Grâce à l’occasion que j’ai eue de rencontrer le « Chief Scientist (OCS) » d’Israël, et le fait d’avoir reçu le livre Start-Up Nation à la fin de la réunion, permettez-moi de vous donner mon opinion sur ce livre très intéressant. Mais tout d’abord voici un certain nombre de choses toutes simples au sujet d’Israël et de l’innovation.

La version française publiée par Maxima en septembre 2011

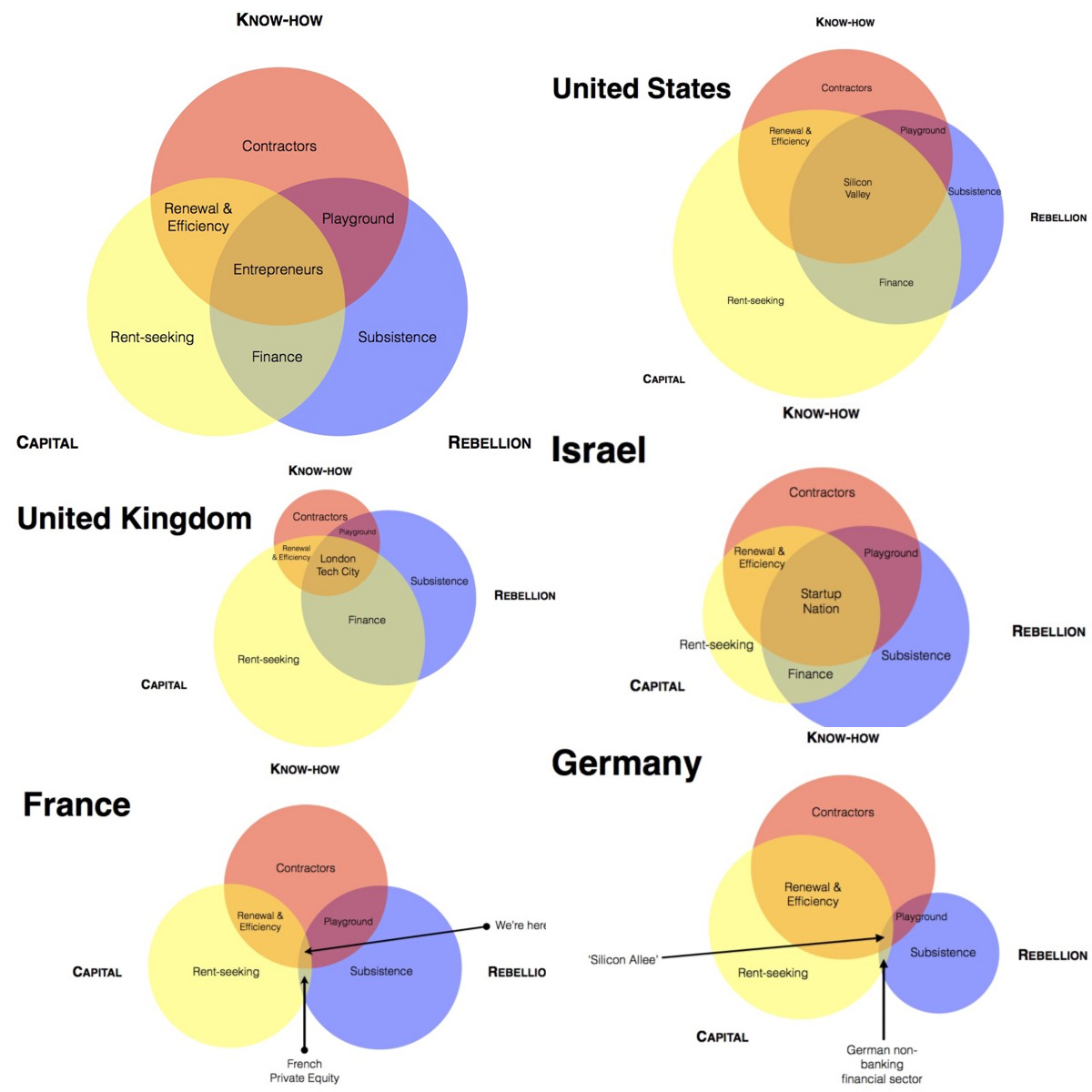

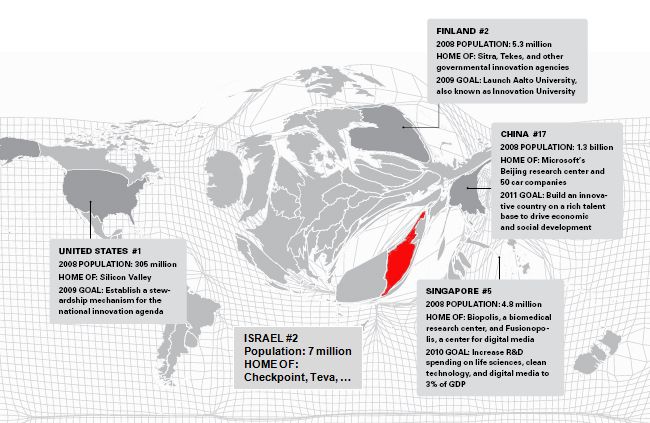

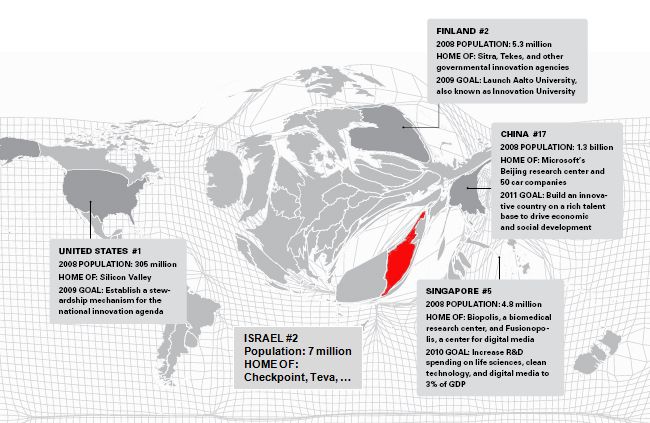

Comme l’indique la carte (adaptée de John Kao, Harvard et présentée à cette réunion de l’OCS), Israël est une superpuissance de l’innovation. Cisco, Intel, Microsoft, Novartis, Nestlé et beaucoup d’autres y sont présents. Check Point est la plus grande réussite des start-up israéliennes, mais Israël a plus de start-up cotées sur le Nasdaq que l’Europe et le capital-risque y est très actif. Enfin, le bureau du Chief Scientist gère et finance le côté public de l’innovation en Israël. Tout cela est parfaitement analysé dans le livre Start-Up Nation que je viens de lire.

Je pensais que je savais beaucoup de choses sur Israël, mais le livre est riche en anecdotes. L’histoire d’Israël est bien décrite et l’innovation a été sans doute une nécessité pour survivre. S’il y a un point que j’ai apprécié un peu mois c’est l’importance que les auteurs donnent à l’armée. Ils