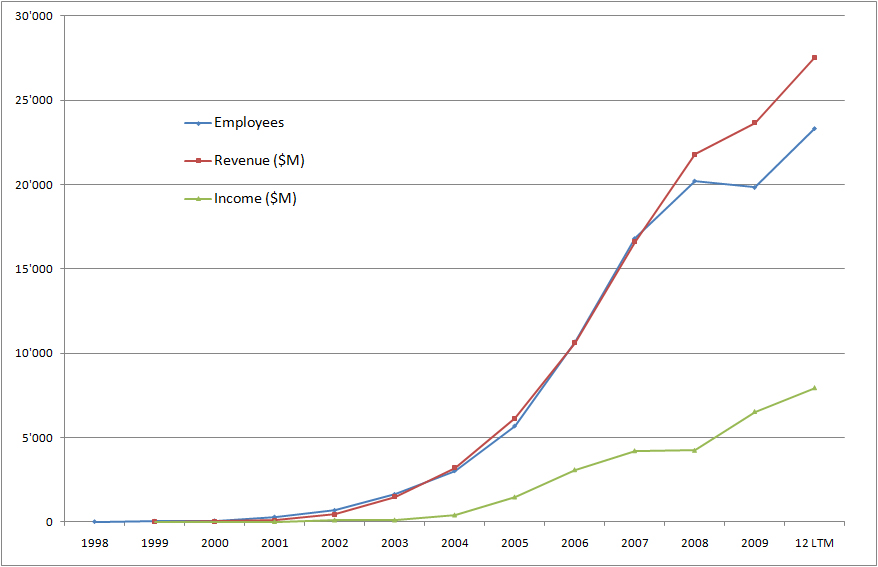

You know Google is one of my favorite topics. I regularly look at their growth for example. So here is it again. Too early to say if they are in the slowing part of the S-curve…

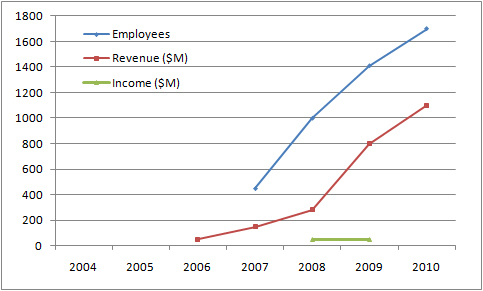

Facebook numbers? it’s rumors mostly so the graph below should be treated cautiously!

The funny thing is that I had noticed there was a relation at Google between employees and revenues, basically $1M per employee. Facebook looks slightly less efficient.

Silicon Valley has always been a war for talents. In the 90s, the electronics industry lost people to the Internet companies (you should remember that Yang and Filo, the founders of Yahoo! were studying in the field of electronic design automation) then Google was doing the same in the early 2000s, now it is about social networking. I would not worry too much for Google though. Not yet! As as Richard Newton was saying in EDA Cafe : “Silicon Valley and the Bay Area are cradles of innovation.” And he further added, stating a colleague of his: “The Bay Area is the Corporation. […When people change jobs here in the Bay Area], they’re actually just moving among the various divisions of the Bay Area Corporation.”

When Valentine was talking (part 2)

I have a short memory for things but when I focus on one point, I stick to it for a few days. After finding a few things on Valentine, I digged a little more and found again the interview I used in my book when he compares Steve Jobs to Ho Chi Min (“We financed Steve in 1977 at Apple. Steve was twenty, un-degreed, some people said unwashed, and he looked like Ho Chi Min. But he was a bright person then, and is a brighter man now”).

There he also explains why Silicon Valley can not be replicated. Here it is:

“There is no question. It’s very difficult. And over the years we’ve been visited by hundreds of people from every country in the world, almost all of the states in the country. They all want to figure out and clone what causes Silicon Valley to exist and thrive. Many or most of the visitors are interested in the underlying employment creation. But if you look at venture capital, it only works two places in the world. It doesn’t work outside the U.S., and it only works in Boston, or the greater Boston area, and in Silicon Valley. Basically, almost no other major financial center in the world has ever generated companies of consequence and providence that is so large and visibly successful.

