Je viens de terminer la lecture de Elon Musk, et après mes deux posts précédents (partie 1 et partie 2), voici les notes complémentaires.

Comment fonctionne l’innovation

C’est vraiment un livre fascinant et Elon Musk l’est tout autant. Un personnage vraiment unique et difficile. Et évidemment il est aussi très critiqué et détesté. Une de ces critiques sévères vient de la Technology Review du MIT avec Tech’s Enduring Great-Man Myth par Amanda Schaffer. Vous devriez le lire. J’en extrais seulement deux phrases:

– « Pour le dire autrement, pensons-nous vraiment que si Jobs et Musk n’avaient jamais existé, il n’y aurait pas eu de révolution du smartphone, pas de regain d’intérêt pour les véhicules électriques? » Eh bien, cela est une question cruciale sur la source de l’innovation. La société ou les individus. La question est pertinente pour la science aussi.

– « C’est précisément parce que nous admirons Musk et pensons que ses contributions sont importantes que nous avons besoin de savoir à qui il doit son succès. » C’est une citation de Mariana Mazzucato que j’ai souvent mentionnée ici. Son livre The Entrepreneurial State est à lire absolument. Il y est question du rôle du gouvernement en matière d’innovation. Ma conviction de plus forte avec les années est que le gouvernement rend les choses possibles (science, technologie et invention, innovation), mais sans des individus d’exception – souvent des génies, parfois à la frontière de la folie – je ne crois pas que autant se passerait.

Maintenant, permettez-moi de citer encore Ashley Vance parce que les derniers chapitres du livres sont aussi passionnants que les premiers. Ces citations montrent que, malgré l’importance du gouvernement, il ne suffit pas à expliquer comment fonctionne l’innovation.

Alors que Tesla devenait une star de l’industrie américaine moderne, ses plus proches rivaux disparaissaient les uns après les autres. Fisker Automotive a fait faillite et a été acheté par une société chinoise de pièces d’automobiles en 2014. Un de ses principaux investisseurs était Ray Lane, un capital-risqueur chez Kleiner Perkins Caufield & Byers. Lane a coûté à Kleiner Perkins une chance d’investir dans Tesla et a alors soutenu Fisker – un choix désastreux qui a terni l’image de l’entreprise et la réputation de Lane. Better Place est une autre start-up qui a eu une plus grande aura encore que Fisker et Tesla mis ensemble et qui a recueilli près de un milliard de dollars pour construire des voitures électriques et des stations d’échange de batteries. La société n’a jamais vraiment rien produit et a déclaré sa faillite en 2013.

Les personnes comme Straubel qui avaient été chez Tesla depuis le début sont prompts à rappeler que la possibilité de construire une voiture électrique impressionnante a toujours existé. « Ce n’est pas vraiment comme s’il y avait une ruée vers cette idée, et nous y sommes arrivés en premier, » dit Straubel. « On oublie souvent avec le recul que les gens pensaient que c’était l’idée business la plus merdique de la planète. Les capital-risqueurs fuyaient tous en courant. » Ce qui séparait Tesla de la concurrence était la volonté de foncer vers cette vision sans compromis, avec un engagement complet à exécuter selon les normes de Musk.

[Pages 315-16]