peuvent avoir raison, ce n’est pas le problème, mais je trouve que le sujet revient un peu trop au fil des chapitres. Cela reste un grand livre et une lecture incontournable pour quiconque s’intéresse à l’innovation high-tech et à l’entrepreneuriat.

Je voudrais maintenant citer un certain nombre de choses que j’ai aimées. Ceci n’est pas structuré du tout, mais je j’espère que je vais ainsi vous inviter à lire le livre. De plus vous verrez que j’ai un peu trop utilisé Google Translate!

Extrait de l’introduction

Eric Schmidt, CEO et et président de Google, a ainsi déclaré que les États-Unis sont numéro un dans le monde pour les entrepreneurs, mais « après les États-Unis, Israël est le meilleur. » Steve Ballmer a appelé Microsoft « une société israélienne autant qu’américaine en raison de la taille et l’importance de ses équipes israéliennes. »

Les auteurs commencent par expliquer que l’adversité et la multidimensionnalité autant que le talent des individus, sont critiques: « c’est une histoire non seulement de talent, mais de ténacité, de contestation incessante de l’autorité, d’informalité tenace, combinée avec une attitude unique envers l’échec , le travail en équipe, un sens de la mission, du risque, et de la créativité interdisciplinaire. »

Chapitre 1 – Persistence

Les Américains ont toujours besoin de placer une plaisanterie, mais je l’ai trouvée drôle et juste!