And you can blame it on the weather. You can give credit to the great universities. You can explain that the venture community here is stronger and more experienced than other parts of the world. But the mystique of why it works is still very hard to narrow down to six or seven simple declarative sentences. And it – it is a local bit of magic that – works at this particular point and time. The duration of the venture industry is probably only from something like 1960 through the present, so you talk about not even half a century. [The interview is dated 2004…] It – it’s still a new and – and sort of closet-like form of financial engineering. We don’t think of it as investing at all. We think of it as building companies, often times building industries. And it’s an entirely different mentality and attitude than in the traditional idea of buying and selling things. And this is not a place where you buy things; this is a place where you build things. And you participate in the founding team that creates an entirely new company and sometimes a new industry. And now there are far more practitioners.

But if you go around the world, the Research Triangle in North Carolina was going to be another magic spot. Well, you can’t name a great company, it’s never been started there. You can look at other centers. Seattle – well, there is a great company there. Maybe there are two great companies there – they include Nike. And – has anything happened in the last twenty-five years in that community other than Microsoft and Nike? And the answer is not a lot. [Well he forgets Amazon!] Lot’s of companies have started. Lots of things going on, but not a lot of monumental success. I mean it’s unbelievable the number of companies that have gained prominence, have revenues of a billion dollars in this tiny, little valley. So it is a bit of enigma what all the ingredients are that everybody would like to clone and take away.

I once tried to explain to the Deputy Prime Minister of Singapore who was here trying to take back the magic, and I said it’s a state of mind. You can’t take it back. Somehow or other you’d have to move your people here and they would have to have their DNA changed so that when they went back to Singapore, there was a DNA adjustment in the way they thought, the way they were willing to take risks. I mean in a place like Japan, if you start a company and it fails you’re disgraced. Some people would commit suicide – if that happened.”

“And here – you – you start a company and you fail, some of the best people are better after their failure than before their failure. So you don’t have the stigma of failure. In Ireland, I can’t imagine with jobs so hard to come by, somebody would leave a good job in a country like Ireland to – to run the risk of their company failing. And a place like Germany, it’s so rigid you’d be socially ostracized, I suspect, if you started a company and – and it didn’t work.

Environmentally here – the other ingredient I forgot to mention and it’s more true now than it ever was, the – the community is built up of emigrants and immigrants. So almost all of the people who have started or participated in starting these great companies have come from some other state. Noyce was from Iowa. Went to Grinnell College. And there’s a – Gordon Moore might be an exception of somebody who was born in California. So we have a whole history of emigrants coming from all over the country, and in the last ten years more than ever, we have a huge population coming from Southeast Asia. It – a month doesn’t go by where Sequoia doesn’t start a new company populated by Indians. Fabulously educated, brilliant entrepreneurs, they come from an economic system that is so different from ours it’s hard for me to understand it, although about once every two months I get a lecture from some entrepreneur who says that you don’t even understand your own system.

You don’t understand how unique it is and – and then the fact that it doesn’t exist anywhere else in the world. So there is something here that is – that is different as perceived by the people who purposely immigrate here.”

When Valentine was talking

Those who follow my blog know I am interested in the history of Silicon Valley, start-ups and venture capital. I had published a while ago data about Kleiner Perkins’ first fund. I’ve been trying ( and I still do) to find data on Sequoia’s first fund (Atari, Apple, Tandem, Altos) without much success [anyone with data on Sequoia I is welcome to contact me!) but today I found an interview fo Sequoia’s founder, Don Valentine, given to Inc. magazine in May 1985. What he told about start-ups, entrepreneurs, investors and big corporations could be said again today. I put in bold characters what stroke me. Enjoy, even if the interview is rather long.

Now I just found a recent interview of Valentine (dated October 2010). Though given 25 years later at Stanford Graduate School of Business, it does not seem valentine has changed much his values and beliefs.

Peaks And Valleys

Venture capitalist Don Valentine scaled the entrepreneurial heights as a key investor in Apple Computer, Altos Computer Systems, and Tandem. Now, amidst uncertainty in Silicon Valley, he talks of opportunity, company building, investor madness, and the failings of the business press.

