This was the question asked by Fred Destin in his blog post last December: The Arrogant VC: A View From the Trenches

I am interested in the topic because I see more and more entrepreneurs who just do not want to face VCs. I think it is a mistake as you may not find adequate resources for your ventures, but it is a real debate.

Destin puts in bold the following arguments:

– behaved in a rude and disrespectful manner

– absence of feedback loop

– lack of empathy

– VCs tend to string along entrepreneurs forever

– vague on their decision and engagement process

– the entrepreneur comes away feeling like he was played

– seeing everything through the lens of money

– out of touch with the reality of entrepreneurs

– VCs really don’t take any personal risk but expect everyone else to…

– dubious practices

and as a conclusion Choose your VC’s with care. Good ones transform your business, bad ones wreck it

I have read this many times, seen it sometimes but not so often. So let me add my piece, taken from my readings. You will find on this blog accounts of books I really recommend, such as Founders at Work, Betting it All, In the Company of Giants. I just extracted comments on investors from these books. I think they are more balanced and as Destin wrote, choose your VCs with care. Here they are:

– Great as long as all goes well.

– Learn about them and their lack of transparency

– Best motivation is not to need investors

– Know people and speak their language

– You can’t live with them, you can’t live without them

– Avoid it if you can

– VCs are politer than others, they rarely say no…

– Bad behaviors on all sides, “We’re interested in you guys because of your management team; we think you’re fantastic … Two weeks later they pull me into the office—before even the first board meeting—and say, “We want to replace you as CEO.”

– When company became popular, VCs knocked at the door

– Move from the ego, “me” to the company, “we”, the shareholders

– Met 43… and a lengthy process; Then once you’ve received a term sheet, then the VCs get interested, and then acquirers get interested. They all told me $18 million wasn’t interesting. And I’d say, “But most people will tell you $50 million, and you know they’re lying. I’m already discounting it because I’m a venture guy just like you are.” And they’d say, “Yeah, but $18 million just isn’t interesting.” So I changed my spreadsheet to say $50 million. And they said, “OK, that’s pretty interesting.”

– We’re also overly paranoid because the first thing we did when we started the company was talk to a bunch of entrepreneurs who told us, “Don’t tell anyone what you are doing. VCs are sharks.” Meanwhile, you hear from the VCs, “You’re too paranoid.” So it’s hard to find the right balance and be human, because you don’t know who’s genuine and who’s not.

– Within venture capital, you don’t want to manage what they call the “living dead.” Their rules of thumb were: typically one out of ten companies is a really big hit; roughly three out of ten go belly up pretty quickly, and you get rid of them. The other five to six are what they call the “living dead.” They grow nicely, organically, but don’t generate spectacular returns, and they take management time and energy.

– The venture capitalists at least in those days, had a terrible track record of bringing people in and then throwing the entrepreneur out.

– We didn’t take any salaries. but we held off on the VCs. We wanted the discipline. Not being paid and having uncertainty of having no safety net is a great motivator.

– It serves an enormous service in the business, in financing companies, in providing leadership, and connections. But we did not need their money or the leadership.

– I learnt something about raising money. They need us as much as we need them.

– I tried to get venture capital money, to no avail. What people don’t understand is that innovation is the hardest thing in the world to fund. I was 28 years old and this was before it was good to be a 28-year-old entrepreneur.

– In the old days, venture capitalists helped a company a lot. They were mentors. Many just bring money today.

– [To raise money,] go with the best venture capitalists and give them more equity. I’ll take a worse deal from Kleiner. They have people like John Doerr. You can’t put into words what that makes.

– We did a lot of market research, studied the customer, understood the problems. We couldn’t even get second meetings [with venture capitalists]. We had no industry experience and at the time VCs did not invest in consumer products.

– I did not have any venture capitalist which was good news and bad news. I could make every mistake, it was my neck, and probably no VC would have given me money: I was a woman, it was software at the time software had no value.