Quatre hommes sont à un coin de rue. . .

un Américain, un Russe, un Chinois, et un Israélien. . . .

Un journaliste vient vers le groupe et leur dit:

« Excusez-moi. . . . Quelle est votre opinion sur la pénurie de viande? »

L’Américain dit: Qu’est-ce qu’une pénurie?

Le Russe dit: Qu’est-ce que la viande?

Le Chinois dit: Qu’est-ce qu’une opinion?

et l’Israélien dit: Qu’est-ce que « Excusez-moi »?

-Mike Leigh dans Deux Mille Ans

– Aucune inhibition à défier la logique de la façon dont les choses ont été faites depuis des années.

– Un attitude rude, une culture agressive mais qui tolère l’échec.

– L’attitude et l’informalité israéliennes proviennent aussi d’une tolérance culturelle pour ce que certains Israéliens appellent des «échecs constructifs» ou «échecs intelligents».

– Il est essentiel de faire la distinction entre « une expérience bien planifiée et la roulette russe ».

(Lors de la réunion avec le chief scientist, il y eut un argument similaire: « si nous avons un taux de succès de 5%, nous ferions mieux de donner la responsabilité de choisir aux ânes et si il est de 70%, nous ne prenons pas assez risques »)

– Amos Oz parle « d’une culture du doute et de l’argument, un jeu ouvert d’interprétations, contre-interprétations, de réinterprétations, puis d’interprétations opposées. Dès le début de l’existence de la civilisation juive, elle a été reconnue pour son plaisir à argumenter. »

Chapitre 2 – Leçons de l’armée

– Hiérarchie étroite et autonomie donnent beaucoup de responsabilités aux individus; dès la base, l’autorité est discutée.

– Les gens sont matures plus tôt.

– Pas besoin d’attendre pour agir.

– « La clé du leadership, c’est la confiance des soldats en leur commandant. Si vous n’avez pas confiance en lui, si vous ne le croyez pas, vous ne pouvez pas le suivre. »

– « Si vous ne savez même pas que les gens de l’organisation sont en désaccord avec vous, alors vous êtes en difficulté »

– « L’expérience réelle aussi vient généralement avec l’âge ou la maturité. Mais en Israël, vous acquérez de l’expérience, de la perspective, et de la maturité à un âge plus jeune, parce que la société mélange tant d’expériences de transformation alors que vous êtes à peine sortis de l’école secondaire. Au moment où ils sortent du lycée, leurs esprits sont différents de ceux de leurs homologues américains. « … » La notion que l’on doit accumuler de la compétence avant de lancer une entreprise n’existe tout simplement pas. «

Un réseau dense – l’ensemble du pays n’est qu’à un degré de séparation (Yossi Vardi)

Chapitre 5 – Ordre et chaos

– « Les dirigeants de Singapour n’ont pas réussi à innover comme Israël dans un monde qui donne une grande importance à un trio d’attributs historiquement étrangers à la culture de ce pays: l’initiative, la prise de risque, et l’agilité; en plus d’être de véritables experts qui peuvent improviser dans des situations de crise. »

– « L’innovation est fondamentalement une entreprise expérimentale » (improvisation plus que discipline)

– « Apprendre de ses erreurs sans craindre de perdre la face. »

– « Personne n’apprend de quelqu’un qui est sur la défensive. »

– « Selon une nouvelle école d’économistes qui étudient les ingrédients clés pour l’esprit d’entreprise, la fluidité est un atout lorsque les gens peuvent traverser les frontières, s’opposer aux normes sociales, créer de l’agitation dans une économie de libre marché, et catalyser toutes les idées radicales. »