He speaks like the New York street kid he used to be, but Don Valentine understands the challenges facing California‘s high-technology entrepreneurs better than most Californians. At 47, the feisty venture capitalist ranks high among the deans of Silicon Valley‘s much ballyhood investment community.

Not that this reputation has made him universally beloved. Gruff sometimes to the point of rudeness, he can be a formidable for of foolishness. As the marketing manager of the then fledgling National Semiconductor Co., Valentine is to have scolded a subordinate so severely on one occasion that the poor fellow fainted dead away. Other victims have also felt the lash of his wit: entrepreneurs and journalists, to name a few.

Despite his prickly manner, Valentine is widely admired among those entrepreneurs who have taken his money, and, more importantly, benefited from his intimate knowledge of building companies in emerging growth industries. The son of a New York City Teamster official and a graduate of Fordham University, Valentine won his spurs in the infant integrated circuit business — at Fairchild Camera and Instrument Corp.‘s semiconductor division from 1960 to 1967, then at National Semiconductor Corp. until 1971.

He then formed his own venture capital firm, Capital Management Services Inc. (now called Sequoia Capital), which was a key early investor in more than 100 California high-technology companies, including Atari, Apple Computer, Tandem, Altos Computer Systems, LSI Logic, and Cypress Semiconductor. With these and other successes, Sequoia Capital over the past 10 years has earned its limited partners returns in excess of 60%.

For all his triumphs, Valentine insists that he doesn’t back in the media’s glorification of his trade. Indeed, he deplores it. And now that the press has decided to deflate the industry’s once-buoyant image, he professes to be relieved. He knew failure, too, in the midst of his successes: Pizza Time Theatre was a Capital Management-launched company.

At the same time, Valentine has not lost faith in the future of U.S. entrepreneurism. Looking out of his office window at the rolling hills above Stanford University, sipping a mug of tea, he reflects that entrepreneurs need only remember the key qualities that have made for their success in the past — the courage to be different, to create markets where none existed before, and to invent radically new ways of doing business. With such weapons, he argues, entrepreneurs can continue to enjoy surprising triumphs against their larger, more entrenched competitors.

INC.: What’s going on in the venture capital business these days? Do you still have people pounding on your doors with new Apple Computers, or new add-ons for the IBM?

VALENTINE: Amazingly to me, yes.

INC.: What do you say?

VALENTINE: Well, the first thing I ask is, “Why, in 1985, do you want to do this? What do you see happening in the world that leads you to believe that you can make a real company, achieve whatever you want to do as an entrepreneur, and at the same time allow us to make a consequential return on the risk we take?”

INC.: And what do they reply?

VALENTINE: Unfortunately, many of them start talking about the installed base, how many are being produced — that sort of thing. They often don’t seem to have any sense that the race has been run, that there’s no longer an opportunity for the modest technical contribution to the evolving family of Apple or IBM boxes.

INC.: Does that mean there’s no more room for anybody in the microcomputer industry, apart from those two?

VALENTINE: Oh, I think Radio Shack is probably a well-entrenched company. They have their own distribution channel, which kind of helps them. And Commodore has staked out a very strong position in Europe and at the very low end. But I wonder if that’s not it.

INC.: What about the IBM-compatibles, the Coronas or the Compaqs?

VALENTINE: I have never believed it was possible to invest and make substantial returns by being compatible with IBM — anywhere, at any time. Not in mainframes, not in disk drives, and certainly not in personal computers.

INC.: The conventional wisdom says you have to be compatible with IBM.

VALENTINE: I think the conventional wisdom must be comprised of what goes on in people’s heads who have no sense of history. There are no historical examples where IBM compatibility has produced anything except annihilation.

INC.: OK. But if computers are not, where do you see any new fields of opportunity?

VALENTINE: Right where they have always been. One of our theories is to seek out opportunities where there is major change going on, a major dislocation in the way things are done. Wherever there’s turmoil, there’s indecision; and wherever there’s indecision, there’s opportunity.When it becomes obvious to anybody who reads Time magazine that it’s useful to have a disk drive on a computer, then it’s already way too late in the cycle to invest in disk drives. So we look for the confusion phase, when the big companies are confused, when other venture groups are confused. That’s the time to start companies. The opportunities are there, if you’re early and have good ideas.

