It’s the second book I read from Randy Komisar (after the Monk and the Riddle) and I have to admit I preferred his first book even if Getting to Plan B is quite good too. I might have been slightly misled by the title even though the subtitle was quite clear, Breaking Through to a Better Business Model. But it might be I never read seriously subtitles. I thought the book was about what you do when you were wrong first. But it is more subtle. It is not so much about what happens if your idea was not good vs. what about finding a better or valid business model. If it says better, you plan A might have been good enough! The other reason I was not totally convinced comes from my feeling the case studies were chosen to illustrate a theory, a process, a framework, but did not prove it. I had the feeling the same case studies might have been used to illustrate opposite views, but again, who am I to say such things!

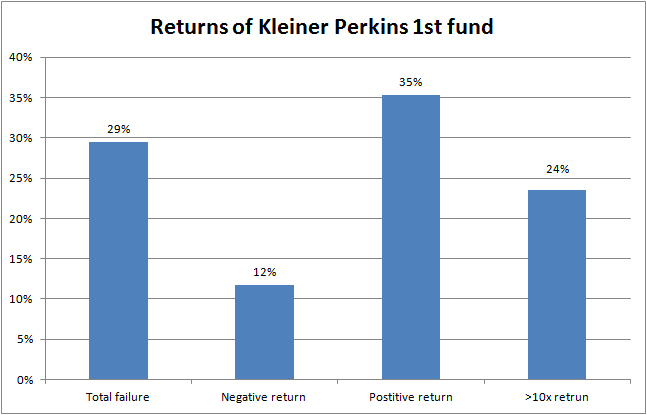

Mullins and Komisar’s book remains a very good book thanks to a rich variety of cases and lessons. In their preface, the authors say important things. “Entrepreneurship is not easy. [..] they are countless tales of companies that quickly went down in flames. Ultimately [many of them] failed because the economics of their business model didn’t work” [Page viii]. I was a little puzzled because I am not so sure; many companies failed because customers did not buy. But it might be the same! The authors claim “they developed a process and a framework to discover the best business model” [page ix]. Again I am puzzled, I am not sure this exists. But still, they certainly provide interesting tools.

One of the most interesting one is the use of analog and antilogs, that I had already mentioned when reviewing Ries’ Lean Start-up. Again For the iPod, the Sony Walkman was an Analog (“people listen to music in a public place using earphones”) and Napster was an Antilog (“although people were willing to download music, they were not willing to pay for it”). Analogs are successful predecessors worth mimicking in some way whereas antilogs are predecessors (whether successful or not) in light of which one explicitely decides to do things differently [Page 14]. But when they claim Apple’s plan B was to transform itself from a struggling PC maker to a consumer electronics powerhouse [page 21] , I find the broadness of the plan B concept really too broad!