Chapitre 7 – Immigration

Les immigrants ne sont pas opposés à recommencer. Ils sont, par définition, des preneurs de risque. Une nation d’immigrants est une nation d’entrepreneurs. – Gidi Grinstein

Sergey Brin fut invité à parler dans une école israélienne: « Mesdames et messieurs, jeunes filles et jeunes garçons », dit-il en russe, sa langue maternelle (ce qui provoqua des applaudissements spontanés). « J’ai émigré de Russie quand j’avais six ans, » Brin continua. « Je suis allé aux États-Unis. Je suis comme vous, j’ai des parents juifs russes. Mon père est un professeur de mathématiques. Mes parents ont une certaine attitude au sujet des études. Et je peux comprendre que ici aussi, car on m’a dit que votre école a récemment obtenu sept des dix premières places dans un concours de mathématiques dans tout Israël. » … « Mais ce que j’ai à dire, » Brin a continué, à travers les applaudissements, « est ce que mon père disait- Mais pourquoi pas les trois autres prix? »

Les auteurs mentionnent les travaux fondateurs de AnnaLee Saxenian (Regional Advantage, the New Argonauts). Voici quelques exemples de la diaspora high-tech israélienne mentionnée dans le livre:

– Dov Frohman – Intel – 1974 – lien Wikipedia. Apparemment, Israël a été au cœur de l’innovation d’Intel dans les dix dernières années et Intel est le premier employeur privé en Israël.

– Michael Laor – Cisco – 1997 – Voir son profil Linkedin . Cisco a acquis 9 start-up israéliennes depuis que Laor est revenu (plus que les acquisitions de Cisco dans aucun autre pays sauf les États-Unis)

– Yoelle Maarek – Google – http://yoelle.com maintenant à Yahoo!

Mais il ne faut pas oublier Mirabilis / ICQ (voir ci-dessous) ou Check Point. Check Point a été créé en 1993, par le Président & CEO de la société Gil Shwed, http://en.wikipedia.org/wiki/Gil_Shwed à l’âge de 25 ans, avec deux de ses amis, Marius Nacht (actuellement au poste de vice-président) et Shlomo Kramer (qui a quitté Check Point en 2003 pour lancer une nouvelle entreprise).

Chapitre 9 – Yozma

Un autre membre de cette unique diaspora: Orna Berry – doctorat USC – Unisys -IBM puis ORNET et Gemini, enfin chef de l’OCS… L’industrie du VC a été vraiment lancée par l’effort de Yozma de même que pour les incubateurs israéliens. Gemini fut le premier fonds Israël. (voir la page wikipedia en anglais sur le capital risque en Israel)

Une autre citation sur les start-up face aux industries plus matures: « Dans l’aéronautique, vous ne pouvez pas être un entrepreneur »… « Le gouvernement est propriétaire de l’industrie, et les projets sont énormes. Mais j’ai appris beaucoup de choses techniques, qui m’ont énormément aidé plus tard. »

Chapitre 12 – La trans-disciplinarité

« Il ya une mentalité multi-tâche ici. » La mentalité multi-tâche produit un environnement dans lequel les titres et les cloisonnements qui vont de pair ne signifient pas grand chose.

– « La combinaison de mathématiques, biologie, informatique et chimie organique à Compugen »

– « Mettre tout cela ensemble nécessite une combinaison de compétences techniques peu orthodoxes. »

« Le terme aux États-Unis pour ce type de choses est un mashup. Et le terme lui-même a été rapidement transformé pour acquérir de nouvelles significations. … Un mashup encore plus puissant, à notre avis, se produit quand l’innovation est née de la combinaison de technologies et disciplines radicalement différentes. Les entreprises où les mashups sont les plus courants en Israël sont celles des appareils médicaux et le secteur de la biotechnologie, où vous trouverez des ingénieurs en soufflerie et les médecins qui collaborent à un dispositif au format carte de crédit. »

Mais les auteurs n’ont pas oublié de mentionner que Israël est un pays avec une raison d’être, une motivation très forte.