INC.: Can you be more specific?

VALENTINE: Sure, the telecommunications industry is a good example. The regulations are unclear, the interpretations are unclear. So the big companies don’t know what they’re allowed to do and what they’re not allowed to do; and neither do the regional companies. They don’t know what they can sell and what they can’t sell. The venture business has never been a business of taking the big companies head-on; in fact, it is always a business of avoiding taking them head-on.

INC.: So the success of venture capital depends to some extent on there being a lot of confusion in the market-place, or at least in the minds of big companies. Is that right?

VALENTINE: Well, I don’t want to leave you with the impression that we’re so much more clever than the people who run big companies — that only we, the venture people, can see through the murkiness. On the other hand, big companies do suffer from certain disadvantages — implementation, for instance. Oftentimes, a big company will develop something, but then it will languish around and never get into production, or get into production too late. Take everyone’s favorite example, the personal computer. Long ago it was too late to be in that business. So what did the big computer companies do? They launched their own personal computers: Wang, NCR, HP, and I don’t mean to leave out Data General and DEC. Now some of those companies might be buying the product from someone; they might get it on an OEM basis, or a license basis, or coventuring it. But it’s all an example of a time when we should be moving in another direction.

INC.: Still, we’re hearing a lot about big corporate types beginning to see the value of “intrapreneurship,” small niche marketing, and so forth.

VALENTINE: I don’t know about all that. Big corporations flap their lips a lot about all the great things they’re going to do, but basically they’re obedient people. When you run a big company, it’s like running anything else that’s big, a church or an army: The key ingredient is obedience. Anything big requires people performing and acting in conventional, predictable ways — within the rules. Entrepreneurism is by comparison the role of the nonconventional person who’s going to do it differently. And in the big corporation, he’s just a flat-out pain in the ass. He doesn’t get through the industrial relations department, because that’s why you have an industrial relations department: to make sure the oddballs don’t get in and create confusion in the obedient world.

What you’re hearing is a fashionable reaction to a currently overreported event. Entrepreneurism is “in”; therefore corporate cultures have to embrace it in order to appear contemporary. I think that after the fad has passed, the big corporations will discontinue it, like affirmative action and the employment of women and all the other bullshit things they do for public appeal. This, too, will pass; and in another two years they’ll be on to something else.

INC.: Yes, but affirmative action accomplished something. Women and blacks were hired. They’re still working. Won’t this intrapreneur faddism, as you call it, leave some of its spirit behind, even after it has passed?

VALENTINE: I would be surprised. The progress of minority groups, the progress of women, is because fundamentally, as individuals, they are contributors, of sex and color. There’s no fundamental reason why intrapreneurship is going to be useful to a multibillion-dollar company.

INC.: You think it’s all public relations, nothing that’s deeply felt?

VALENTINE: Yes. Big corporations are made up of several ingredients. One part is public relations. But another part is accounting. Big companies are run by accountants, whose mentality is to control things, to homogenize things. That’s what control is: sameness, predictability. Look at what happens to an entrepreneurial company when it’s acquired by a giant. The giant comes in and says: “We have to change a few of the rules. Don’t worry; we’re not going to change the company. We just want you to think about a few things. You’ve got to have a compatible health plan. Ours is better than yours, so we’ll fix that. And this accounting firm is really better than your accounting firm, so we’ll fix that, too.” It’s death by a thousand cuts. A little nick here, a little cut there, a little change here — nothing significant. But at the end of a short period of time the people are so driven by controlling and accounting that the environment of nonconventional solutions is lost.

INC.: So you’re saying that big companies are doomed in their efforts to coopt the entrepreneurial spirit.

