After reading a couple of top 10 and must-read list of books, here is an exercise I had never done. I went through my past readings and quickly built my own top 10 / must-read – business books. If you want an exhaustive list you could have a look at all the Must Watch or Read articles on this blog. here is my ranking:

#1: The Four Steps to the Epiphany by Steve Blank,

(subtitled Successful Strategies for Products that Win)

Although it is rather painful to read because of the density of advice and check-list, it is the must read book for any entrepreneur who must understand the complex relations between building a product and service and selling to customers. Here is my post, dated November 2013.

#2: The Hard Thing about Hard Things by Ben Horowitz.

(Building a Business When There Are No Easy Answers)

A honest and toughest account about what entrepreneurship means. As the great Bill DAvidow was saying, “Being an entrepreneur is not for the faint of heart”. More about my account dated May 2014.

#3: Regional Advantage by AnnaLee Saxenian.

(Culture and Competition in Silicon Valley and Route 128)

Not a book about entrepreneurship but about high-tech clusters. Saxenian explained (already) in 1994 why Silicon Valley had won. It is the book to read to understand what start-ups really are and why they are important. A short indirect account dated October 2011.

#4: The Black Swan by Nassem Nicholas Taleb.

(The Impact of the Highly Improbable)

It is not directly related to innovation and entrepreneurship, but successful start-ups are highly improbable events with huge impact. A fascinating book I first talked about in July 2012 but I mention the concept and author so many times you could also check the tags Black Swan and Taleb.

#5: The Man Behind the Microchip by Leslie Berlin.

(Robert Noyce and the Invention of Silicon Valley)

The best (in fact nearly the only!) biography of an entrepreneur I read so far. It’s great, moving and full of information. You can read my short account dated February 2008 but you could also read more in The Tinkerings of Robert Noyce dated August 2012.

#6: Founders at Work by Jessica Livingston

(Stories of Startups’ Early Days)

Great interviews of start-up founders with an account dated June 2008. I had read before and I read since many other books built with such interviews. No doubt this is the best one.

#7: I’M Feeling Lucky by Douglas Edwards

(Falling On My Feet in Silicon Valley)

I could not have a top 10 list without a book about Google! This is my favorite one (but close to #8). When a marketing expert is hired by two crazy founders and learns he does not kwow so much about marketing and many other things. And in addition, it is the funniest business book I have ever read. My account is dated December 2012.

#8: How Google Works by Eric Schmidt & Jonathan Rosenberg, with Alan Eagle.

(The rules for success in the Internet Century)

I initially thought a book written by the chairman and former CEO of Google would not be very enlightening. I was totally wrong. great lessons. great advice. A recent account dated November 2014.

#9: The Art of Start by Guy Kawasaki.

(The Time-Tested, Battle-Hardened Guide for Anyone Starting Anything)

The best book about what you need to say with a powerpoint pitch or write in a business plan. A simple, direct to the point about launching any venture. One of my oldest (and shortest) posts, dated March 2008

#10: Against Intellectual Monopoly by Michele Boldrin and David K. Levine.

An important analysis of the crisis of intellectual property: “It is common to argue that intellectual property in the form of copyright and patent is necessary for the innovation and creation of ideas and inventions such as machines, drugs, computer software, books, music, literature and movies. In fact intellectual property is a government grant of a costly and dangerous private monopoly over ideas. We show through theory and example that intellectual monopoly is not necessary for innovation and as a practical matter is damaging to growth, prosperity and liberty.” I wrote many posts about it, the latest being dated May 2013.

#11: Something Ventured

It is so difficult to build such lists, I cheat twice! First with the greatest ever video document about Silicon Valley. You must watch and listen to Sandy Lerner, the co-founder of Cisco. And it is freely available on youtube, so no excuse not to watch this fascinating movie. My account is dated February 2012.

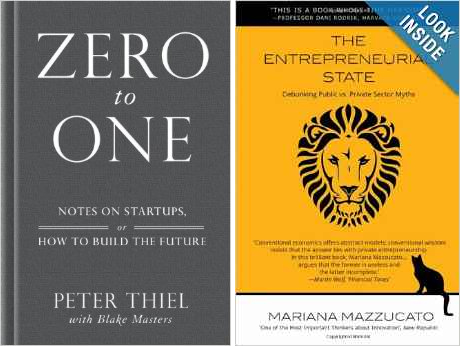

#12: The Unfinished Debate about the Individual and the State between Peter Thiel and Mariano Mazzucato

My second extension to the top 10 is made of two books! Peter Thiel is the author of Zero to One (notes on start-ups or how to to build the future). Mariana Mazzucato wrote The Entrepreneurial State (debunking public vs. private sector myths). But again, I produced so many posts on the topics they address you can also check the tags Mazzucato and Thiel. After the terrible events “Je Suis Charlie” which happened in Paris in early January 2015, these two books remind us about the complexity of analyzing how individuals and groups (societies, institutions, states) interact (with some tension) to create and innovate.