Sometimes I make a copy/paste of articles that I have particularly appreciated, with the objective of then translating them to English from the French part of this blog. (Sorry for the bad English, this is pretty quick and dirty). Here I will add my own comments in brackets and italics. You can find the original article and the comments on Frenchweb.fr.

Withings or the story of a French naivety

François Nemo expert in disruptive strategies.

The spectacular acquisition of Withings by Nokia does not illustrate as it is always argued the weakness of our financing system but the lack of vision and commitment of our entrepreneurial scene. It shows our failure in creating an ecosystem with the right scale to position ourselves in the digital war against China and the United States. It is time to mobilize our energies to “beat the GAFA” and defend our sovereignty.

[For years, I have been saying that we do not have so much a funding problem, but a problem of culture, a complete misunderstanding of the importance of start-ups and their growth.]

After Captain Train bought by the British for €200M, it is now an emblem of the French technology, Withings – which made the buzz at CES in Las Vegas by playing the “made in France” card, – to be bought by Nokia to €170M. And I am ready to bet that Blalacar would not withstand a proposal from Facebook if it decided to introduce carpooling in its range of services to connect the planet. The adventure of the so-called French jewels has unfortunately only one outcome: a big check!

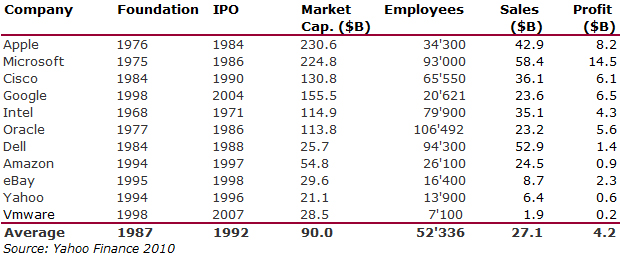

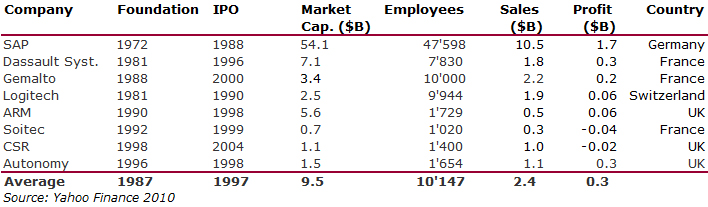

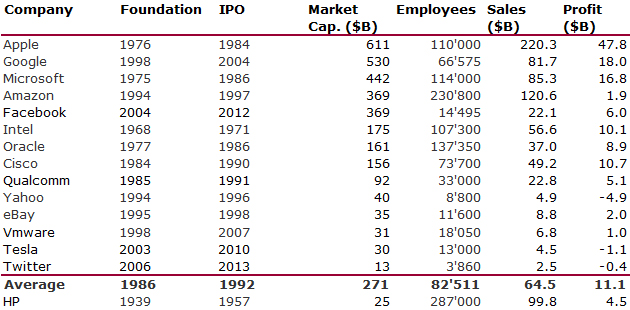

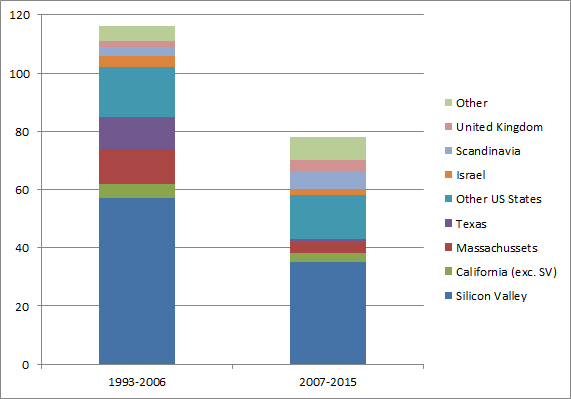

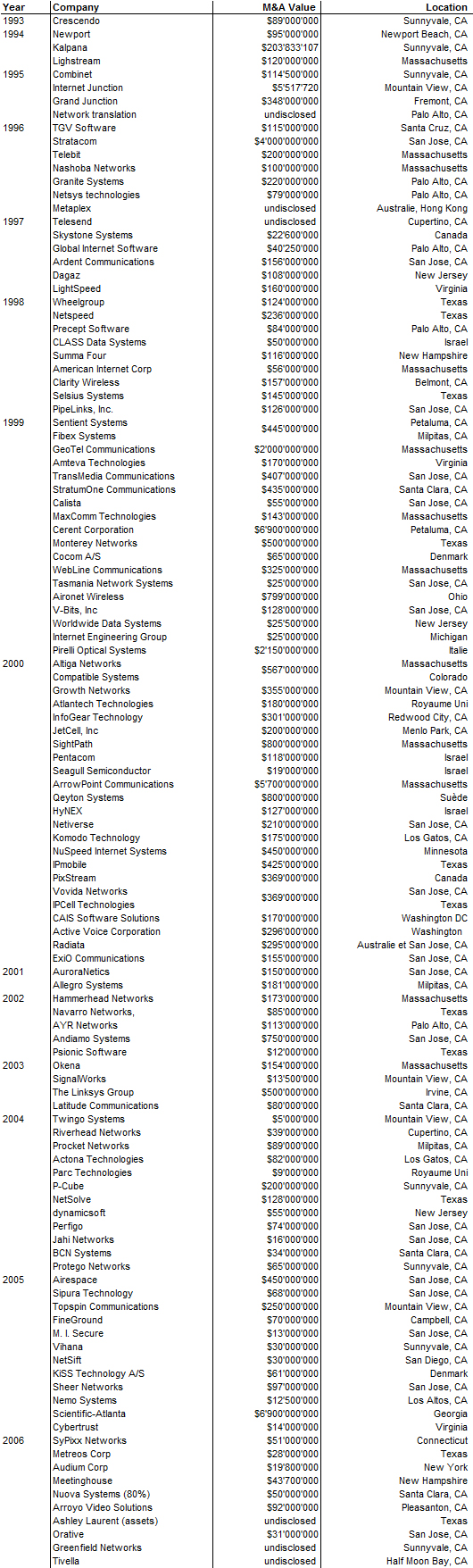

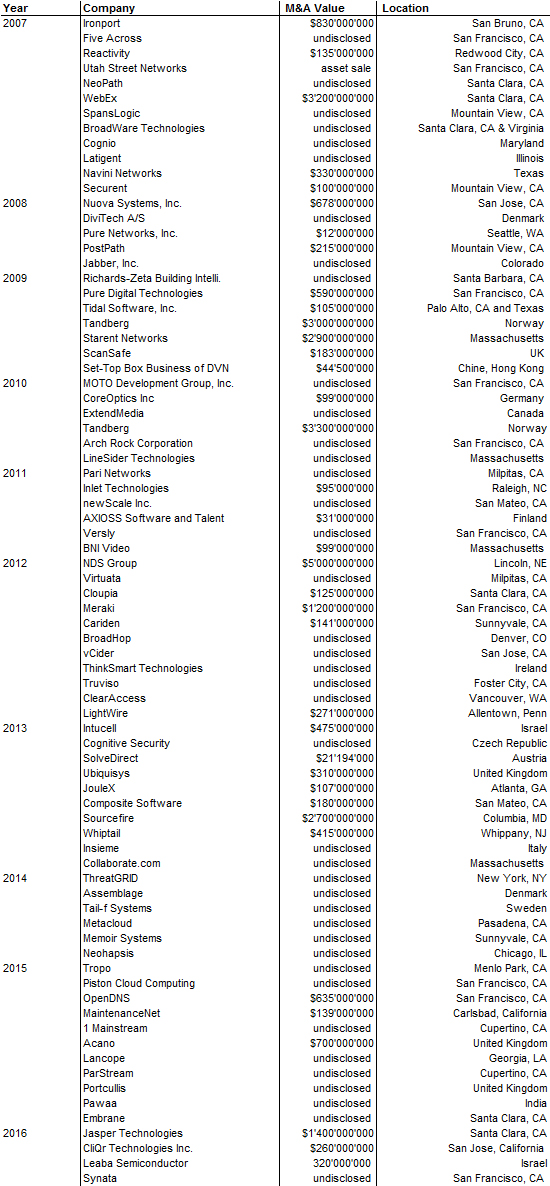

[I will let you browse my documents on Slideshare and especially the one that compares Europe and Silicon Valley and its slide 37]

Intelligence First

As technology develops, the more it disappears behind the ideas. The “purpose” or the “raison d’être”. The big digital players have understood this by turning to “intelligence first.” The product is a feature that is integrated in a platform whose role is to solve the world’s problems, health, travel, leisure … manage a community, organize a circular, iterative, open and inclusive ecosystem that connects direct users and producers to shorten and optimize the interaction. This is the announced death of sites and applications. The role of the entrepreneur is then to defend a “vision” and then to design the system to match it. He is a conductor more than a resource creator who will defend the key assets of the company; ideas and data. In this new context, mono-products like Withings companies have no chance to grow if not to integrate an ecosystem. One can also wonder about the real benefits for Whitings of being acquired by Nokia? Dropbox or Evernote had bitter experiences in yielding to the striking power of large platforms. And what about the relevance of that phrase of Steve Job: “You are a feature, not a product” by refusing to buy Dropbox ten years ago?