VALENTINE: Yes, but not the entre-preneurial product. The bioengineering world may be a good example. The bioengineering product is a technique, more a manufacturing process than a freestanding product. And the logical people to be in the biolengineering business are the pharmaceutical and drug companies, right? So why, then, do you have all there bioengineering firms starting up since 1978 or so? I think what happened was that the big pharmaceutical companies had other fish to fry. They had their scientists grinding away on other products. But meanwhile they saw all these little companies getting venture financing, and what they did, cleverly, was to point some money at this one, then at that one, knowing that later they would catch up with them. They knew that the venture companies couldn’t walk the new interferon drug, or whatever, through the Federal Drug Administration cycle, into production, and into the marketplace. That’s a very expensive process and requires a lot of know-how. They knew that the little companies didn’t have that kind of wherewithal. But the big companies did; so that when the time came they knew that they could come in and pick up the marketing rights from the little companies.

INC.: You seem to have a lot of ideas about big companies. Have you ever worked at one?

VALENTINE: That depends on what you mean by “big.” I worked at Fairchild, where I joined an already existing sales force and sales concept, and I managed it up to $150 million from the mid-20s. Then, at National Semiconductor, I got the opportunity to design a sales concept and sales force from scratch. They were losing about $2 million when I got there, and by the time I left they were earning about $40 million. I enjoyed that. I like taking the proverbial blank piece of paper and designing another approach to doing things. It matched my personal goals. But then I found myself no longer challenged. More important, I found that I didn’t like companies when they got to $40 million or $150 million. I hated them.

INC.: What was it you couldn’t stand?

VALENTINE: Success, I think, is what I couldn’t stand. When a company succeeds, the founders no longer have a personal impact on strategy, no longer have a direct contact with the customers. They become managers and superiors, while all the other guys who work with them have the fun. And if you don’t let them have the fun, you can’t keep them. I like doing things personally. I like seeing the customers, the applications of a product. I don’t like seeing them through a sales force. By the same token, I like planning products and strategies, personally, not through three layers of people. So I opted for venture capital, where I could act personally and permanently in a small-company, fast-track, growth environment — somewhat as a dilettante rather than a full-time manager. Managing a company that was growing at 10% or 20% a year wasn’t even an option for me. I wanted an environment where I could invest in small companies and enjoy their success, modestly contributing at the strategic level. Venture capital is where I can do that, and in a multitude of companies at the same time.

INC.: Let’s talk about how that works. When an entrepreneur walks into this room, looking for money presumably, how do you size him up?

VALENTINE: The characteristic we’re concerned with every time is whether the person knows what he doesn’t know — whether he’s mature enough to recognize it, talk about it, and do something about it. That’s one of our critical tests. Many entrepreneurs have incredible blind spots. For instance, they are often, correctly, said to be insensitive to the importance of sales, or manufacturing, or how to get good gross margins. They’re not deliberately blind; they just haven’t thought about those things.

INC.: How do you test for blind spots?

VALENTINE: We discuss it. We ask them about their products, their approach, and what skills they think are crucial to the company’s growth. Then we want to know whether those skills are resident in the team; and if so, who has them; and if not, why not, and where they’re going to come from. Our world is one of constant Socratic questioning. We spend a small part of our time trying to find out which questions are relevant, and the rest of it we spend listening.

INC.: How important to you is the business plan?

VALENTINE: Most important, but for a not very obvious reason. We must have something that will tell us how people think. We get one or two of these plans every day and we can’t possibly understand the nuances of every business. So the business plan to us is where we begin to learn about the people. We can’t tell whether the numbers are right, therefore we concentrate on how they reached the numbers, the thought processes that led them to conclude that their project was possible.

INC.: Where do most entrepreneurs fail in their thinking?

VALENTINE: Well, that’s one of the great ironies of my career. It’s the computer. The prevalence of the computer and the spreadsheet has caused entrepreneurs in the last two or three years to develop pro forma projections of their businesses. They’re no longer written out by hand and really thought about, with the result that many people have no personal understanding of the numbers they’re projecting. Sometimes you find incredible market shares being achieved in just four years, simply because the numbers suggest it; or sometimes you find sales expenses projected at numbers far below what you’ll probably need to get the orders. Things like that fall out because the numbers are generated impersonally, and nobody thinks about the relationship between them and the structures that have to be in place before the numbers start coming in.