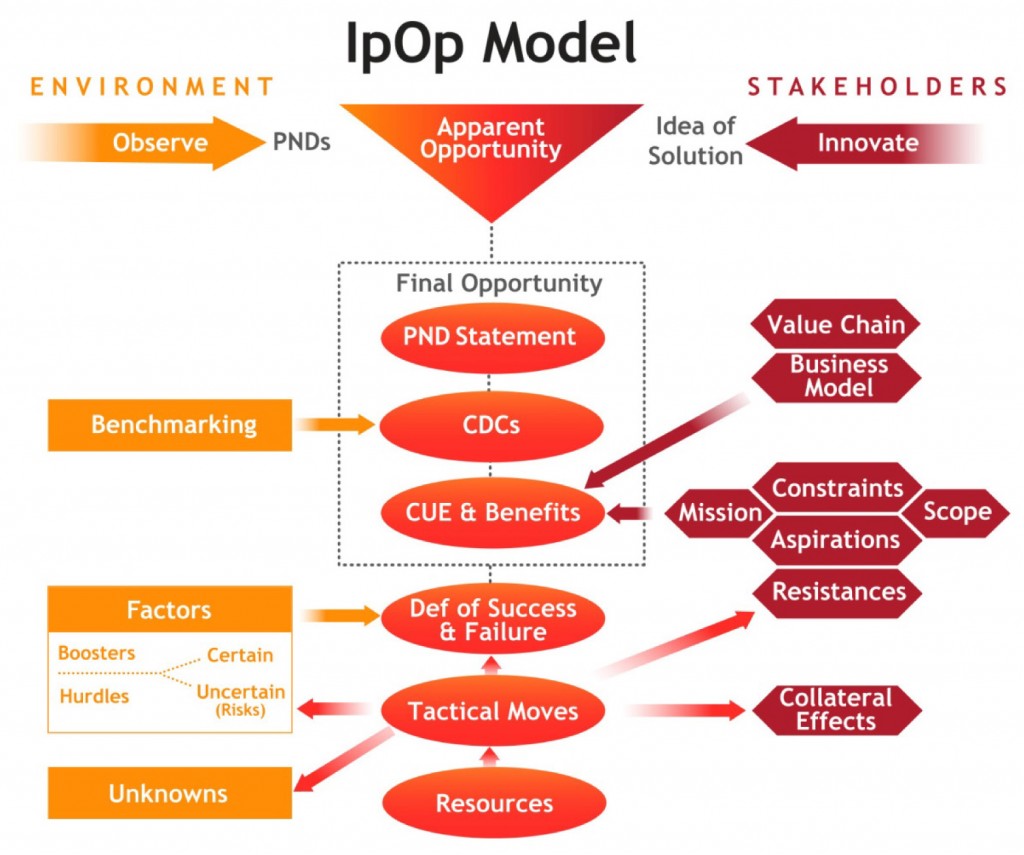

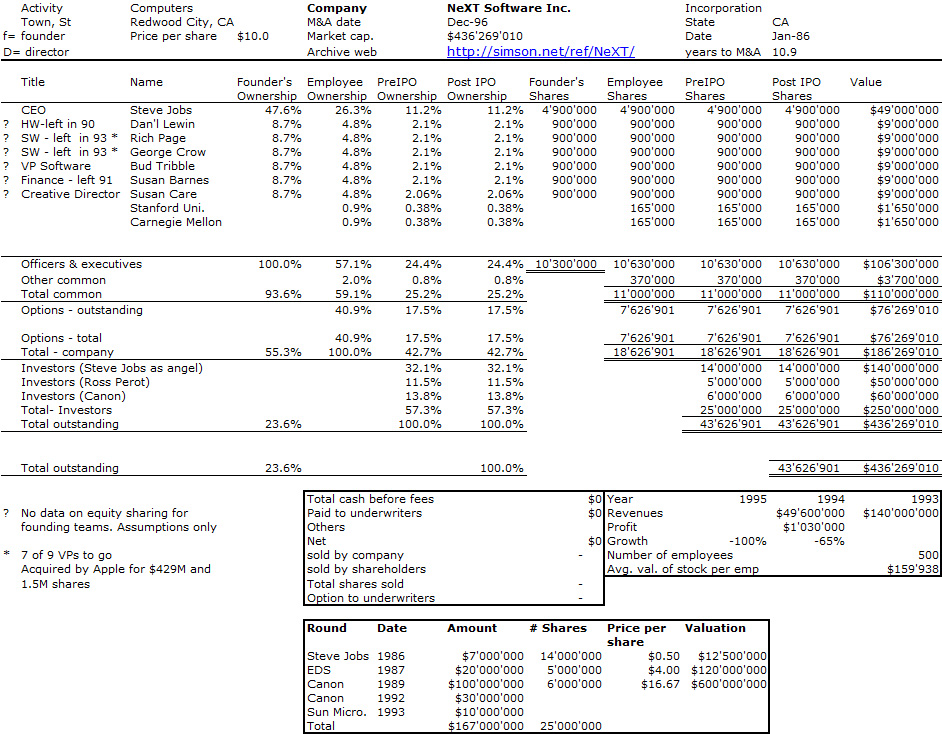

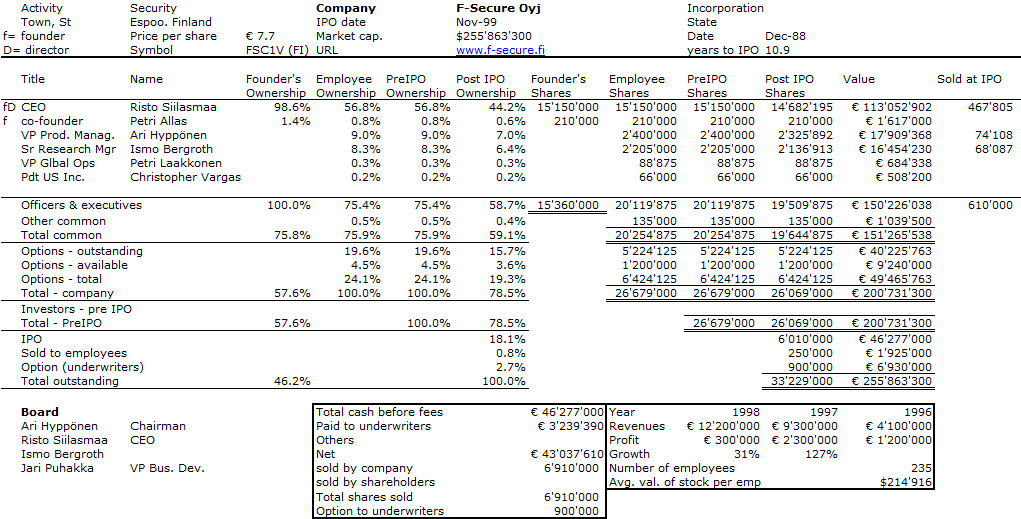

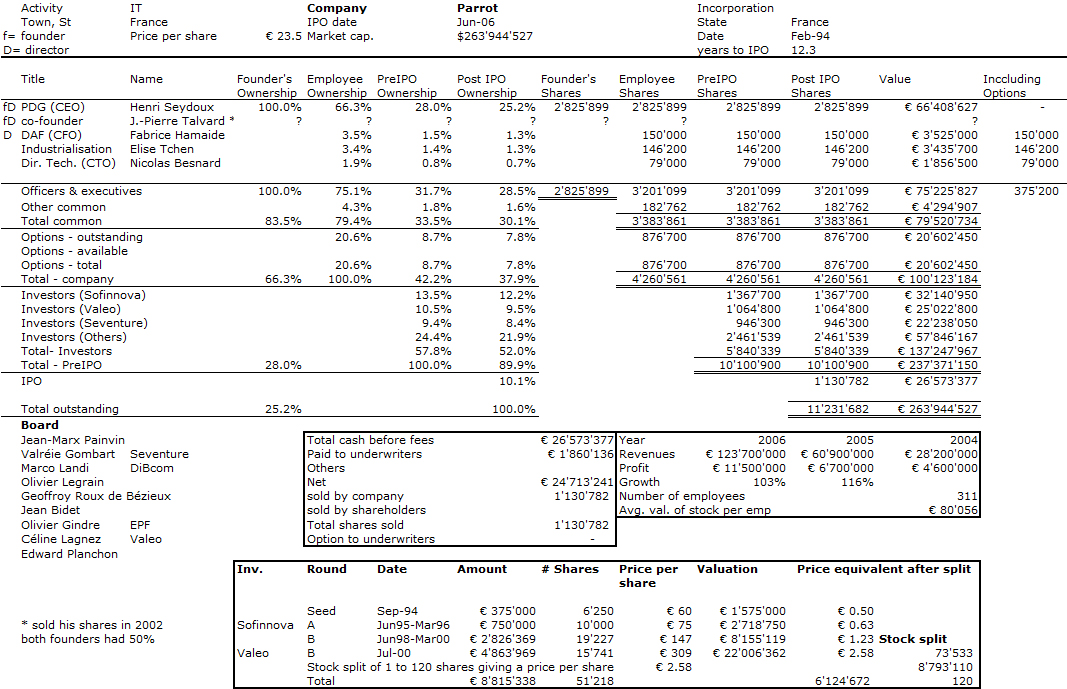

Then their methodical dashboard is about validating leaps of faith by testing hypotheses. And what is new compared to other important references such as Steve Blank’s customer development is the focus on the business model through 5 elements: revenue, gross margin, operating expenses, working capital and investments.

| Business model element | Relevant analogs and the numbers they give you | Relevant antilogs | Leaps of faith around which you will build your current dashboard | Hypotheses that will prove or refute your leaps of faith |

| Revenue model | ||||

| Gross margin model | ||||

| Operating model | ||||

| Working capital model | ||||

| Investment model |

Why plan A won’t work? The authors answer, page 3, by quoting Albert Page: “it takes 58 new product ideas to deliver a single successful new product”. And a few lines below, “figuring out what the customer wants is not easy.” PayPal worked on its plan G! Google’s plan C works. Plan A had no revenue model, plan B was licensing, plan C was advertising. (But remember Google was always a search engine. In terms of product, it was still plan A! That is why I said before I was misled by the title Getting to Plan B)

They begin chapter 1 with the following: “Mediocre success – finding a passable business but missing the real potential – is equally problematic. Arguably, it’s worse than missing the target completely because it will tie down your considerable talent in a venture with no real future. You and other entrepreneurs and innovators like you are the lifeblood of today’s economy. And to waste your talent on something mediocre would be a real shame.”