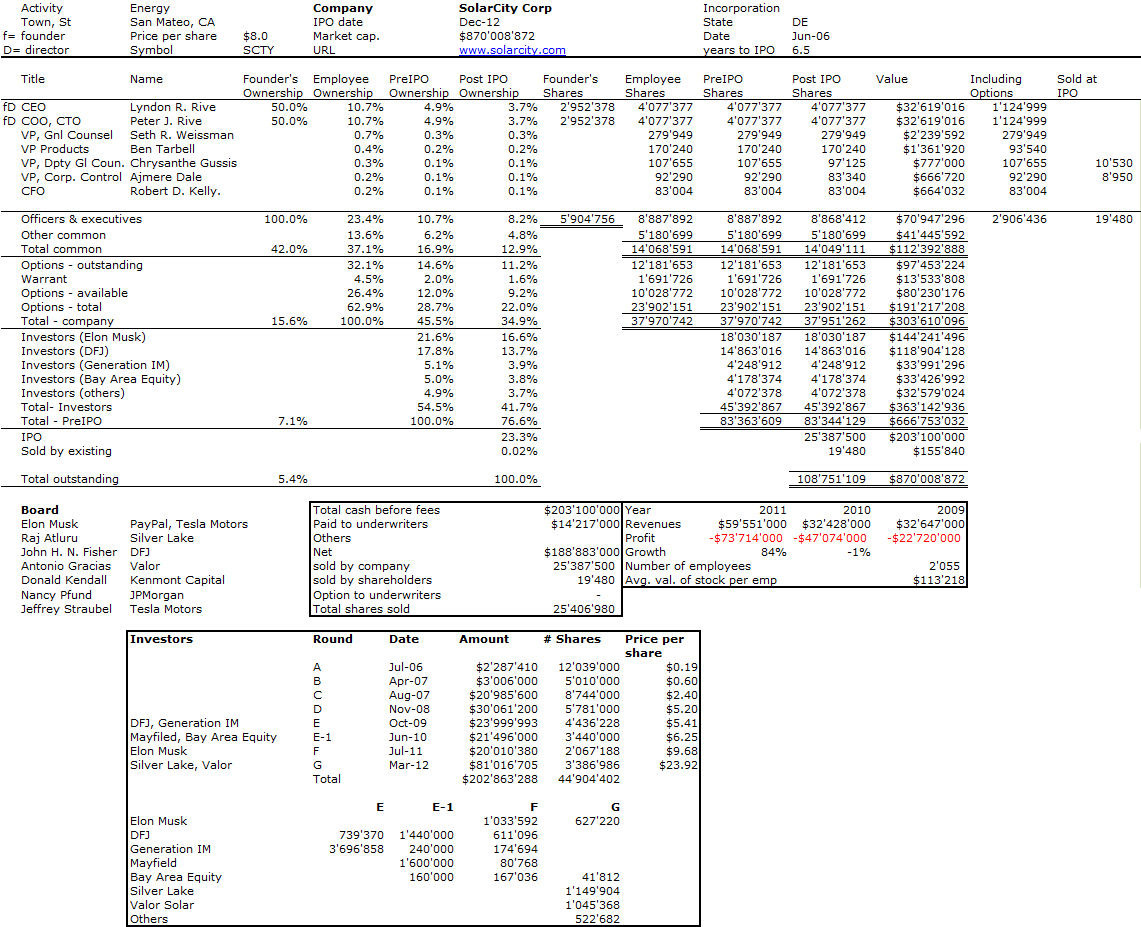

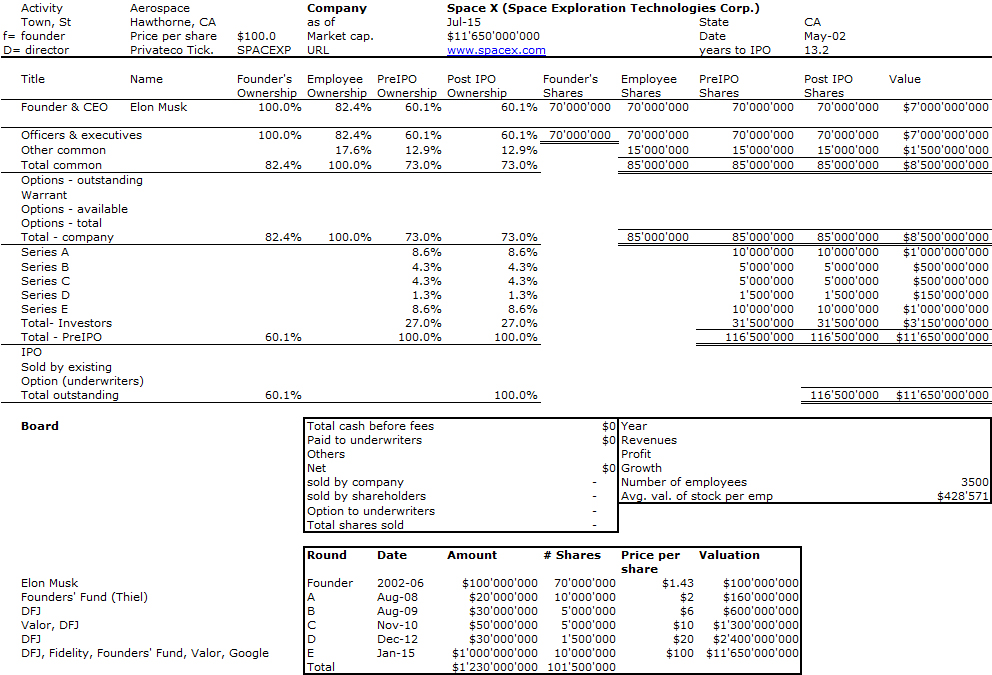

Pendant toute la période de croissance de SolarCity, la Silicon Valley a déversé d’énormes quantités d’argent dans des entreprises de technologie verte avec des résultats souvent désastreux. Il y a eu les bourdes dans l’automobile comme Fisker et Better Place, et Solyndra, le fabricant de cellules solaires que les conservateurs aiment à considérer comme un récit édifiant des gaspillages du gouvernement et de clientélisme. Certains des plus célèbres capitaux-risqueurs dans l’histoire, comme John Doerr et Vinod Khosla, ont été attaqués par la presse locale et nationale pour l’échec de leurs investissements verts. L’histoire était presque toujours la même. Les gens avaient jeté l’argent dans les technologies vertes car cela semblait être la bonne chose à faire et non pas parce qu’il y avait une vraie opportunité. Des nouveaux types de stockage d’énergie aux voitures électriques et aux panneaux solaires, la technologie n’avait jamais été tout à fait à la hauteur du prix payé et demandait toujours trop de financement du gouvernement et d’incitations pour créer un marché viable. Une grande partie de cette critique était juste. Il y a juste qu’il y avait ce personnage, Elon Musk, qui semblait avoir compris quelque chose que tout le monde avait manqué. « Nous avions une règle générale de ne pas investir dans des sociétés de technologie propre pour environ une décennie, » a déclaré Peter Thiel, cofondateur de PayPal et capital-risqueur au Founders Fund. « Sur le plan macro, nous avons eu raison, car les technologies propres comme secteur ont été assez décevantes. Mais au niveau micro, il semble qu’Elon ait les deux sociétés de technologie clean-tech les plus prospères aux États-Unis. Nous préférerions expliquer son succès comme un coup de chance. Il y a toute cette histoire d’Iron Man dans