The new war of ecosystems

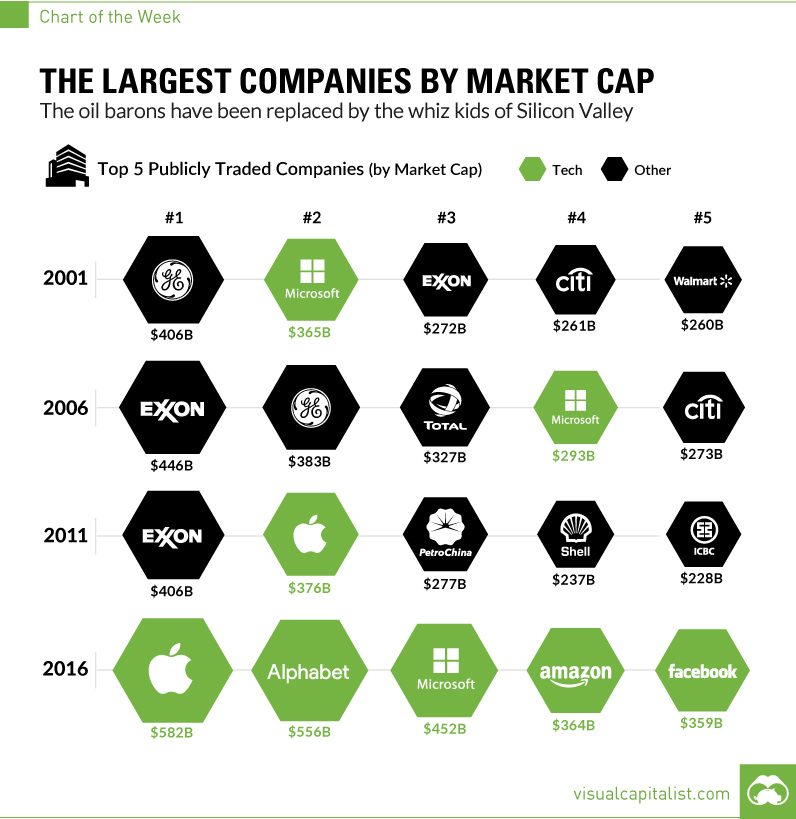

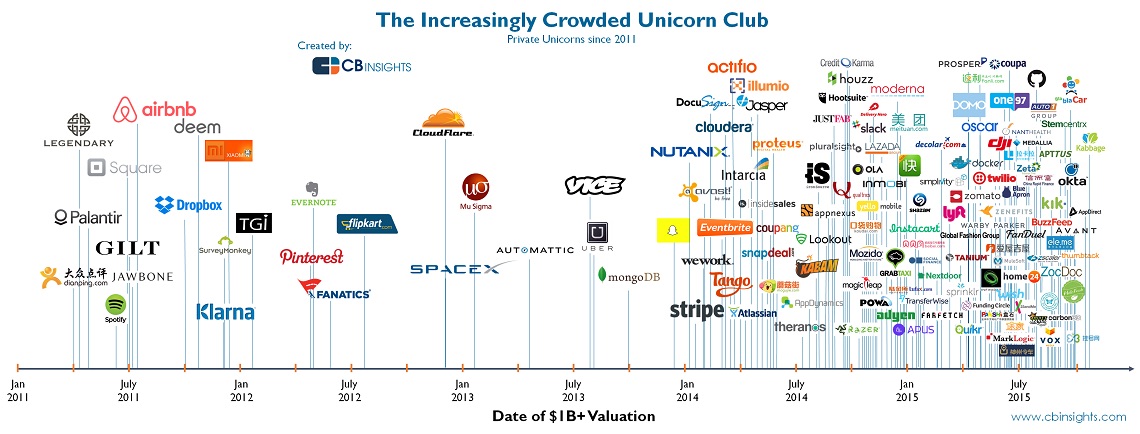

This is on the field of ecosystems that now compete the two giants of the digital world, the United States with GAFA, underpinned by an ideology, and China with more pragmatic companies like Alibaba, WeChat who developed new ecosystems in booming sectors by creating new business models and which after reaching an impressive number of users on their domestic market are beginning to position themselves internationally by triggering a fierce fight with the Americans. It is in this context that the GAFA (mostly) do their “market” in the four corners of the planet to feed and enrich their ecosystem. And France with the quality of its research and its dynamic start-ups is a particularly attractive hunting ground.