So for us the business plan is a bridge to communication. We’ve never invested in a company that achieved more than 70% of its plan. But that’s not such a great failing, in our view. We’re dealing with people who are supreme optimists. If they weren’t, they wouldn’t be starting companies, they’d be working in some nice, comfortable haven. They would not be doing the hardest thing in the world. So we’ve become less concerned about the completeness of the plan than we are about how the founders reached their conclusions — what factors they considered relevant, what assumptions they made, how realistically they viewed the competition, and so forth. These are things which, from our point of view, you can learn only by listening, not by reading.

INC.: What do you look for in terms of growth — the company that gets up and running at $25 million to $50 million a year, or one that goes to $200 million?

VALENTINE: I wish your question had more alternatives. But if I have to choose, my interest is always in people who can get the company from zero to $25 million or $50 million as quickly as possible.

INC.: Why is that?

VALENTINE: Well, the thing you have to keep in mind is that we invest in partnerships that last from 8 to 10 years, at the end of which time they terminate. This means that the real time frame of our growth expectations is about 5 years. How much can you legitimately expect a company to grow in 5 years? Not to $200 million or $300 million. Of course there are exceptions — Apple, for one — but their principal effect has been to confuse people about the real history of venture capital. Historically, the probability of a venture investor having even one Apple to his credit in 7 or 8 years is very low. If he were really good, out of 30 or 40 investments, he might make 2 or 3 Apples, but never 10. It’s absolutely unrealistic, in my opinion, to expect $200 million to $300 million in 5 years. On the other hand, it is perfectly reasonable to expect $25 million, $35 million, $50 million in that time, and that’s what we look for.

INC.: That certainly seems a lot more modest than what you were saying not long ago. It sounds as though you’ve radically scaled down your expectations from what they were a few years ago.

VALENTINE: Let me suggest that it’s you, the press, who have had to scale down your expectations, and you want to impute your disappointments to me. The fact that a company goes from zero to $50 million counts for a lot to me. Now it is true that during much of 1982 and all of 1983 there was a real pricing insanity in the venture field. Investment bankers, pension fund managers, a good many new players were racing around frantically to get their money employed in start-ups or mezzanine financing. This drastically shortened the amount of time available to study investment opportunities. We saw companies being funded very rapidly, so rapidly that we didn’t get a chance to participate. We were too slow. Recently, as a matter of fact, we were talking about one such company, wondering why we hadn’t made an investment in it. Well, the other investors were more agile. They moved before we could, in our iceberg fashion. As it happened, this company didn’t succeed. We had dodged the bullet. But the point is that the reason we were able to dodge the bullet is that we didn’t adjust our approach during that period of insanity. You know the old saw — keeping your head while all around you people are losing theirs. Well, I don’t want to suggest that all the companies we ducked in that period of frenzy were properly ducked. I suspect some were successful. But I don’t believe the venture investment community was ever conceptualized or designed to produce a dozen $500-million companies per year. History, at any rate, shows that it works best at delivering lots of small-niche companies, employing hundreds of people, doing brilliantly on $25 million to $50 million a year in revenues.

INC.: But isn’t there a danger in that sort of thinking? Aren’t you doing these companies a disservice by focusing on relatively short-term growth? Don’t you have some responsibility to make sure they have management capable of taking them past the $50-million mark?

VALENTINE: If you’re going to talk about responsibility, the real question is, to whom and to what constituency am I primarily responsible? I would say that our first responsibility is to our limited partners, who are mainly members of various pension plans in the United States. They’re the ones who own our companies, and when I think of responsibility, I think about those people, and the returns that they have signed up for and expect to be delivered.

INC.: Yes, but even so, we’ve seen loads of companies go to $30 million or $40 million in sales and then collapse, sometimes before going public. Don’t you at least have a responsibility to get managers who can keep companies solid over the 5-to-10-year period of your involvement?

VALENTINE: Of course. And after having made investments in perhaps 150 companies, we are inclined to believe that there is one set of management skills needed to start a company and another set needed to manage a bigger company. They are rarely resident in the same person.

INC.: So, even within a 5- or 10-year time frame, it’s almost inevitable that you’re going to have to make significant management changes.