laquelle il est présenté comme un homme d’affaires de dessin animé – cet animal de zoo très rare. Mais aujourd’hui, vous devez plutôt vous demander si son succès n’est pas un acte d’accusation contre le reste d’entre nous qui avons travaillé sur des choses beaucoup plus incrémentales. Dans la mesure où le monde doute encore d’Elon, je pense qu’il est une réflexion sur la folie du monde et non pas sur la folie supposée d’Elon. »

[Pages 320-21]

Tony Fadell à propos de Musk

Tony Fadell, l’ancien dirigeant d’Apple, crédité pour avoir mis l’iPod et l’iPhone sur le marché, a caractérisé le smartphone comme représentant d’un type de super-cycle dans lequel le matériel et les logiciels ont atteint un point critique de maturité. L’électronique est de qualité et peu chère, tandis que le logiciel est plus fiable et sophistiqué. […] Google a ses voitures sans conducteur et a acquis des dizaines d’entreprises de robotique car l’entreprise cherche à fusionner le code et la machine. […] Et une multitude de start-up ont commencé à intégrer dans les dispositifs médicaux du logiciel puissant pour aider les gens à surveiller et analyser leurs organes et diagnostiquer leur condition. […] Zee Aero, une start-up de Mountain View, compte quelques anciens employés de SpaceX et travaille à un nouveau type secret de transport. Une voiture volante enfin ? Peut-être. […] Pour Fadell, l’activité de Musk se trouve au sommet de cette tendance. « Que ce soit Tesla ou SpaceX, vous parlez de combiner le savoir-faire dans la fabrication et la production de l’ancien monde avec la technologie à faible coût des objets de grande consommation. Vous mettez ces choses ensemble, et elles se transforment en quelque chose que nous n’avons jamais vu auparavant. Tout à coup, vous avez un changement radical. C’est comme passer de zéro à un. »

[Pages 351-52] Cela ne vous rappelle pas le Zero to One de Peter Thiel.