Now the book shows that success does not have only one way. The Silverglide case [pages 74-78] shows that an entrepreneur can succeed with $80k for friends and family money whereas I am not even sure how many hundreds of millions Jeff Bezos needed before reaching profitability for Amazon.com [pages 186-192]. Many case studies illustrate how to optimize each of the 5 business models elements [chapters 3-7], whereas chapter 8 shows that you will need to find a balanced solution trying to get the best of these 5 key financial objectives. Amazon.com needed to reach a very large size to make its automated process worthwhile but “great lessons are born from leaps of faith” [page 192].

I fully agree with their final chapter’s early sentence: “As you know by now, this is not a book about business planning. It’s about, in a sense, business discovering. Quoting Eisenhower, “plans are useless, but planning is indispensable” or McArthur: “No plan ever survives its first encounter with the enemy”. So again, the building blocks of the process are:

– an identified customer pain and a solution or an opportunity to offer delight,

– some relevant analogs and antilogs,

– which lead to some as-yet-untested leaps of faith,

– which lead to a set of hypotheses to test them,

– a dashboard to focus your attention on what’s most important right now and to provide some mid-course corrections,

– all comprehensively organized, in just the right sequence, to inform and create the five elements of your business model.

[page 208]

Does this mean you need a plan B right from the start? The answer [page 212] is nice: “There’s a temptation to think that, since plan A probably won’t work, you should have plan B in your hip pocket. Don’t do it. A contingency plan would probably be just as flawed.”

There is clearly in the eraly 21st century a new trend in that business plans may not be a sufficient tool, not to say even necessary. From Randy Komisar, through Eric Ries, to Steve Blank (including my recent account of Cohen’s Winning opportunities), the important element is the discovering process of your business, of your customers in an iterative and flexible manner. This is clearly an important lesson to remember.