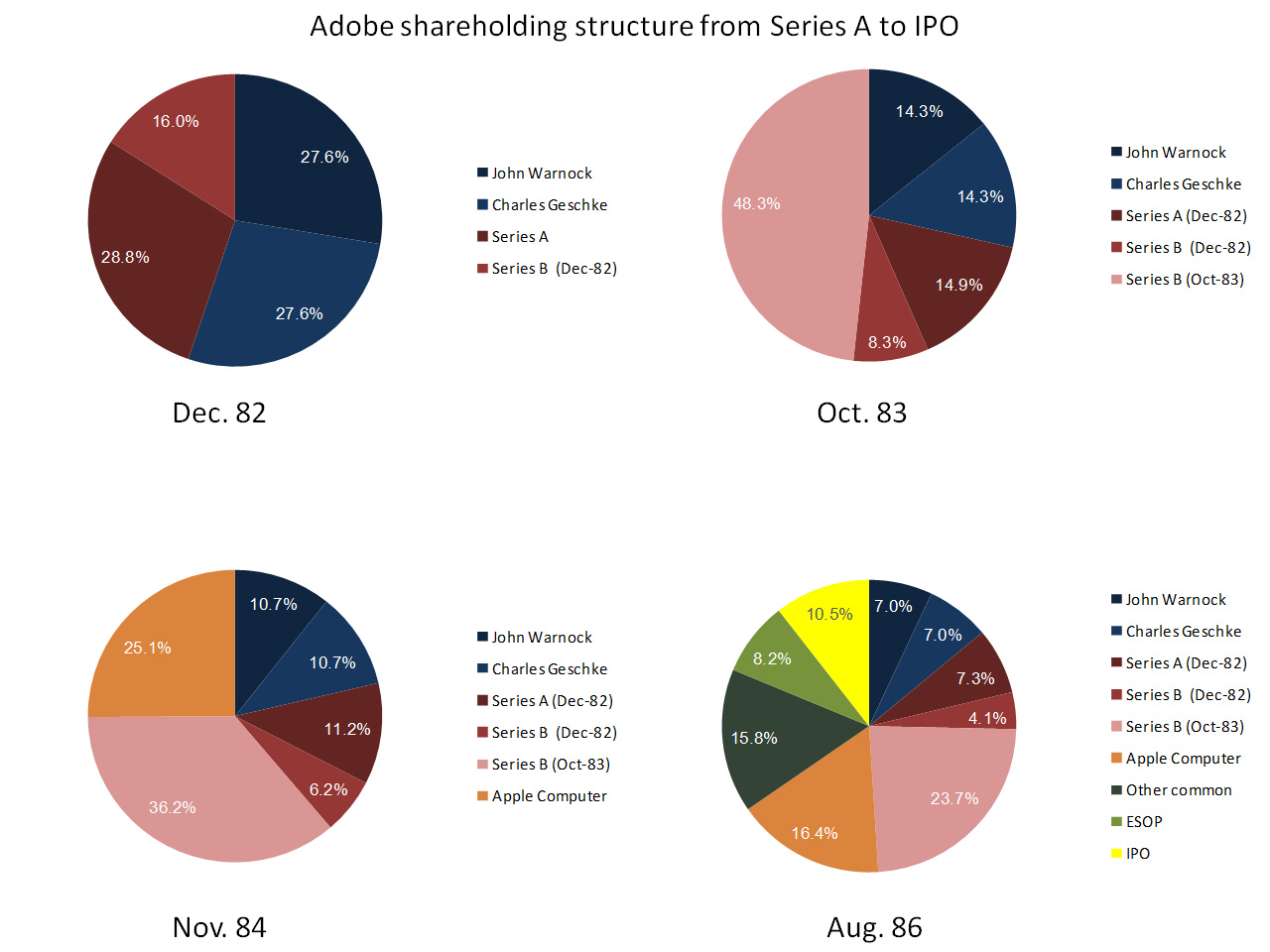

– In 83, I used the board to get some experienced business people. We got Dave Marquardt, a venture capitalist who bought 5% of the company for $1M.

– The downside to venture guys is that they sometimes think they know more than they do about what’s best for your company. They don’t want to admit when they make mistakes