Les role models

« Bien qu’Israël fût déjà bien immergée dans la haute technologie, la vente d’ICQ/Mirabilis a été un phénomène national. Il a inspiré beaucoup d’Israéliens à devenir entrepreneurs. Les fondateurs, après tout, étaient un groupe de jeunes hippies. Nombreux sont ceux qui pensent qu’exposer à toutes les formes de succès pousse à penser « si ce gars-là l’a fait, je peux faire mieux« . En outre, la vente a été une source de fierté nationale, comme gagner une médaille d’or aux Jeux Olympiques. »

«Il y a un moyen légitime de réaliser un profit parce que vous êtes en train d’inventer quelque chose», dit Erel Margalit «Vous parlez d’un mode de vie, pas nécessairement combien vous allez gagner, même si l’argent est aussi une motivation.»

« En effet, ce qui rend le mélange actuel d’Israël si puissant est qu’il est un mashup de patriotisme des fondateurs, de motivation, de conscience constante de la rareté et de l’adversité et doté en plus d’une culture de la curiosité et de l’agitation qui ont des racines profondes dans l’histoire juive et israélienne. » explique Shimon Peres et d’ajouter: « La plus grand contribution du peuple juif dans l’histoire est l’insatisfaction ».

Encore une fois: « pas seulement du talent, mais de la ténacité, une insatiable contestation de l’autorité, une informalité déterminée, et une attitude unique face à l’échec, le travail en équipe, la motivation, le risque et la créativité interdisciplinaire. »

En guise de conclusion

« Alors, quelle est la réponse à la question centrale de ce livre: Ce qui rend Israël si novateur et entrepreneurial? L’explication la plus évidente réside dans un modéle de cluster classique du type décrit par le professeur de Harvard, Michael Porter et que la Silicon Valley incarne. Il se compose d’une proximité de grandes universités, de grandes entreprises, de start-ups, et d’un écosystème qui les relie entre eux, y compris des fournisseurs, un bassin de talent, et du capital risque. La partie la plus visible de ce système est le rôle des militaires avec une R&D considérable dans les systèmes de pointe et des unités d’élite technologique. Les retombées de cet investissement important, tant dans les technologies que les ressources humaines, vont directement vers l’économie civile… Mais cette « couche externe » n’explique pas entièrement le succès d’Israël. Singapour a un fort système éducatif et la conscription, la Corée; a été confrontée à une menace sur sa sécurité durant toute son existence; la Finlande, la Suède, le Danemark et l’Irlande sont les pays relativement petits avec une technologie de pointe et d’excellentes infrastructures, ils ont produit beaucoup de brevets et en ont connu une croissance économique robuste. Certains de ces pays ont connu un croissance plus forte qu’Israël, mais aucun d’entre eux n’a produit un tel nombre de start-up ou n’a attiré de tels niveaux de capital-risque. Ce qui manque dans ces autres pays est un noyau culturel construit sur un goût de l’agressivité et un esprit d’équipe, bâtis sur un isolement et un réseau dense, avec le désir du petit de devenir grand. Quantifier cette face cachée, qui fait partie d’une économie culturelle n’est pas chose facile. C’est une combinaison inhabituelle de caractéristiques culturelles. En fait, Israël a des scores élevés sur l’égalitarisme, le dévouement et l’individualisme. En Israël, ces attributs apparemment contradictoires, à la fois ambitieux et collectiviste prend son sens quand on sait que les Israéliens vont passer tant de temps dans l’armée . Il n’y a pas de leadership sans exemple et sans inspirer votre équipe. Le secret du succès d’Israël est la combinaison d’éléments classiques de grappes technologiques avec certains éléments uniques de la culture israélienne qui renforcent les compétences et l’expérience des individus, les fait travailler ensemble plus efficacement en équipe, et fournit des connexions fortes et facilement accessibles au sein d’une communauté établie et en pleine croissance. »

J’espère que vous seraz arrivé au bout de ce long article malgré la langue googlelienne! Si cela est le cas, je crois que votre prochain achat sera Start-Up Nation!