Why Europe is not able to create worldwide ecosystems?

The acquisition Withings is not as it is claimed a financing problem, an inadequate investment European ecosystem that would prevent a rapid scale-up of our jewels. The scope of Withings whatever the funds injected made impossible anyway a development outside of any platform. The question is why Europe is not able to create worldwide ecosystems in which promisng start-ups like Withings find their place?

[The failure of the European Union is not political only. There is also economic failure. So much fragmentation and so much national selfishness …].

We do not think digital at the right scale!

Our speech about the “Made in France”, staged around our digital champions and their presence at CES supported by the Minister of Economy himself is something naive and pathetic. All the institutional and private infrastructure, accelerators, think tanks, French tech, CNNum, Ecole 42, The Family, accelerator or NUMA, to name only the most prominent are not programmed to develop platforms with visions but products and features or laws and reports. This is our economic and entrepreneurial culture that is in question. A world still very marked by the culture of the engineer and the specialist. A world that is unfamiliar with and remains wary of notions of vision and commitment and more generally to the world of ideas. Rather conservative entrepreneurs who do not perceive the deeply subversive nature of the digital revolution and the need to change the “scale of thinking.”

Large groups who all have a start-up potential

We could also rely on large established groups who all have a start-up potential just like the American Goldman Sachs saying: “We are no longer a bank, but a technology company, we are the Google of finance” by having three thousand five hundred people working on the subject and by announcing a series of measures such as giving access to market and risk management data as open source. One can easily imagine corporations like La Poste and Groupama which business will be radically challenged in the next five years preparing for the future by organizing an ecosystem around wellness and healthcare (for example) that would integrate their know-how with Withings. But listening to the representatives of the major groups, Pierre Gattaz or Carlos Ghosn, for example, one quickly perceives their shortsightedness and lack of interest (they have nothing to gain) for disruptive strategies.

[Which role models or mentors could have our young generations in Europe, not only in France, at the end of their studies? How could they build GAFAs when the model is today the CAC40 and a very engineering culture, indeed].

Are we ready to live in an ” Fisher Price Internet”

Are we doomed to become satellites, and lose our economic sovereignty and security by staying under the influence of GAFA. Or as proposed François Candelon, Senior Manager at the Boston Consulting Group in a very good article “look at what China can teach and bring” and “create a Digital Silk Road”. Are we doomed to choose between Scylla and Charybdis? No! Because even if the web giants with their vision paved the way to new relationships by building the most disruptive companies in history, they leave us facing a huge gap. The “technical transformation of the individual.” Are we ready to live in an ” Fisher Price Internet” as Viuz claimed “in closed houses” run by machines “with chubby groves, manicured lawns and paved roads” where exclusivity, premium and scarcity matter leaving out of the door a part of the population. A kind of ultra-secure retirement homes for the wealthy?

Breaking the GAFA

We must unhesitatingly rush into a third track: “Breaking the GAFA”. If the formula is somewhat provocative, it encourages mobilization. The gap will be difficult to catch up, but it is time for Europe to build on its historical and fundamental values to build new ecosystems and enter fully into the economic war between the two major blocs. Propose alternatives to GAFA. “Use algorithms and artificial intelligence to create an augmented intelligence and solve the complex problems that the ecological and social emergency create” as said Yann Moulier Boutang. Integrate new technologies to rebalance the power relationships, find the keys to a true economy of sharing and knowledge to tackle the question of the future of work, compensation, health, freedom, education …

To scale

A rupture that requires a change of scale by challenging our economic culture and our understanding of the world. A rupture which, even if it still faces a “diabolical” inertia, has become a necessity for many of us.

If you are part of this new “generation” of “intelligence first”, if you have ideas and solutions to change our scale of reflection, I invite you to join us on Twitter or email @ifbranding f.nemo@ifbranding.fr together, we have solutions to propose and build projects.

The author

François Nemo expert in disruptive strategies.

Website: ifbranding.fr

Twitter: @ifbranding

Medium: @ifbranding