VALENTINE: I’d say “management additions.” Sometimes the man who starts as president of a company is replaced by another member of the team when the company reaches a later stage of development. But with the exception of someone like [Tandem Computers Inc. president] Jim Treybig, it’s rare that a successful, driving entrepreneur becomes a successful executive capable of managing the assets and people of a $100-million or $500-million company. A great many entrepreneurs just cannot make that transition.

INC.: Of course, to listen to the entrepreneurs these days, the problem they’re having is getting people to invest at all. They refer to the venture capital community as “the valley of the maybes.” That certainly wasn’t the situation a year or two ago. Have you changed with the times, too?

VALENTINE: I don’t know. We don’t keep data; we don’t want our investment process dictated by the numbers. But looking back over the past 15 years, I would guess we’ve made substantially the same number of investments every year, with only a small range of differences. It’s not that we planned it that way; it just turned out that way. But the other key point is that we almost always invest in the early stages. We reconsider this virtually every time we meet to discuss strategy, but we’ve always found that for our purposes it made sense to continue to invest in the early phases of a company.

INC.: Why is that?

VALENTINE: Because in the company-building business, which is the business we perceive ourselves to be in, it’s easier to have an impact on the concept and personality of the company. This is difficult to do after the first financing. By then other people are influencing the company; its personality has been determined. We’ve seen companies that have been very badly influenced: for example, encouraged or tolerated in habits of irresponsible spending. We just find it easier — as in child-care — to form company attitudes toward spending and growth early on.

INC.: What’s your “letting go” point? When does it seem you can no longer impose your will on them?

VALENTINE: May I quibble with the question?

INC.: Quibble all you want.

VALENTINE: Thank you. We don’t view ourselves as “imposing our will” on a team starting a company. We don’t see ourselves as relating to companies in an adversarial way. We see ourselves as encouraging them, as a stimulator. The important thing we have to maintain in perspective is that other people are running the company. It is their company. On the tactical level we are at best a partner, but mostly a cheerleader. For example, during the wooing process — when the decisions are made whether to invest or not — we try to avoid having any of our ideas taken up as part of the concept of the company, lest we distort the entrepreneur’s or management’s view of what’s supposed to happen. We don’t make an investment decision based on our ability to enforce our will. That’s a repugnant concept. We want to make sure that the company is one where the entrepreneurs are having their ideas financed, and that they are passionately committed to those ideas.

INC.: So what exactly do you bring to the table — besides capital, I mean?

VALENTINE: I would say the main thing is what we call “intelligence equity” — experience the companies don’t have, contacts they don’t have, perspectives they don’t have. Basically, we give them the opportunity to move from the entrepreneurial stage to that of a larger, more stable company. Altos, for example, is now a company with around $103 million in annual sales. When we invested in it, it was comfortably successful, doing something like $12 million to $15 million a year. Altos was profitable, had money in the bank, had no debt, and was developing a fair amount of momentum. They really didn’t need our money, but they realized that they were entering a risky period, with a lot of unanswered questions — the more so because they didn’t know what the relevant questions were. So they were clever enough to want to associate with other people who could help them identify the questions as well as the answers — not just us, but lawyers, accounting firms, and so on.

INC.: All right, but let’s face it. Your experiences are heavily oriented toward the computer industry. How valuable are they in, say, a restaurant chain, not to mention any names?

VALENTINE: Well, it’s true that most of our expertise is in the computer area, and we probably have less to offer to companies outside the wide embrace of technology, especially companies in slower-growing industries. There are leverage skills we don’t have. We are probably better off staying out of those businesses.

INC.: But doesn’t the same reasoning apply in a technology-based industry like biotech? Don’t you think that microbiology demands profoundly different skills and perspectives than micro-electronics?

VALENTINE: A lot of fundamentally different skills and a lot of fundamentally similar skills.

INC.: For instance?

VALENTINE: Well, it’s true that many of us understand the world of bits and bytes, and relatively few have much experience in the world of microbiology, partly because this hasn’t been a business before. So, from one perspective, we’re operating at a disadvantage.