Larry Page à propos de Musk

Google a investi plus que toute autre société de technologie dans les projets les plus fous de Musk: les voitures sans conducteur, des robots, et même un prix pour une machine qui ira sur la lune à bas prix. L’entreprise, cependant, fait face à un ensemble de contraintes et d’attentes qui son liées à l’emploi de dizaines de milliers de personnes et l’analyse constante des investisseurs. C’est dans cet esprit que Page se sent parfois un peu jaloux de Musk, qui a réussi à prendre des idées radicales comme base de ses entreprises. « Si vous pensez à la Silicon Valley ou aux chefs d’entreprise en général, ils ne manquent pas habituellement d’argent », dit Page. « Si vous avez tout cet argent, que vous allez sans doute donner et ne pourriez même pas tout dépenser même si vous le vouliez, alors pourquoi consacrez-vous votre temps à une entreprise qui ne fait pas vraiment quelque chose de bon ? Voilà pourquoi je trouve Elon un exemple inspirant. Il a dit: ‘Eh bien, que dois-je faire vraiment dans ce monde ? Résoudre les voitures, le réchauffement climatique, et rendre l’humanité multi-planétaire.’ Je veux dire que ce sont des objectifs assez convaincants, et il a maintenant les entreprises pour le faire. »

[Page 353]

Larry Page sur l’éducation

Ceci est un passage très intéressant [pages 355-56] indépendant de Musk: « Je ne pense pas que nous fassions un bon travail en tant que société à décider quelles choses sont vraiment importantes, » a dit Page. « Je ne trouve pas que nous éduquions les gens à réfléchir de cette façon générale. Vous devriez avoir une assez large formation scientifique et technologique. Vous devriez avoir une formation en leadership et un peu de formation de type MBA ou de connaissance sur la façon de gérer les choses, organiser les choses, et trouver de l’argent. Je ne pense pas que la plupart des gens le font, et c’est un gros problème. Les ingénieurs sont formés en général dans un cadre très rigide. Lorsque vous êtes en mesure de penser à toutes ces disciplines ensemble, vous commencez à penser différemment et vous pouvez rêver de choses beaucoup plus folles et comment elles pourraient fonctionner. Je pense que c’est vraiment une chose importante pour le monde. Voilà comment nous faisons des progrès. » [Pages 355-6]

Quelques derniers mots sur Musk

Il est presque drôle de constater que Musk passe tellement de temps à parler de la survie de l’homme, mais ne soit pas prêt à faire face aux conséquences de ce que son mode de vie fait de son corps. « Elon est arrivé à la conclusion au début de sa carrière que la vie est courte », a déclaré Straubel. « Si vous avez vraiment intégré cela, vous en arrivez à la conclusion évidente que vous devriez travailler aussi dur que vous le pouvez ». Souffrir a toujours été la chose de Musk. Les enfants à l’école l’ont torturé. Son père a joué avec lui à des jeux d’esprit brutaux. Musk a ensuite abusé d’un rythme de travail inhumain et et a toujours poussé ses entreprises aux limites. L’idée d’équilibre vie-travail semble vide de sens dans ce contexte. […] Il estime que la souffrance a contribué à faire de lui qui il est et lui a donné des réserves supplémentaires de force et de volonté. [Page 356]

Toutefois….

Comme l’a dit Thiel, Musk pourrait très bien être celui qui aura redonné de l’espoir aux gens et renouvelé leur foi dans ce que la technologie peut faire pour l’humanité. [Page 356]