But it’s also true that microbiology is basically a tool for solving problems, just as a computer is a tool for solving problems. The challenge in both cases is to identify the problem and the best tool with which to solve it. From that perspective, we still have something to contribute to these companies, not so different from what we’ve contributed to computer companies. After all, we’ve seldom contributed anything to, say, the electronic architecture of a computer, or the kind of circuitry needed, or the speed or packaging. It’s rare for investors to get involved in that kind of detail.

INC.: Can you give us an example of the kind of “intelligence equity” you might provide to a biotech company, or a telecommunications company, for that matter?

VALENTINE: Sure. One thing about both those industries is that they tend to be very capital-intensive, so you have to find creative ways to raise money. We try to help companies do just that.

One example is a company called Equatorial Communications, which had to acquire $16 million worth of transponders on satellites in order to be operative as a communications company. That’s a lot of money, and the situation required a solution that would not be an equity disaster to the founders and early investors. I mean, if the company went to the market and tried to raise the money, they would have no equity left. They needed a way to finance assets that had never been financed before — the worth of which were therefore unknown — and they had to do this before the satellite was launched.

Well, through a combination of leasing and guarantees, modest amounts of equity were sold in order to control two transponders on Westar 4.The solution involved corporations, insurance companies, and banks — nontraditional financiers for a company like Equatorial. Frankly, nothing like it had ever been tried before because nothing like it had ever been needed. Since then, this kind of solution has also been used in many of the modestly successful bioengineering companies.

INC.: I suppose another solution would be to form one of these so called alliances, or corporate partnerships, with a larger company.

VALENTINE: Absolutely. That’s something we’ve done in the semiconductor industry — so that, for example, a company like LSI Logic can go into business and, through Johnson Controls, have the ability to purchase equipment worth $20 million for very little in the way of equity.

INC.: Do you think that this sort of alliance will become more common in the future, that people will be looking less to the equity market?

VALENTINE: I think corporate investors are a necessity in a capital-intensive business, where the equity leverage in a model venture deal can be easily lost. Obviously, straightforward debt doesn’t work. These companies don’t have the underlying equity from which to borrow from traditional sources. So corporate America has been one of the solutions. Insurance companies have been interested participants in these things, and some of the pharmaceutical companies as well.

INC.: Does this mean that small companies and large companies have more in common now than before?

VALENTINE: I view the small company as a vehicle for the individuals involved, but large companies can also benefit from their activities. Entrepreneurial companies are a stir to get big companies moving. What’s more, the people who work in big companies often own the small companies through their pension plans. One of our largest partners is General Electric, so the employees of GE benefit from our companies’ successes.

INC.: Let me change the subject and ask how all this affects you personally. You’ve had a string of spectacular successes as an investor, beginning with Apple. You’ve noted how unusual that is. Isn’t there a risk that they might go to your head? Don’t you ever get a slight Deity Complex?

VALENTINE: I suppose the correct way to answer that, in a magazine interview, is to say yes. It makes one appear humble. But the answer is no. I think I always understood why Apple worked, and that there was a great amount of luck involved, both for Apple and for our being investors in it. The publicity, if anything, reinforced this sense of perspective. Also, I have a teenage daughter whose role in life seems to be keeping my ego in check. At every opportunity she reminds me of my mortality.

INC.: Speaking of mortality, I take it that you don’t think we’re coming to the end of the Age of the Entrepreneur — despite all these stories of “Doom in Silicon Valley.”

VALENTINE: I think the thing that’s coming to an end is the reporting of it. Newspapers and magazines — and let’s throw in TV — are usually interested in short-term fads and “trends,” and since there are many more media than there are fads, the latter tend to get overreported. The fact that the media are now writing about “Doom in Silicon Valley” means to me only that they are getting tired of writing about “Boom in Silicon Valley.” For the public, maybe things will come back into some sort of historical perspective. Entrepreneurism is not the solution to all the economic problems of the country or the world. No one ever conceived it to be — except the press.

INC.: So in a way the doom-talk might be good.

VALENTINE: It might be good if fewer company presidents and venture capitalists have to talk with reporters. More time will be spent in creating new companies.